🎧 Morning Brief #0093 - audio debate on today’s market setup

Today the FOMC will set the tone for financial conditions in the coming weeks, and the BTC market approaches this event not in panic mode but in a phase of recovered internal structure. The key question of the day is whether this reversal will hold after the Fed statement and press conference, or whether macro volatility will once again weigh on risk.

TL;DR

Today's FOMC is the key macro trigger, while BTC's internal structure has already improved over recent days. If financial conditions do not tighten, the bounce may solidify, but if the dollar and yields strengthen, the market will quickly return to defensive mode.

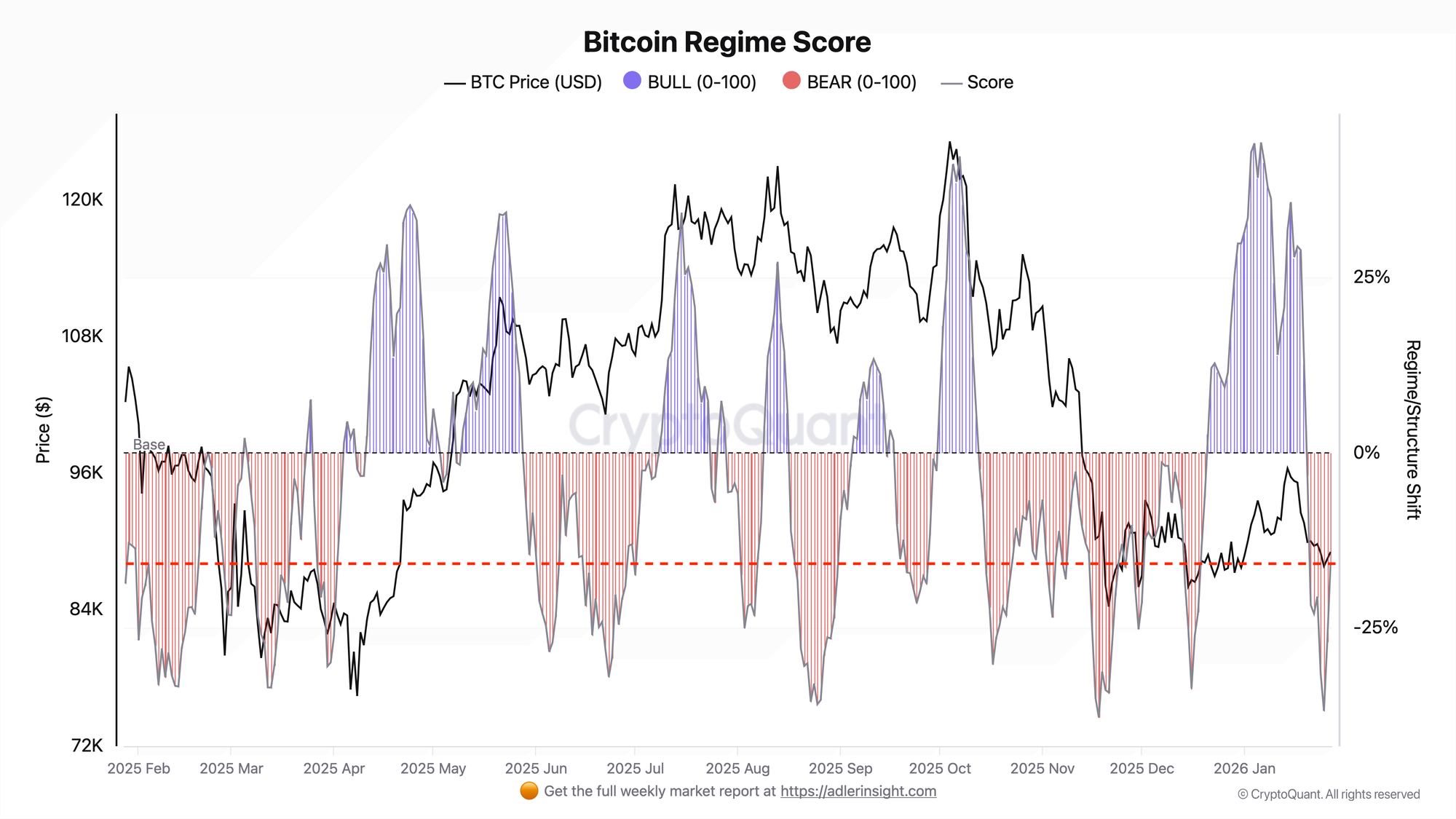

Bitcoin Regime Score

Over the past three days, the regime score improved by +21 points (from -36.8 to -15.7), while price over the same window rose approximately 1.4%. What matters is not the price movement itself, but that the structure within the index has reversed: the aggressive flow component (taker) moved from deep negative to positive, the open interest component (OI) also turned positive, the funding rate remains consistently positive, and the trend component is still negative but has moved noticeably closer to zero. This shifts the market from a phase of clear pressure to a recovery phase, where the key factor becomes confirmation of continued movement.

