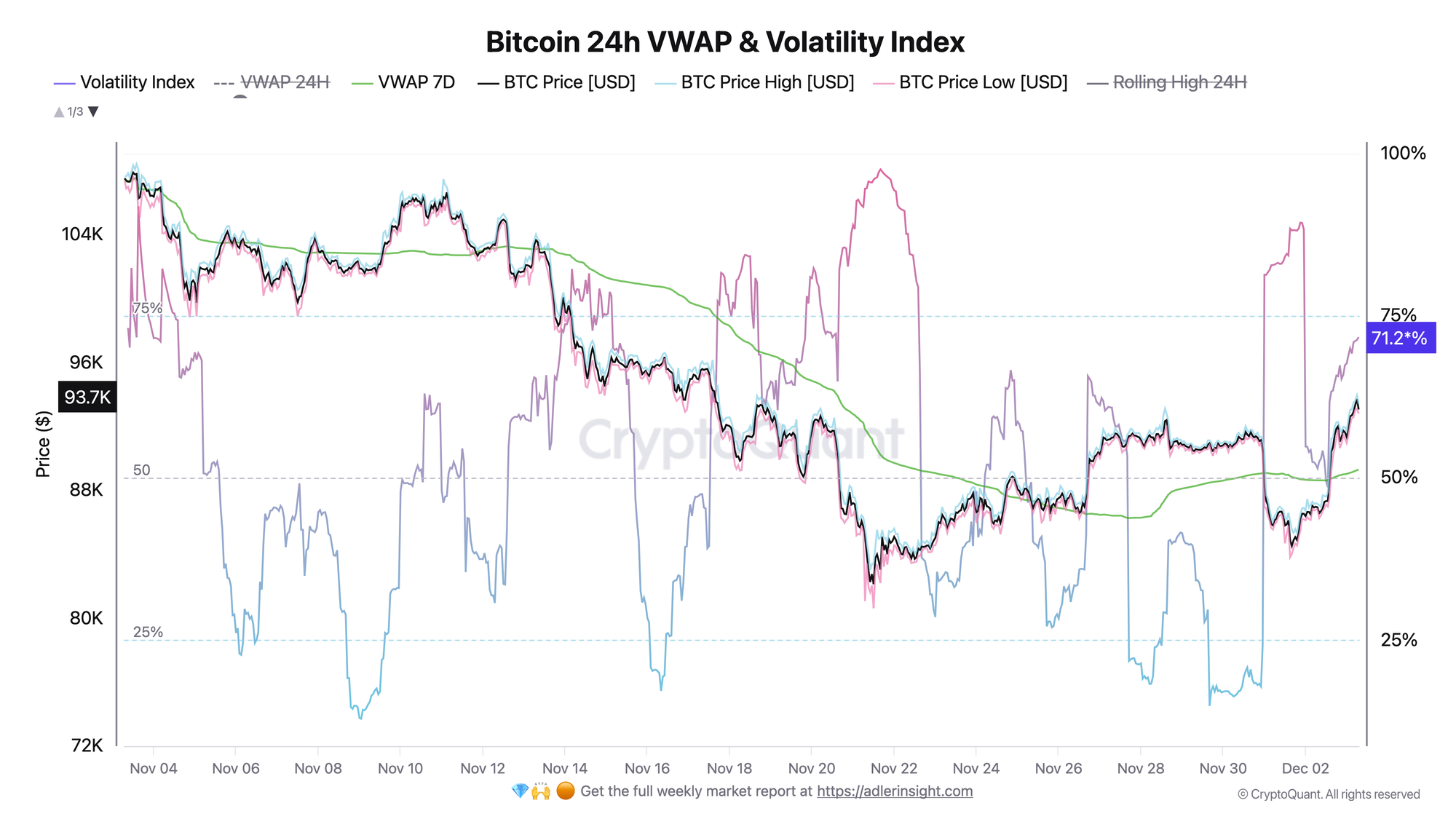

Bitcoin is trading in the $93K zone, with volatility rising to 71% - a reaction to Vanguard's policy shift, which now allows trading of third-party crypto ETFs on its platform.

TL;DR

Technically, BTC holds above the 7D VWAP with volatility around 71%, while fundamentally the market reacts to the decision by Vanguard - the world's second-largest asset manager - to open access to trading third-party crypto ETFs.

Bitcoin 24h VWAP & Volatility Index

Bitcoin has risen to the $93K level, with the first cryptocurrency's volatility growing and approaching 71%. The chart shows a transition from low-volatility consolidation in late November to the current high-volatility regime. Price broke through the 7D VWAP (green line) from below and has held above it since December 1. The market has entered a high-volatility regime.

Liquidity Inflow from Vanguard's 50M Clients

Vanguard has officially changed its stance on cryptocurrencies, now allowing brokerage clients to trade crypto ETFs including bitcoin and ethereum. Against this backdrop, BTC gained approximately 7%, with the market anticipating a new source of capital inflow in addition to the existing ≈$120 billion in U.S. spot BTC ETFs (about 6-7% of bitcoin's market capitalization).

Vanguard, the world's second-largest asset manager, with over $10.9T AUM and a client base of more than 50 million investors. Historically, Vanguard avoided crypto exposure, but an official article published on December 1, 2025, "Cryptocurrencies and Vanguard: What Investors Need to Know" cemented the policy shift: the brokerage platform now permits trading of selected third-party crypto ETFs and funds.

This policy creates a new liquidity channel, comparable in effect to the launch of the first spot BTC ETFs in January 2024. Against the backdrop of already strong demand - BlackRock's IBIT remains the fastest-growing ETF in history - expanding access for Vanguard's 50+ million clients could significantly amplify inflows into the crypto space.

Additional macro factor: the market is actively discussing the possibility of appointing Kevin Hassett (former CEA chairman in the White House and advocate for more aggressive rate cuts) as the new Fed chair. This strengthens risk appetite and supports market reaction to the Vanguard news.

FAQ

Has Vanguard launched its own crypto ETFs?

No. Vanguard is not launching its own crypto ETFs and does not plan to do so. The company has merely permitted trading of third-party crypto ETFs on its platform. This is a change in access policy, not a launch of its own products.

Does this mean massive capital inflows from Vanguard clients?

Not automatically. The decision merely opens the channel, while actual inflows will depend on client preferences and market conditions. However, given Vanguard's scale (50+ million investors, >$10.9T AUM), even 1-2% of active participants could generate inflows comparable in strength to the first weeks of spot BTC ETF launches in 2024.

Conclusion

The combination of BTC volatility rising to 71%, technical hold above the 7D VWAP, and fundamental news from Vanguard has created an environment of heightened risk appetite: the largest traditional broker now opens access to third-party crypto ETFs, including products on BTC, ETH, XRP, and SOL, expanding capital inflow channels and amplifying the effect observed after the launch of spot BTC ETFs in 2024, while speculation around the possible appointment of Hassett as Fed chair strengthens expectations of looser monetary policy, adding additional momentum to the market.