As the leading cryptocurrency declines, composite miner financial health indices remain near stress zones.

TL;DR

The financial health index is at a critical threshold, demand-supply balance is weak, and nominal revenues have reached local lows.

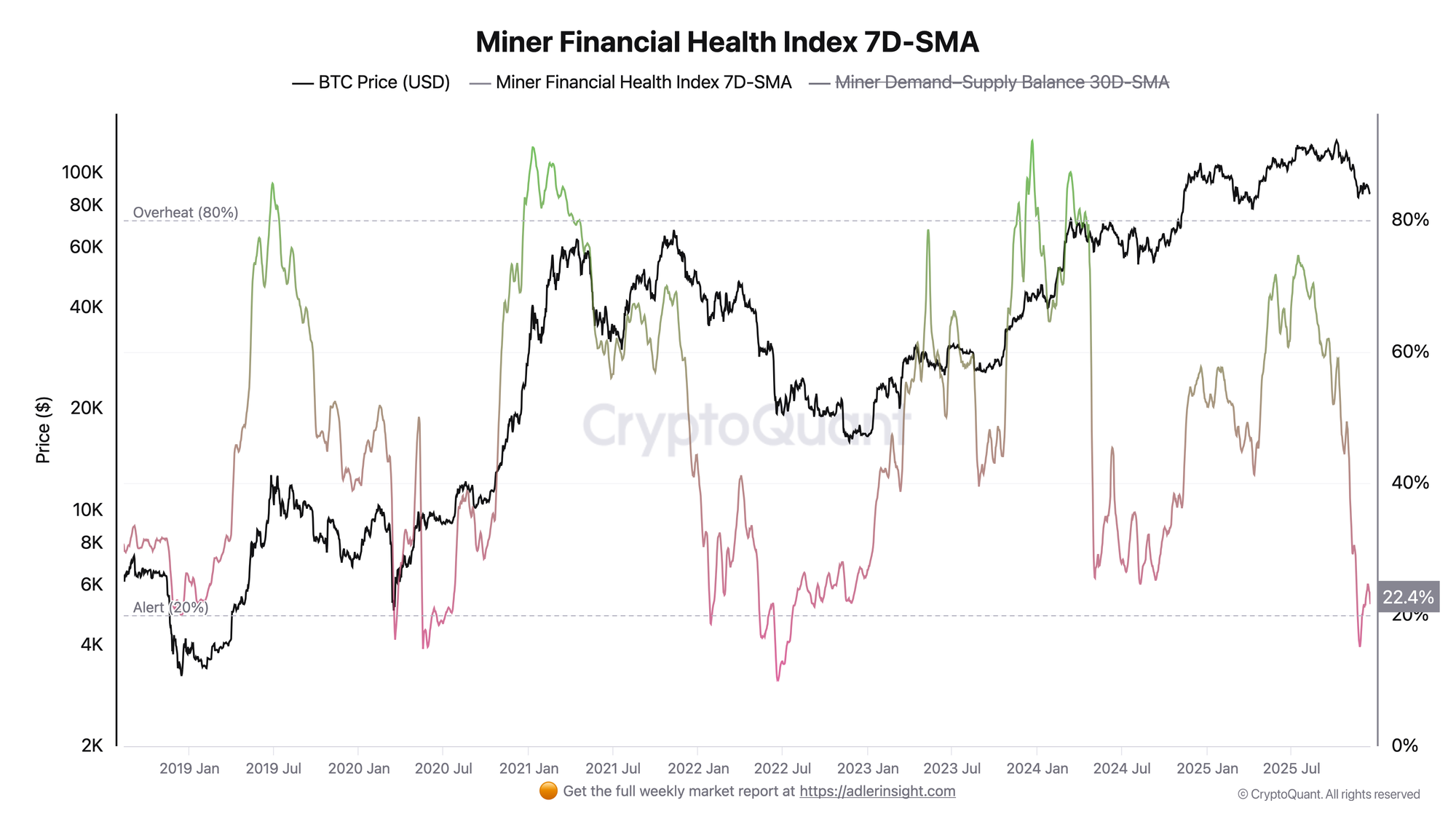

Miner Financial Health Index

The composite index evaluates mining profitability through hashprice, revenue per block, fee share, and total revenue with normalization using annual Z-scores. Zone above 80% signals overheating, below 20% indicates stress.

The index stands at 22% and has again approached the Alert zone. The current reading is one of the lowest since 2022, despite BTC price holding significantly above summer 2022 levels. Such values were observed during post-correction stress periods or immediately after halvings.

The index positioning near the 20% threshold indicates that relative mining profitability is under pressure. The main deterioration trigger is a breakdown below the Alert zone, which historically preceded miner capitulation.

