Bitcoin enters mid-week amid a clear deterioration in structural indicators. Both charts point to a shift in market regime into bearish territory, the composite structure signal has moved into negative territory, while the fast components of the Bull-Bear Index demonstrate growing pressure from derivatives.

TL;DR

Bitcoin registers a transition of market structure into risk-off mode: both indicators have shifted into bearish territory, requiring heightened caution until signs of reversal emerge.

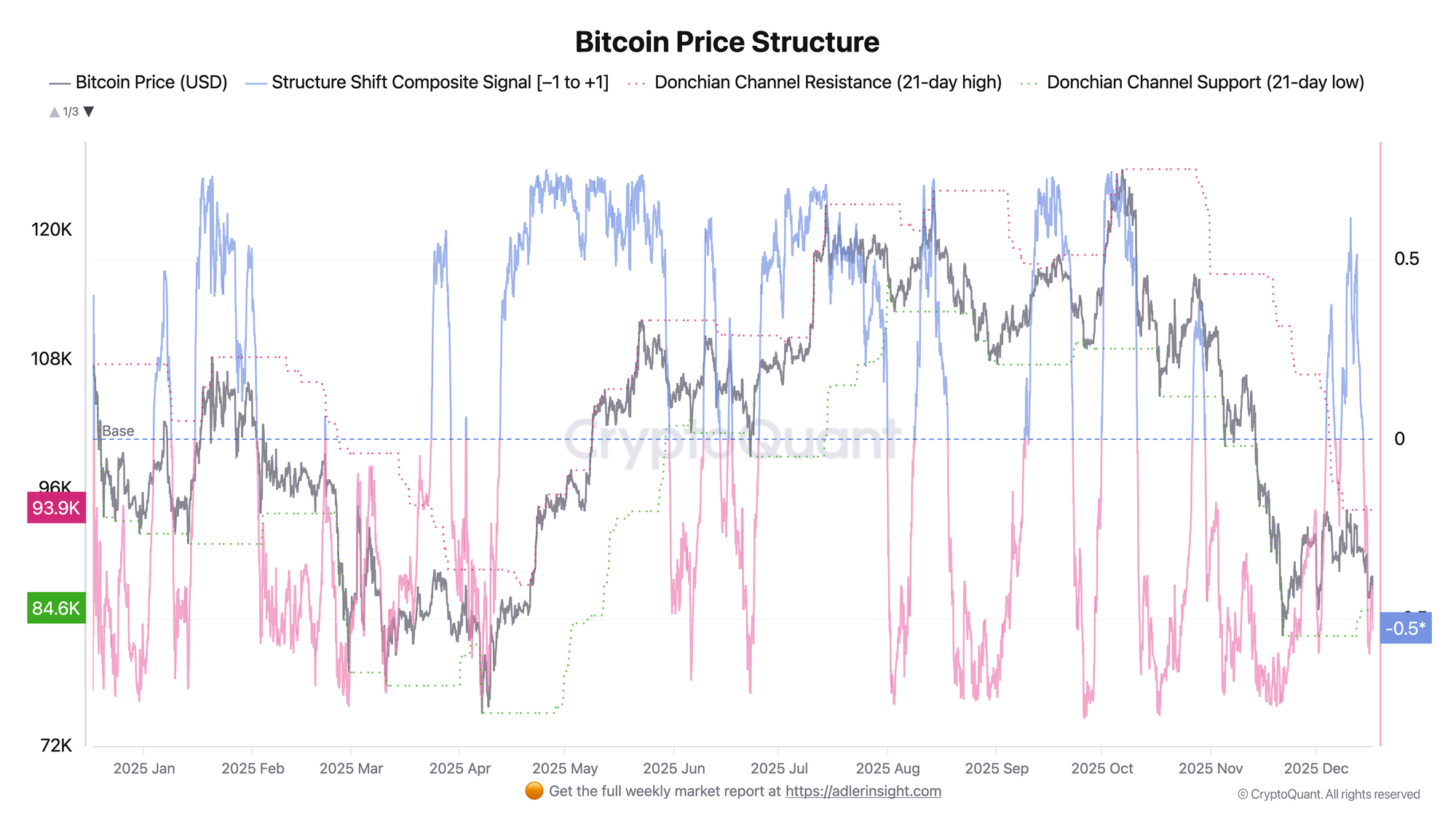

Bitcoin Price Structure

The Structure Shift composite indicator measures the state of market structure in a range from -1 to +1, where values below zero indicate bearish regime dominance. The chart shows that the signal has declined from positive territory and currently sits at the -0.5 level, corresponding to a sustained bearish regime. Price has meanwhile dropped to the lower boundary of the 21-day Donchian Channel and trades near the support level around 85K.

The current signal position confirms that the market has established itself in the bearish structure zone. The main trigger for improvement would be a return of the composite signal above the zero level while holding channel support.