The current picture is neutral with a bearish tilt (Score still below zero), but with clear momentum improvement. For this reversal to become sustainable, the market must maintain improvement in the derivatives layer and avoid another blow to trend through a macro shock.

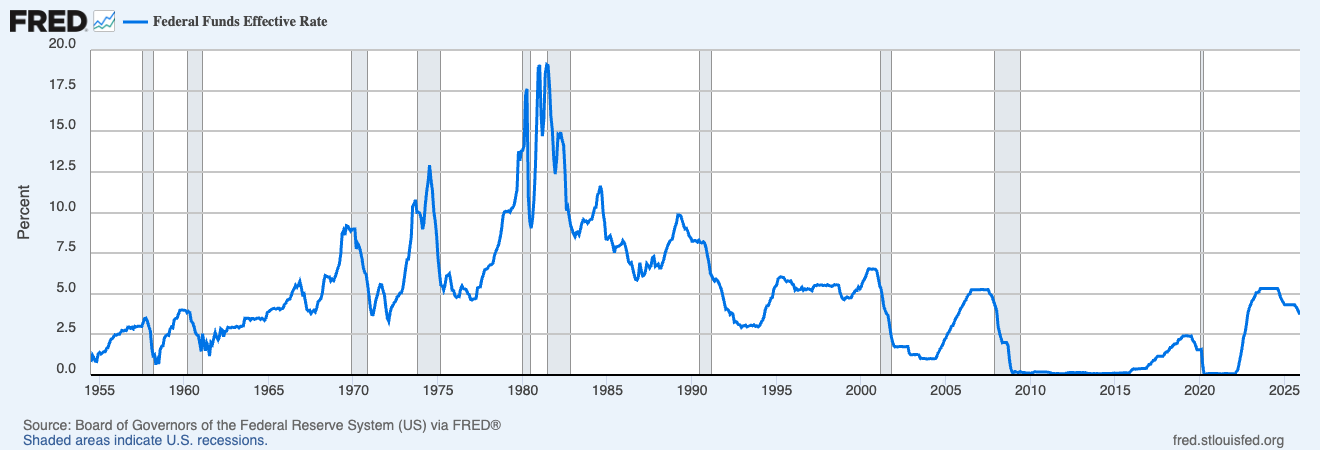

Federal Funds Effective Rate

The rate decision and official statement will be released at 2:00 p.m. ET, with Powell's press conference starting at 2:30 p.m. ET. Today's consensus is a pause, meaning maintaining the rate range at 3.50%-3.75%, but the market will assess not the pause itself but the tone: how ready the Fed is to continue easing after the series of cuts in late 2025. An additional layer of uncertainty comes from political pressure and discussions about changing the Fed chair, as Powell's term expires in May 2026, and markets are sensitive to any hints regarding the regulator's independence.

For BTC, this is a day about liquidity conditions, not the rate headline itself. If the rhetoric proves more hawkish than the market expects, the more likely scenario is a return of the regime to negative territory through deteriorating trend and demand. If the pause is accompanied by a dovish signal about further easing, the current regime reversal has a chance to push toward zero and above.

Macro & Fed Decoder for Humans

How to read Fed signals and macro data without excessive theory - quickly and by checklist.

FAQ

Why is the rhetoric more important than the rate itself?

Because the rate is almost fully priced in, and the market reacts to the trajectory ahead: what the Fed considers the main risk - inflation or the labor market, and how close the window for next steps is.

What counts as confirmation of regime reversal after FOMC?

Confirmation is when the improvement is not limited to a single day but persists for several sessions: the regime score continues moving toward zero, and the trend component stops being negative or at least stabilizes near zero.

CONCLUSIONS

Current position is neutral with priority on risk control: BTC's internal metrics have already improved over recent days, but the regime score is still below zero, so the market remains vulnerable to a macro blow. The main trigger of the day is the reaction of financial conditions after the press conference, and the main risk is that a hawkish pause strengthens the dollar and yields and breaks the recovery, returning the market to a more defensive configuration.