🎧 Morning Brief #91 - audio debate on today’s market setup

Bitcoin is entering a zone that preceded the main capitulation phase in 2022. Net Realized P/L has dropped 97% from peaks and reached near-zero levels - exactly as it did before the decline from $30K to $16K.

TL;DR

Net Realized P/L at zero - just like June 2022 before the major decline. Whales remain in profit, but their buffer is shrinking.

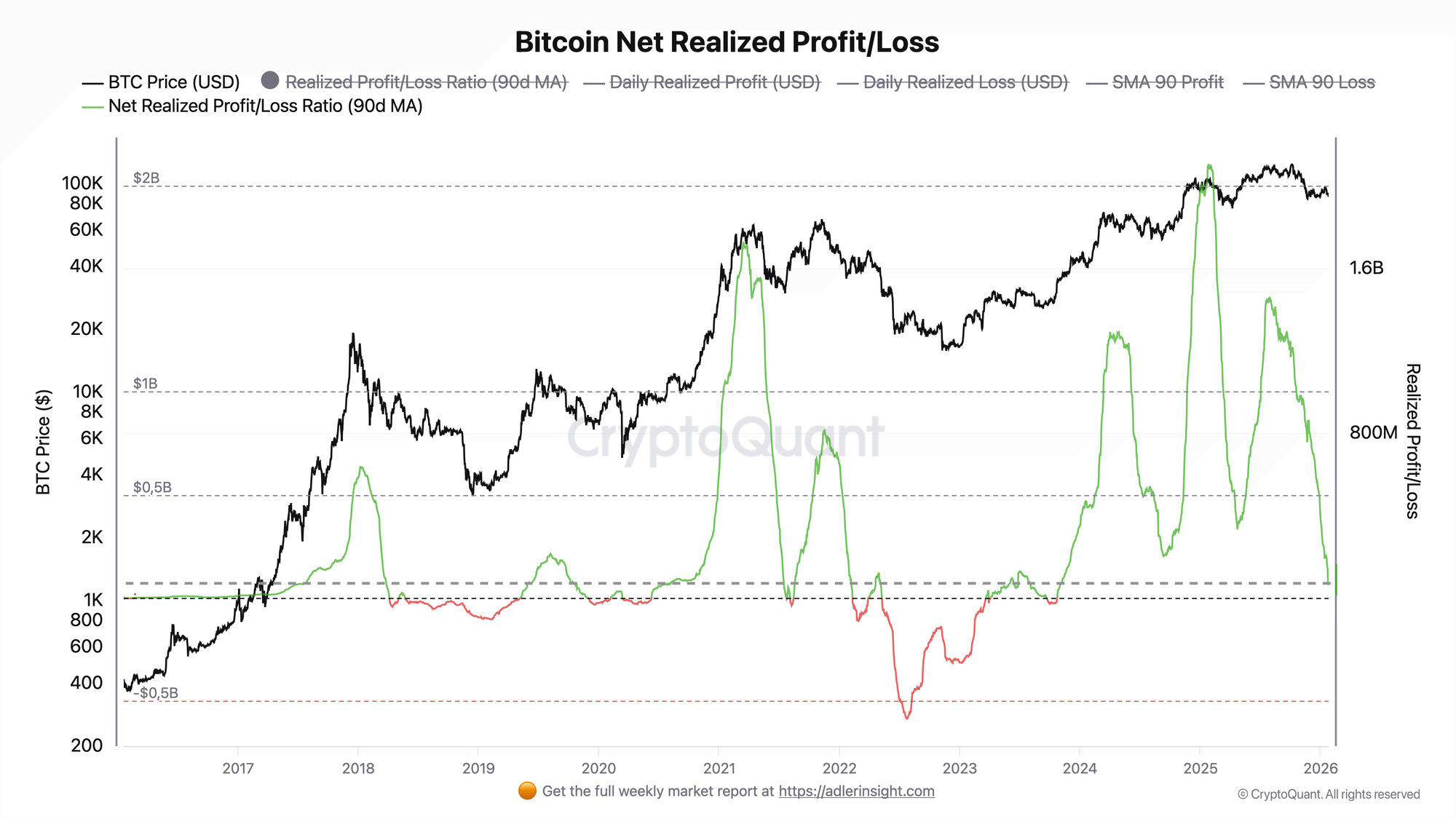

Bitcoin Net Realized Profit/Loss

The metric reflects the difference between realized profits and losses of network participants, smoothed by a 90-day moving average.

In late 2024 - early 2025, the indicator reached extreme values above $1.5B, which historically corresponds to overheated zones. By January 26, 2026, Net Realized P/L contracted to $60M - a decline of more than 97% from peak values. The metric sits near the zero line, signaling that profit-taking pressure has been nearly exhausted.

In 2022, before the main decline phase, the metric also passed through zero before moving into deeply negative territory (down to -$350M), accompanying the price drop from $30K to $16K. The current return to zero is not a reversal signal - it may merely be an intermediate point before transitioning into loss realization mode, similar to June 2022.

