Three months of data reveal a radical regime shift. November's capitulation with z-score ranging 8–11 marked the cycle's peak stress point. Since then, the 7-day moving average of realized losses dropped from $2.4B to $0.5B - a reduction of approximately 80%. Current loss spikes are residual noise, not a new wave of selling.

TL;DR

This brief compares the current loss regime to November's capitulation. Core thesis: the market has already passed through peak stress, seller pressure is structurally exhausted, and conditions for a local recovery are forming.

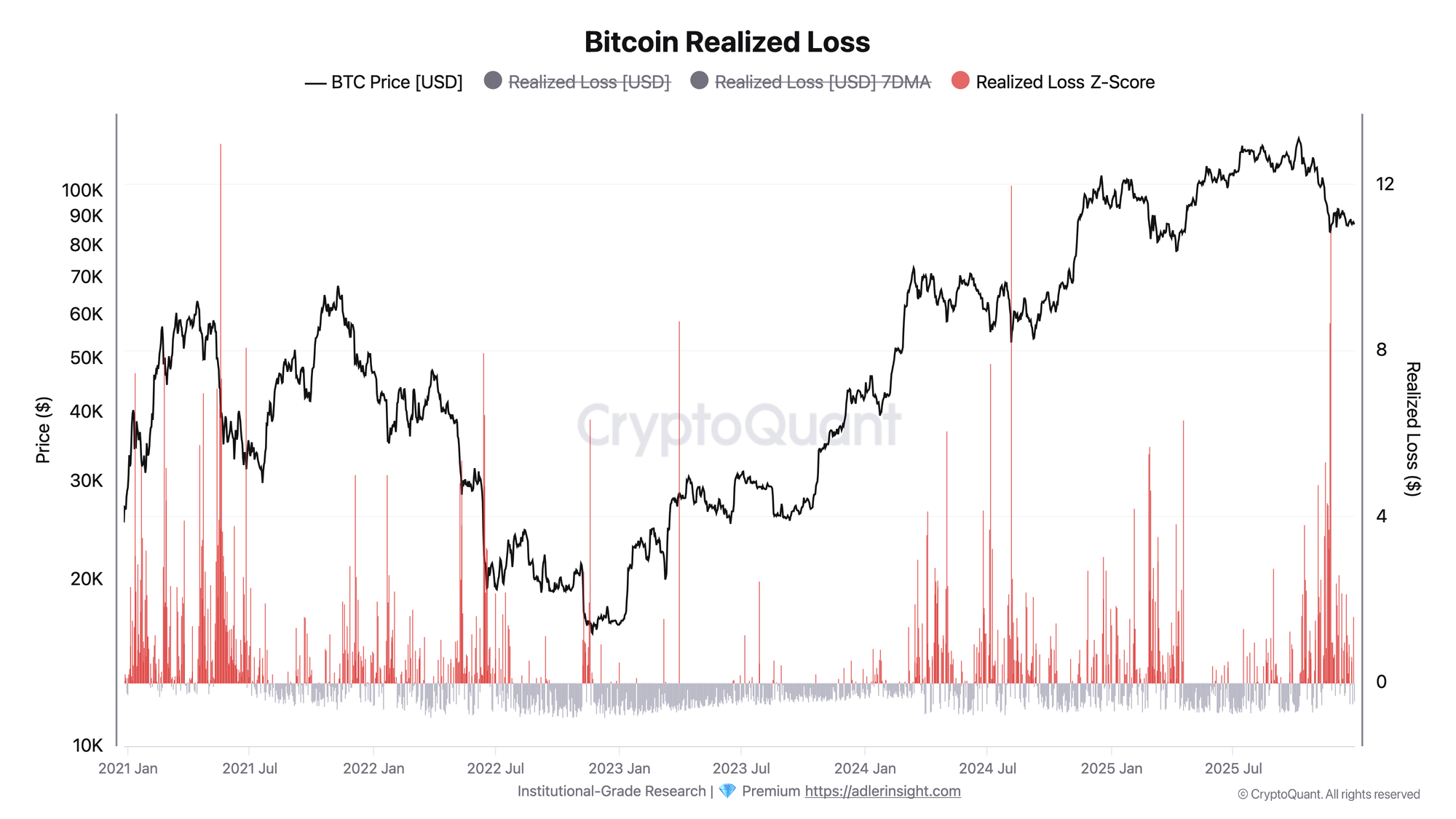

Bitcoin Realized Loss (7D SMA & Z-Score)

Chart showing Bitcoin realized losses with 7-day moving average and z-score, illustrating the transition from November's extreme capitulation to December's normalization.

This metric tracks the volume of losses locked in when coins move, normalized via z-score to identify extremes.

November marked the point of extreme stress: on November 21–22, z-score reached 8.7–10.9 with daily losses exceeding $5B. Against this backdrop, the December 26 spike with z-score around 1.6 appears insignificant. The key structural shift is the roughly fivefold reduction in weekly losses: from a peak of $2.4B in late November to the current $0.5B. Essentially, the market has returned to September–October loss levels, which historically preceded local growth phases.

The scale of SMA decline points not to a temporary pause but to structural seller exhaustion. Participants willing to realize losses have largely already exited their positions. Historically, a return of z-score above 2 combined with rising SMA serves as a reassessment trigger - until this occurs, the base case remains constructive.

