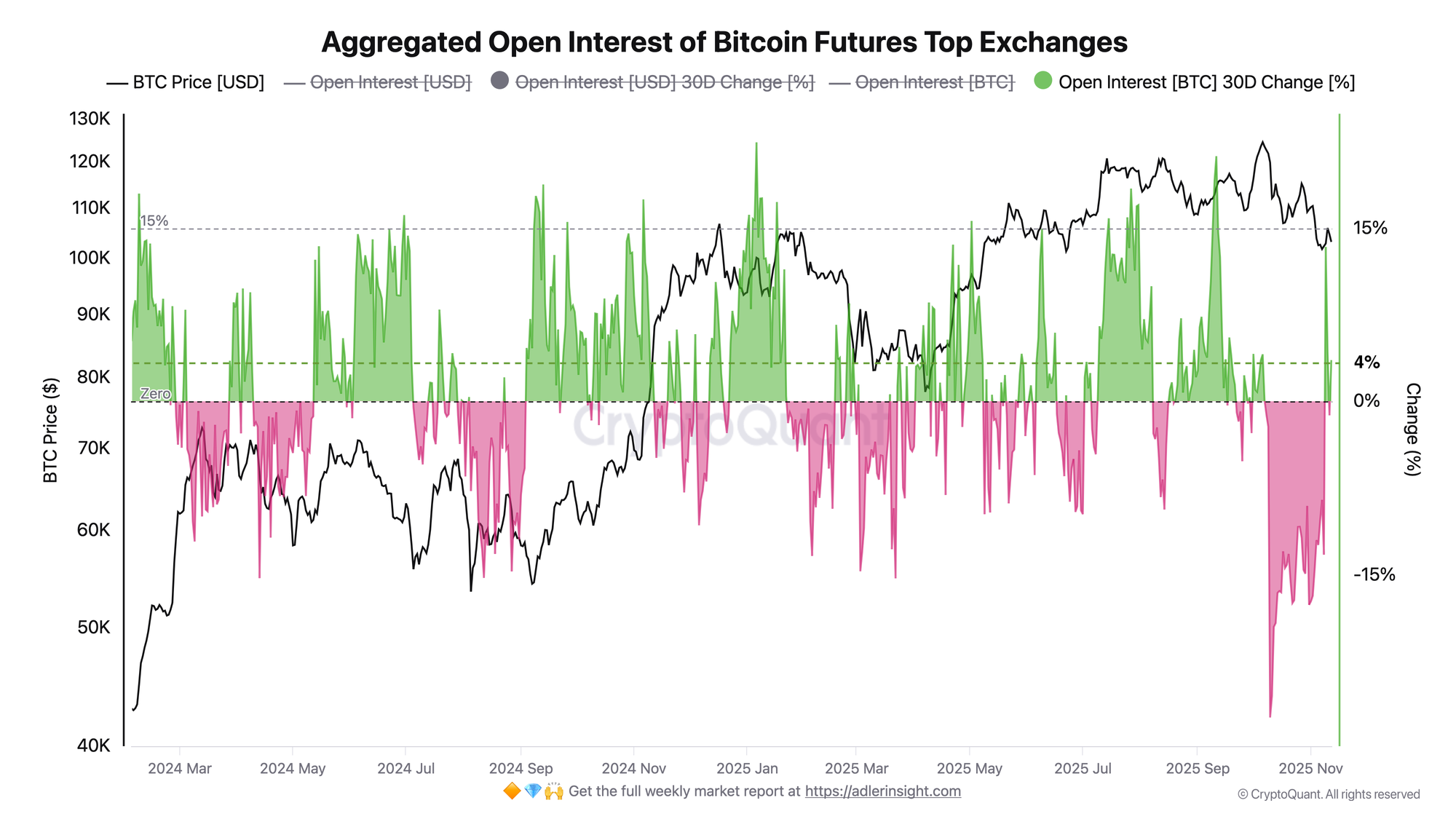

Monthly changes in futures Open Interest have risen to +15% with a neutral Funding Rate.