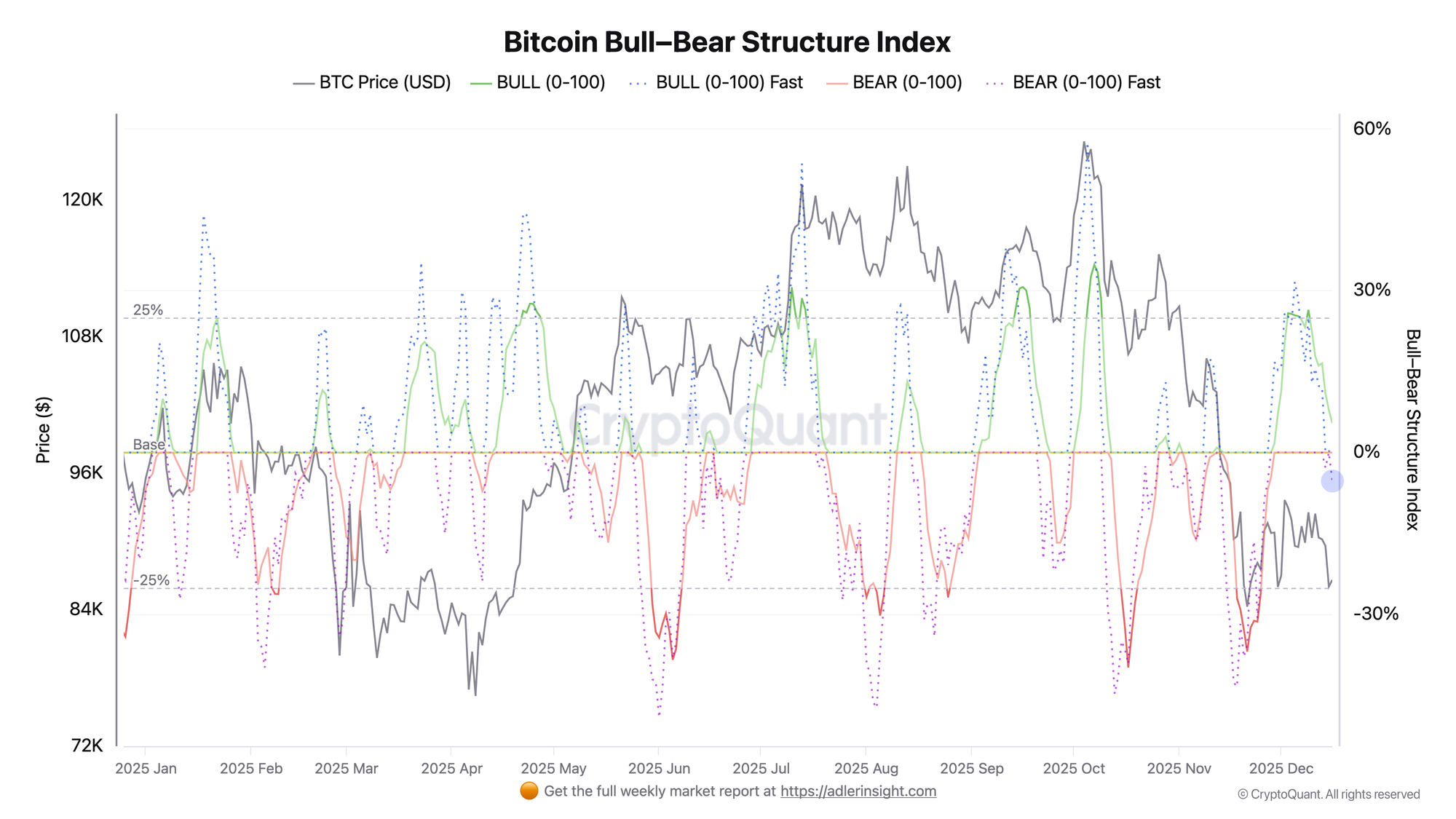

Bitcoin Bull-Bear Structure

The Bull-Bear Index separates market pressure into bullish and bearish components, where fast components reflect short-term derivatives dynamics. Current data shows that the bullish regime (BULL) has dropped to minimal values of 5%, while the fast bearish component (BEAR Fast) has moved into negative territory. This indicates growing seller pressure specifically through the derivatives market.

The index configuration signals that short-term momentum is on the bears' side, and spot demand is insufficient to offset pressure from the futures market. A reversal requires recovery of the bullish component.

Both charts consistently point to one conclusion: a local structural shift into bearish territory is confirmed by both the composite signal and Bull-Bear regime dynamics. The main risk today is continued pressure through derivatives amid absent spot support.

FAQ

What does a negative Structure Shift Composite Signal value mean?

Negative signal values indicate that the combination of structural factors trend, momentum, and positioning has shifted in favor of bears. This is not a forecast of decline, but a statement of the current regime requiring defensive positioning.

What level serves as the trigger for regime change?

The key reference point is a return of the composite signal above zero with simultaneous recovery of the Bull-Bear bullish component above the 5% level. Until then, the structure remains in risk-off mode.

CONCLUSIONS

Structural indicators synchronously confirm the market's transition into bearish regime. The Structure Shift composite signal has dropped into negative territory around -0.5, while the Bull-Bear Index registers minimal bullish component values amid activated derivatives pressure. The current regime is risk-off with emphasis on position protection. The main trigger for improvement is a return of Structure Shift above zero and recovery of the bullish regime. The main risk is intensified derivatives pressure on a break of 85K support, which could accelerate the correction.