The Fed is in an easing phase, today's meeting expected to cut rates by 25 bp, Bitcoin testing support at $112.3K amid volatility surge to 54%.

TL;DR

The Fed holds its meeting with an expected rate cut, creating a favorable backdrop for risk assets. Bitcoin in consolidation mode with sharp volatility spike—the market preparing for directional move following the regulator's decision.

#Bitcoin #FederalReserve #Macro #Volatility

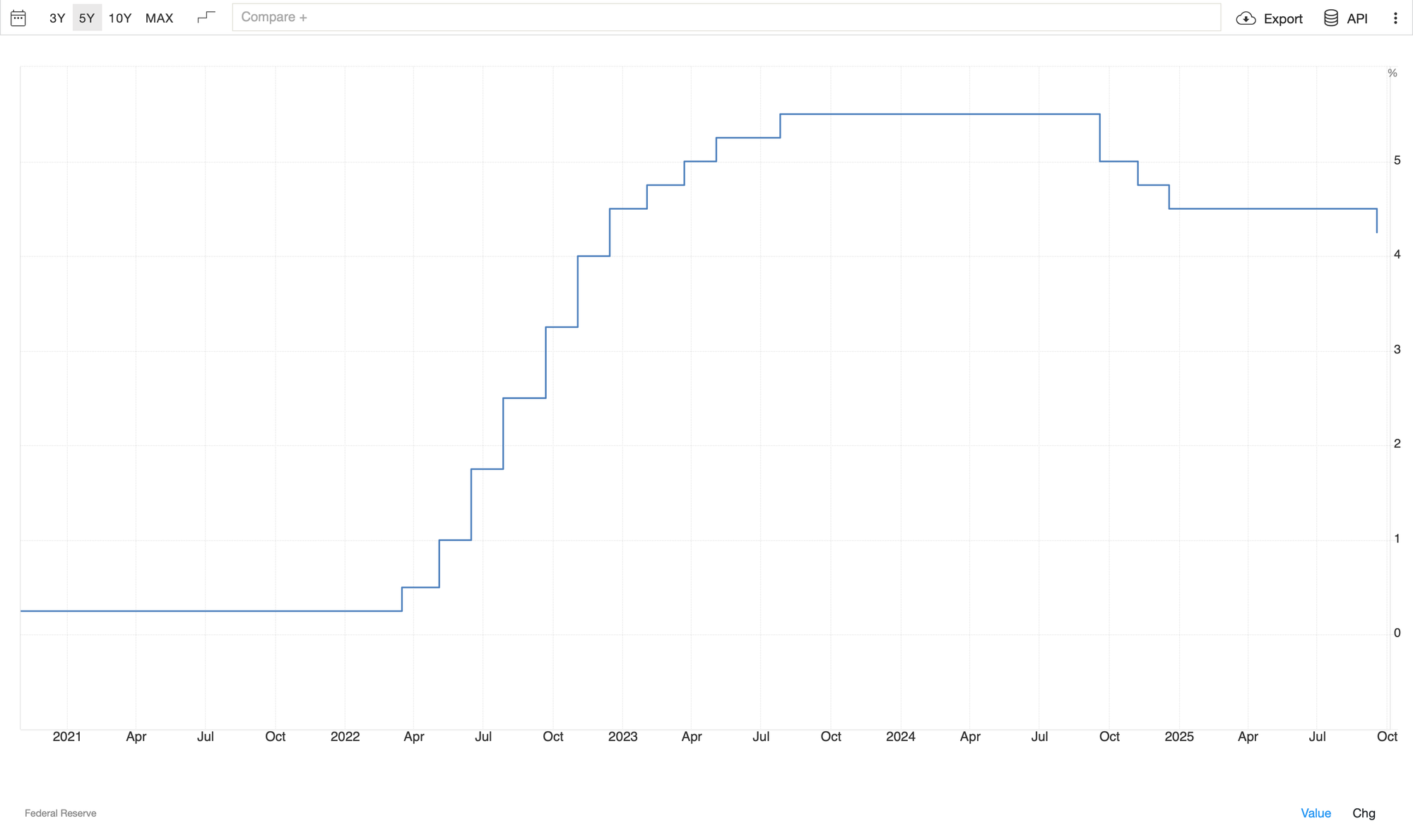

Federal Reserve Funds Rate

Current Fed funds rate at 4.25%, according to FOMC minutes, majority of officials consider further easing appropriate - about half of participants expect two more 25 bp cuts by year-end. However, inflation risks remain skewed to the upside, which could slow the pace of cuts.

