ETFs show outflows of -$250M per day, but new investors continue entering - the divergence signals redistribution of coins from large holders to retail.

TL;DR

Institutions are selling through ETFs (-$250M/day), retail is active (Young Supply 18.7%, inflow of new money over 30 days $5.42B). Price holds above $102K - for now demand from below compensates pressure from above.

#Bitcoin #ETF #OnChain #NewInvestors

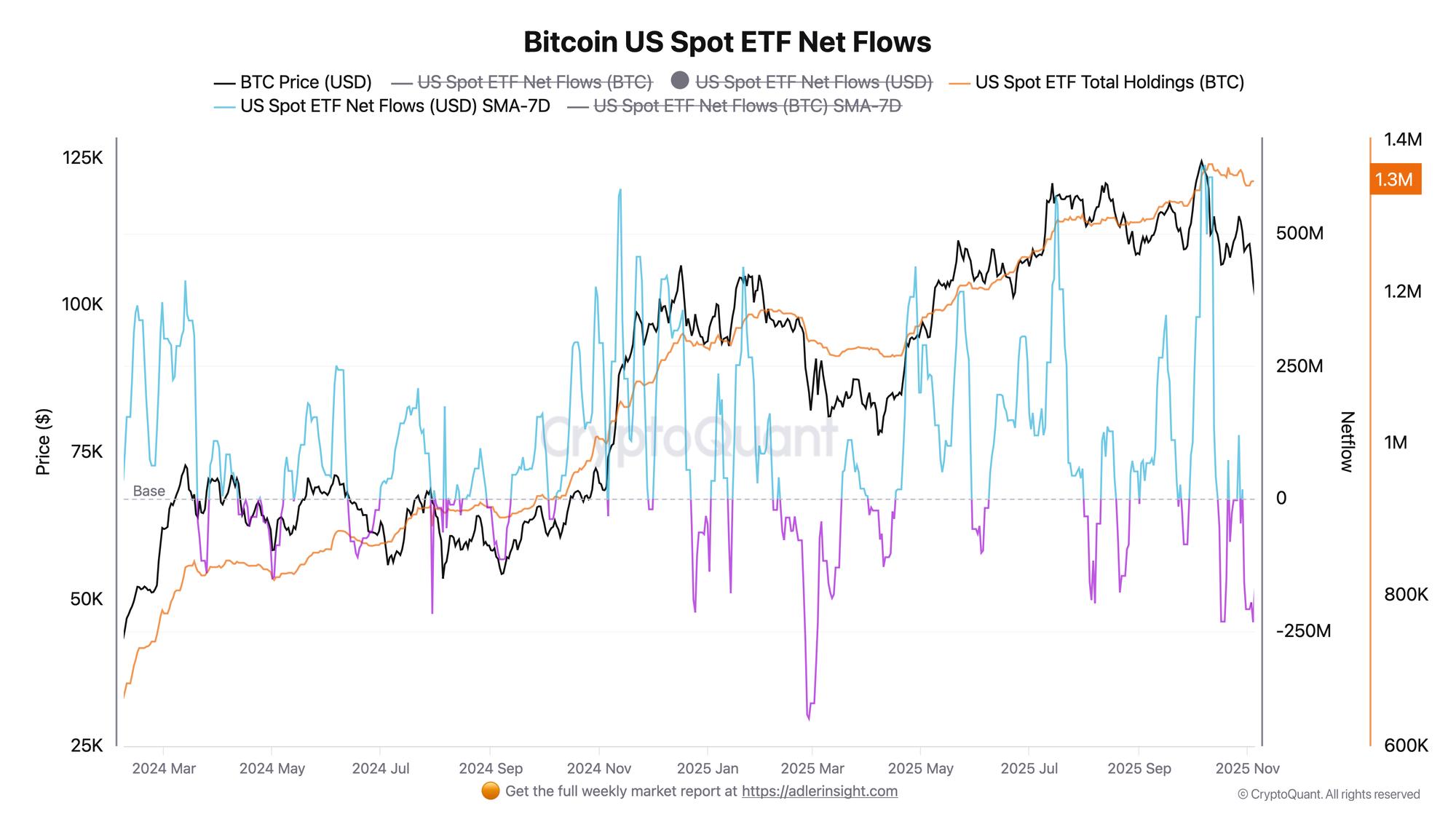

Bitcoin US Spot ETF Net Flows

Recent days show sustained outflows around -$250M through US spot ETFs. 7D SMA has moved into negative territory, indicating a weekly trend of profit-taking by institutions. Total holdings stabilized at 1.3M BTC - there is no massive outflow from funds at this hour, but daily demand is weakening.

