With a Futures - Spot basis = 0.43%, Bitcoin is sustained by spot demand rather than leverage.

TL;DR

Low derivative "temperature" (basis = 0.43%, pressure = 10) keeps Bitcoin price in a narrow range through spot. For rapid growth, an increase in Open Interest and funding rates is needed; risks will increase if basis rises above 1.5–2.0% amid a spike in OI/Funding Rate or a reversal of Netflow to positive territory along with pressure rising >50.

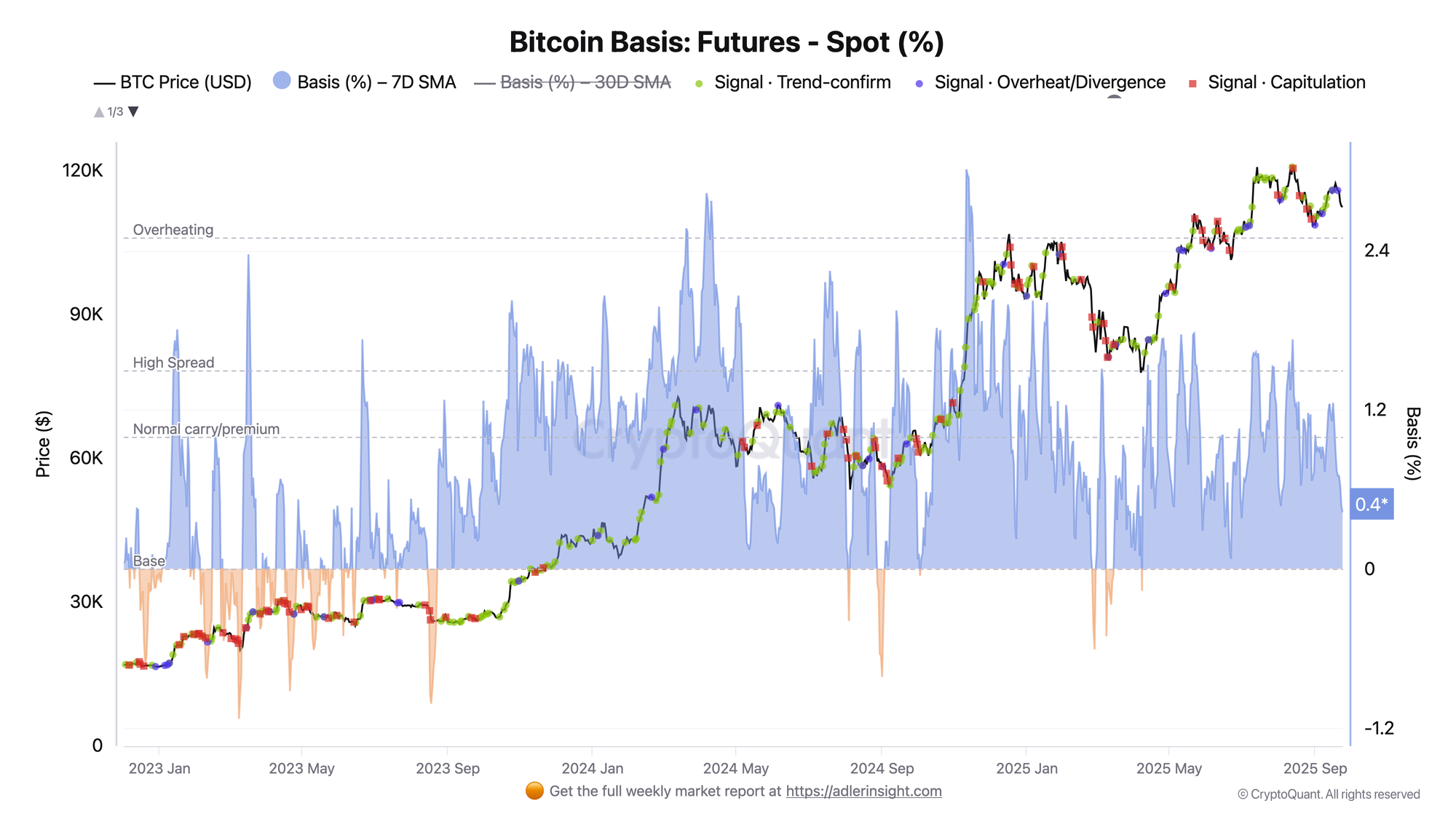

Bitcoin Basis: Futures - Spot (%)

