Two indicators point to a similar picture: derivatives positioning remains negative, while market sentiment has dropped to levels comparable to the largest capitulations of recent years. Both signals create an elevated risk environment where short-term selling pressure combines with high levels of fear.

TL;DR

The futures market remains under bear control, with the Positioning Index holding in negative territory at -4, confirming short dominance and structural selling pressure, while Fear & Greed has collapsed into extreme fear—a level close to the largest capitulations of past years.

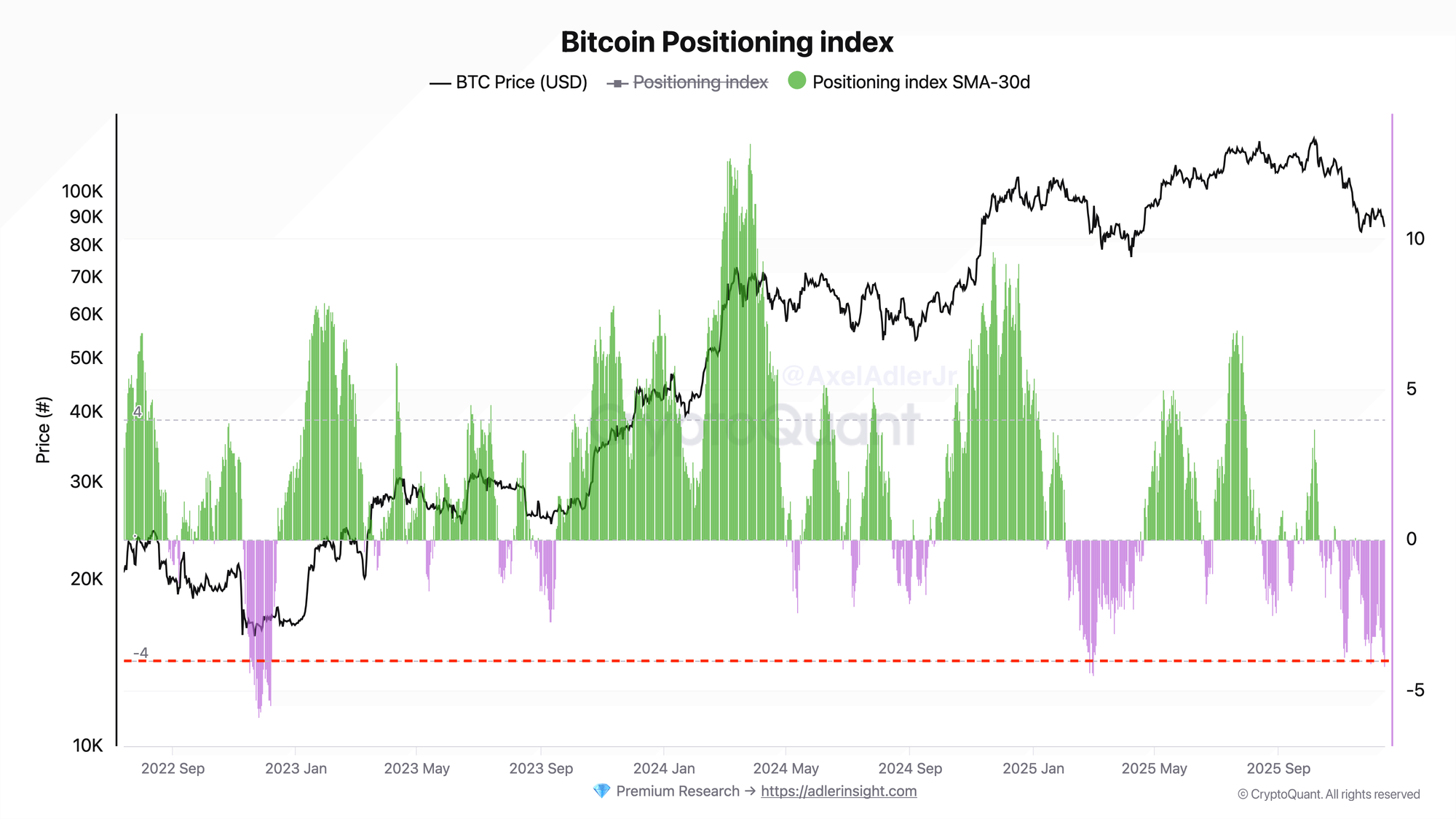

Bitcoin Positioning Index

The indicator aggregates changes in open interest and funding rates, reflecting the dominant direction of positions in derivatives. The current index value is in negative territory at -4, corresponding to a bearish regime with a downtrend signal. Visually, the chart shows a predominance of purple bars over the past four weeks, indicating sustained pressure from short positions.

Negative positioning amid declining prices confirms that bears control the short-term dynamics. The key trigger for a regime change will be the index returning to positive territory above zero, combined with price consolidation above local highs.

