Bull-Bear Structure Index rose above zero for the first time since October 12 -market dynamics and sentiment have synchronously turned bullish.

TL;DR

Technical reversal confirmed: both indicators in positive territory, investors need to monitor consolidation above $115K for continued upward movement.

#Bitcoin #OnChain #Sentiment #BullishReversal

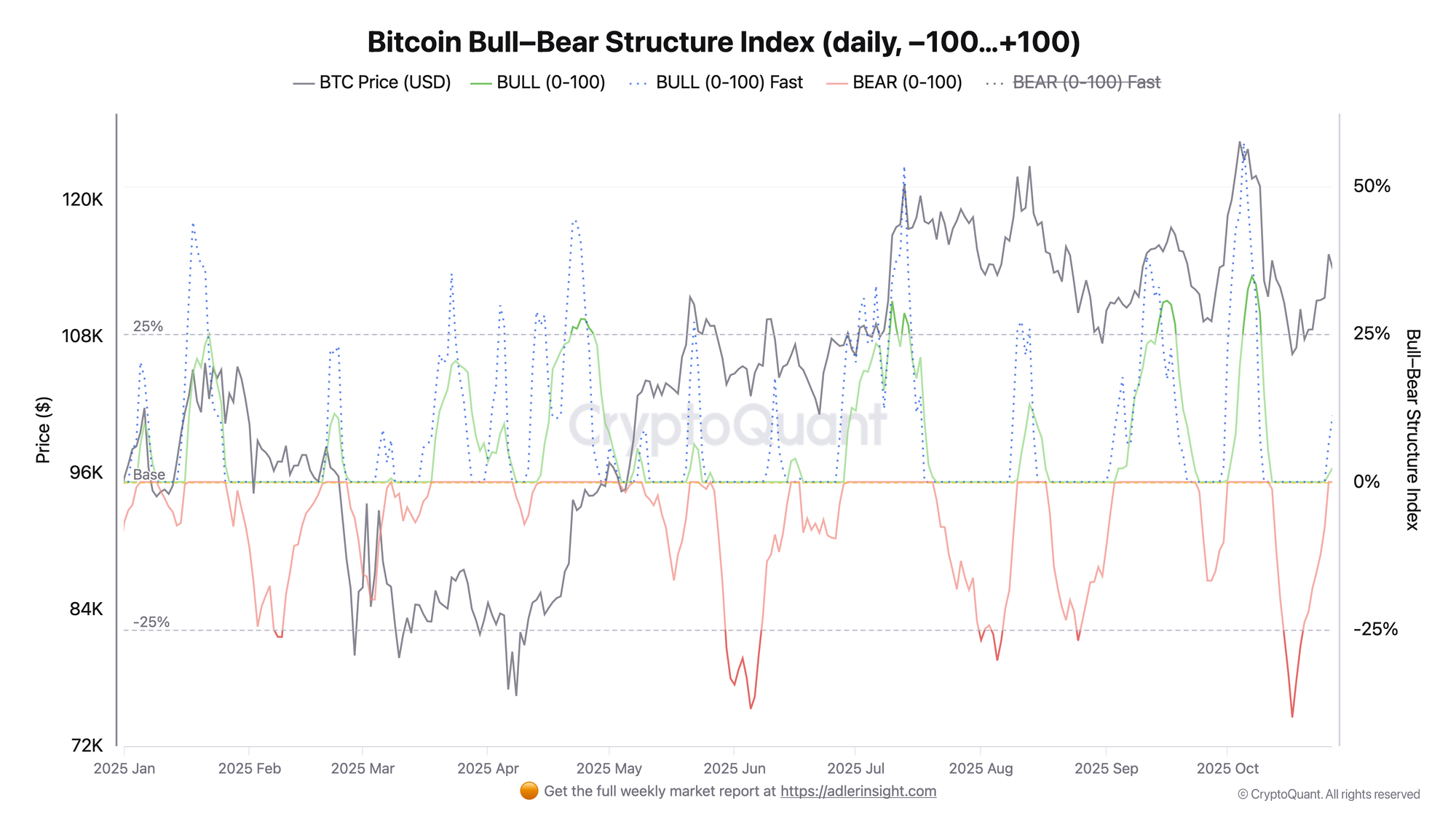

Bull-Bear Structure Index

The index broke above the zero level for the first time since October 12, signaling a shift in balance of power toward bulls. BTC trading at $114K, and the Bull-Bear Structure Index (combination of market and on-chain metrics) returned to positive territory for the first time in two weeks. This technically means that the aggregate strength of buyers exceeded seller pressure across a wide range of parameters from derivatives positioning to on-chain metrics dynamics. The bullish component (green line) stands at +1.25%, the fast version of the index shows acceleration of bullish momentum at +10%, confirming a sustained reversal.