TL;DR

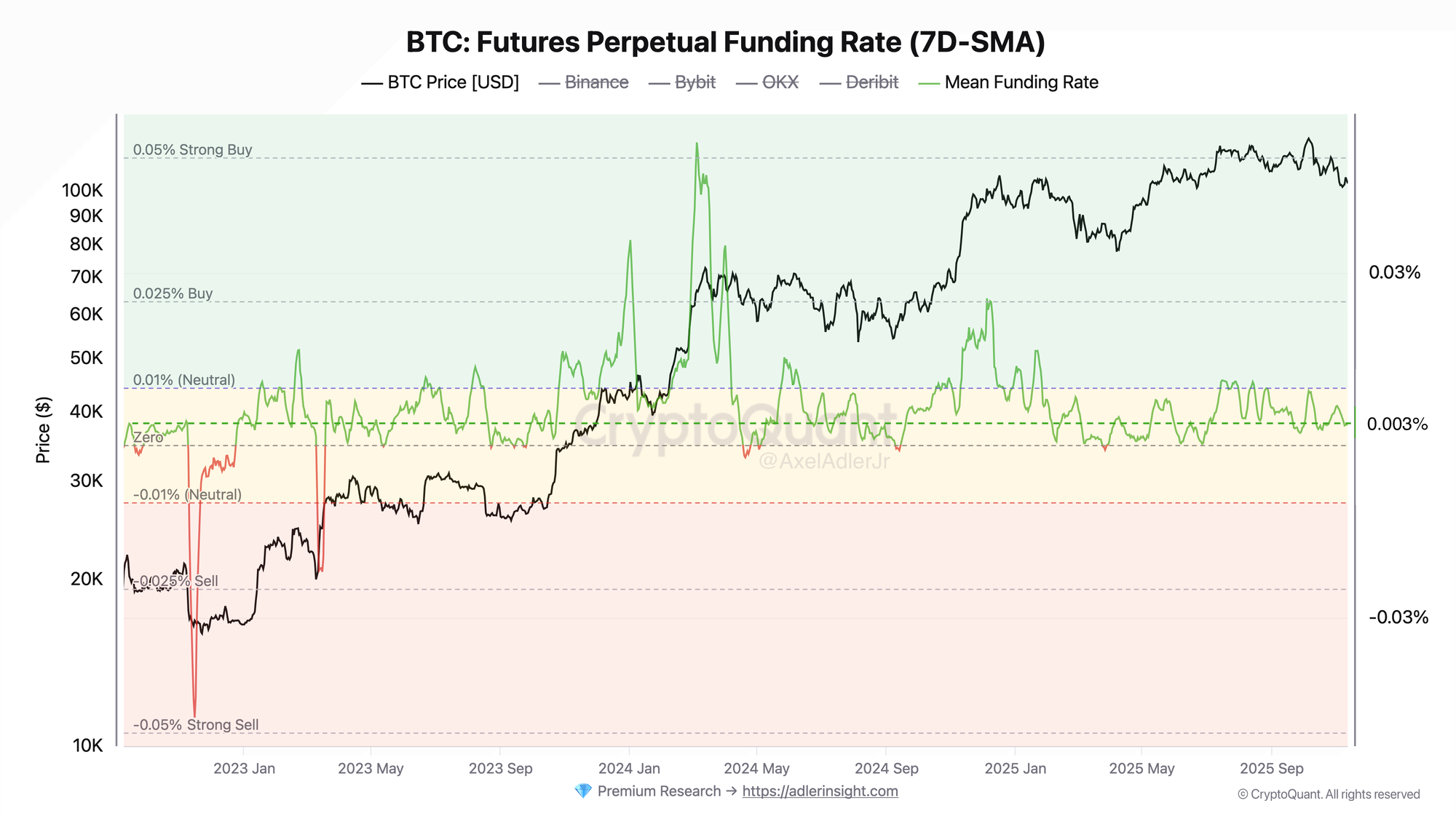

Monthly changes in BTC futures Open Interest have risen to +15%. Average Perpetual Futures Funding Rate remains in the neutral zone.

#Bitcoin #OpenInterest #FundingRate

Aggregated Bitcoin Futures Open Interest

Current 30-day change in BTC-equivalent OI stands at +15% at a price of $103,180 - a recovery following the leverage flush in October 2025. The market has completed a full deleveraging cycle and is returning to a zone of moderate Open Interest growth. The transition of OI from deeply negative territory to moderately positive creates a foundation for volatility.

Perpetual Futures Funding Rate

Current Funding Rate of 0.003% remains in the neutral zone and is -70% below the average value of the 2024-2025 bull trend (0.010-0.015%). The Futures market maintains balance between long and short positions without speculative overheating.

OI has recovered following capitulation, Funding Rate has stabilized in the neutral zone. The market has undergone a cleansing of excessive leverage. The current configuration indicates an absence of bullish conviction.

FAQ

What does OI recovery mean?

The market has completed a full deleveraging cycle: October's -24% capitulation cleared excessive leverage, while current growth shows participant reentry without aggressive overheating.

Under what conditions could the current configuration lead to price decline?

Key risk - stagnation in OI change without price growth will indicate lack of demand.

CONCLUSIONS

The derivatives market has completed its deleveraging phase following October's -24% OI capitulation and transitioned into a moderate recovery mode at +15% with neutral Funding Rate. The configuration indicates normalization of futures structure: excessive leverage has been liquidated, new positions are being opened without speculative overheating. At a price of $103K, the market is in a zone of technical consolidation with potential for volatile movement.