Technical transfer of ~800K BTC within Coinbase triggered artificial spike in on-chain metrics by ~$68B, though no actual sales occurred.

TL;DR

Massive UTXO migration on Coinbase distorted on-chain metrics, creating false signal of profit-taking worth tens of billions of dollars.

#Coinbase #OnChain #LTH

LTH Cash Extraction

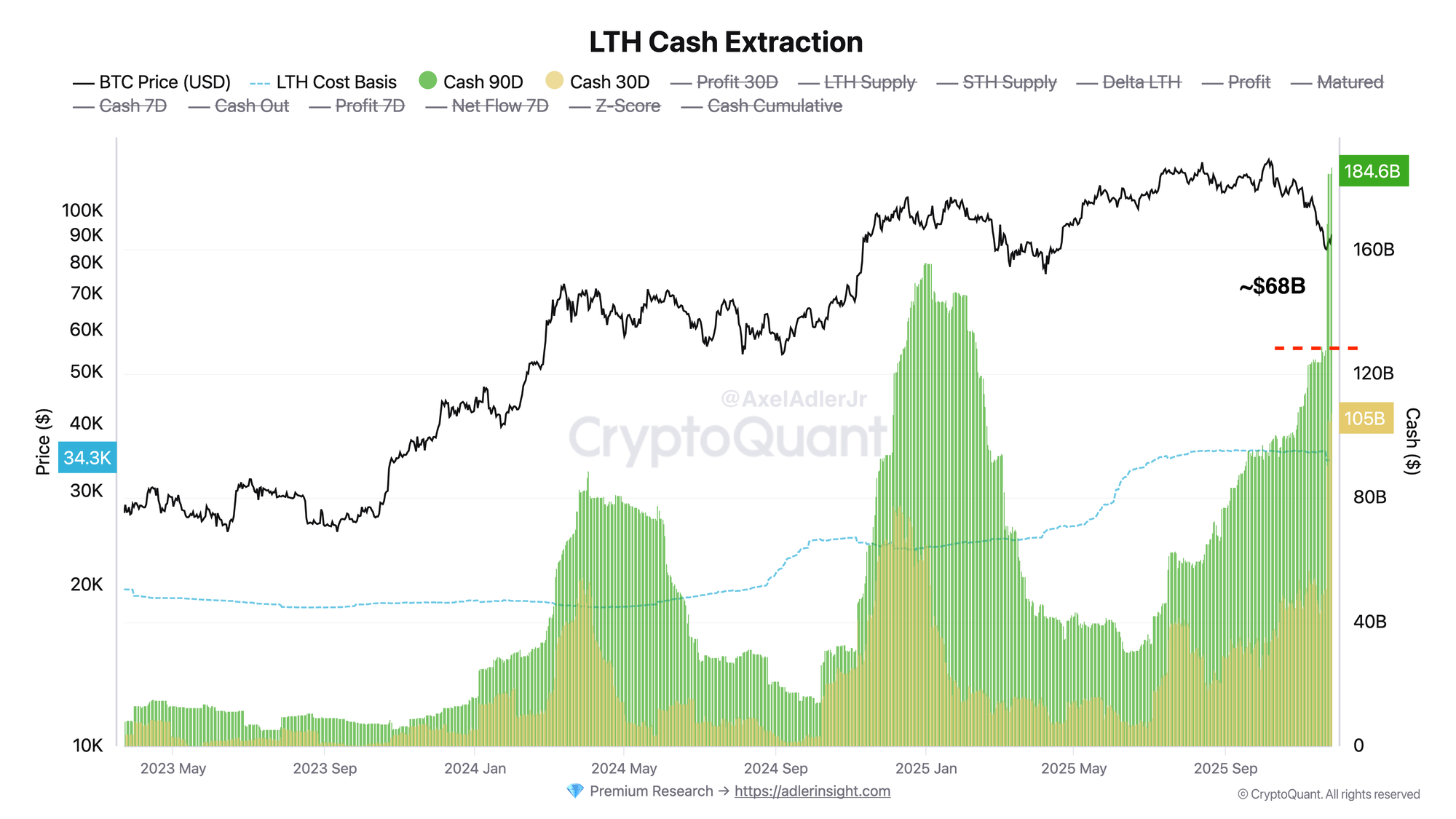

Chart captured anomalous spike in sales starting November 22, with sales volume increasing by ~$68B (marked by red dashed line). However, this signal is an artifact of Coinbase technical wallet migration, when ~800K BTC moved from old addresses (>155 days) to new ones, automatically changing status from LTH to STH. No actual sales occurred - this is internal rebalancing of exchange coins. Coinbase moved funds from old P2PKH (Pay-to-Public-Key-Hash) addresses to P2WPKH (Pay-to-Witness-Public-Key-Hash) SegWit format addresses. Total of 286 transactions for 798,636 BTC.

DISTORTIONS IN ON-CHAIN METRICS

Migration of ~800K BTC distorted key holder behavior indicators:

LTH Supply / STH Supply: Artificial drop in LTH Supply and rise in STH Supply created illusion of massive "smart money" sell-off.

LTH Realized Profit/Loss: Models reflect fictitious profit of ~$68B, though coins never left Coinbase.

UTXO Age Distribution (HODL Waves): UTXOs "reset" by age, creating false signal of long-term position decay.

Coin Days Destroyed (CDD): CDD spike mimics "old coin awakening," though this is internal Coinbase operation.

FAQ

What does current LTH Cash Extraction spike of ~$68B mean?

This is technical artifact caused by ~800K BTC migration within Coinbase. Models erroneously interpret this as massive LTH profit-taking.

CONCLUSIONS

Coinbase migration creates effects that on-chain models automatically interpret as largest LTH sell-off of the cycle. Current LTH Cash Extraction spike is not a sell-off, but technical effect of coin migration to new Coinbase wallets.