Bitcoin lost 26% from ATH $125K, oscillator shows Long Liquidations dominance at +20%, market sentiment remains in the fear zone at -89.

TL;DR

Extreme fear at -89 in the market, accompanied by massive long position liquidations.

#Bitcoin #Liquidations #Fear #Capitulation

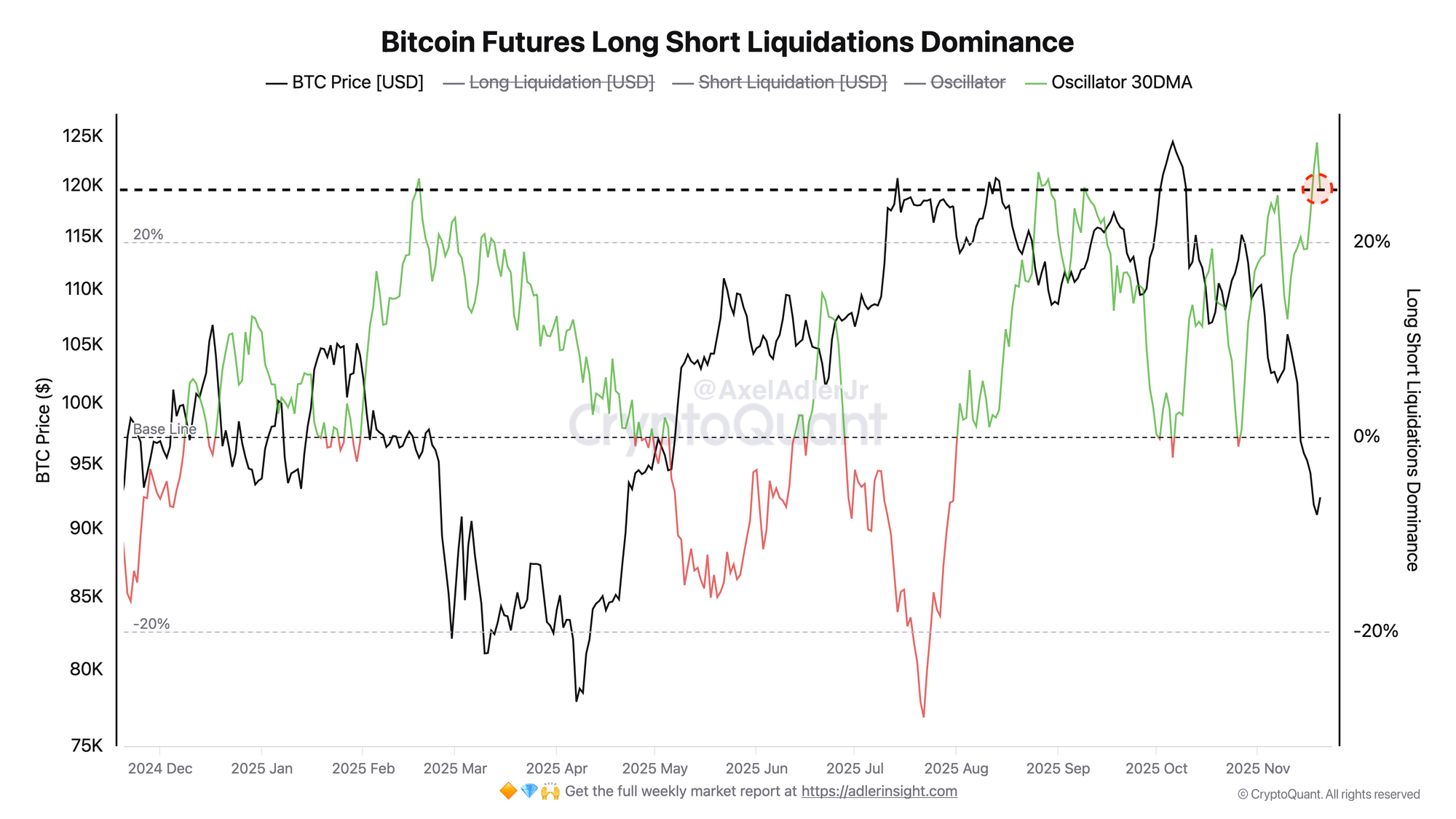

Bitcoin Futures Long Short Liquidations Dominance

The oscillator at +20% indicates Long Liquidations dominance - long positions are being force-closed en masse during the drop from $125K to $92K. The 30-day moving average has slightly declined but still remains at extreme levels. The current oscillator level is at extreme values for the past 12 months.

