Bitcoin volatility remains elevated but progress toward deceleration has emerged following the spike.

TL;DR

Bitcoin volatility remains high at 0.019, but the slope is declining, creating a technical window for a brief consolidation period.

#Bitcoin #Volatility #Macro #OnChain

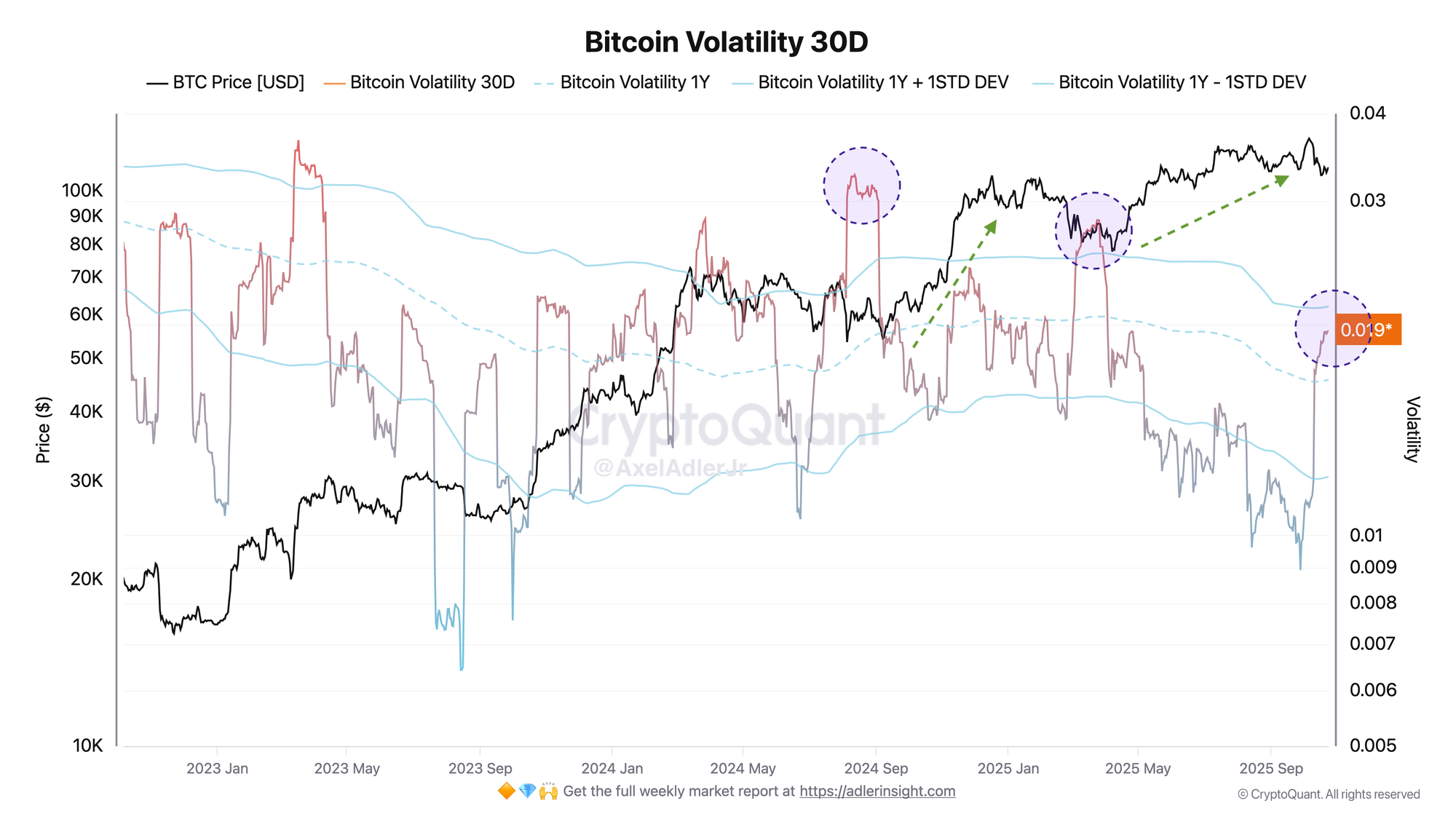

Bitcoin Volatility 30D

The volatility wave remains elevated at 0.019, but the angle is declining, with the market transitioning from sharp movements to moderate consolidation. Cooling near the +1σ range of average values opens the path for more moderate movement following elevated liquidations.

