Exchange Netflow is one of the key on-chain indicators for analyzing buyer and seller pressure in the Bitcoin market. In this guide, we'll break down how it's calculated, how to interpret its values, and how to apply it in trading strategies.

What is Exchange Netflow?

Exchange Netflow shows the difference between the amount of Bitcoin flowing into exchanges and the amount of Bitcoin flowing out of exchanges over a given period.

Formula:

Exchange Netflow = Exchange Inflow - Exchange Outflow

Where:

- Exchange Inflow - volume of BTC deposited to exchange addresses

- Exchange Outflow - volume of BTC withdrawn from exchange addresses

Data Sources:

- CryptoQuant — most comprehensive exchange data

- Glassnode — alternative provider

- Coinglass — free basic charts

How Exchange Netflow Is Calculated

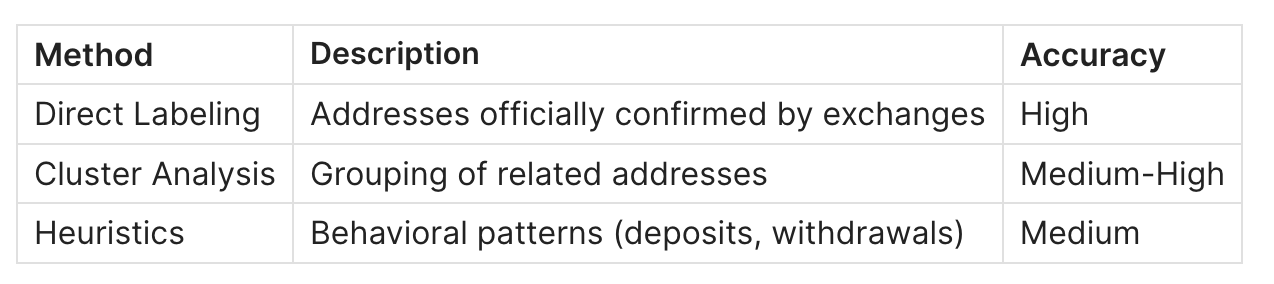

Step 1: Identifying Exchange Addresses

Analytics platforms maintain databases of addresses belonging to centralized exchanges. Identification methods:

Step 2: Tracking Flows

For each transaction on the Bitcoin network:

- Determine whether the sender or recipient address belongs to an exchange

- Classify as Inflow (to exchange) or Outflow (from exchange)

- Sum the volume in BTC

Step 3: Calculating Net Flow

All flows are aggregated over a period (hour, day, week):

Process Visualization:

[User A] ──── 5 BTC ────→ [Binance] = +5 Inflow

[User B] ──── 3 BTC ────→ [Coinbase] = +3 Inflow

[Coinbase] ──── 10 BTC ────→ [Cold Wallet] = -10 Outflow

───────────

Netflow = 8 - 10 = -2 BTC

(Net Outflow)

How to Interpret Exchange Netflow Values

Positive Netflow (Inflow > Outflow) — Inflows to Exchanges

What it means:

- More BTC is flowing into exchanges than out

- Holders are preparing to sell

- Potential selling pressure is increasing

Market Context:

- Short-term: possible downward pressure on price

- At cycle tops: sign of distribution

- Extreme values: potential sell signal

Negative Netflow (Outflow > Inflow) — Outflows from Exchanges

What it means:

- More BTC is being withdrawn from exchanges than deposited

- Holders are moving coins to cold storage

- Available supply for sale is decreasing

Market Context:

- Short-term: reduced selling pressure

- At cycle bottoms: sign of accumulation

- Sustained outflows: medium-term bullish signal

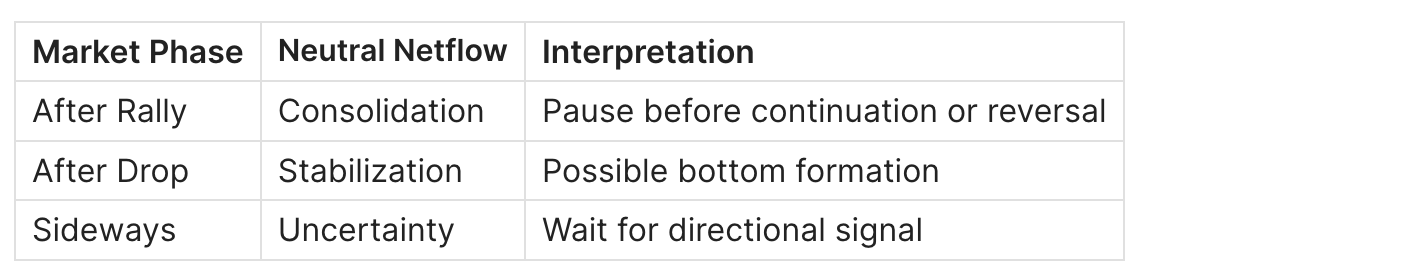

Neutral Netflow (Near Zero)

