🎧 Morning Brief #107 - audio debate on today’s market setup

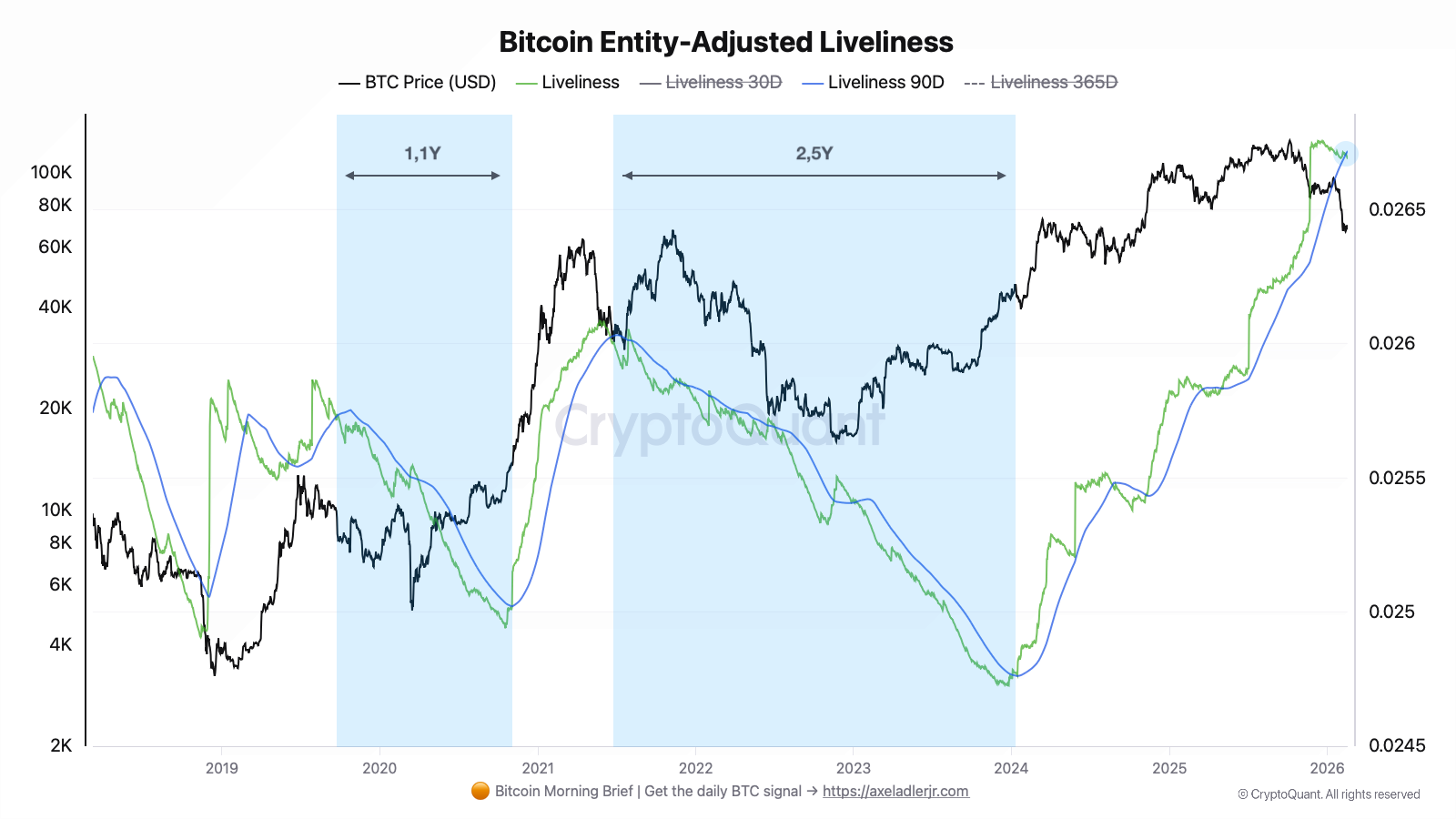

The bear cycle started from the ATH ~$125K in October 2025 - and Entity-Adjusted Liveliness confirms it: the metric reached its cycle maximum of 0.02676 in December 2025 with a characteristic lag relative to price, and is now reversing downward. Historically, such a reversal has opened an accumulation phase lasting from 1.1 to 2.5 years.

TL;DR

Liveliness peaked after the price ATH and began declining - a signal of transition from distribution to accumulation. The question is not whether the bear cycle has started, but how deep and how long it will be.

Bitcoin Entity-Adjusted Liveliness: Cycle Peak and Reversal Signal

Entity-Adjusted Liveliness - cumulative ratio of all coin days destroyed to coin days created, filtered for internal transfers between wallets of the same entity.

FACT: Price reached ATH ~$125K in October 2025, but Liveliness continued rising for two more months, peaking at 0.02676 only in December 2025 - standard lag of a cumulative metric. Since December, the green line has been reversing downward. Values as of February 17, 2026: Liveliness = 0.02669, 30D = 0.02670, 90D = 0.02672, 365D = 0.02622. The raw metric is already below both the 30D and 90D - both moving averages are hanging overhead.

Two previous accumulation cycles are clearly visible on the chart: 2020 - 1.1 years, 2022-2024 - 2.5 years. Both began exactly this way: the green line reversed from its peak and entered a sustained decline, with price following downward. The current pattern is structurally identical.

CONCLUSION: If the pattern repeats, the accumulation horizon is - at minimum through end of 2026, realistically through mid-2027. Key confirmation trigger: 90D reverses downward and breaks below 365D (0.02622) from above. Until that crossover occurs, the mid-cycle reset scenario with renewed growth remains in question.

💡 Stop holding through every crash - start your 7-day free trial. Weekly Engine tells you when to stay in, when to step aside, and when risk is rising. Start here.

FAQ

How does this cycle differ from 2022?

Structurally Liveliness behaves identically, but there is a fundamental difference on the demand side: ETF purchases and corporate accumulators create structural bid that did not exist in 2022. This does not cancel the bear cycle by Liveliness, but may shorten its duration and limit the depth of the price correction.

What do we need to see to confirm the reversal into accumulation?

Two sequential signals: Liveliness continues declining for the next 4-8 weeks without bouncing above 30D, and 90D reverses downward breaking below 365D (0.02622) from above - analogous to what happened in mid-2022 and mid-2020. Until then, the structure remains indeterminate.

CONCLUSIONS

Entity-Adjusted Liveliness has given a clear signal: the metric peak in December 2025 confirmed that the LTH distribution phase is complete, with price already having corrected 25% from the October ATH of $124K by that point - and now showing losses of -45%. Historically, such Liveliness reversals have opened accumulation phases lasting from 1 to 2.5 years, and we are at the very beginning of this phase. The main trigger for a change in view: 90D breaking below 365D with simultaneous price stabilization above local lows. The main risk to the bearish scenario - structural ETF demand that may deform the classic pattern and shorten the accumulation cycle.

More on Coin Days Destroyed and Liveliness metrics - in the educational guide: CDD & Liveliness: Definition, Formula & Cycle Signals