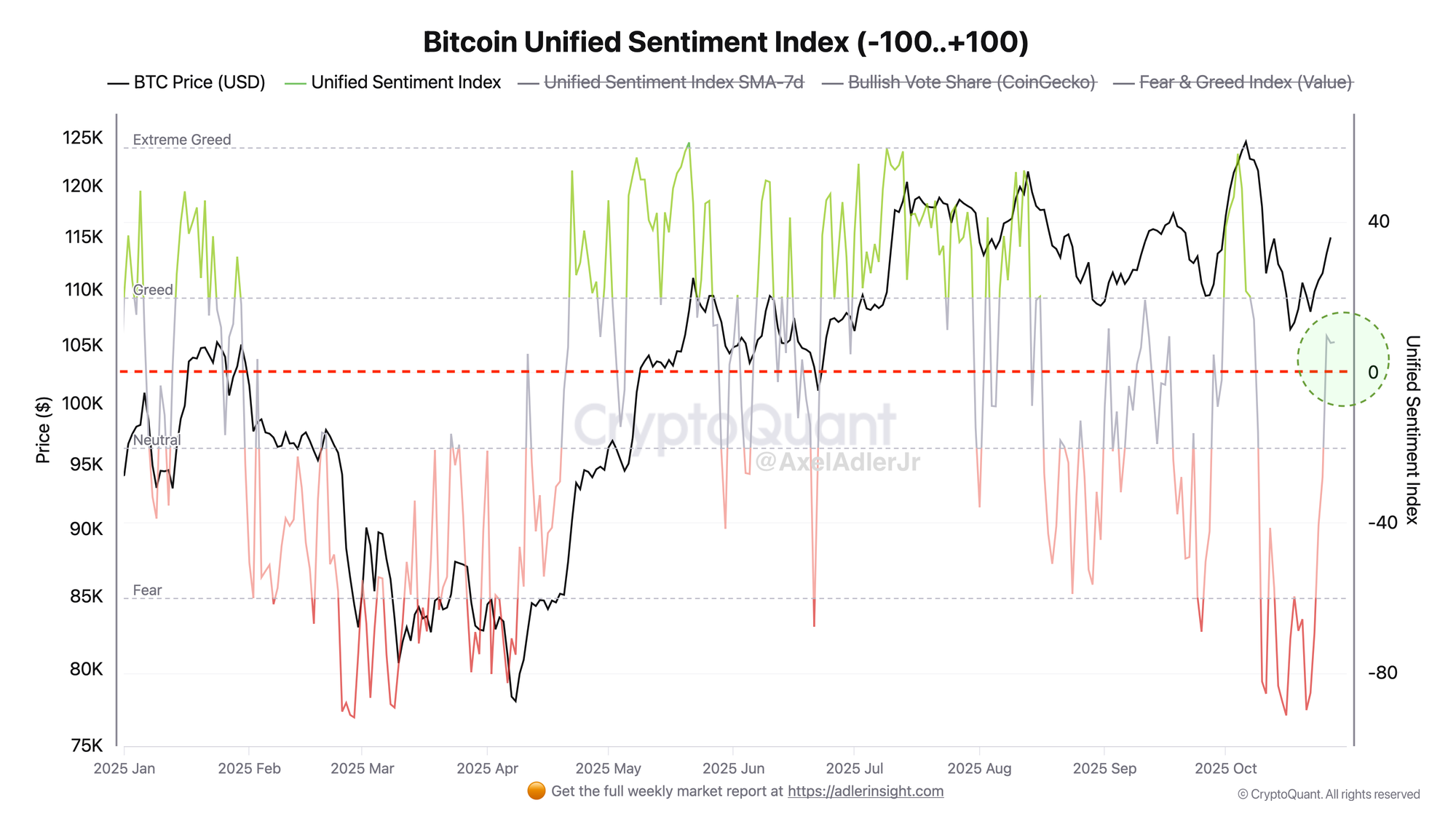

Unified Sentiment Index

Investor sentiment moved into positive territory at +8 synchronously with the structural reversal, essentially the alignment of signals strengthens the bullish case. Unified Sentiment Index (based on CoinGecko Bullish/Bearish votes and Fear & Greed Index). This is an important moment for the market in sentiment shift after several weeks of pessimism. Bull-Bear Structure reflects objective market and on-chain dynamics, Unified Sentiment shows broad market sentiment.

FAQ

What does the current Bull-Bear Structure picture indicate?

Breakout above zero for the first time since October 12, technical reversal in favor of bulls. Market and on-chain metrics show buyer dominance. As long as the index holds in positive territory, the structure supports growth.

How to interpret Unified Sentiment signals in today's context?

Sentiment moving into positive territory synchronously with structural reversal is a bullish signal. Sentiment is not overheated, which provides room for growth without risk of immediate correction on euphoria.

CONCLUSIONS

Base case scenario - continued growth against the backdrop of technical reversal and sentiment alignment. Bulls currently control market structure and sentiment. Maintaining Bull-Bear Structure above zero is critical for the market—this is the foundation of the current move.