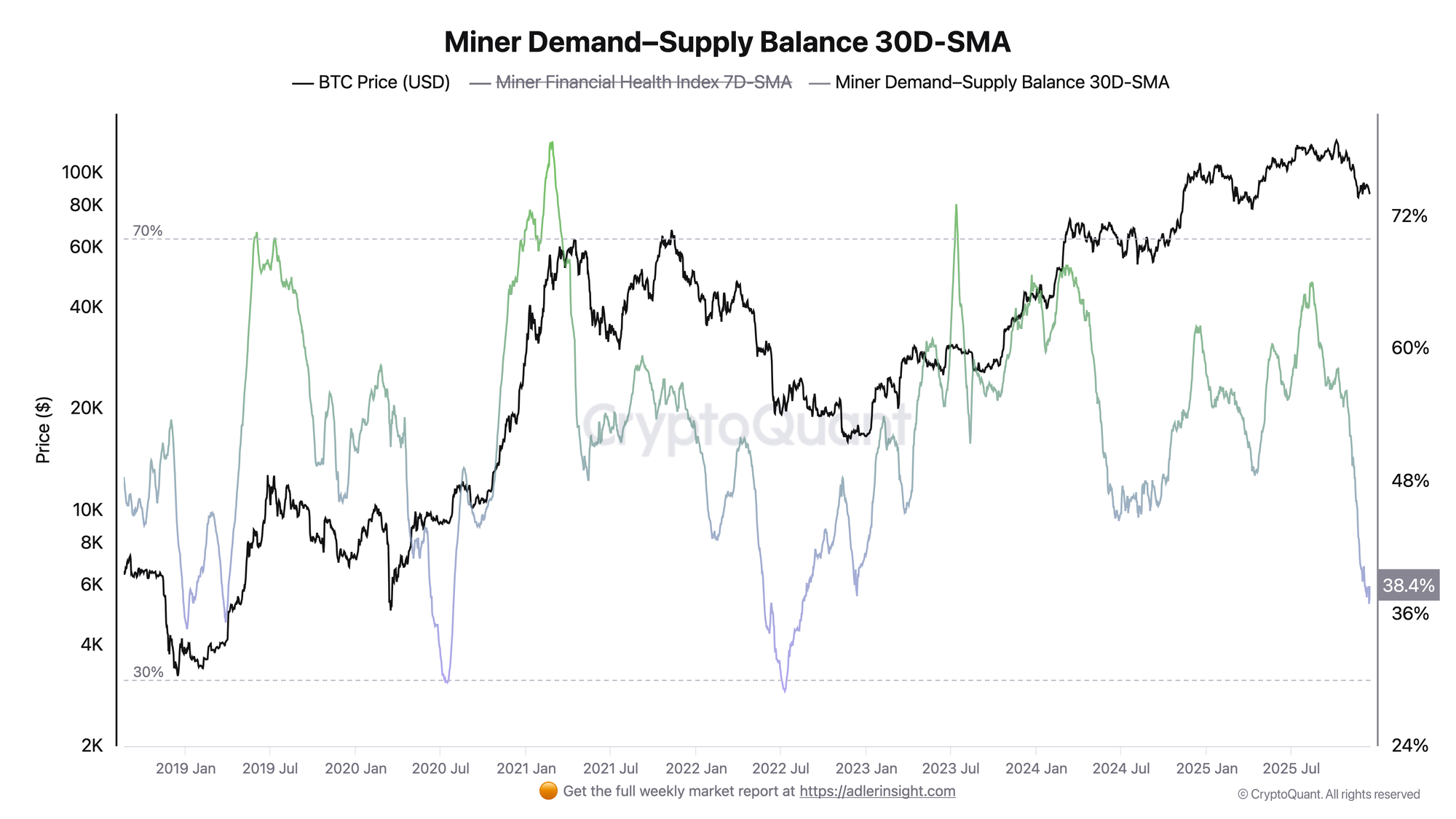

Miner Demand–Supply Balance

The index measures the ratio of fee revenue to issuance, reflecting users' willingness to pay for blockspace relative to new coin supply. The current reading is 38% on the 30-day average. The index has declined from local highs and sits in a neutral-weak zone, with recent months showing a steady decline from levels above 60%.

A weak reading indicates low organic demand for blockspace: users are not willing to compete for block space through high fees. A risk-on scenario requires a return above 50%, which would need either a surge in transaction activity or a significant on-chain event.

Both indices point to deteriorating quality of miner revenues. The Financial Health Index registers profitability stress, while Demand–Supply Balance confirms the cause lies in weak fee contribution.

