After a series of large bullish liquidations, the market is consolidating at the $107K level, while the derivatives flow index has failed to rise above the bullish threshold.

TL;DR

The market is in a bearish deleveraging phase, price is below Fair Value $112K, pressure from short positions remains elevated.

#Bitcoin #Derivatives #Liquidations #Futures

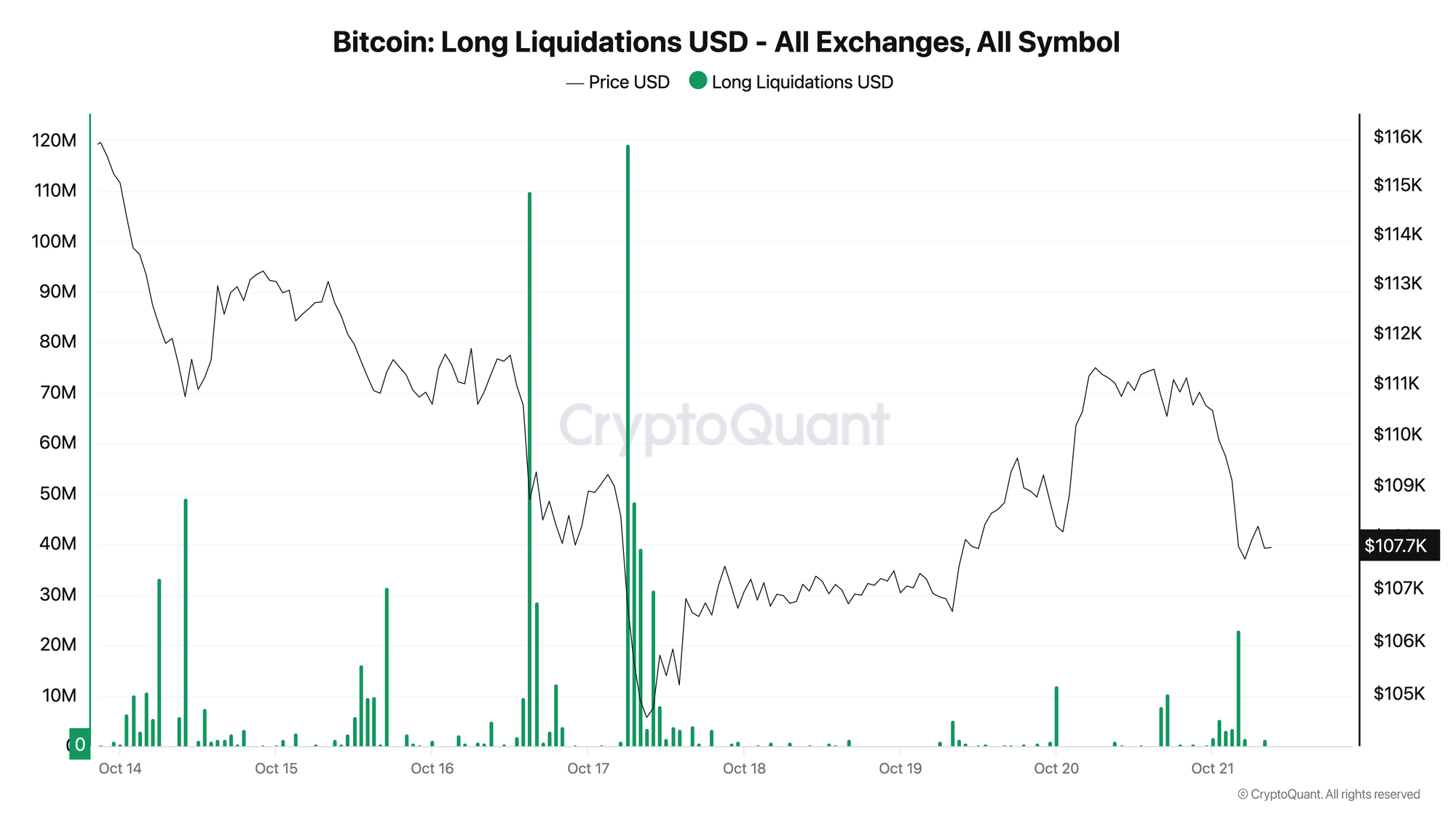

Bitcoin Long Liquidations

The peak of bullish liquidations occurred on 17 Oct, after which volumes subsided, but this morning small spikes again pushed the price lower. While there are no new liquidation extremes yet, which reduces immediate selling pressure, "fragility" persists below key price levels.