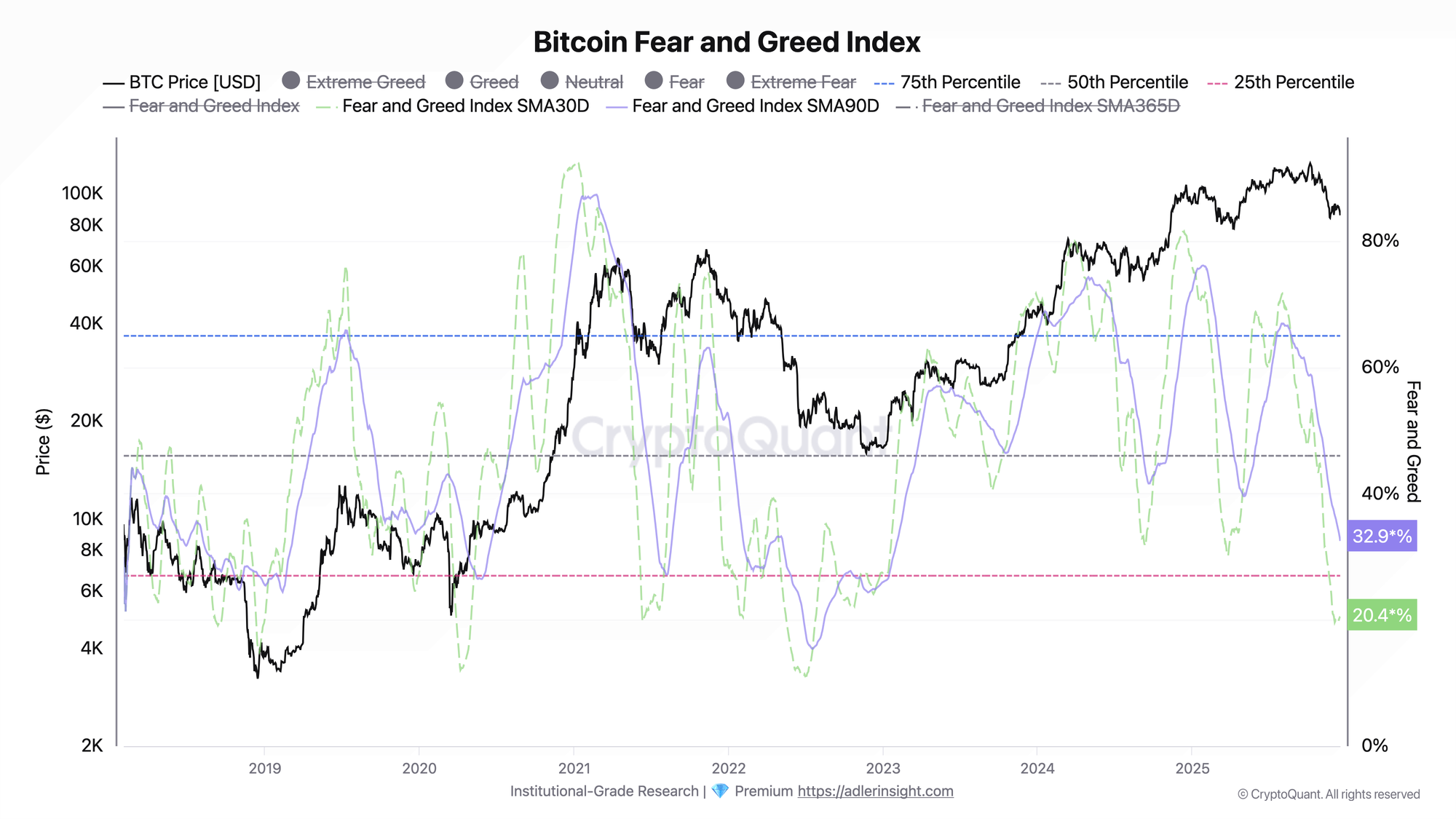

Bitcoin Fear and Greed Index

The index measures overall market sentiment on a scale from extreme fear to extreme greed. The current value corresponds to the extreme fear zone and is significantly below the 25th percentile. The SMA-30D has dropped to 20, while the SMA-90D has fallen to 32, indicating sustained deterioration in sentiment since September 2026. The market is in a state of deep capitulation; however, extreme fear alone is not a signal for an immediate reversal. The coincidence of extreme fear with negative futures positioning confirms that selling pressure has a structural basis rather than being purely an emotional reaction.

FAQ

Why doesn't extreme fear mean an immediate buy?

The extreme fear zone can persist for weeks before the market finds a bottom. Without confirmation from other metrics, low sentiment merely registers the market's state but does not provide an entry point.

What signal will confirm a reversal?

A transition of the Positioning Index into positive territory combined with price holding above key support levels. Additional confirmation would be Fear and Greed rising above the 25th percentile without new price lows.

CONCLUSIONS

The futures market remains under bear control: the Positioning Index is in negative territory with a downtrend signal, while extreme fear on Fear and Greed at 11 is comparable to the largest capitulations of recent years. The current regime is risk-off, where structural selling pressure combines with deep pessimism among market participants.