What it means:

- Balance between inflows and outflows

- Market is in equilibrium

- No clear directional pressure

Market Context:

Exchange Netflow Trading Signals

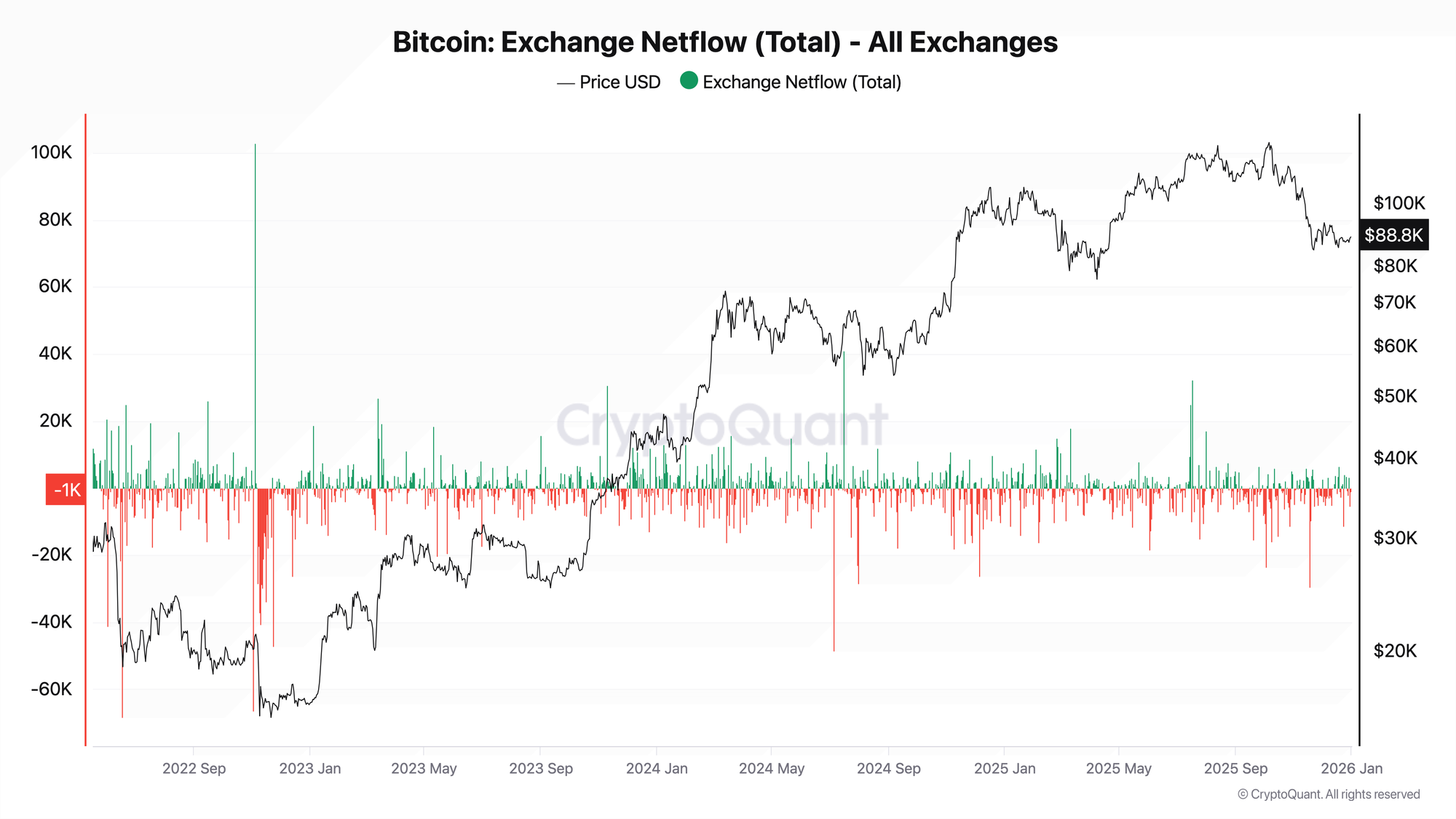

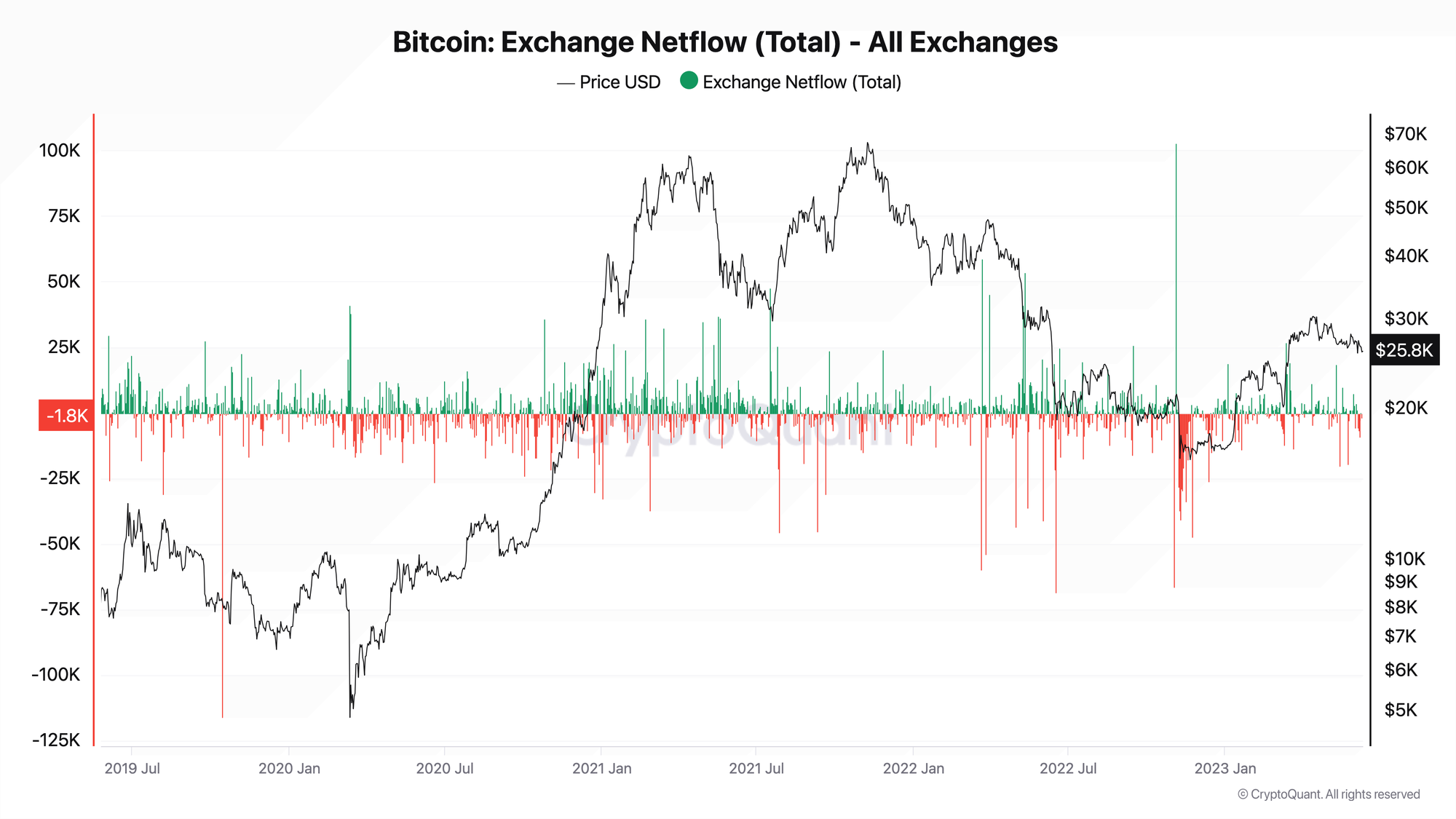

Historical Example 1: 2020 Accumulation

Situation: March-October 2020, BTC from $5,000 to $13,000

Exchange Netflow Behavior:

- Sustained outflows after the March crash

- Exchange reserves decreased by ~225,000 BTC over 8 months

- Institutions (Grayscale, MicroStrategy) were accumulating positions

Conclusion: Prolonged outflows from exchanges preceded the 2021 bull rally.

