The composite risk oscillator remains one step away from a risk-off signal, while STH-SOPR confirms unprofitable selling.

TL;DR

Bitcoin is in a zone of elevated pressure: the composite risk oscillator has reached 58 points and is approaching the critical risk-off threshold >60, which coincides with phases of price pressure. To relieve short-term pressure, the risk model needs to pull back from the 60 threshold and STH-SOPR must recover above 1.00, whereas consolidation of the oscillator above 60 and further SOPR decline to 0.98-0.975 will strengthen the negative scenario for Bitcoin.

#Bitcoin #OnChain #Macro

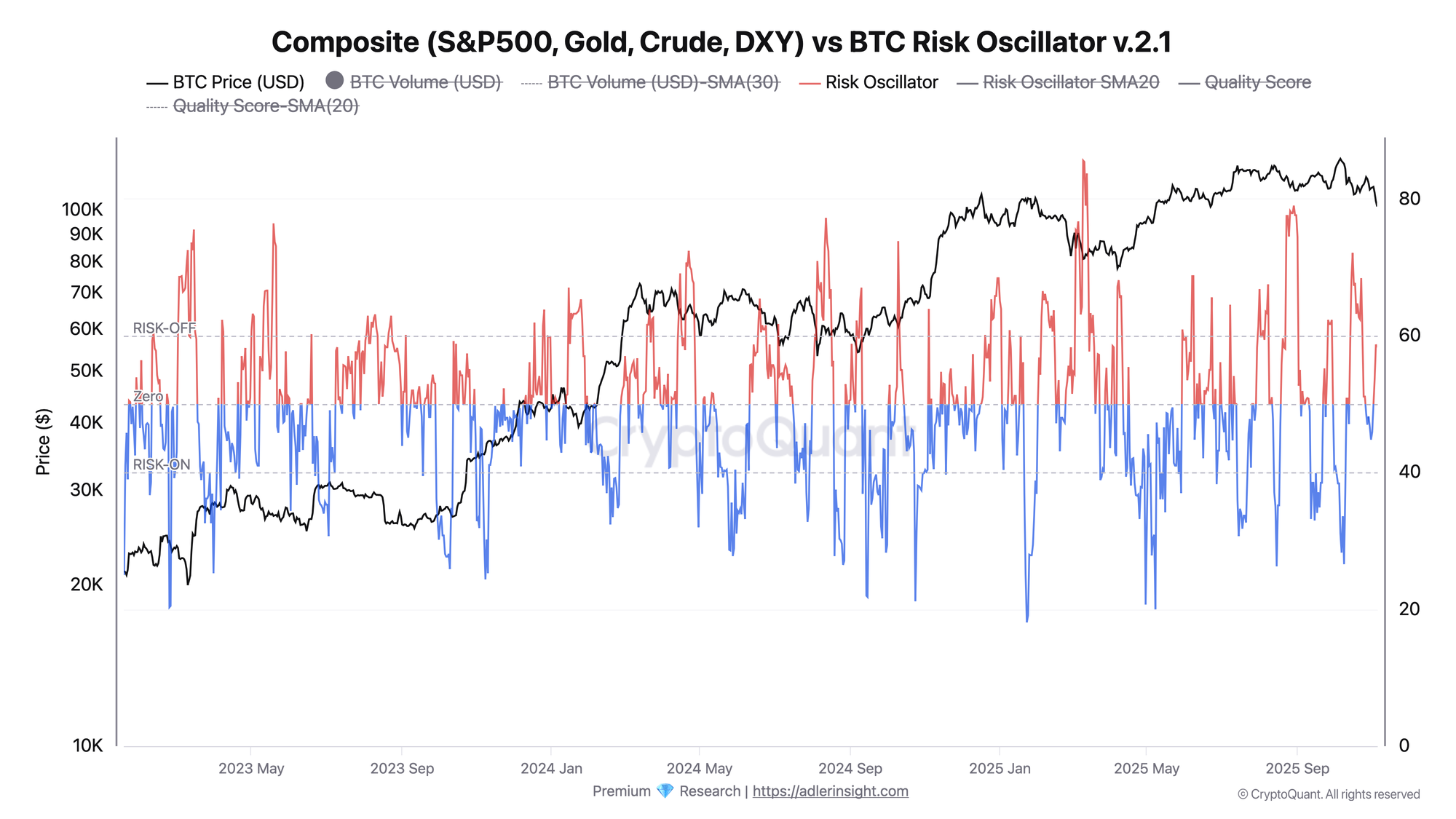

Composite (S&P500, Gold, Crude, DXY) vs BTC Risk Oscillator

Current model value - 58 pts. Threshold >60 is interpreted as active risk-off for BTC. Peaks above the threshold coincided with phases of price pressure. The model oscillates at the upper boundary of the "neutral-restraining" regime: with strengthening dollar/yields and equity weakness, a breakthrough into risk-off is likely, while weakening DXY/UST10Y will support indicator pullback downward.

