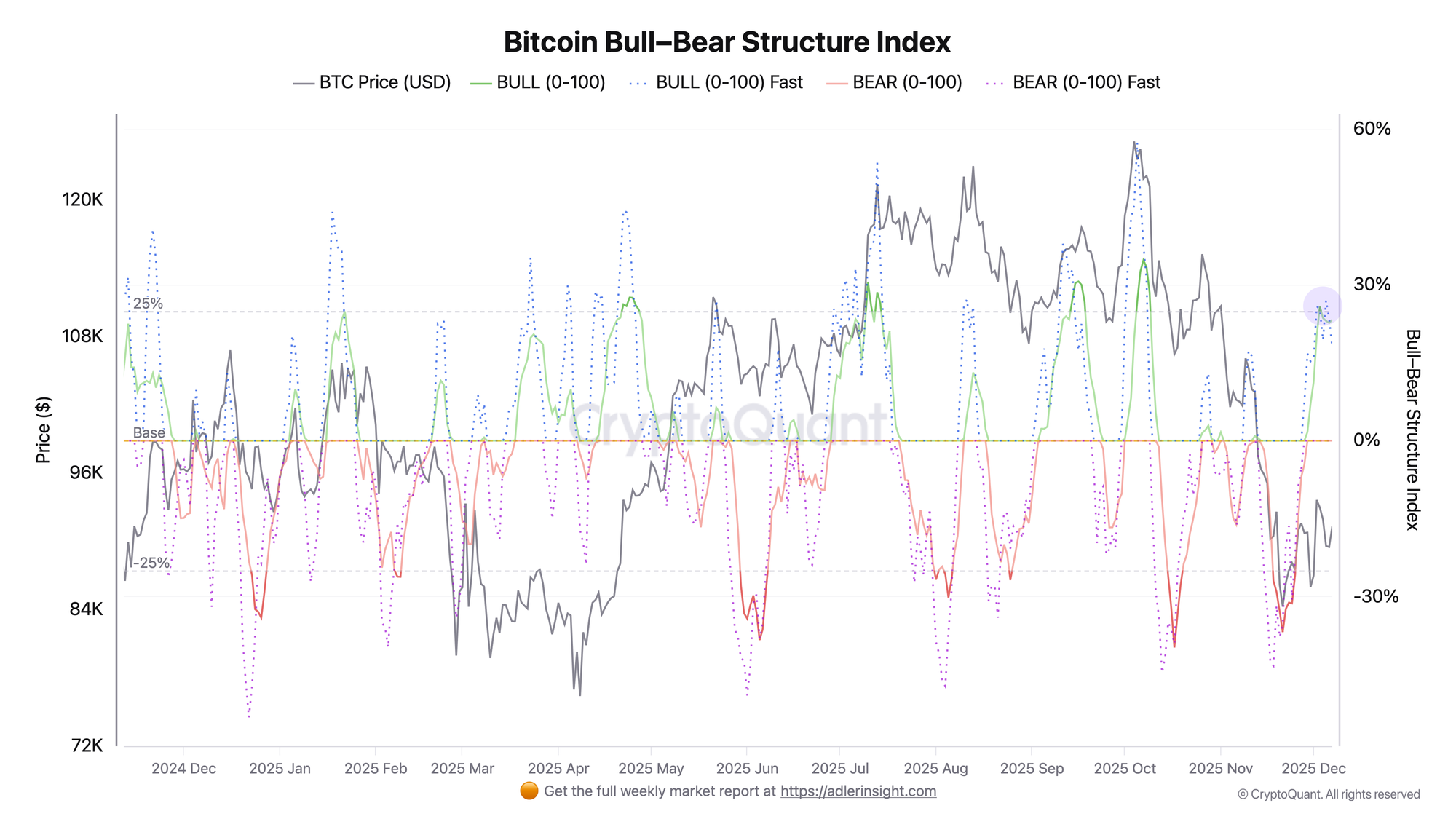

The Bull-index has risen to the 23% zone, while the fast-version has declined to 18% - the FAST < SLOW divergence signals potential problems for bulls.

TL;DR

Bitcoin maintains a confirmed bullish structure, but fading short-term momentum and divergence between slow/fast indices signal the need for defensive triggers.

Bitcoin Bull-Bear Structure Index

The composite index aggregates six market and on-chain components, using SLOW and FAST versions to determine market structure. The chart shows that FAST < SLOW divergence has historically emerged before corrections or prolonged sideways movements. The current divergence of -5.28 points is still moderate, but this is the first signal since the beginning of the month. Against the backdrop of the upcoming Fed meeting on December 9–10 and the rate decision announcement on December 10, the market will be in wait-and-see mode with elevated volatility: Fed funds futures currently price in an 85% probability of a 25 bps cut to the 3.50–3.75% range, so any deviation from this baseline scenario (more hawkish tone and pause → risk of divergence deepening and FAST dropping below 0%, more dovish signals → chance of FAST recovering to the +25–30% zone) could amplify the move.

FAQ

What does the FAST < SLOW divergence mean?

This is a signal that short-term drivers (funding rate, taker imbalance, fresh ETF/exchange flows) have weakened faster than the medium-term structure. Historically, such divergences have preceded either corrections or prolonged consolidations.

CONCLUSIONS

Against the backdrop of the Fed meeting and the market-priced 25 bps rate cut, the sensible tactic for today is not to increase risk. Overall, the picture looks like a tactically fragile market. The Bull-index in positive territory and preserved bullish structure allow maintaining baseline long exposure, but the weakening fast-component is the first warning signal, pointing to short-term momentum burnout and elevated risk of regime change.