Bitcoin Basis is the futures premium to spot. When it's high, the market is "buying with leverage," when it's low/negative - derivatives are cooling or experiencing stress. Currently, the 7-day basis is 0.43% with BTC price at $112.4K and a downward slope. This means: demand for longs through futures is moderate, price is held more by spot rather than leverage - therefore impulses are shorter, liquidation cascades are rarer.

What this means for the next 48h: with such basis, price growth requires additional Open Interest and positive funding rates, without these parameters growth is limited. If basis accelerates >1.5% amid rising OI/funding - this is a sign of "chase" or impulsive growth with overheating risk at >2–3%. The opposite scenario <0%: a signal of pressure on derivatives, more common during sell-off phases accompanied by panic and local bottom.

What to watch for confirmation/invalidation:

- OI dynamics (is leverage growing),

- Funding rate (quarterly contracts vs. daily).

Bullish but healthy background = basis 0.8–1.8% with gradual OI growth, overheating >2% Bearish pressure = <0%.

While basis is low and declining - spot has priority, volatility is contained and the market is inclined toward sideways or decline until a trigger appears.

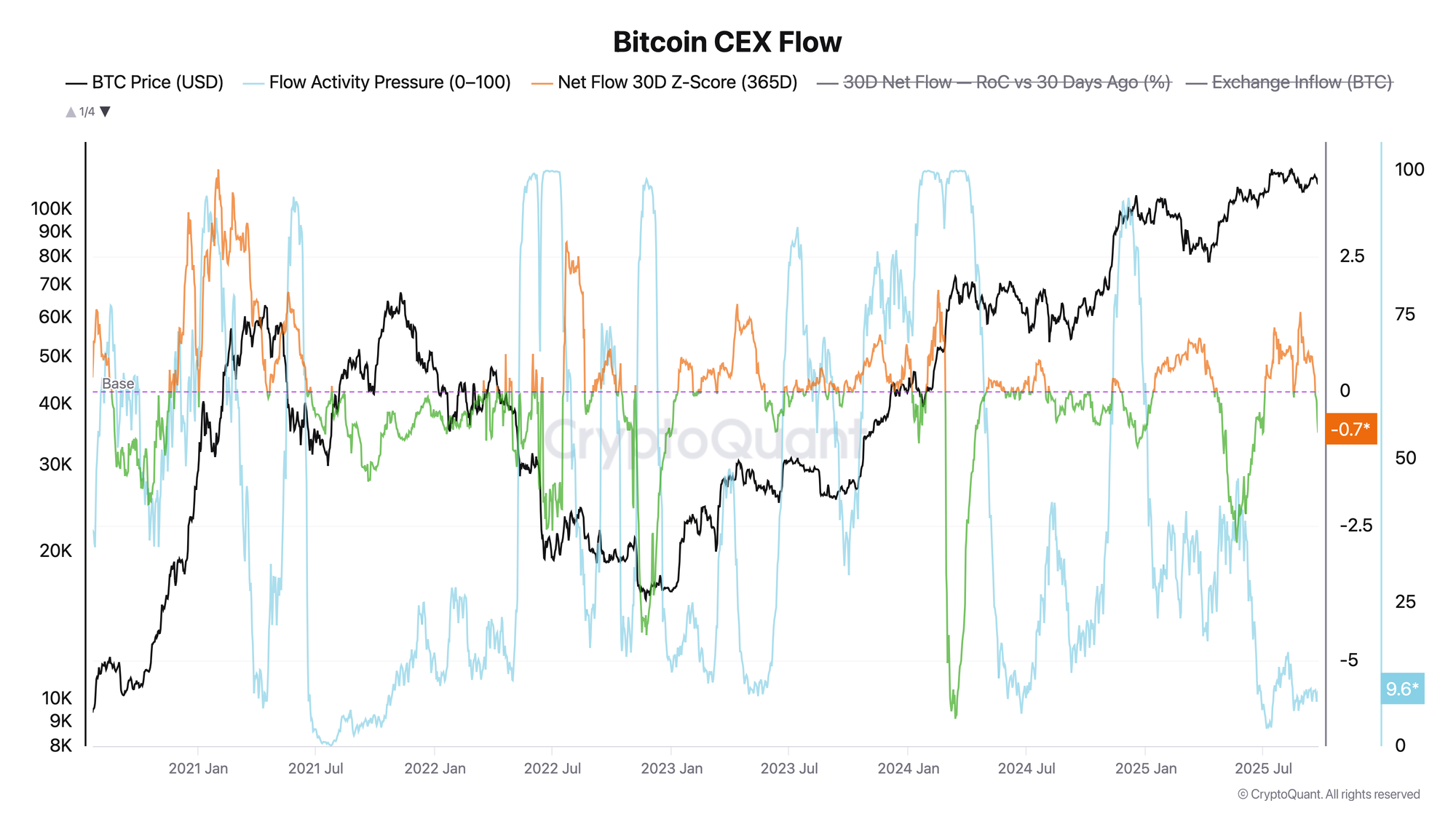

Bitcoin CEX Flow

The market looks cooled from the exchange flows perspective. The Flow Activity Pressure (0–100) indicator has dropped to 10 - the lower limit in the annual window. This means that total inflows+outflows on exchanges are currently low: there are no signs of overheating or panic, and the probability of sharp impulses caused specifically by a spike in exchange activity is below average. Against this background, price consolidates or "is in sideways and doesn't receive impulse from exchange flows."

