EU50 dropped to 5601 with daily change of −0.21%, the unified Bitcoin sentiment index fell into the fear zone, confirming bearish backdrop.

TL;DR

Europe's morning is passing amid volatility and political-trade risks. The euro-zone index EU50 holds at 5601, intraday decline of −0.21% maintains a cautious tone. The unified BTC sentiment index dropped to −86, indicating extreme fear and weak short-term demand.

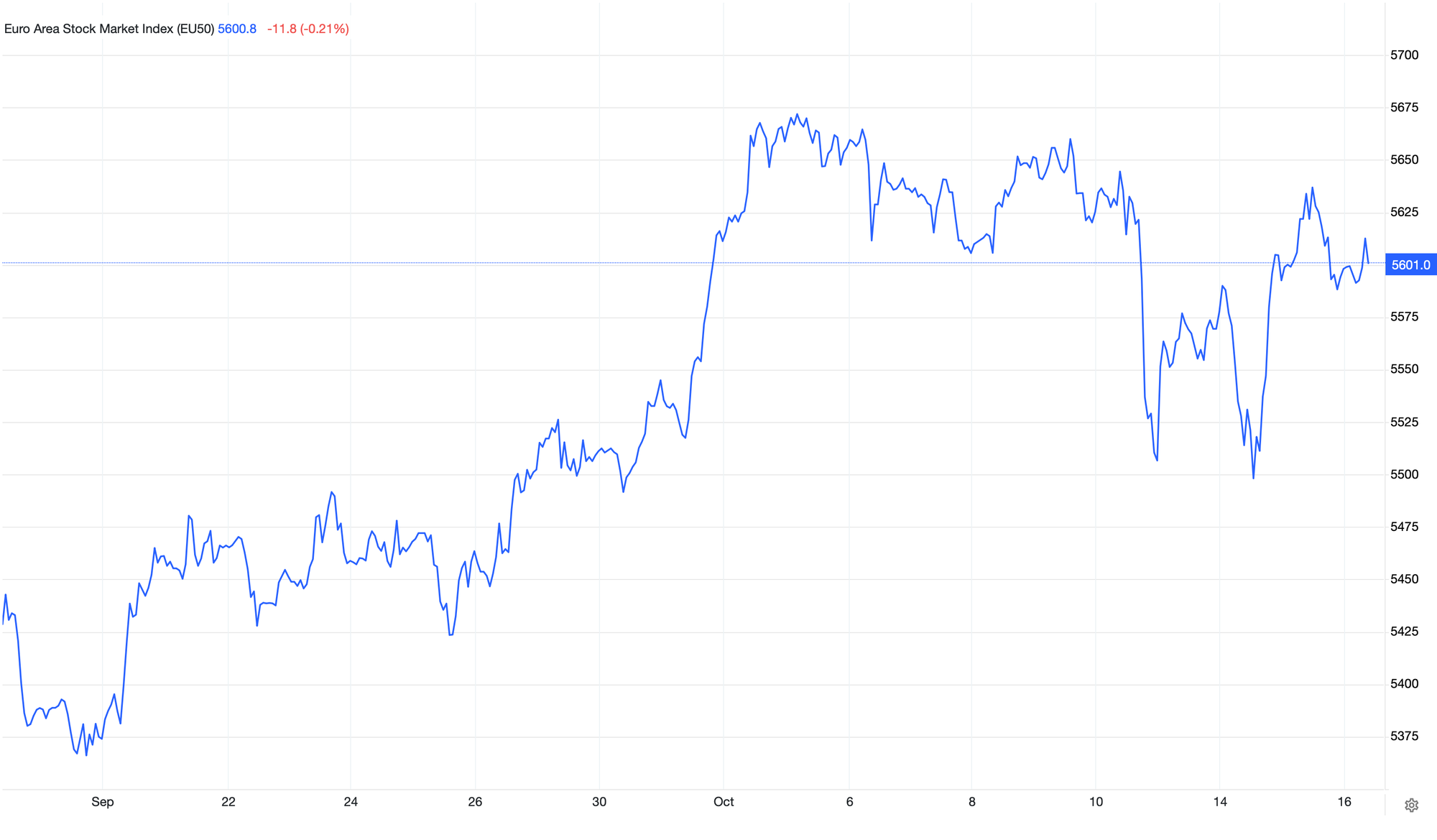

Euro Area Stock Market Index (EU50)

EU50 is consolidating at 5601 after a volatility spike. Local support is visible in the 5550 zone, resistance at 5650. Consolidation above will weaken downside risk and open a window for growth. A drop below 5550 will intensify selling and push toward testing lower boundaries.