Historical Example 2: Distribution at the 2021 Top

Situation: March-April 2021, BTC $58,000-64,000

Exchange Netflow Behavior:

- Sharp increase in exchange inflows

- Several days with Netflow +30,000-35,000 BTC

- Long-term holders began taking profits

Conclusion: Extreme inflows to exchanges coincided with the local top before the correction to $30,000.

Historical Example 3: FTX Capitulation 2022

Situation: November 2022, FTX collapse

Exchange Netflow Behavior:

- Massive outflows from exchanges due to fear

- Record withdrawal volumes

- Paradox: outflows were forced (distrust of exchanges), not accumulation

Conclusion: Context matters — not all outflows are bullish. You need to consider the reasons.

Practical Application

Buy Signal:

- Sustained outflows from exchanges (>7 days)

- Declining exchange reserves

- Confirmation: STH SOPR near 1.0, positive funding after negative

Caution/Sell Signal:

- Sharp inflows to exchanges (>15,000 BTC/day)

- Especially from large wallets (whale alert)

- Confirmation: high STH SOPR (>1.05), overheated funding rate

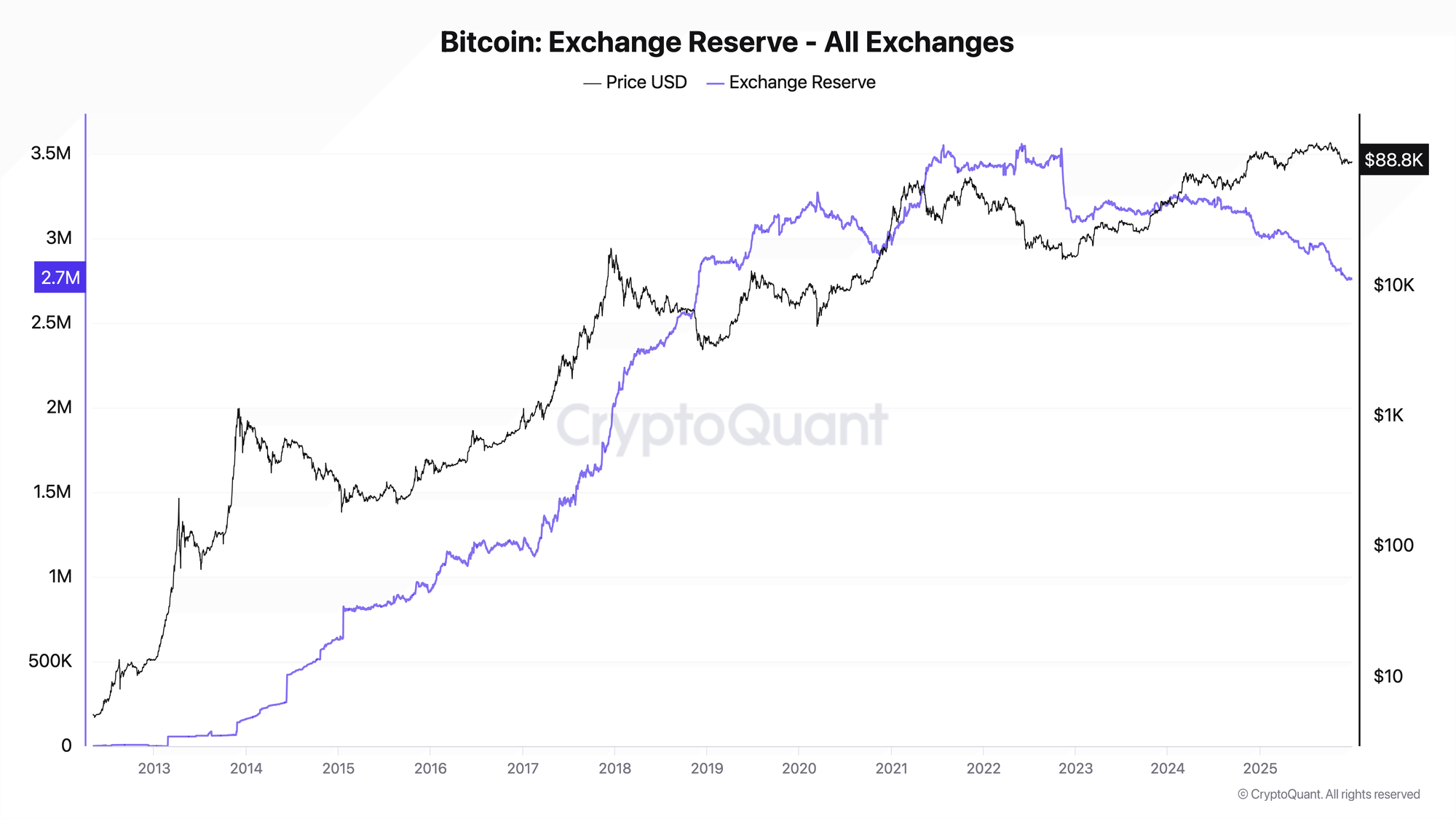

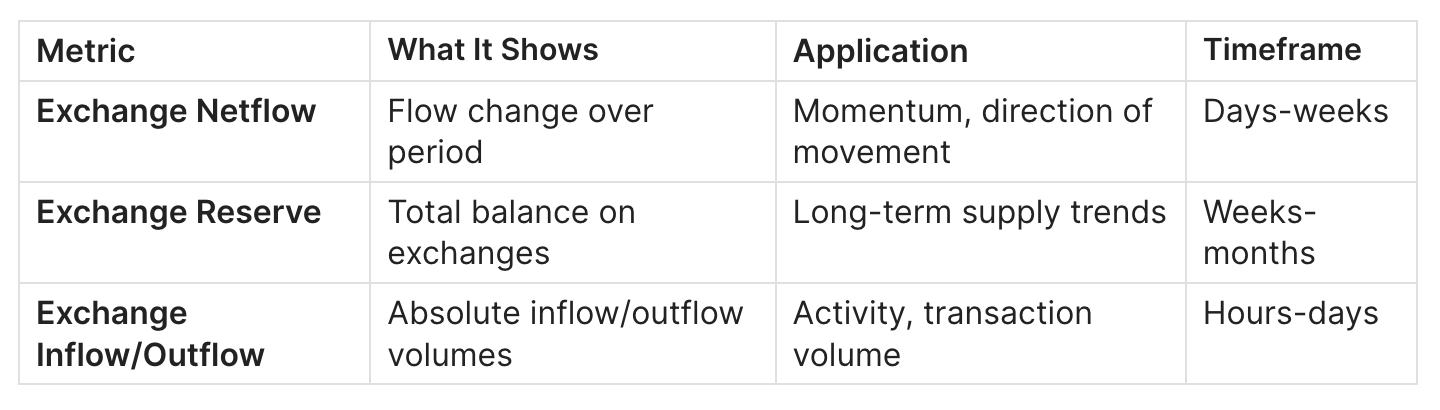

