Market in wide profit (99.4%) of holders in plus, STH NUPL 0.10, momentum persists, but risk of profit-taking and correction grows.

TL;DR

Almost all BTC supply is in profit and STH NUPL is in positive territory, trend remains bullish, but strong risk of tactical pullbacks emerges, key triggers are intensified exchange inflows, futures overheating.

#STH #SUPPLY #NUPL

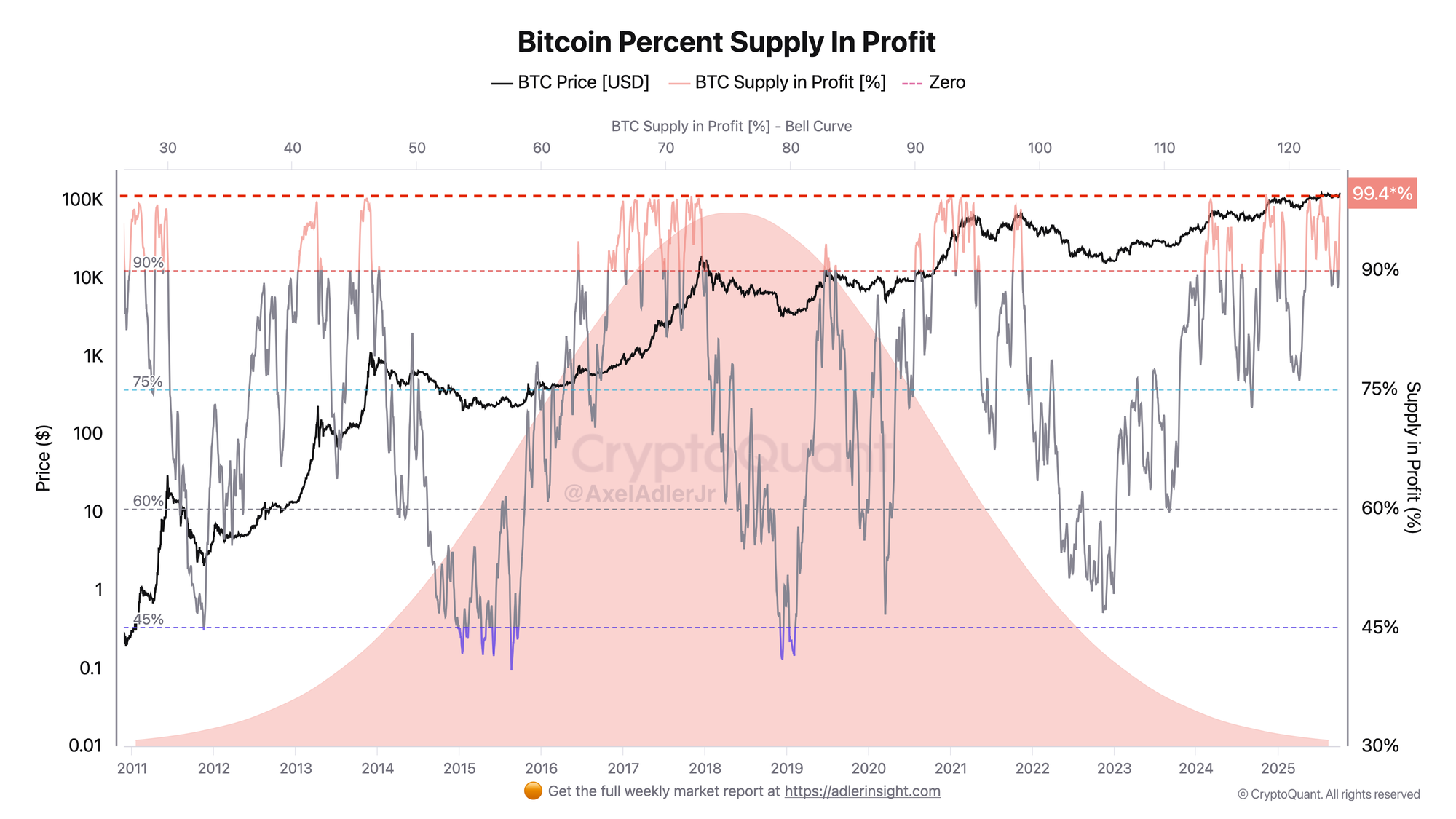

Bitcoin Percent Supply In Profit

Percent Supply in Profit shows the share of coins whose purchase price is below the current market price. Zones of 45–60% correspond to late bear market phases and accumulation, 75–90% to sustainable bullish phases, and extremes of 90–95% are observed during trend accelerations and late growth stages.

Current situation on the chart: currently Supply in Profit 99.4% of supply is in profit - almost the maximum possible value. This confirms the dominance of bullish structure: there are almost no sellers trapped in loss, selling pressure at a loss is absent, but the opposite risk of profitable coin realization emerges. Essentially, such an extreme means that the overwhelming majority of holders are in profit and motivation for profit-taking increases, which can provoke quick unwinds.

The backdrop remains positive, but the balance of risks shifts in the short term toward volatile pullbacks/breather to discharge the extreme.

