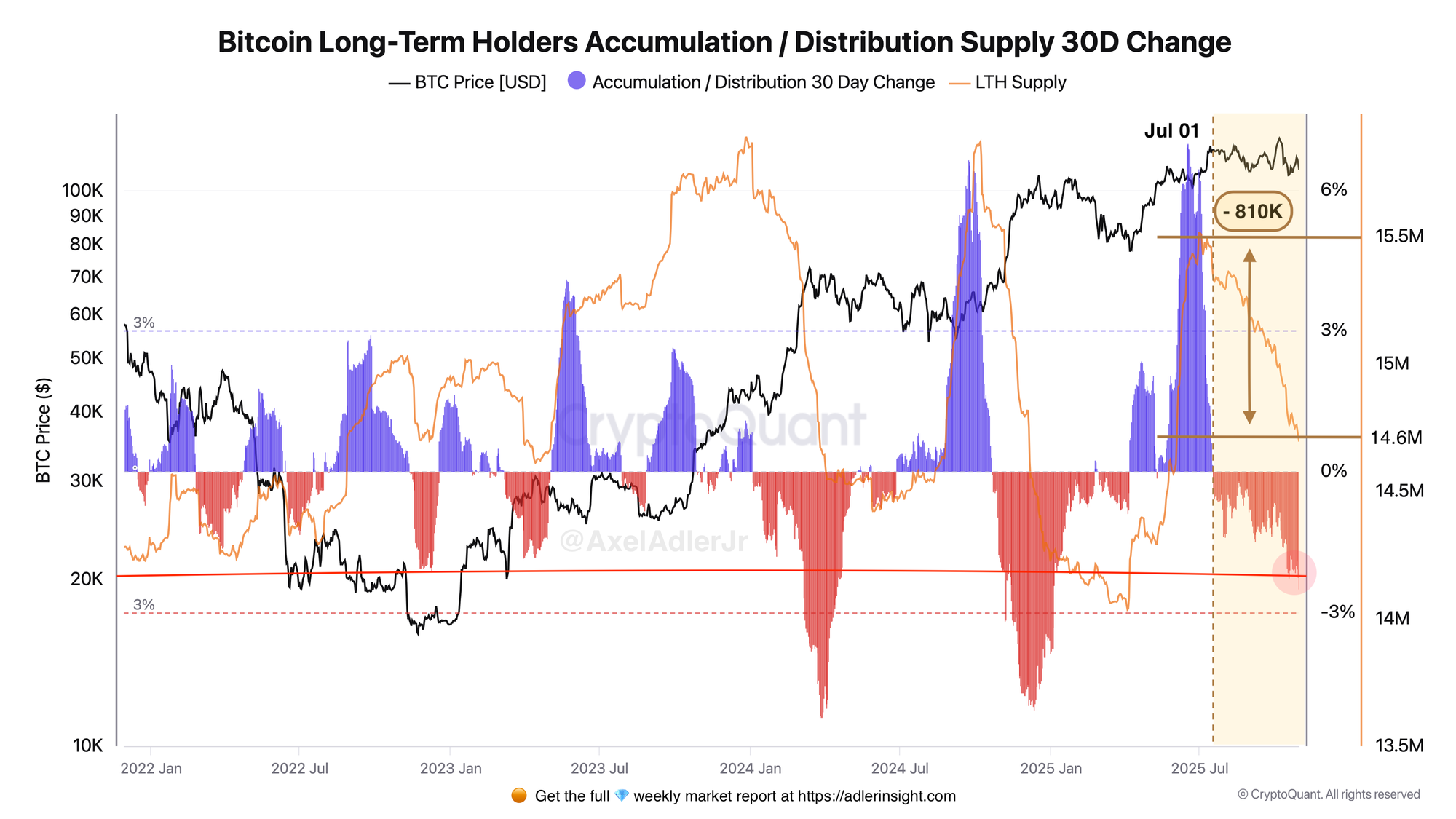

Long-term holders have sold 810K BTC since July, further growth requires completion of the current distribution wave.

TL;DR

LTH continue to actively distribute BTC, having sold approximately 810K BTC since July. Until this wave of distribution completes, growth will remain limited and the market will stay volatile.