From the supply direction perspective, Net Flow 30D Z-Score (365D) = −0.7, this is a moderate skew in favor of withdrawals (buying) relative to the annual average. Typically, this regime reduces the overhang of quick liquidity on the sell side and supports price on drawdowns, coins are being bought and withdrawn from exchanges. However, the signal scale is not extreme (not < −2), so by itself it doesn't trigger a trend - it's more of a background-bullish context for a "slow" sideways.

What to watch next: if Flow Pressure sharply jumps >70–80 and Net Flow Z-Score reverses toward >+1, this will be a sign of active exchange circulation returning.

FAQ

What is Bitcoin futures to spot basis and what level is considered risky?

Basis is the futures premium/discount to spot price. Low basis (0.43%) means the market is held not by leverage but by spot. Healthy background is 0.8–1.8%; >1.5–2.0% with rising OI/Funding Rate - a sign of "chase" and potential overheating, <0% coincides with stress/sell-offs.

How to read Flow Activity Pressure (0–100) together with Net Flow 30D Z-Score?

Flow Pressure measures exchange flow intensity: low (10) - market is "cooled," few spikes/panic, >70–80 - increased probability of volatile movements. Net Flow 30D Z-Score < 0 means predominance of withdrawals (price support), > 0 - inflows to exchanges (supply increase). The most risky combination is Pressure >50–70 and Net Flow > 0.

Conclusions

The futures to spot basis remains low (0.43%) and declining, while Flow Activity Pressure is near the lower boundary of the range - this indicates cooling derivatives and absence of overheating/panic from exchange flows, while the 30-day Net Flow Z-Score = −0.7 means a moderate predominance of withdrawals from exchanges, which reduces the overhang of quick liquidity and supports price on pullbacks. The base scenario for the near term is sideways market/grind higher through spot and off-chain flows; clear upside will require OI growth and consistently positive funding.