Exchange Netflow vs Exchange Reserve vs Exchange Balance

When to Use Which

Exchange Netflow is best for:

- Determining short-term direction of pressure

- Identifying reversal points

- Tactical decisions (days-weeks)

Exchange Reserve is best for:

- Assessing long-term accumulation/distribution trends

- Understanding structural market changes

- Strategic positioning (months)

Separate Inflow/Outflow Analysis is best for:

- Understanding market activity

- Assessing liquidity

- Identifying anomalies

Combined Analysis

The strongest signals occur when multiple indicators align:

Negative Netflow + Falling Reserve + STH SOPR < 1

= Accumulation amid weak hands capitulation

→ Strong buy signal

Positive Netflow + Rising Reserve + STH SOPR > 1.05

= Distribution, profit-taking

→ Caution signal

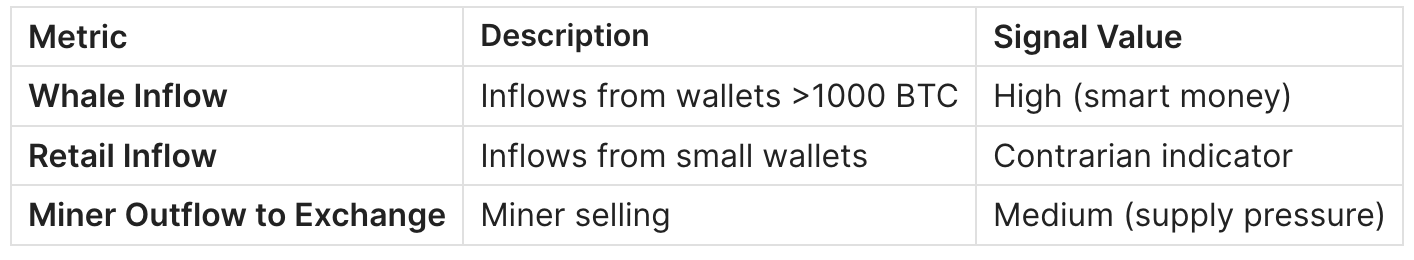

Advanced Exchange Flow Metrics

By Participant Type

By Exchange

Different exchanges have different user profiles:

- Coinbase: Institutions, US investors

- Binance: Retail, Asian market, derivatives

- Kraken: Europe, large players

Usage Example: Inflows to Coinbase with outflows from Binance may indicate institutional buying, not retail selling.