#Bitcoin #OnChain #LTH #Distribution

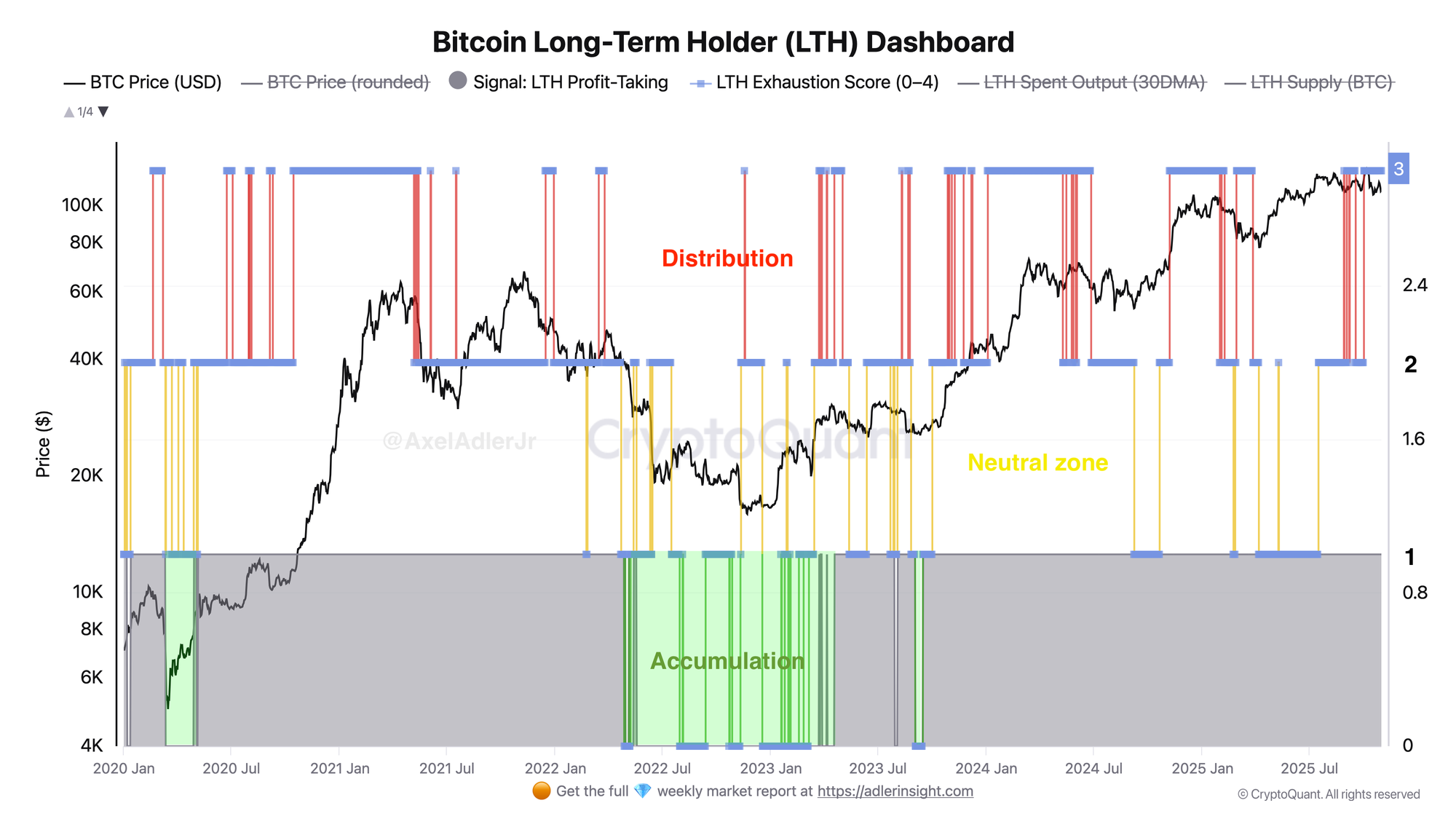

Bitcoin Long-Term Holder

LTH are actively taking profits (red Distribution bars), the Exhaustion Score remains at 3 - the market is in distribution mode with a high probability of correction in the absence of new buyers.

Bitcoin LTH Supply 30D Change

Since July 1st, LTH have sold 810K BTC, their total supply decreased from 15.5M to 14.6M BTC. Both charts confirm a unified picture: long-term holders have been in active distribution mode since early July, until metrics return to neutral or accumulation zones, further growth will be limited and volatility will remain elevated.

FAQ

What does the current picture on the Bitcoin Long-Term Holder chart mean?

LTH are actively taking profits, the market is in distribution mode, new ATHs are only possible with strong inflow of new demand.

How to interpret the signals from the LTH Supply 30D Change chart in today's context?

Active LTH distribution puts pressure on price, suppressing demand, which restrains growth.

CONCLUSIONS

Bitcoin remains under stress until the current distribution wave completes while long-term holders are taking profits, growth will be limited.