Progress in US-China dialogue reduced demand for safe-haven assets, gold testing $4.07K, the first cryptocurrency holding key levels ahead of central bank decisions.

TL;DR

Bitcoin consolidating near $115K below the STH 1W-1M Realized Price zone of $115K, gold retracing toward $4.0K after rally.

#Gold #Bitcoin #Macro #FedWeek

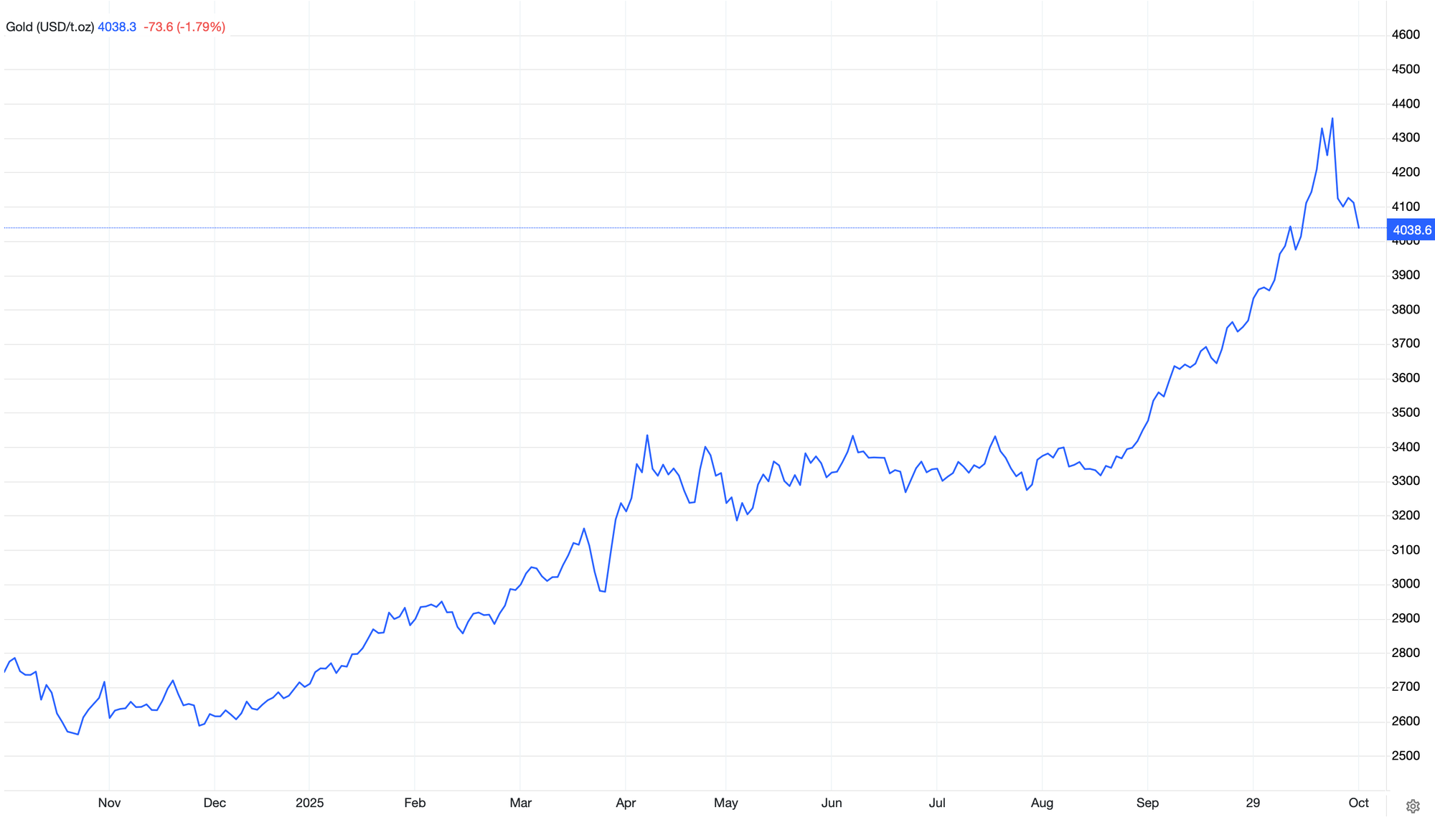

Gold Spot Price

Gold falling to $4,070 following progress in US-China trade negotiations, reducing risk premium.

Preliminary agreement on fentanyl export controls and tariffs paved the way for a Trump-Xi meeting in South Korea this week. The market shifted focus to central banks: the Fed preparing a 25 bp cut following weak CPI. Gold's decline amid easing trade conflict is typical - the asset loses its protective function when geopolitical tensions decrease.