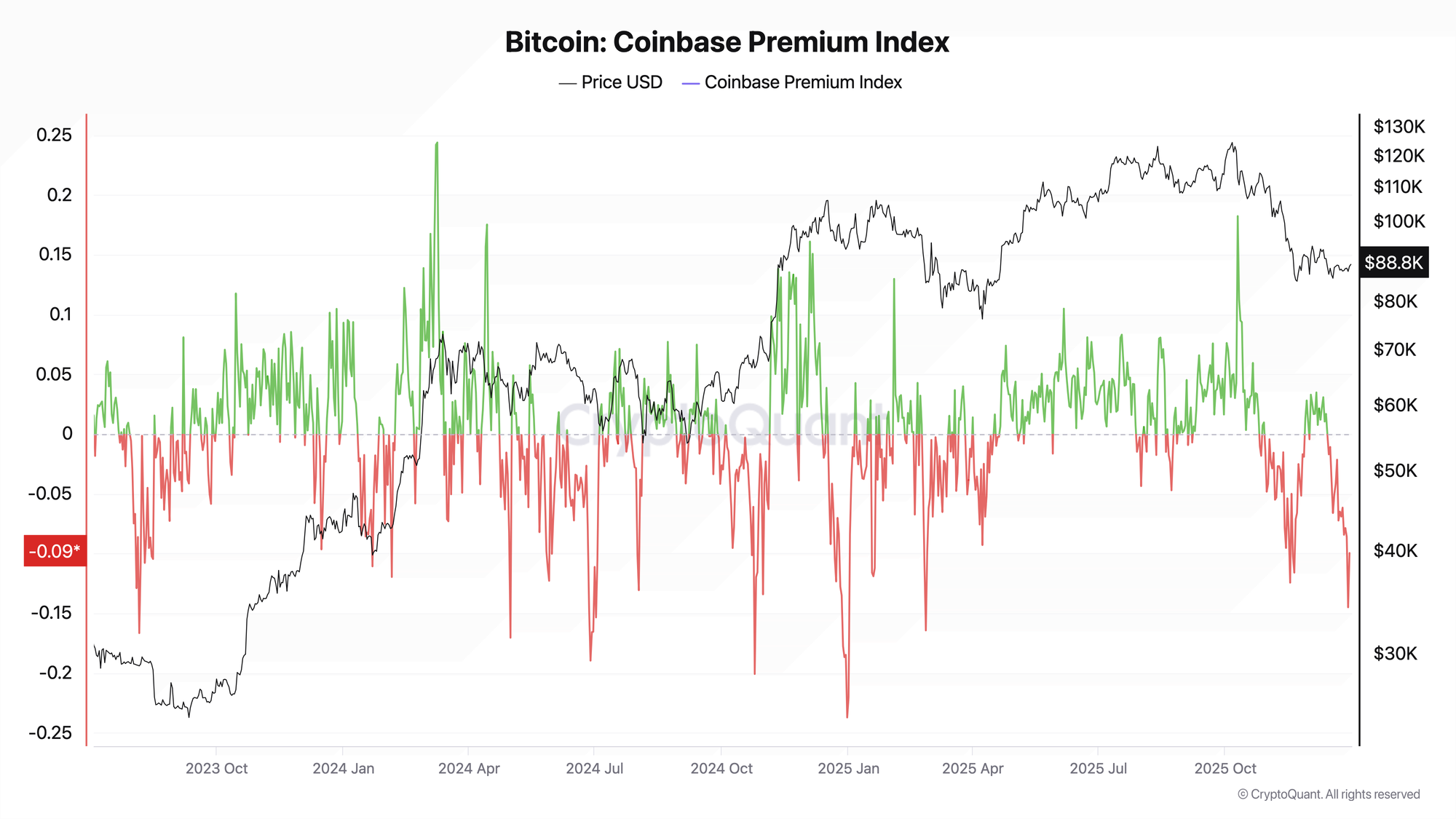

Coinbase Premium + Exchange Flow

Coinbase Premium > 0 + Outflow from Coinbase = Institutions buying OTC/accumulating

