Short-term holders are selling at breakeven, the market is frozen in range, and the political deadlock in Congress threatens a spike in volatility.

TL;DR

Bitcoin is in consolidation mode: short-term holders are selling near cost basis, creating a balance of supply and demand without clear momentum. To confirm an upward trend, the profitability indicator needs to sustain above the critical level for several consecutive days. However, the macroeconomic backdrop is complicated by a high probability of a US government shutdown due to budget deadlock between parties, which has historically led to increased market volatility and capital outflows from risk assets into defensive instruments.

#STH #SOPR #US-GOV

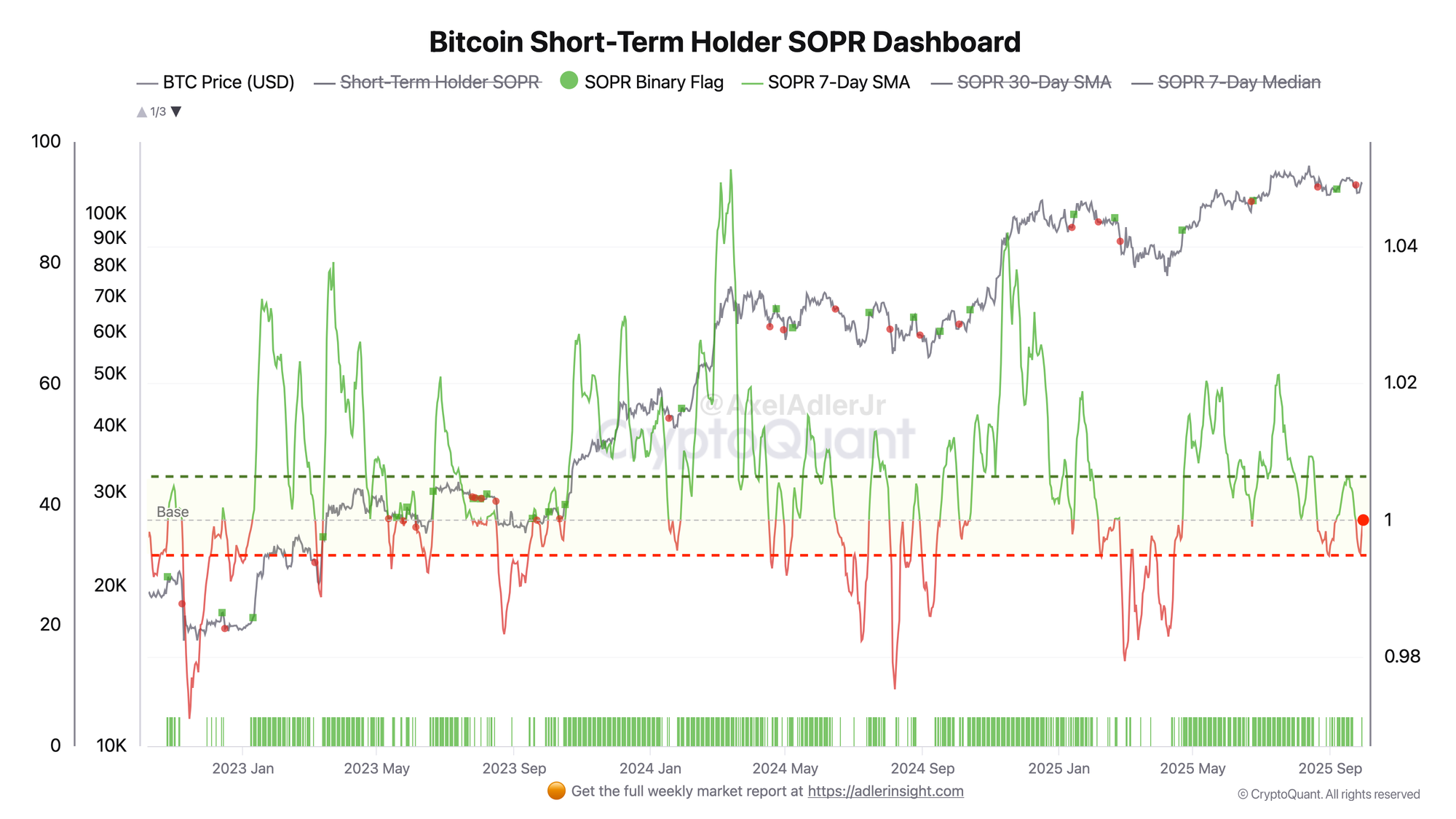

Bitcoin Short-Term Holder SOPR

STH SOPR = 1 means that the average sale by short-term holders occurs near cost basis - the market is at a balance point. While the metric fluctuates around 1, momentum typically stalls: any movement above 1 quickly makes yesterday's underwater holders profitable and pushes them to take profits, increasing opposing supply. To accelerate the trend, a sustained rise in SOPR > 1.002 for a couple of days in a row is needed.

Where We Are Now

- STH SOPR = 1.00 at zero profit/loss -> market in equilibrium, momentum is stuck.

- Compressed range: dips below 1 are bought up, but breakouts above 1 quickly meet profit-taking - supply from STH appears on rallies.

- Binary-Flag on the chart frequently flickers, which is typical for range-bound conditions (no sustained trend).

What Would Confirm an Up-Drive

- SOPR > 1.002–1.01 and holds for 2–4 days straight.

- SOPR sloping upward and absence of deep drops <1 in response to local price pullbacks.