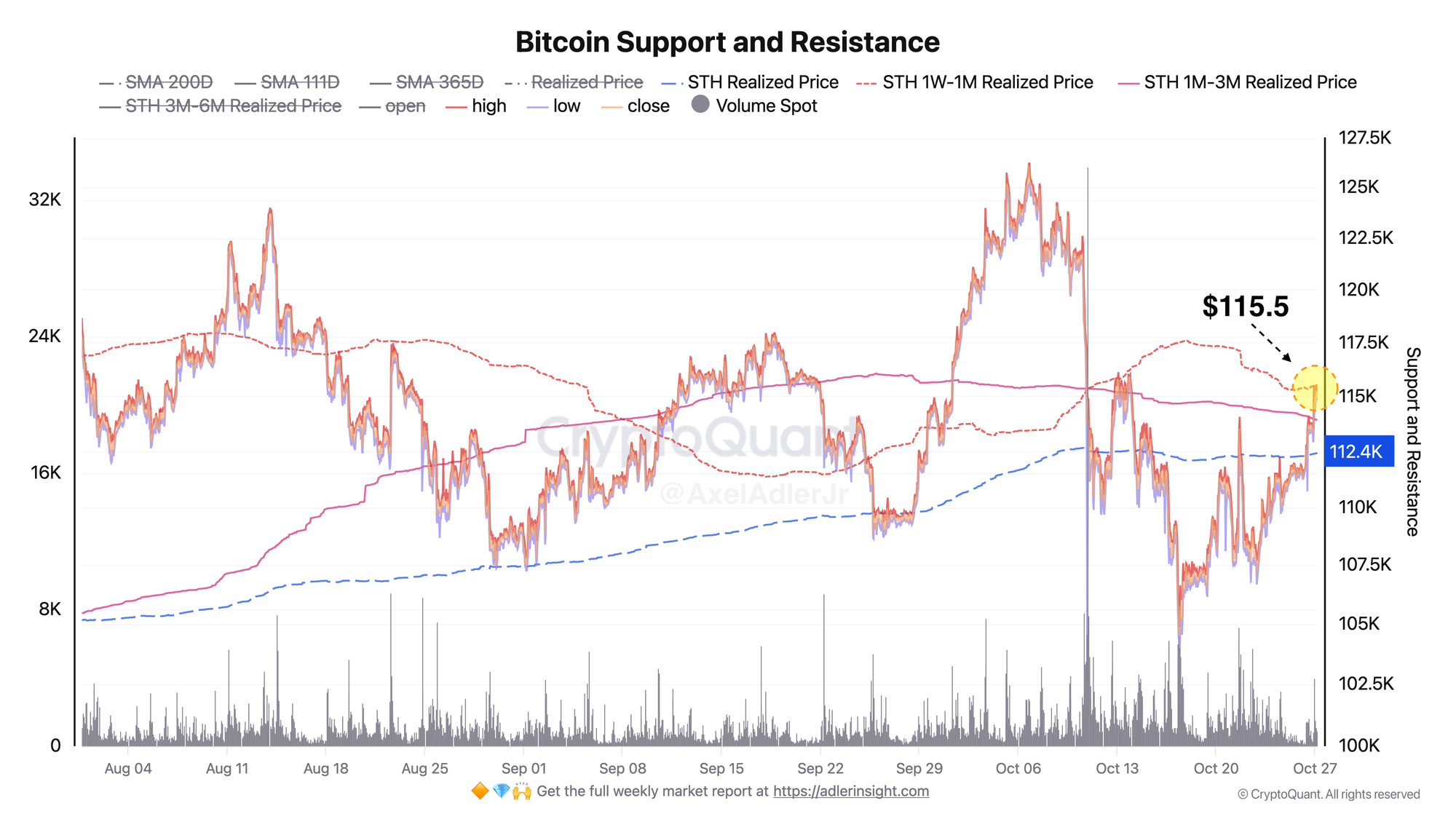

BTC STH 1W-1M Realized Price

Short-Term Holders Realized Price (1W-1M) for coins purchased within the 1 week to 1 month range testing the $115K zone, with base support at $112.4K. This metric shows the level at which new participants are at breakeven. In the current configuration, the $115K zone acts as resistance. The market awaits a catalyst from the Fed decision.

Both assets reacting to declining risk premium following trade news, but differently: gold falling as a classic safe haven, Bitcoin holding as risk-on. The divergence is moderate—if the Fed softens rhetoric on Wednesday, BTC could move higher while gold remains under pressure from a strong dollar.

FAQ

What does the current gold picture indicate?

The drop to $4.07K is a technical correction after the rally on trade risks. As long as price holds at $4.05K, downside risk is limited.

How to interpret STH Realized Price for BTC?

If market price is above STH Realized Price - short-term holders are in profit.

If below, they're at a loss.

CONCLUSIONS

Base case scenario until Wednesday: gold drifting toward $4.05K, BTC holding at $114K–$116K. On Wednesday following the Fed decision, expect volatility and watch for initial DXY reaction.