Coinbase Premium < 0 + Inflow to Coinbase = Institutions selling

Limitations of Exchange Netflow

When the Indicator Doesn't Work

1. Internal Exchange Transfers

- Movements between hot and cold wallets within exchanges

- Can create false inflow/outflow signals

- Solution: use filtered data (CryptoQuant "adjusted")

2. New/Unidentified Addresses

- Not all exchange addresses are labeled

- New exchanges may not be included

- Solution: use multiple data sources

3. Changing Participant Behavior

- Growth of DeFi and DEX reduces CEX metrics significance

- Institutions use OTC, bypassing exchanges

- Solution: supplement with Stablecoin flows, ETF flows analysis

4. FTX-Type Events

- Force majeure outflows due to fear

- Not related to bullish accumulation

- Solution: consider news background

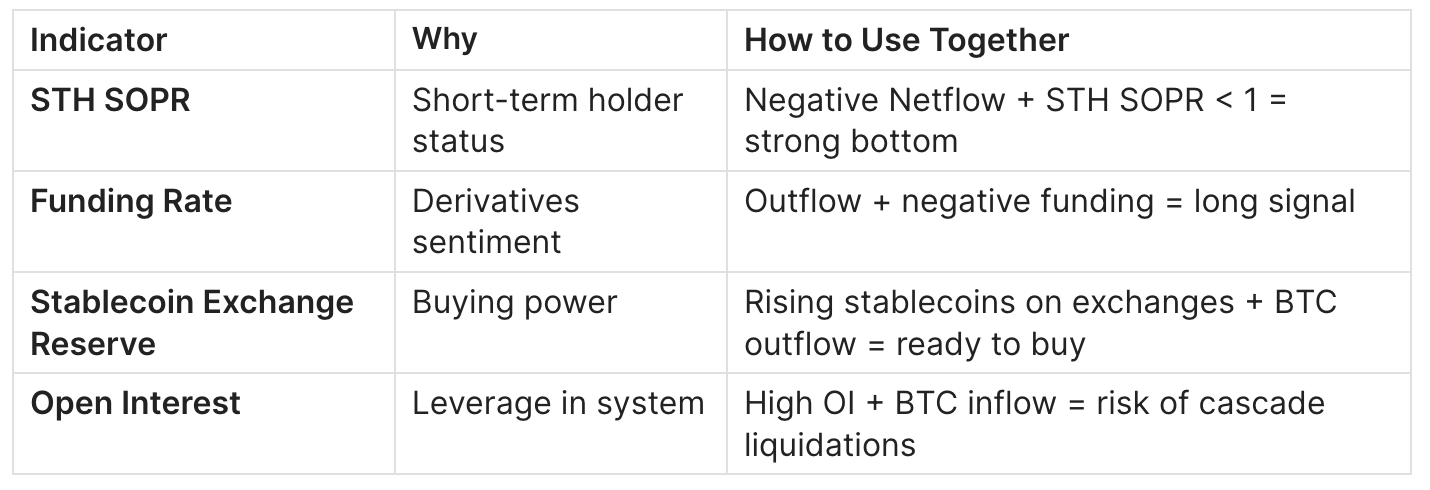

Which Indicators to Combine With

FAQ

What Exchange Netflow Value Is Considered Significant?

Depends on context and timeframe:

- Daily Netflow: >10,000 BTC — significant signal

- Weekly Netflow: >30,000 BTC — strong signal

- Trend matters more: 5-7 days in one direction is more important than a single day

Where to Find Exchange Netflow Data?

Free:

- CryptoQuant — basic charts (requires registration)

- Coinglass — Exchange Balance

Paid (extended data):

- CryptoQuant Pro — from $29/month (exchange breakdown)

