The market pulled back from the 125K highs to the current 90K zone with a current drawdown of -27%, while 67% of supply remains in profit.

TL;DR

Bitcoin went through a -35% correction from ATH 125K, currently trading at -27% drawdown. Supply in Profit holds at 67% - above the critical 50% level despite short-term bearish pressure.

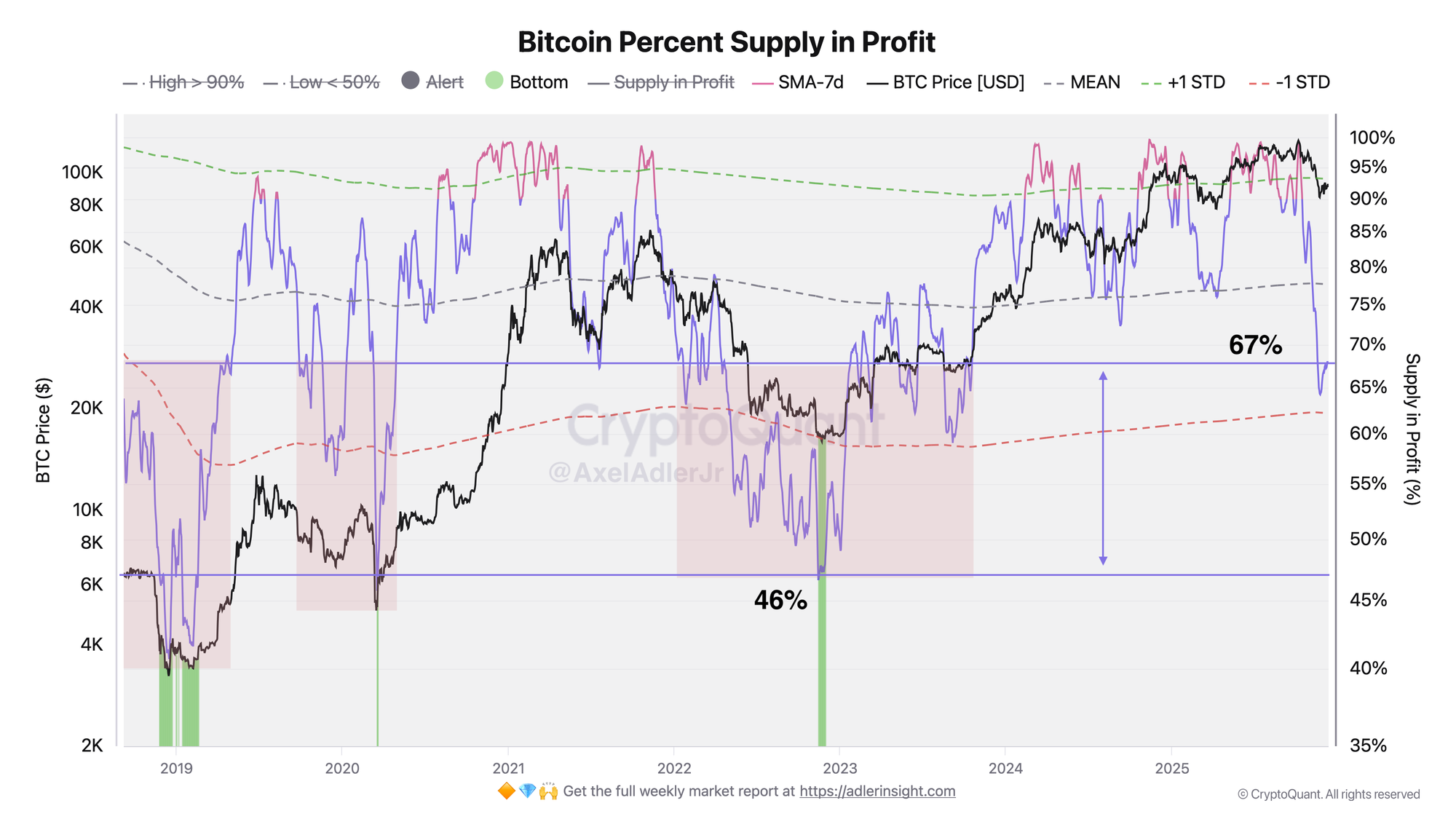

Bitcoin Percent Supply in Profit

The metric reflects the share of current Bitcoin supply that is in profit, and it's currently holding above the critical threshold of 50%. For context: at the 2023 bottom, the indicator dropped to 46%, and current values resemble the beginning of the prolonged correction in 2022. As long as the metric stays above 50%, the market structure looks only moderately bearish, but a break below this level would open a zone of elevated risk and could intensify correction pressure.

