Derivative pressure is maintained above the critical level of 50.

TL;DR

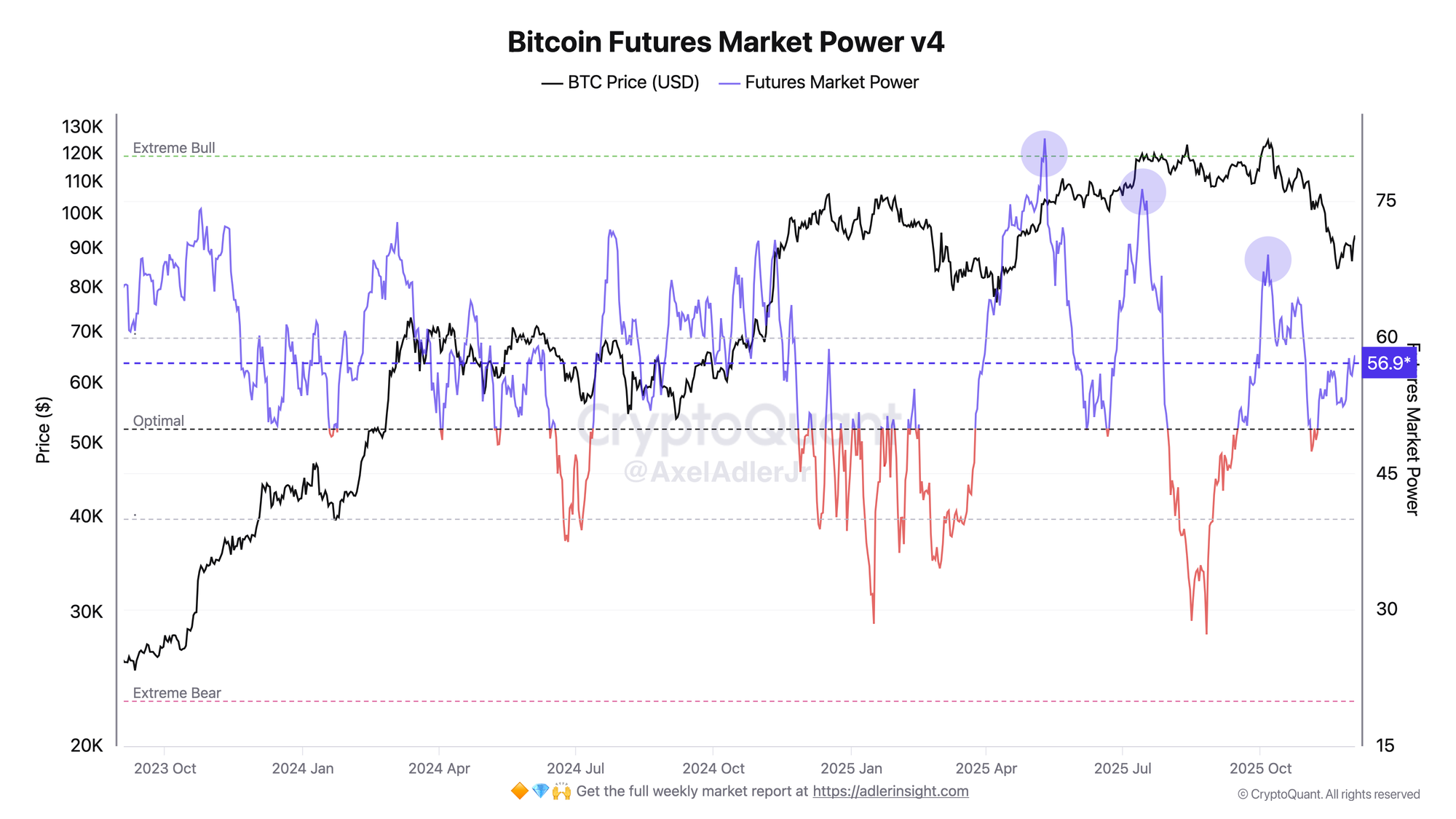

The Bitcoin Futures Market Power Index is at 56.9, generating a Bull Signal.

Bitcoin Futures Market Power

The index is at 56.9 in the neutral zone (40-60), which is above the critical threshold of 50 and generates a Bull Signal. The metric shows no extremes - neither overheating (>80) nor critical bearish pressure (<20). The chart displays a normalized composite indicator (0-100), combining relative Open Interest, Funding Rate, and Taker Imbalance. The scale is constructed so that 50 = optimal threshold, empirically identified as the best separator between periods of growth and decline due to derivatives market pressure.

Risk for today: Moderate - the index is in the neutral zone with minimal margin above the critical level of 50

Action points:

- Loss of 50 - critical signal, transition to bear signal, correction risk

- Break above 60 - confirmation of bullish momentum, transition to bullish zone

- Drop below 40 - entry into weak bearish, strengthening bearish pressure

- Spike below 30 - extreme bearish signal, high risk of collapse

FAQ

What does the current level of 56.9 mean?

The index is in the neutral zone (40-60), indicating the absence of strong imbalances in derivatives. Bull signal is active (above 50), but without signs of overheating. The neutral zone means that derivative pressure shows no extremes - this is a normal market condition without excessive leverage in either direction.

How reliable is the current bull signal?

The signal is close to the critical threshold of 50. The margin is only 6.9 points - any strengthening of bearish pressure can quickly return the index below 50. To be confident in continued growth, we need to see the metric consolidate above 60.

CONCLUSIONS

Overall, the derivatives market supports a bullish scenario, but does so without a safety margin: the index holds in the neutral zone at 56.9, only slightly above the key level of 50, so the current bull signal remains valid but vulnerable to strengthening bearish pressure. There are no signs of overheating or panic yet, so risk can be considered moderate, however, confirmation of sustainable upside will require consolidation of the index above 60, while loss of the 50 level will become an early warning of a transition to a corrective phase.