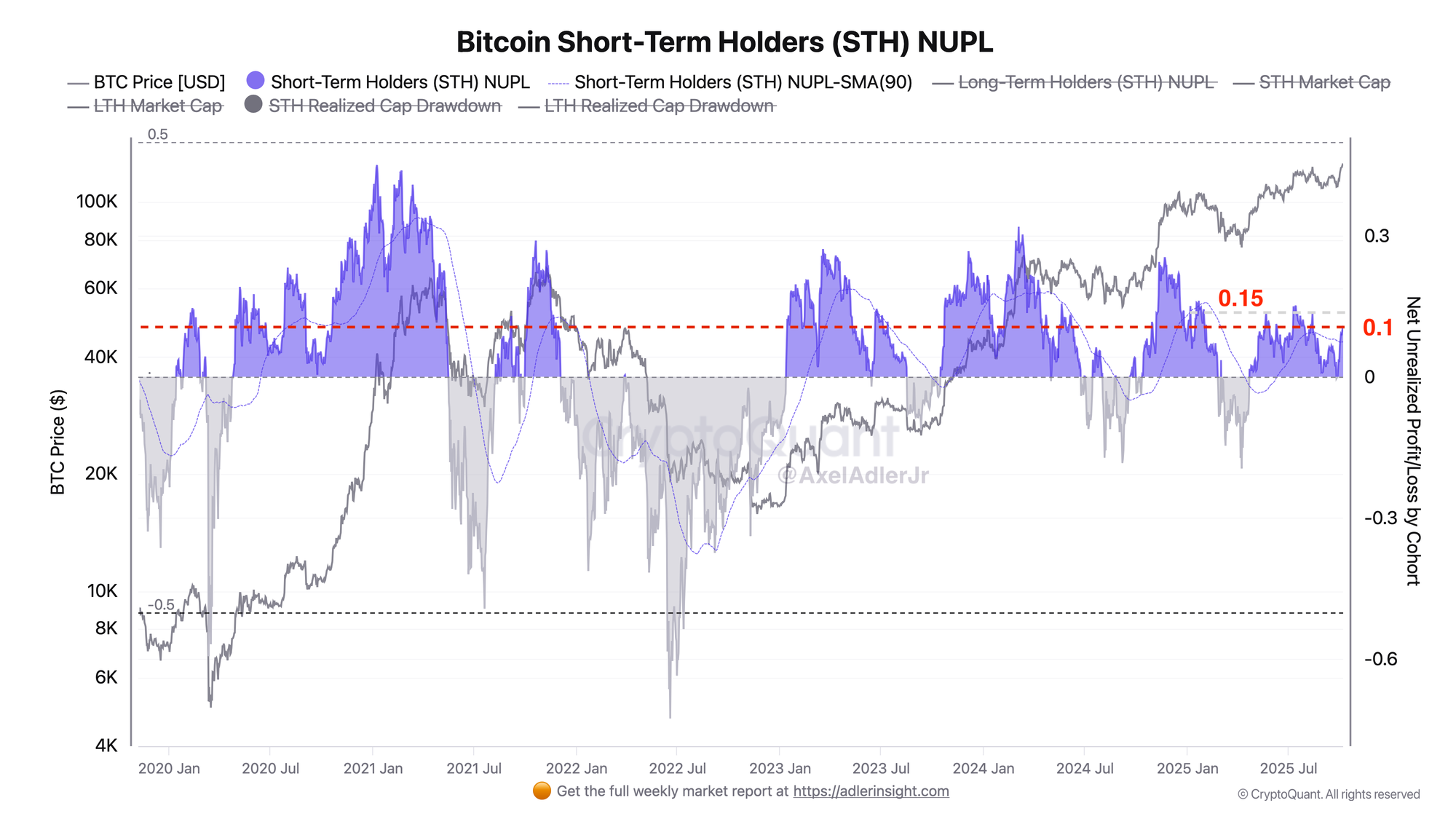

Bitcoin Short-Term Holders (STH) NUPL

STH NUPL is the net unrealized profit/loss for short-term holders (users who hold coins for less than 155 days). A value equal to 0 means no profit, >0 - profit or bullish backdrop, <0 - stress/capitulation. For STH, the indicator is more cyclical and sensitive to price; they are the ones who lock in profit more often and set short-term reversals. Practically important zones in 2025: 0.10–0.15 - confirmed uptrend, but discharge risk grows, >0.2 - overheating and frequent pullbacks. An indicator of 0.05 on pullbacks is considered healthy within the trend.

On the chart, STH NUPL fluctuates in positive territory at 0.10, the 90-day SMA holds above zero but is already directed downward. This means short-term holders are back in profit, forced selling pressure is low. At the same time, the market has repeatedly hit the 0.15 area, where realization intensifies and quick unwinds appear, which explains the recurring pullbacks after local highs.

FAQ

How to read the signal when Bitcoin Percent Supply in Profit rises to 99–100%?

An extreme of 99.4% means almost all UTXOs are in profit, forced selling pressure at the moment is low. But motivation for realization grows and consequently volatile pullbacks.

Why is STH NUPL = 10% important for short-term forecast?

STH NUPL = 0.10 says that short-term holders are in sustainable profit and support growth, however when rising to the 0.15 zone in the current phase, they start locking in profit, provoking quick pullbacks.

Conclusions

The trend remains bullish but correction risk intensifies: STH NUPL = 10% shows that short-term holders support growth with current price increase. The nearest risk is volatile unwinds during surges to ATH amid realized profit spikes and derivatives overload.