Gold has retreated to the $4.26K level after its rally, while the compression of unrealized profit in the BTC network reflects a neutral balance between buyers and sellers.

TL;DR

Both assets are in a waiting phase. High probability of false moves within ranges until an external trigger emerges.

#Bitcoin #Gold #NUP

Gold

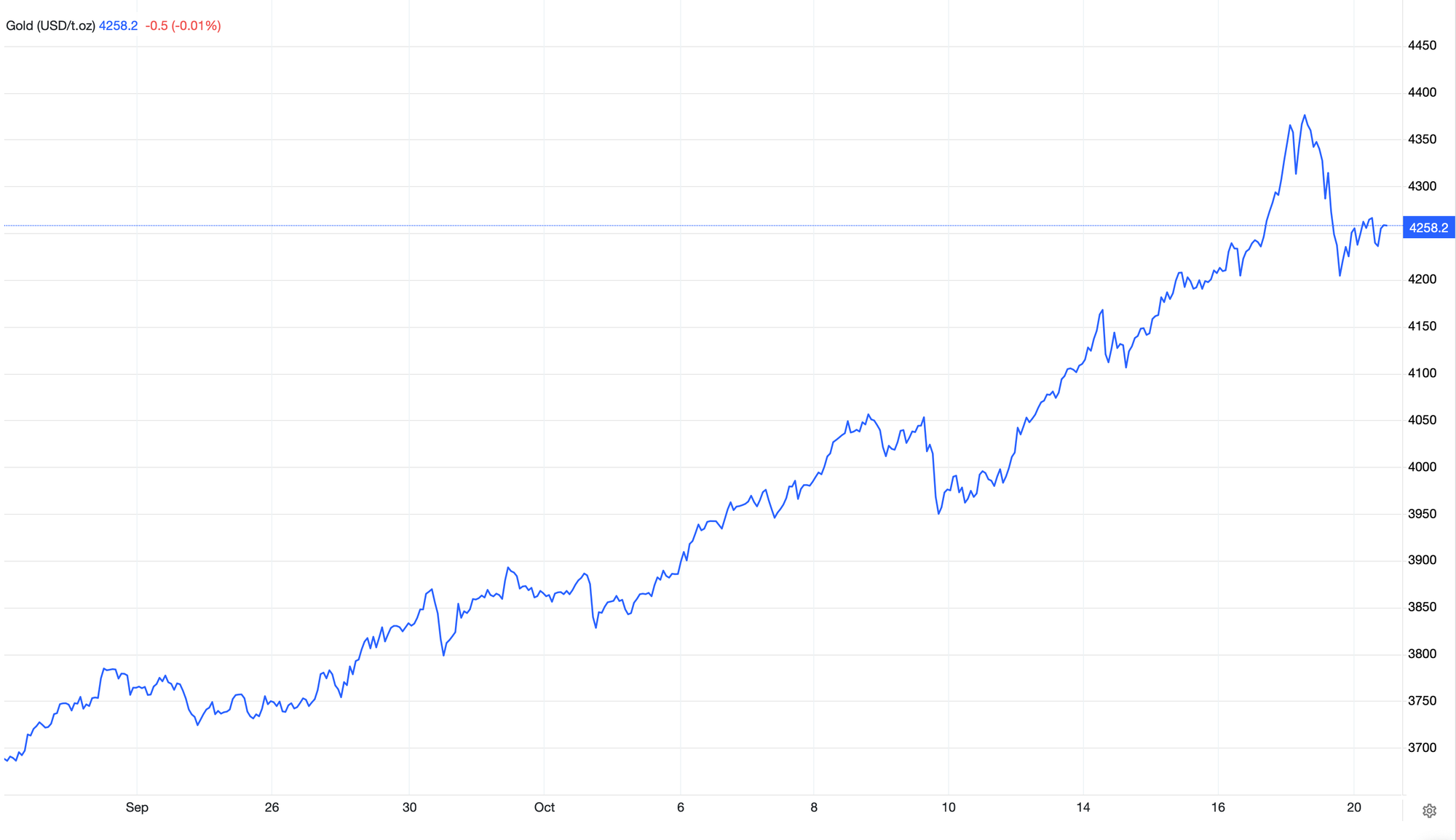

The current picture for gold: an upward structure with correction and consolidation at $4.26K. Gold has pulled back after acceleration and stabilized at $4.26K. Following the new ATH, a correction to $4K should be expected with subsequent recovery toward the ATH level. In fact, gold's rise reflects investors' defensive response to risk, when concerns about global economic stability come to the forefront. During such periods, investors move away from risky assets in favor of a "safe haven," which is what gold represents.

Bitcoin Net Unrealized Profit (NUP)

When unrealized profit on BTC "compresses" as shown on the chart, it means the market has balanced out: previously, some investors had large paper profits, but now old players have partially locked in profits and sold to those entering at higher prices, so the average profit on coins is leveling out around 0.49. As a result, the system is less overheated by greed and has less pain from losses, as coins have been redistributed from old players to new ones. Essentially, this indicates cooling emotions and profit balance among holders. The metric can be understood as the "temperature" of profit among holders: the higher the indicator, the more realized profit and the risk of a pullback.

FAQ

Why is gold consolidation important for assessing market risk?

Gold is sensitive to expectations for real rates and geopolitical risks. Stabilization at $4.26K shows a wait-and-see stance from participants and reduces the likelihood of sharp fluctuations until new macro signals appear.

What does the compression of BTC unrealized profit indicator mean?

Most investors have neither large paper profits nor significant losses, old players have partially locked in profits, new ones entered at higher prices, and the market is reaching a more stable balance without overheating or panic.

CONCLUSIONS

Both assets are in a phase of technical consolidation, reflecting the wait-and-see position of market participants. Under current conditions, there is a high probability of consolidation within ranges with possible false breakouts until an external macroeconomic or geopolitical catalyst emerges that will determine the direction of the next impulsive move.