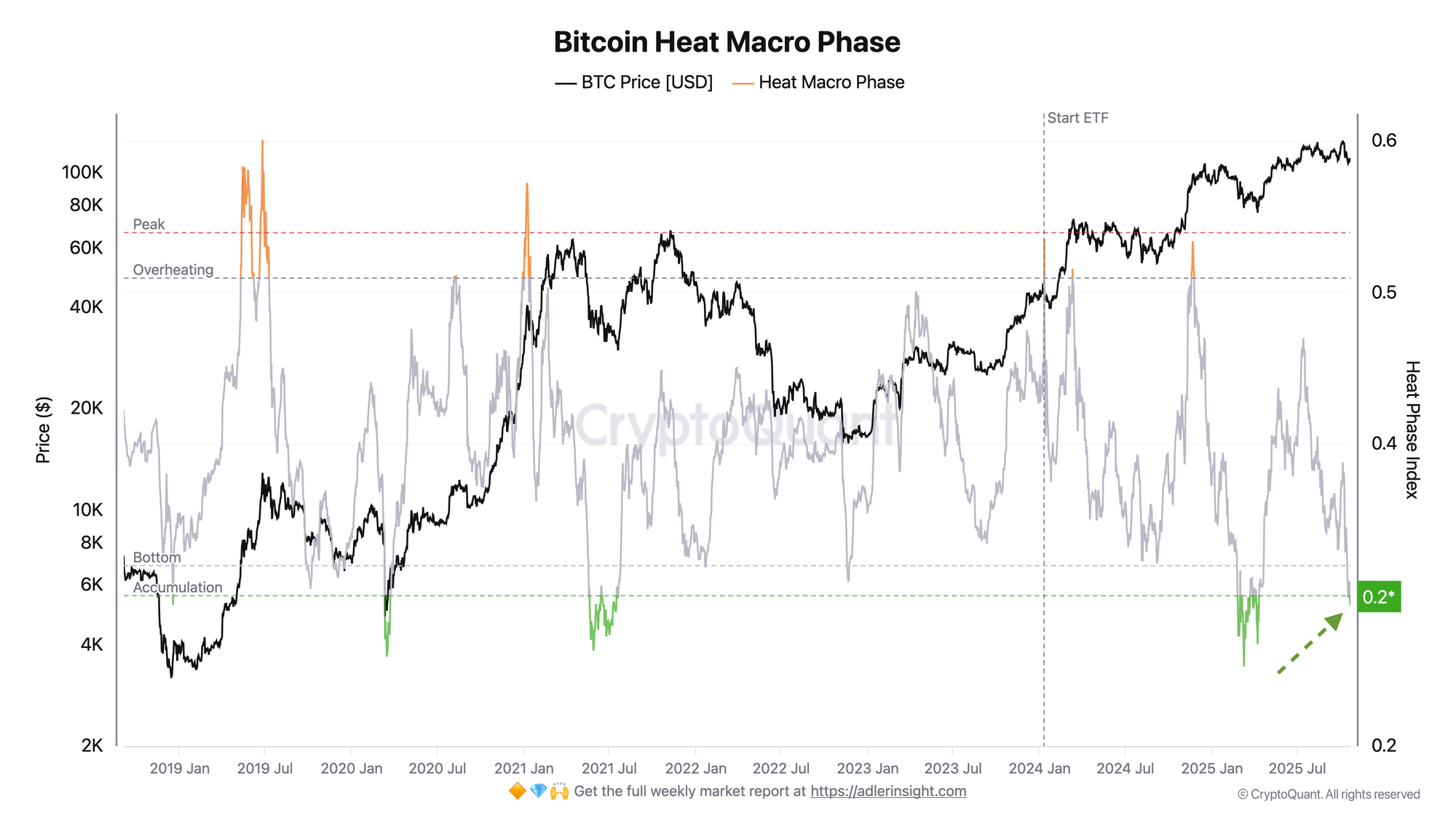

Bitcoin Heat Macro Phase

Bitсoin Heat Macro Phase has declined into the Bottom / Accumulation zone, indicating reduced speculative pressure. In a bull market, such values coincide with initial accumulation periods before the next rally. Cooling volatility creates a technical window for consolidation, while Heat Macro Phase in Accumulation provides a backdrop for position accumulation.

FAQ

What does the current picture on the Bitcoin Volatility 30D chart indicate?

The volatility wave remains elevated, but a downward trend is evident, creating a window for more moderate volatility.

How should Bitcoin Heat Macro Phase chart signals be interpreted in the current context?

The current accumulation zone in a bull market, with price reversal upward from this base against declining volatility, represents a bullish signal over a 1-month+ horizon.

CONCLUSIONS

Volatility remains elevated at 0.019, but the declining slope indicates a transition to moderate consolidation. Heat Macro Phase in the accumulation zone at 0.2 and declining volatility create a technical window for consolidation and base formation ahead of potential continued growth over a 1+ month horizon.