Gold sets new record on soft Fed expectations and weak dollar, bitcoin holds Cost Basis of short-term holders and battles nearby resistance levels.

TL;DR

Gold reached new records amid expectations of Fed policy easing and dollar weakness, strengthening demand for safe-haven assets amid political and trade risks. Meanwhile, Bitcoin is holding key support at the "cost basis" level of short-term holders and consolidating below nearby resistance zones; a break above will open the path to new local highs, while losing support would increase correction risks.

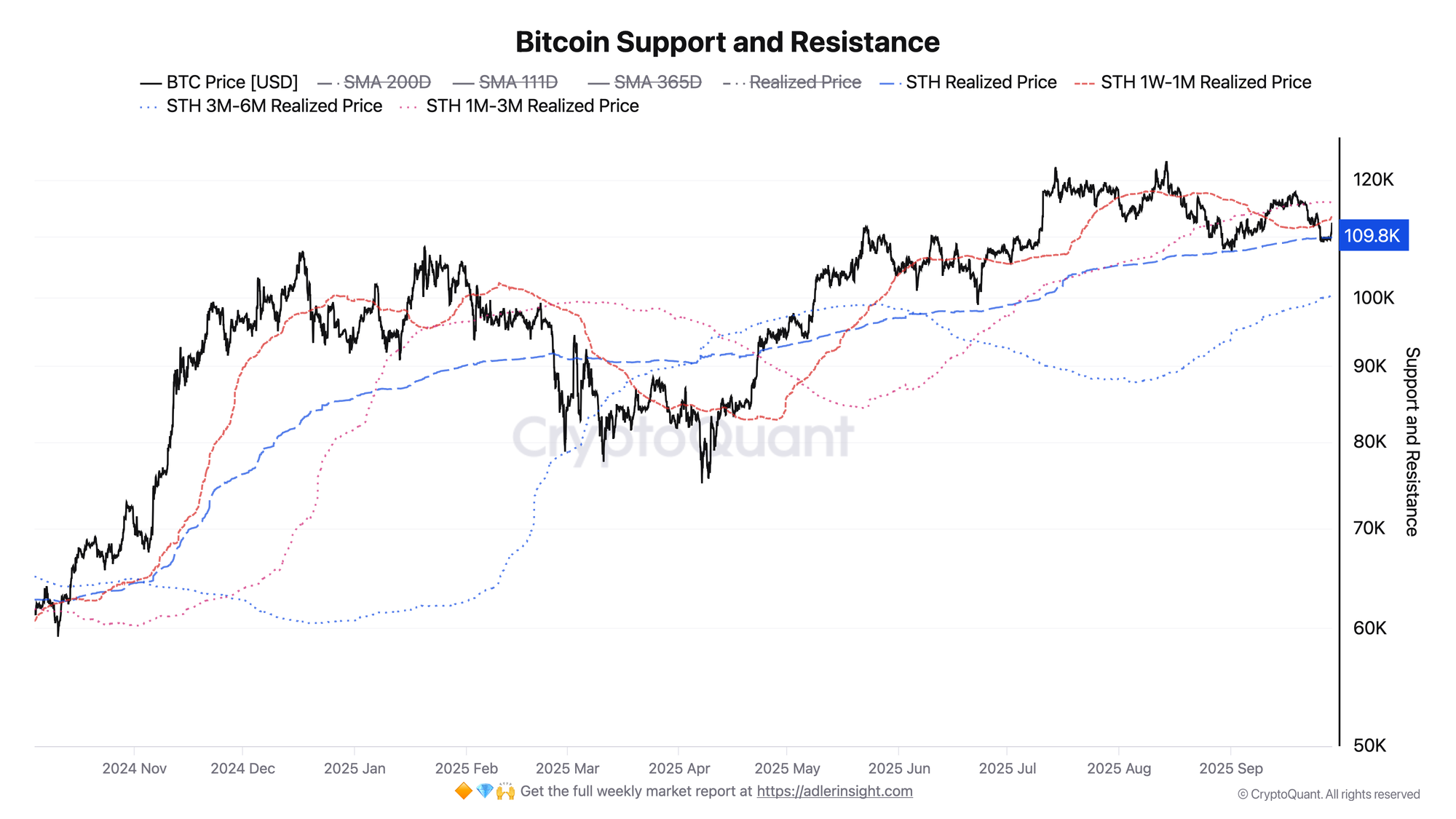

Framework note: The STH Cost Basis is part of the broader realized price structure. For a deeper breakdown of how realized price bands define support/resistance across cycles: → Bitcoin Realized Price Bands Explained: Cycle Analysis, Signals, and Historical Examples.