- Glassnode Studio — from $39/month

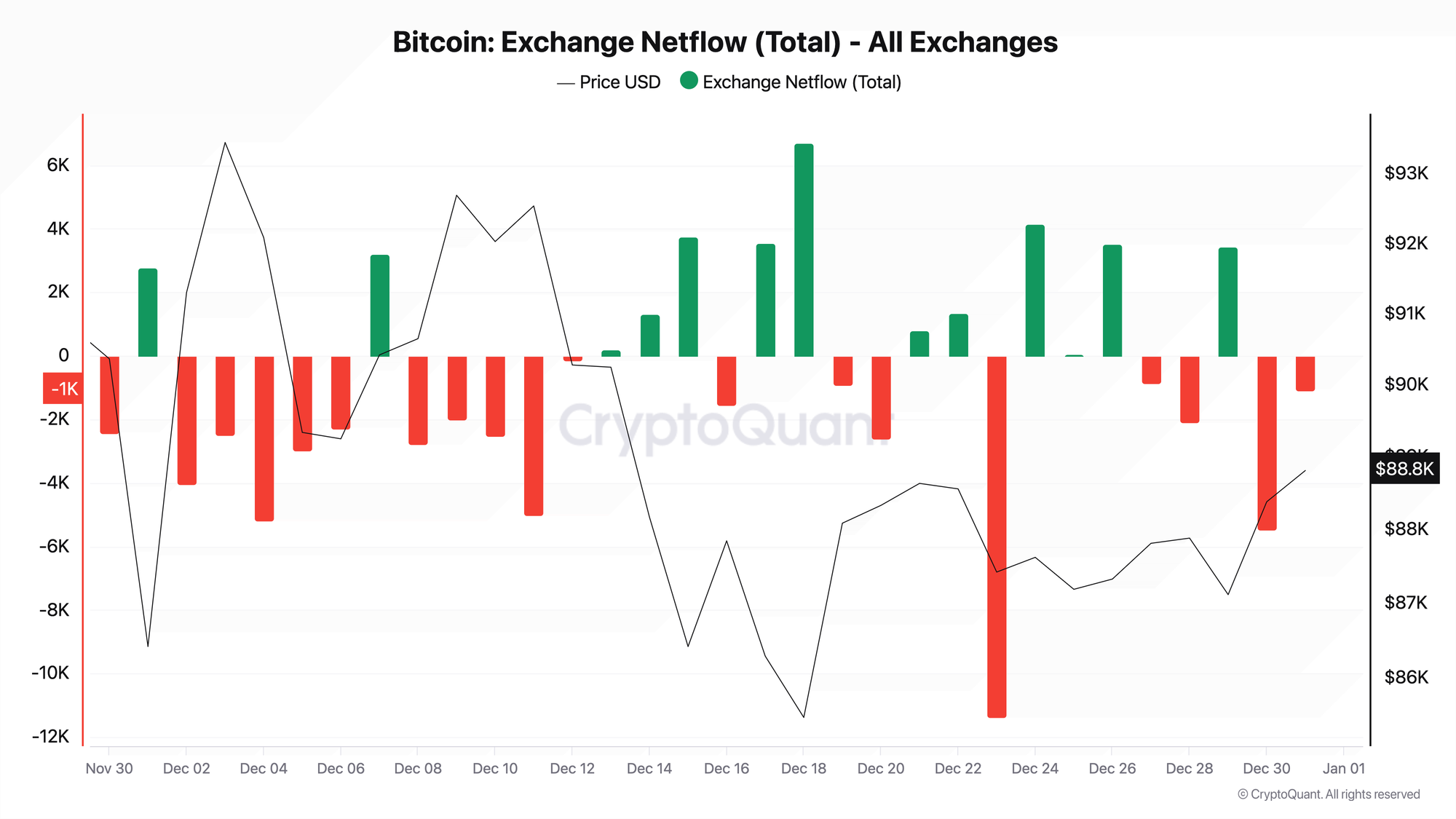

Is Exchange Netflow Currently Bullish or Bearish?

Current analysis of Exchange Netflow and other on-chain metrics is published in ADLER AM — daily morning briefs on the Bitcoin market. Detailed Bitcoin market analysis is published on Substack, subscribe via AdlerInsight

How to Distinguish "Healthy" Outflow from Panic Outflow?

Healthy Outflow (Accumulation):

- Gradual, steady

- Against a backdrop of stable or rising prices

- No negative news

Panic Outflow (Distrust):

- Sharp, impulsive

- After negative events (hacks, bankruptcies)

- Accompanied by price decline

Conclusion

Exchange Netflow is a powerful tool for understanding the supply and demand balance in the Bitcoin market. Key principles:

- Outflow = reduced supply. Sustained outflows from exchanges historically precede price increases

- Inflow = selling pressure. Sharp inflows often coincide with local tops

- Context determines interpretation. The reason for the flow matters more than the flow itself

- Combine with other metrics. Netflow + SOPR + Funding provide more reliable signals

- Watch whale flows. Large transfers have greater predictive value