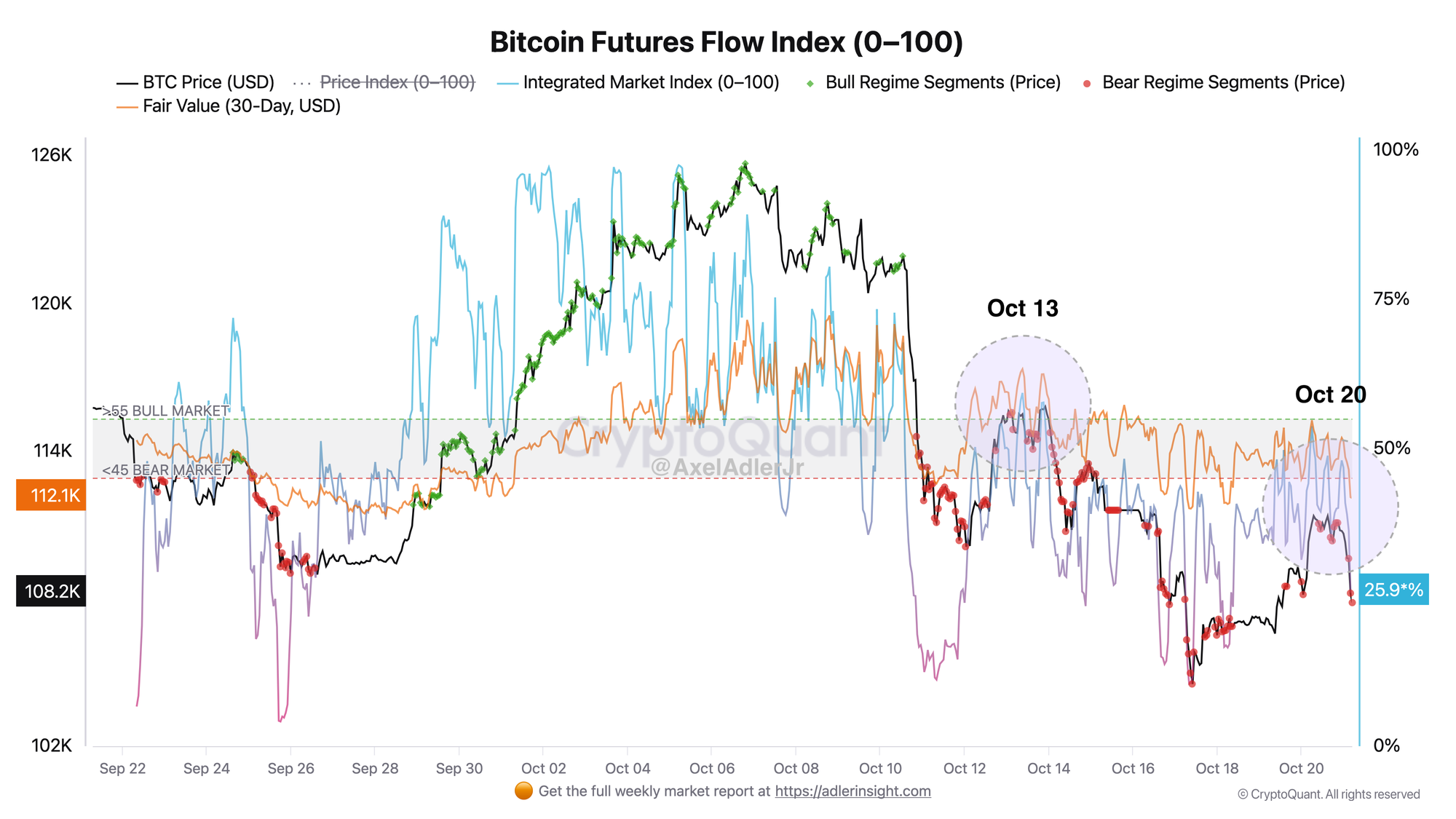

Bitcoin Futures Flow Index

The index remains in the "bearish" area <45, price is below the 30D Fair Value of $112K, and price segmentation shows predominance of bearish segments after 10 Oct. This indicates an incomplete derivatives deleveraging phase. To change the regime, the index needs to return to neutral values and price needs to consolidate above fair value.

FAQ

Q1: What does the current picture on the Bitcoin Long Liquidations chart indicate?

Large long liquidations on Oct 16–17 cleared part of the leverage; the absence of new extremes reduces immediate pressure, but below $112K the market remains vulnerable to repeated spikes.

Q2: How to interpret the Bitcoin Futures Flow Index signals in today's context?

While the index is below 45, the baseline regime is "bearish". Confirmation of an upward reversal requires the index returning to >45 together with price > $112K, otherwise risks of retesting the lower zone persist.

CONCLUSIONS

Bitcoin is in a bearish pressure phase following a series of large long liquidations on October 16-17 that cleared excessive leverage on derivatives. The current price of $107K has consolidated below the fair value of $112K, while the futures flow index remains in the bearish zone at 25% (threshold for bullish regime >45). The absence of new liquidation extremes reduces the risk of immediate cascading decline, however structural vulnerability persists.