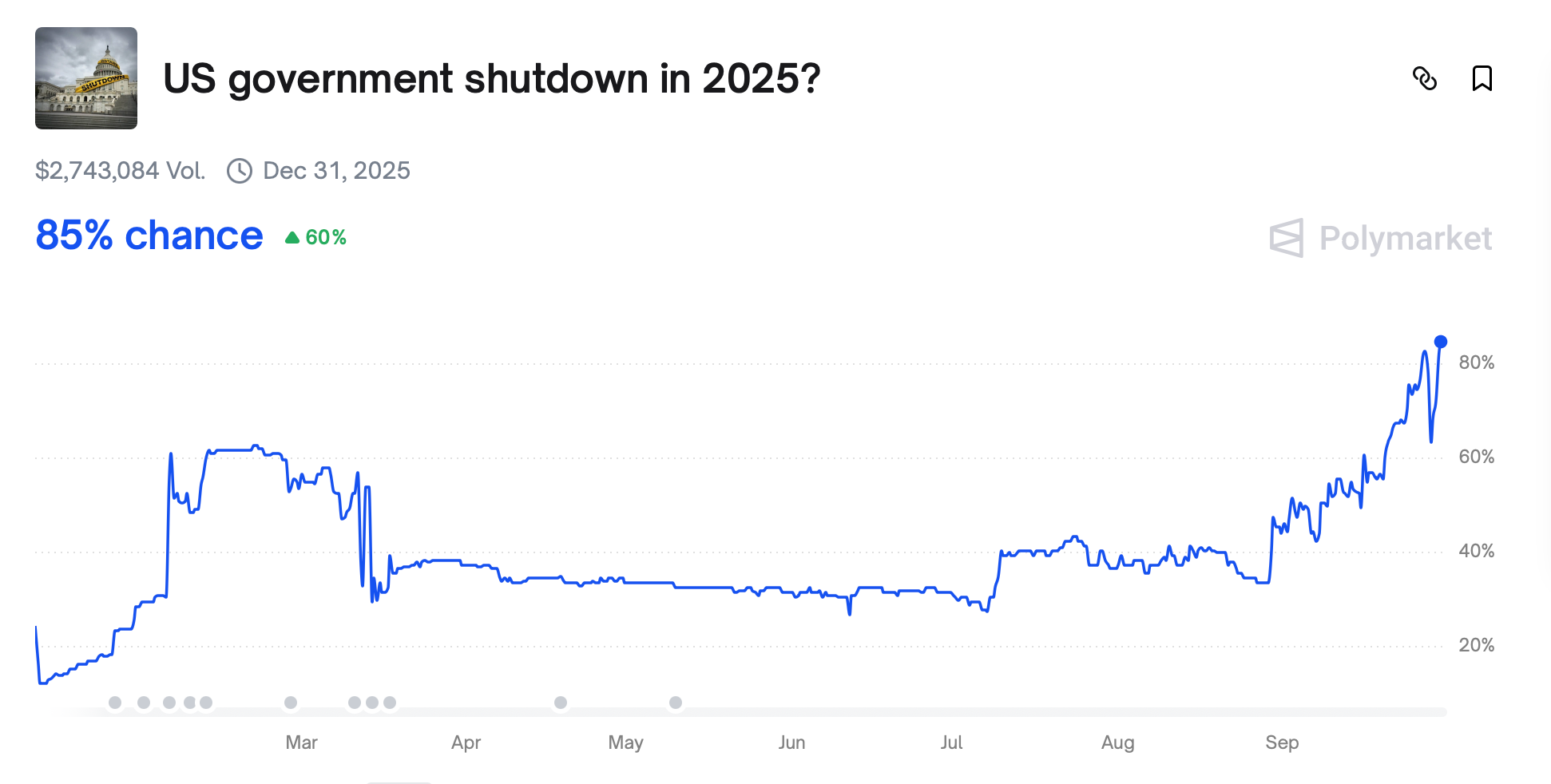

US Government Shutdown in 2025

Currently, the probability of a US shutdown in 2025, according to Polymarket data, is estimated at approximately 85%, reflecting growing investor concern in recent weeks. The main risk is the lack of agreement on the timing and terms of a temporary budget: Republicans led by Donald Trump and his allies propose extending the deadline to November 21, while Democrats insist on only a brief extension of funding for a week to ten days. Such asymmetry of positions increases the likelihood of deadlock, especially given the high level of political polarization and both parties' desire to use the budget process as a leverage tool.

If a compromise is not reached, a real threat of government agency shutdowns will emerge in early October. Similar crises have been accompanied by spikes in US stock market volatility, increased risk premiums in Treasuries, and strengthened demand for defensive assets. For cryptocurrencies, such a scenario could mean increased uncertainty and profit-taking. In the coming days, the dynamics of negotiations in Congress will become a key factor setting the tone not only for the political agenda but also for market behavior.

FAQ

What is STH SOPR and why is 1.00 important for Bitcoin?

Short-Term Holder SOPR shows whether short-term holders are selling at a profit (>1), breakeven (=1), or at a loss (<1). A value around 1.00 typically corresponds to market balance and consolidation mode.

What trigger would confirm the continuation of BTC's uptrend?

Serial maintenance of SOPR-median > 1.002–1.01 for 2–4 days plus an upward slope of the 7-SMA with no deep drops <1. This reduces opposing supply from STH and supports momentum.

How does the probability of a US government shutdown affect gold, the dollar, and crypto?

Historically, shutdowns increase short-term volatility and demand for "safe havens" (gold), while delays in macro data and regulatory pauses add uncertainty for stocks and crypto. The current high probability of a shutdown amplifies this effect.

Where can I track the shutdown probability in real-time?

On prediction markets, such as Polymarket - they currently estimate the risk of a 2025 shutdown at approximately 84%.

Conclusions

STH SOPR shows the market in balance (1.00), indicating range-bound/momentum slowdown conditions; to confirm an uptrend, we need to see serial maintenance of SOPR-median >1.002–1.01 for several consecutive days. Simultaneously, the macro risk - high (85% per Polymarket) probability of a US government shutdown - is capable of disrupting the bullish signal, increasing volatility, and triggering profit-taking.