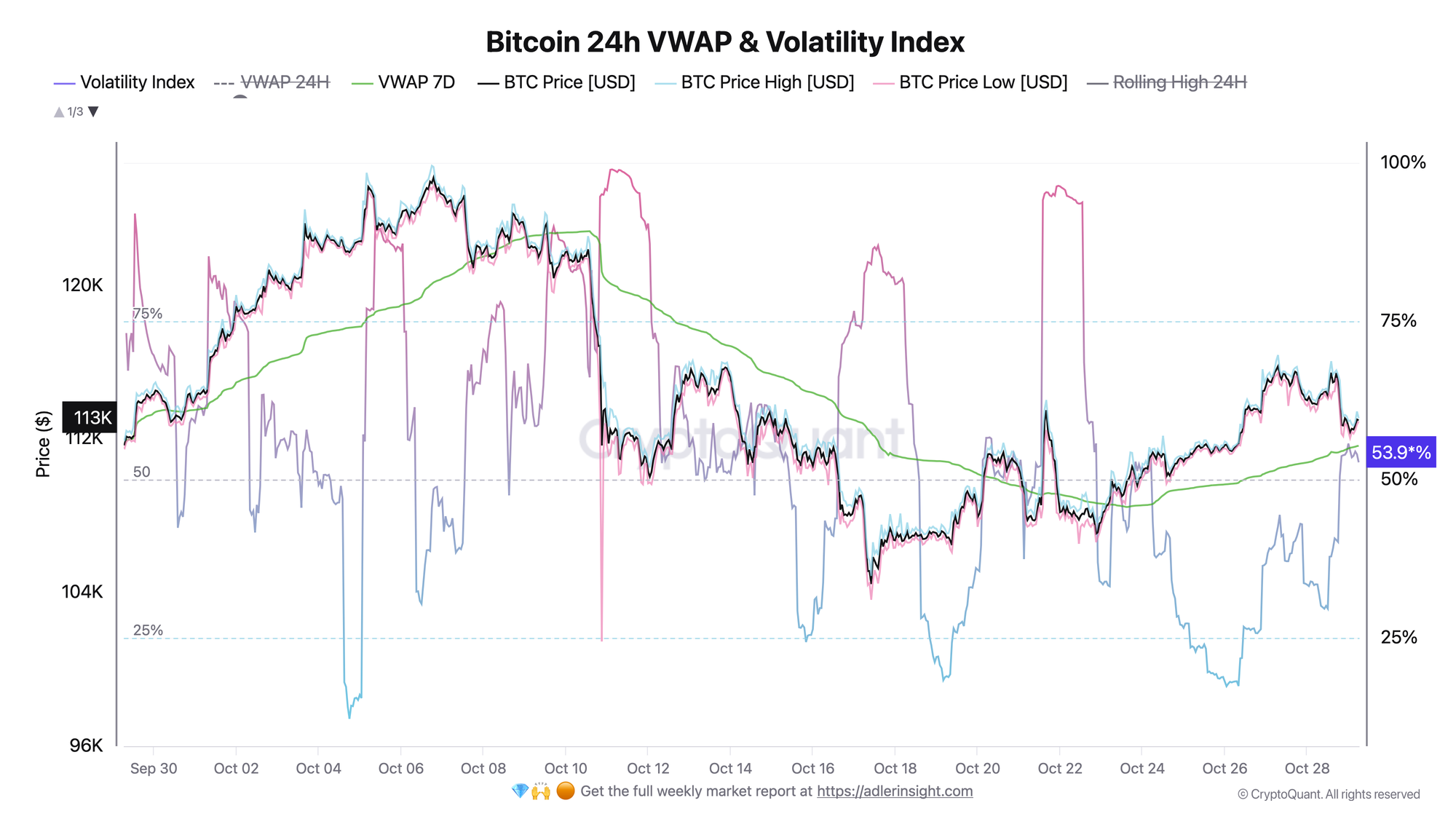

Bitcoin 24h VWAP & Volatility Index

Bitcoin trading in the $112.0-116.0K range with volatility at 53.9%, which increased by 190%, under pressure after testing local highs of $116.0K. Current price of $112.9K trading below 24h VWAP of $113.9K, indicating short-term seller dominance. Volatility index rose from 18% to 54%, signaling heightened liquidation risks in both directions amid anticipation of the Fed decision.

FAQ

What does the current Federal Reserve chart picture indicate?

The Fed is in an easing phase, but the pace of further steps remains in question due to persistent inflation risks. The market is pricing in another 50 bp of cuts by end of 2025. Fed policy easing is favorable for risk assets.

How to interpret Bitcoin chart signals in today's context?

Against the backdrop of 190% volatility increase, the current picture looks like pre-breakout consolidation. Price below 24h VWAP of $113K, but above critical support at $111K.

CONCLUSIONS

Fed policy easing creates a macro-favorable backdrop for risk assets, volatility surge indicates approaching volatility increase amid the Fed decision.