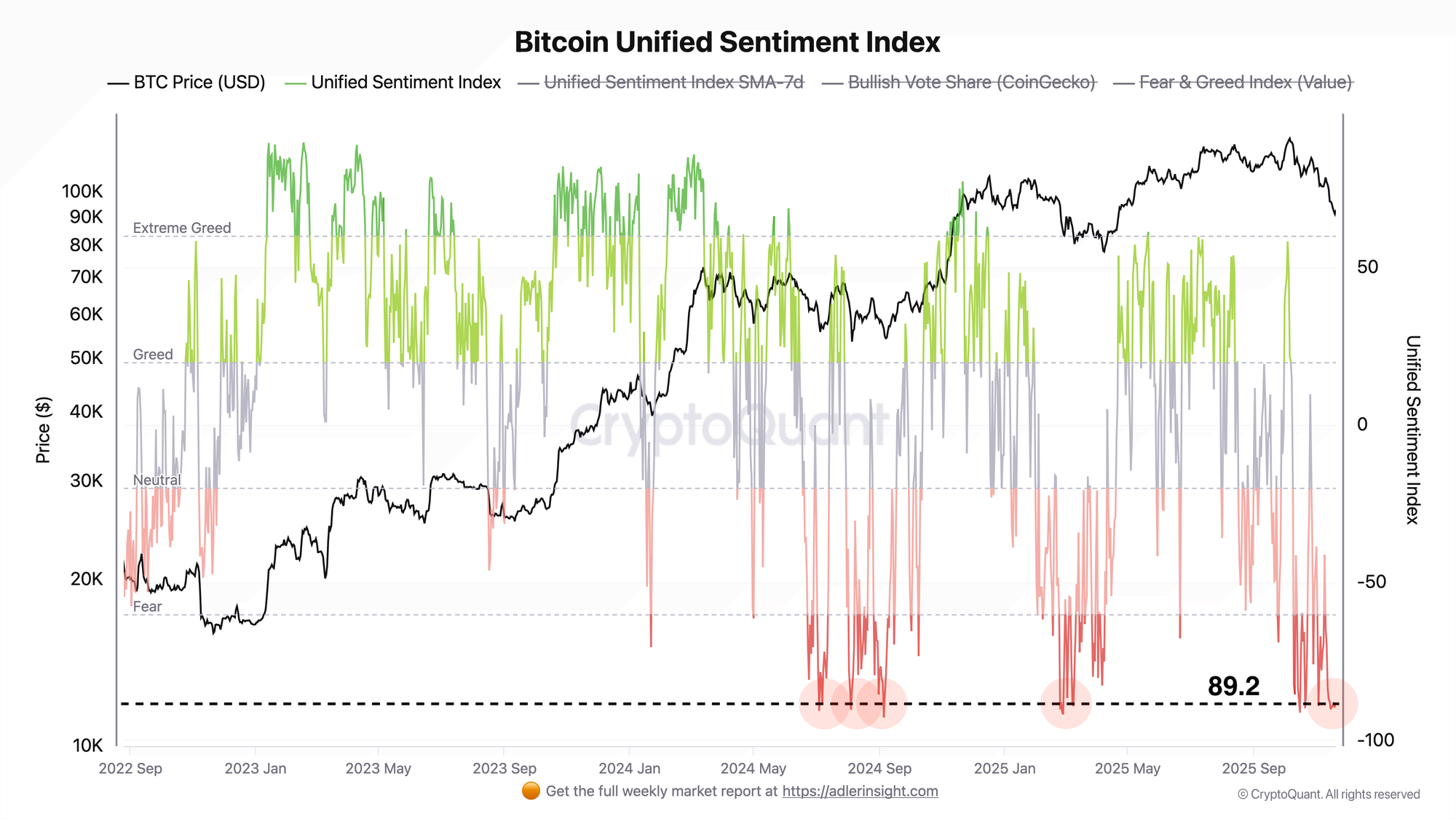

Bitcoin Unified Sentiment Index

The Unified Sentiment Index shows a level of -89, which is in the deep Fear zone, close to the extreme minimum of -100. Red bars dominate completely, green ones have disappeared, the market has shifted into panic mode. Long Liquidations dominance combined with extreme fear creates a negative market picture - in other words, peak pessimism.

FAQ

What does the current liquidations chart picture indicate?

The oscillator at +20% extreme means that most longs have already been force-closed. This is a bearish signal in the short term, but may precede consolidation at current levels.

Is fear at -89 the bottom, or could it get worse?

A value of -89 is close to historical lows and statistically points to proximity to a local bottom in a bull market. However, the current market phase has shifted and there are no guarantees on timing or depth - the index could continue falling to -95/-100, and the correction could drag on.

CONCLUSIONS

The current configuration of the futures market and overall sentiment shows extremes on both indicators. Given the shift in market phase, the base case scenario is an attempt at local consolidation following the wave of forced liquidations. At the same time, the risk of another downward impulse and new local lows remains high: market structure still corresponds to a heightened volatility regime.