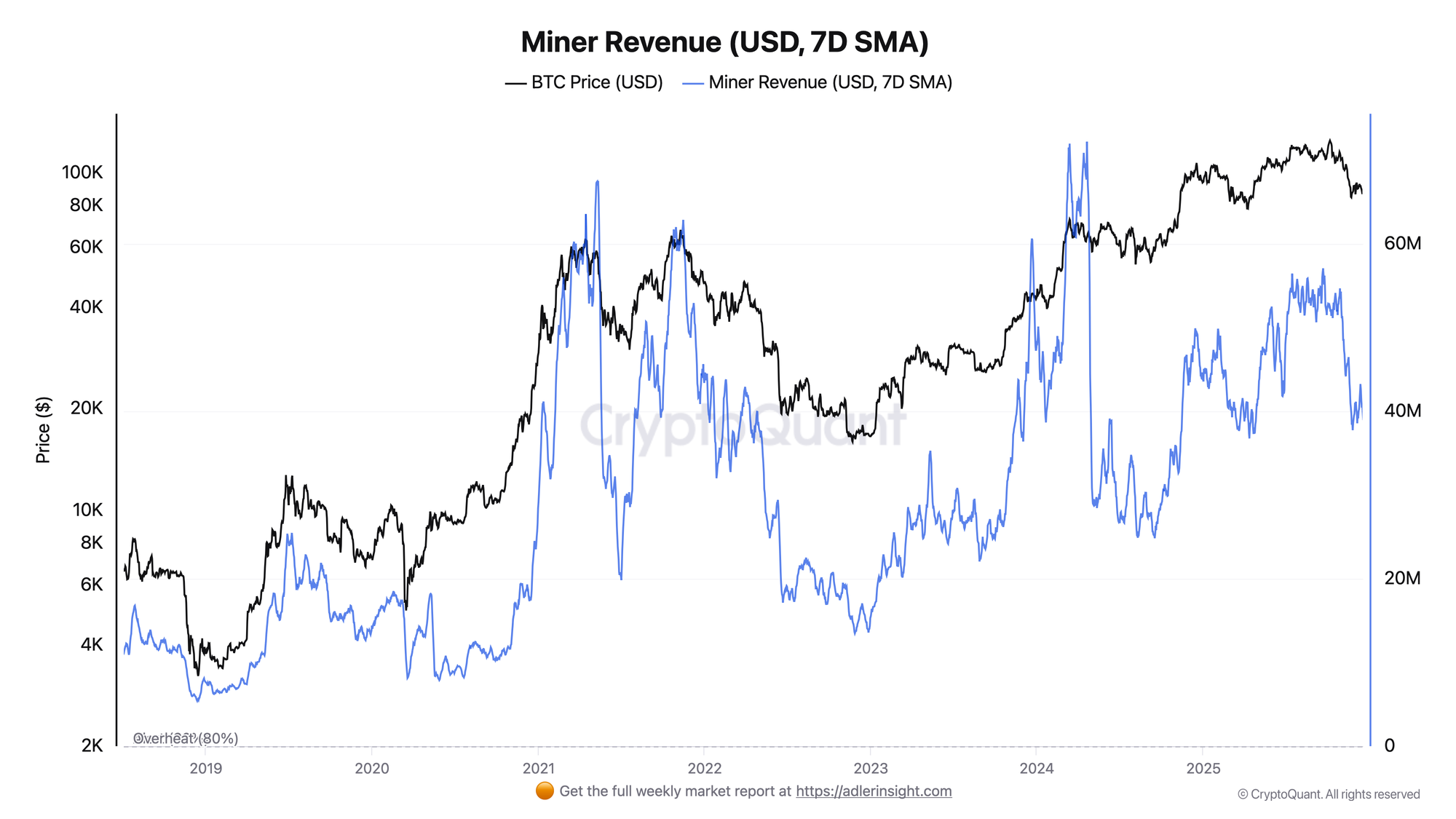

Miner Revenue

The metric displays total miner revenue in USD (subsidy + fees) with smoothing to filter daily noise. Miner revenue has declined to approximately ~40M following a local peak. The chart clearly shows the blue line retreating from its peak value. The current revenue level corresponds to 2025 average values and is significantly below extremes observed during periods of elevated network activity.

Declining nominal revenue intensifies profitability pressure already registered by normalized indices. If absolute revenues continue falling while current difficulty levels persist, this will amplify stress for less efficient miners.

FAQ

Why do indices show stress at relatively high BTC prices?

Indices are normalized against annual averages and account not only for absolute revenue but also its structure. Difficulty growth post-halving and low fee share in revenues reduce relative profitability even when price remains elevated.

What Miner Financial Health Index level would signal a position reassessment?

A sustained breakdown below the 20% zone historically preceded miner capitulation periods and could pressure price through forced selling. Conversely, a return above 30% with Miner Demand–Supply rising above 50% would signal normalization of mining economics.

CONCLUSIONS

Miner economics are in a state of structural stress: the financial health index sits near the critical 20% threshold, demand-supply balance is weak at 38%, and nominal revenues have retreated from local highs to 40M. The regime remains risk-off from a mining metrics perspective. The main deterioration trigger is a sustained move of the Miner Financial Health Index below 20% with subsequent hashrate decline and forced selling. The main improvement trigger is a fee surge and Miner Demand–Supply Balance returning above 50% alongside revenue stabilization. The primary risk is continued margin pressure on less efficient miners while current network difficulty persists.