#GOLD #STH #COST-BASIS

Gold

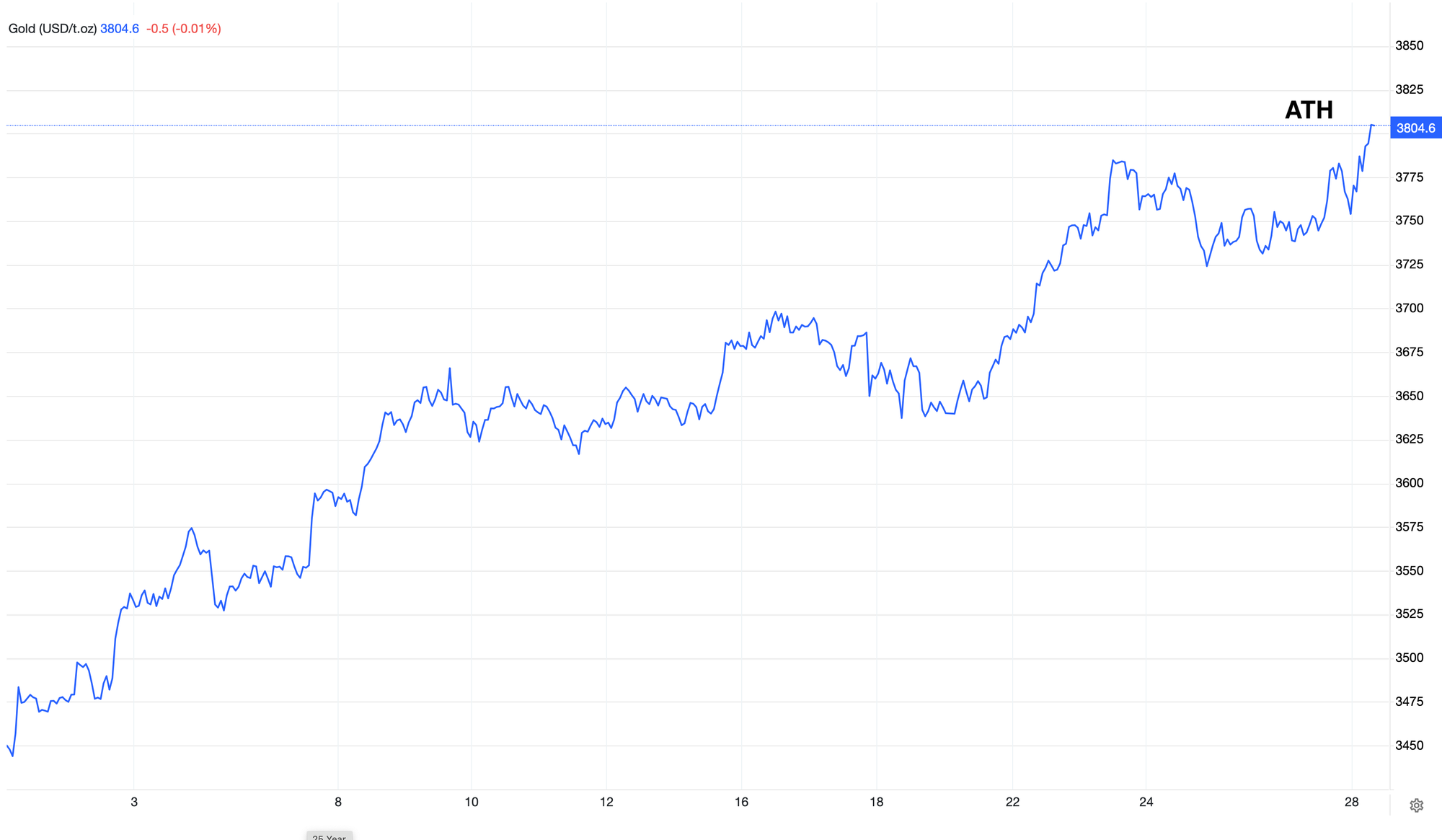

Gold prices climbed to new all-time highs above $3,804 per ounce, supported by expectations of further rate cuts in the US and dollar weakness. PCE inflation data released on Friday matched forecasts, reinforcing market confidence that the Fed can continue policy easing this year. Futures markets are now pricing in approximately 90% probability of a rate cut in October and roughly 65% probability of an additional move in December.

At the same time, investors are assessing the risk of a potential government shutdown in the US, which could delay the release of key labor market statistics and complicate the Fed's work. Additional uncertainty comes from trade risks: President Donald Trump announced a new round of tariffs on imports of pharmaceuticals, trucks, and furniture last week, taking effect October 1.

Bitcoin Support and Resistance

Bitcoinp once again confirmed the importance of the STH Realized Price ($109.8K) level, bouncing up from it. This indicator reflects the "average cost basis" of coins held by short-term holders (up to 155 days) and acts as dynamic support. As long as the price stays above it, new investors are on average in profit and not inclined toward mass sell-offs. Currently, BTC is trading at $112.3K, with the nearest resistance zones located just above STH 1W–1M RP ($113.6K) and STH 1M-3M RP ($115.6K). At these levels, many recent buyers reach breakeven or small profit and tend to take profits, creating additional supply. If the market manages to consolidate above $116K, most short-term holders will be in profit, selling pressure will ease, and these zones may switch roles to become support, opening the path higher.

Conclusions

Markets continue to show contrast between safe-haven assets and risk instruments. Gold updated all-time highs thanks to expectations of soft Fed policy and dollar weakness, reflecting high demand for protective assets amid political and trade risks. Meanwhile, Bitcoin is holding key support at STH Realized Price ($109.8K) and attempting to break through resistance levels in the $113-116K range.