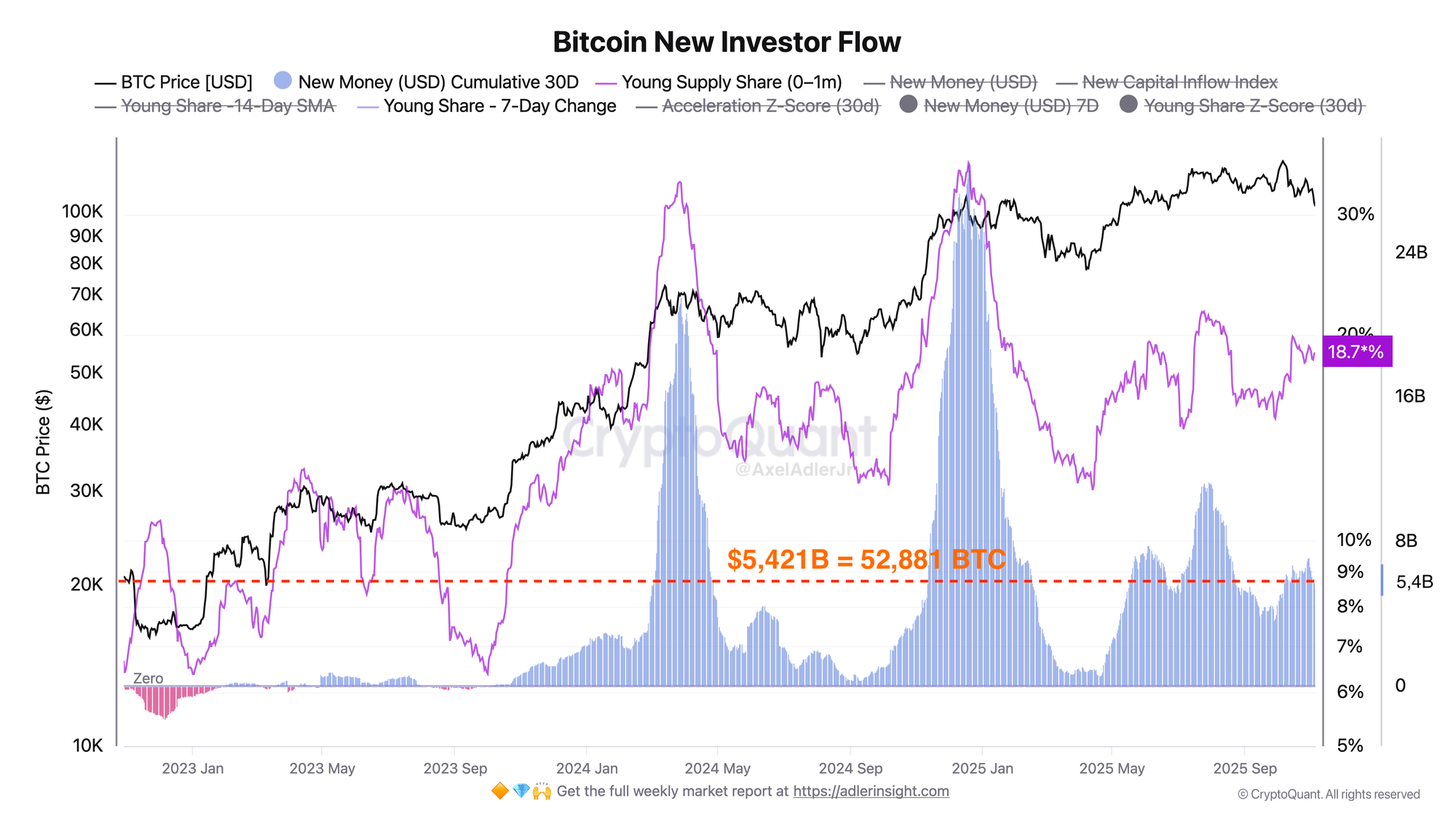

Bitcoin New Investor Flow

New players continue entering the market, as evidenced by inflow spikes. Young Supply 18.7% is in the "healthy" range - not overheated (like >25%), but not capitulation either (like <10%). With Young Supply at 15-20%, price either forms a plateau before the next impulse, or corrects 10-15% for a reset.

FAQ

What does the current picture on ETF Net Flows mean?

Outflows of -$250M/day represent profit-taking by large holders after the rally to $125K. 7D SMA in negative territory confirms the weekly outflow trend.

How to interpret New Investor Flow signals in today's context?

Young Supply 18.7% and inflow of $5.42B indicate that new players are active and ready to buy on dips, but inflow volumes are not record-breaking.

CONCLUSIONS

The market is in a redistribution phase: institutions are reducing positions through ETFs, new players are catching coins on corrections. As long as Young Supply >15% and price holds above $103K, the structure remains moderate, with a negative bias toward the bearish side.