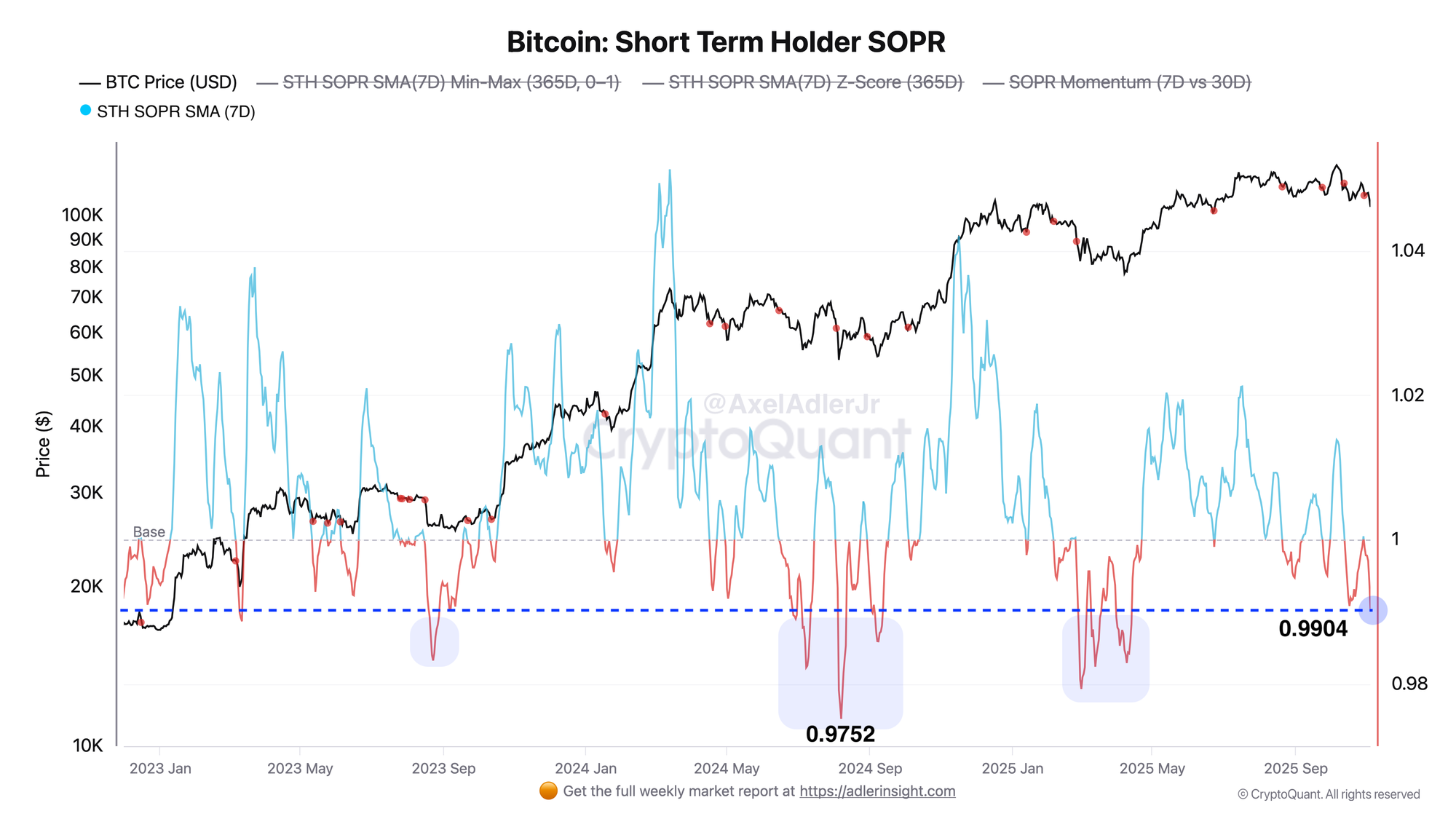

Bitcoin: Short Term Holder SOPR

7-day STH-SOPR = 0.9904 (below parity 1.00), Z-score −1.29 - unprofitable sales dominate, but without extreme. For comparison: in August 2024, a drop to 0.9752 (Z −2.43) accompanied deeper capitulation. A brief rise above 1.0005 at the end of October did not hold - seller pressure returned, remaining moderately high.

Connection between the two metrics: if Risk Oscillator breaks 60, STH-SOPR will likely deepen further below. The reverse scenario will require simultaneous Risk Oscillator pullback from the threshold and SOPR return to >1.00.

FAQ

What does the current picture on the Risk Oscillator chart mean?

Value 58 indicates a restraining backdrop, transition >60 will be a clear risk-off signal for BTC.

How to interpret STH SOPR signals in today's context?

While <1.00 - unprofitable sales continue, sustained elevation of the metric >1.00 will relieve short-term pressure.

CONCLUSIONS

Base scenario: neutral-restraining regime of price pressure with risk of breakthrough into risk-off if dollar/10-year Treasury yields strengthen. Relief will come with risk model pullback from 60 and STH-SOPR recovery >1.00.