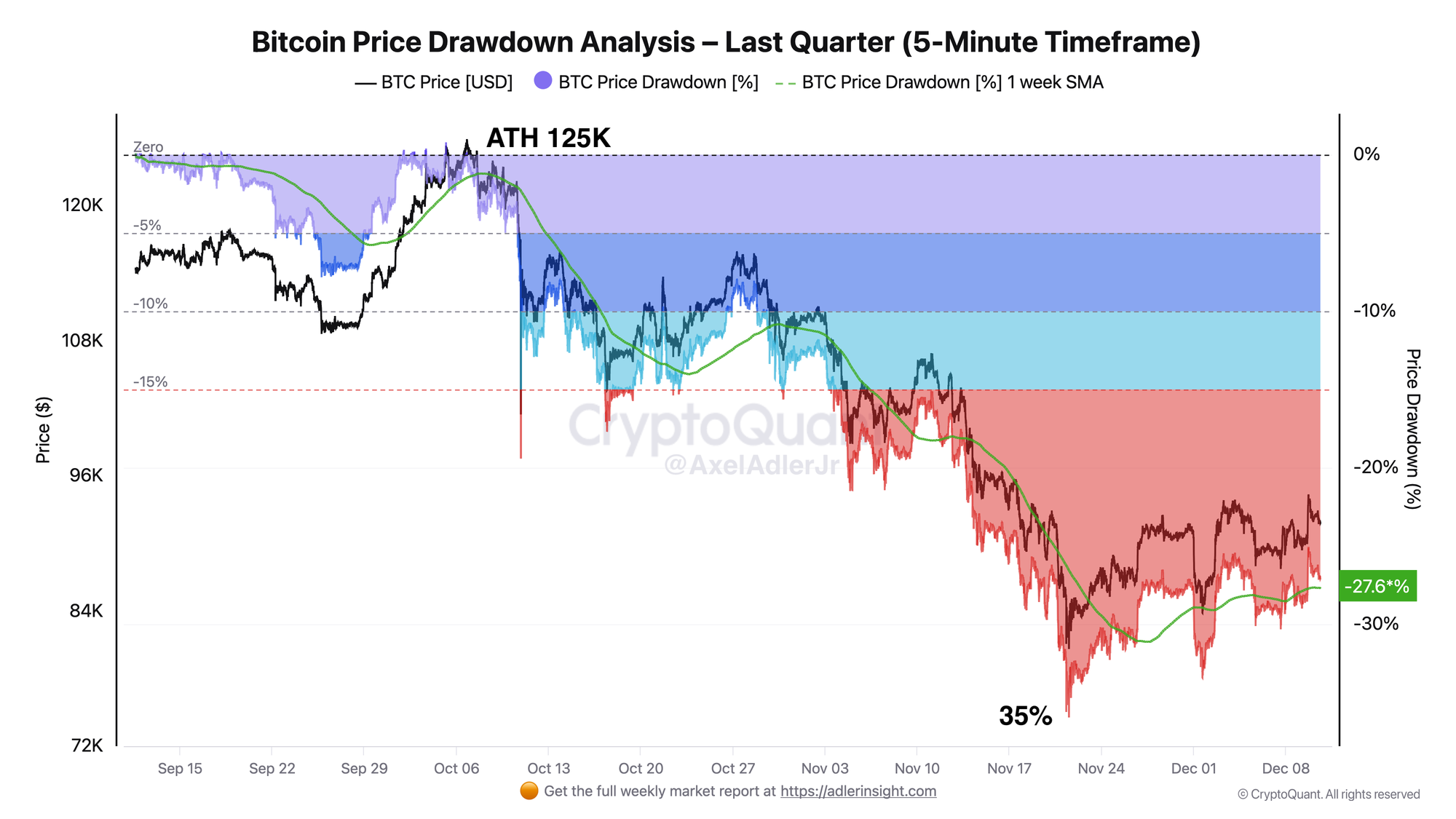

Bitcoin Price Drawdown Analysis

The chart captures quarterly drawdown dynamics: after reaching ATH 125K (early October), the market went through a deep correction with a peak of -35%. The current drawdown has recovered to -27.6%, showing partial recovery, with the 1-week SMA (green) beginning to turn upward. The color gradient (red zone at -15% and deeper) indicates prolonged stay in the significant correction zone.

Today's risk: Moderate - the market is in a stabilization phase after strong November correction.

FAQ

What does the current Supply in Profit picture mean?

67% - this is not the 90%+ euphoria where tops usually form, nor is it capitulation below 50%.

How to interpret Price Drawdown signals in today's context?

The reduction in drawdown after the -35% peak shows a recovery process, confirming the formation of a short-term base.

CONCLUSIONS

The current market picture indicates a stabilization phase after the correction: with price drawdown from ATH reduced from -35% to -27%, and the Supply in Profit metric holding at 67%, the market demonstrates a moderately bearish structure. Signs of recovery persist - short-term moving averages are beginning to turn upward, and the share of supply in profit remains above the key 50% threshold. Together, these signals form a picture of cautious but building recovery, where the market is balancing between seller pressure and buyers' attempts to form a sustainable local bottom.