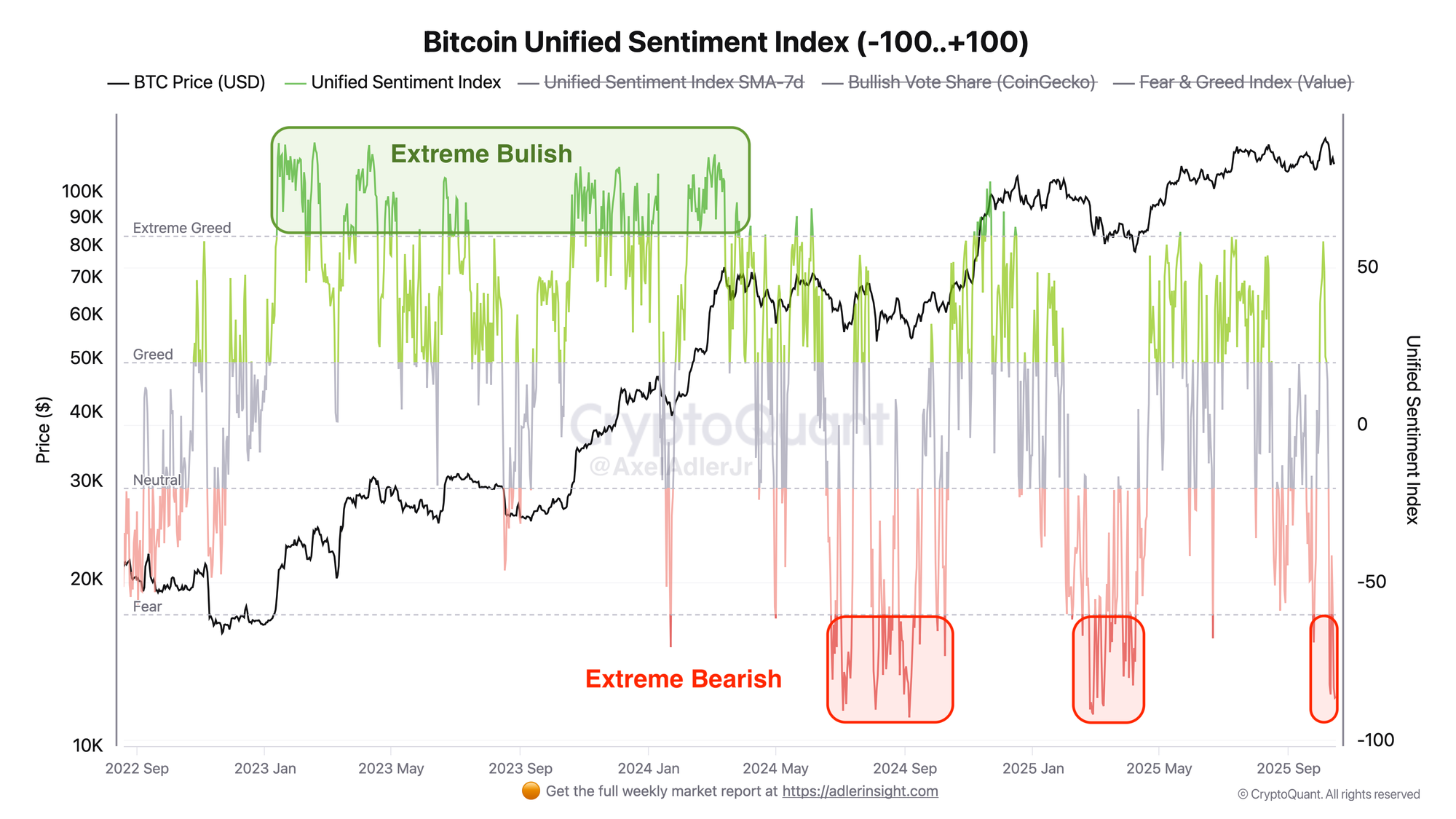

Bitcoin Unified Sentiment Index

Unified BTC sentiment dropped to −86, corresponding to the "extreme bearish" zone. Essentially, metric drops below −80 are accompanied by capitulation phases and subsequent consolidation. Transition to neutral territory will require a return to the −20 level and stabilization there for at least 3–5 sessions. Sustainable shift to risk is confirmed when the index consolidates above 0.

FAQ

Why is weak EU50 opening important for short-term risk?

EU50 reflects investors' cautious risk appetite. When European stock indices go negative, cross-asset funds reduce risks.

How to interpret unified BTC sentiment value below −50?

Value below −50 corresponds to fear phases, when participants realize losses and demand is weakened.

Conclusions

The base scenario for this morning is bearish. EU50 fluctuates with downward bias, market sentiment at extremely low levels, indicating risk-off mode and increased probability of a range with downward bias.