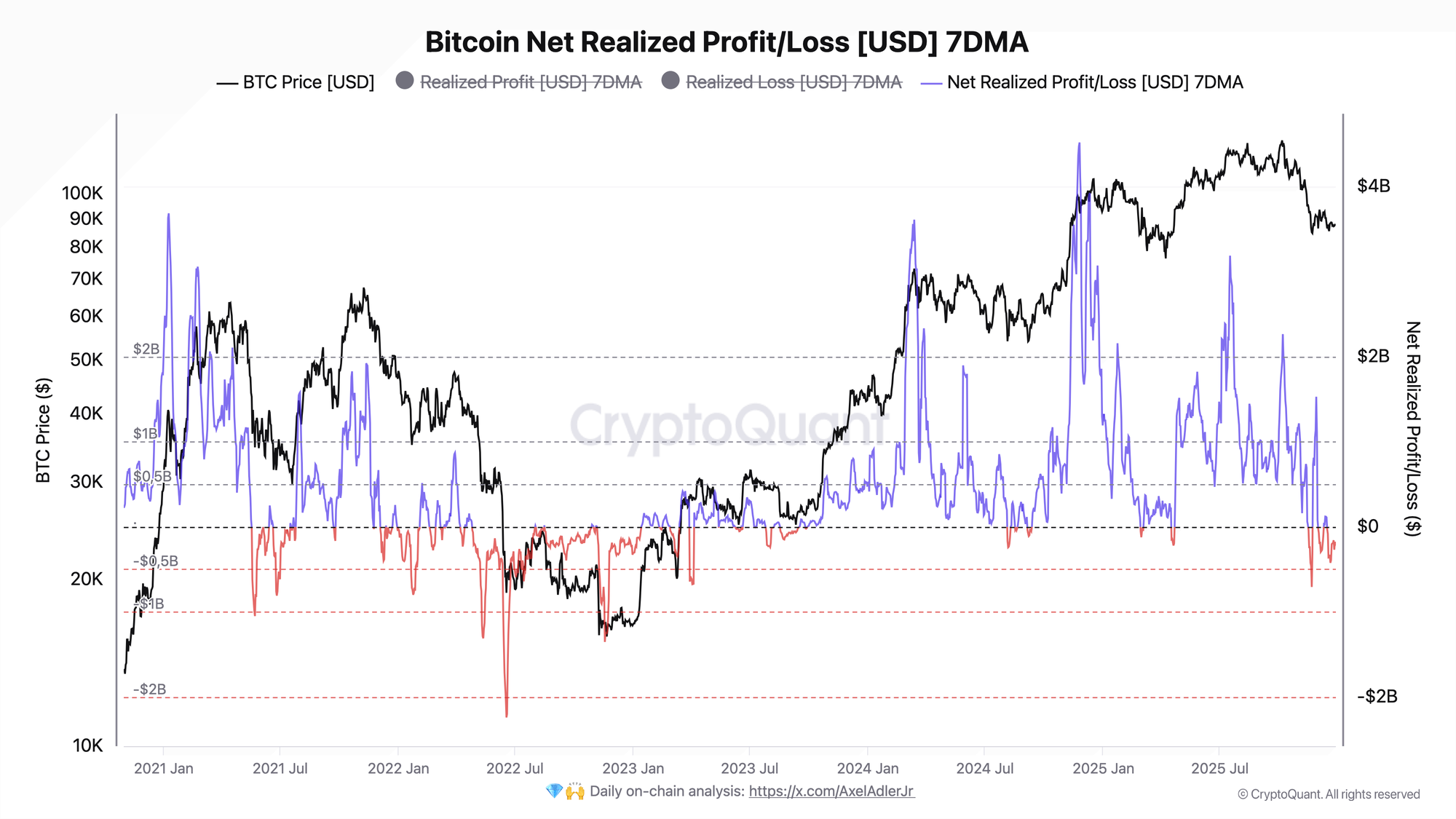

Bitcoin Net Realized Profit/Loss (7D SMA)

This indicator measures the difference between realized profit and losses averaged over a week; negative values indicate losses dominating and vice versa.

Net P/L remains in negative territory, yet the trajectory is unambiguously upward. The depth of negative values decreased by nearly half over the last week of December. Importantly, this improvement occurs against a backdrop of no pronounced price trend - suggesting natural pressure exhaustion rather than forced compression.

Net P/L approaching the zero line creates conditions for a regime shift. Historically, crossing into positive territory coincides with renewed local growth. Both charts form a coherent picture: November absorbed the bulk of weak hands, December became an absorption phase, and January could mark a turning point if new demand emerges.

FAQ

Why does November's capitulation matter more than December's spikes?

A z-score in the 8–11 range is an extreme reading that occurs only a few times per four-year cycle. This is the moment when even committed holders capitulate. After such an event, the pool of potential sellers shrinks dramatically. December's spikes with z-score around 1–2 represent normal volatility, not systemic stress.

What will confirm a transition to sustained growth?

Net P/L crossing into positive territory while the loss z-score remains below one. This would signal that profit-taking once again dominates over panic selling, and new demand is absorbing supply.

CONCLUSIONS

The market passed through November's extreme capitulation, which flushed out the bulk of weak hands and reduced seller pressure by approximately 80%. Current positioning is constructive neutrality with risk-on conditions forming. Net P/L is trending toward the zero line, and the loss z-score has stabilized in the neutral zone. The main trigger for a bullish reassessment is net P/L crossing into positive territory. The key risk is not renewed capitulation (there is no fuel for this in the current structure), but rather external shocks or absence of new demand, which could lead to prolonged consolidation instead of impulsive growth.