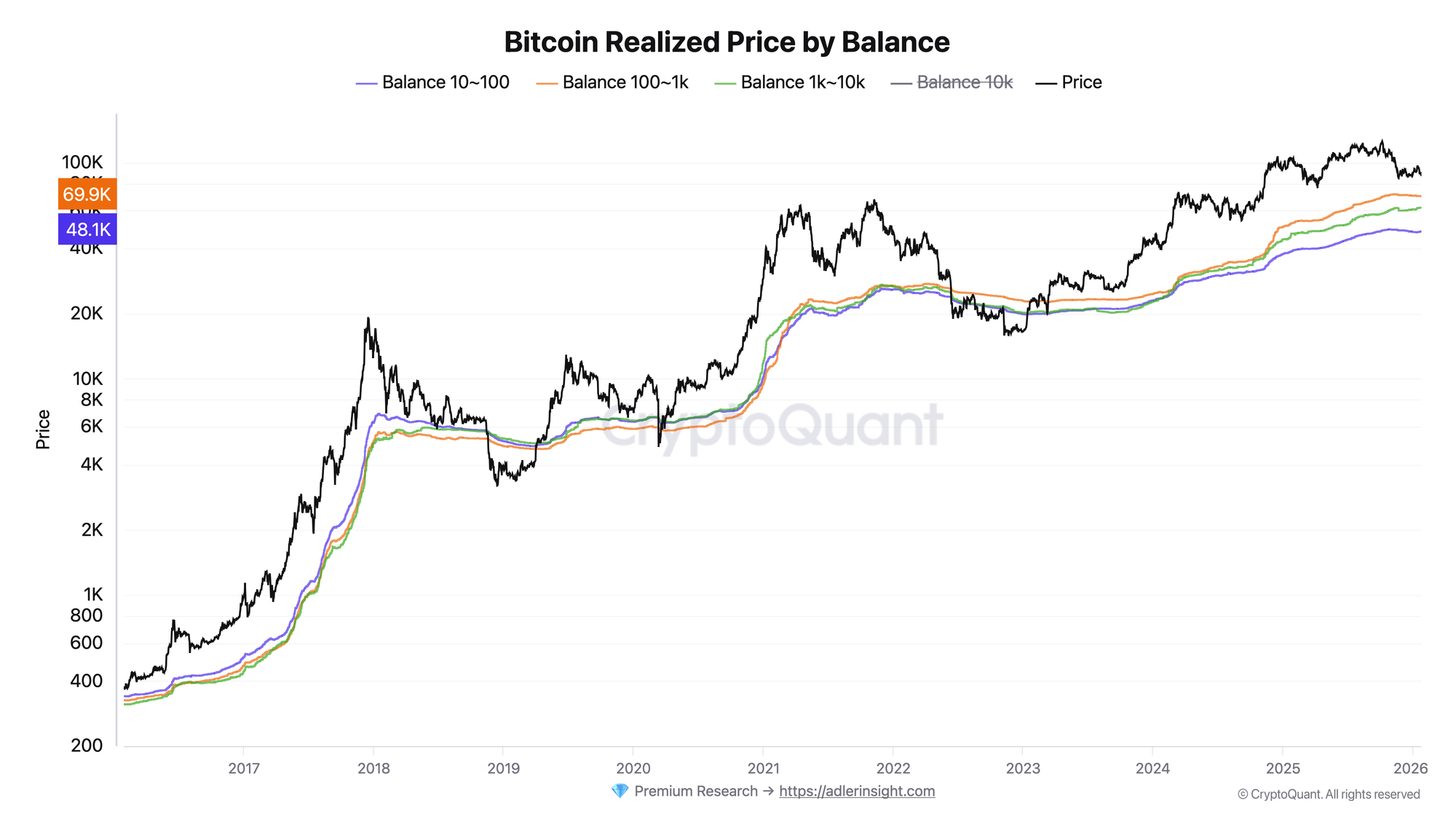

Bitcoin Realized Price by Balance

The metric shows Realized Price - the average purchase price of coins - for cohorts with balances of 10-100 BTC, 100-1K BTC, 1K-10K BTC, and 10K+ BTC.

At the current price of $87,600, all large cohorts remain in profit. The 100-1K BTC cohort has the highest average entry price at $69,900, meaning a current profit buffer of approximately 25%. Smaller and larger holders (10-100 BTC and 10K+ BTC) have significantly lower entry prices - around $48K and $51K respectively, with buffers of 70-80%.

Current picture: whales (100+ BTC) remain in a comfortable profit zone, which explains the absence of panic selling despite the decline from peaks. However, the fact that Net Realized P/L has zeroed out while large players remain profitable points to exhausted new capital inflows - the market is sustained by the absence of seller pressure, not buyer strength.

Both charts form a unified picture: profit-taking has concluded, but this is not a reversal - it's a pause. Whales aren't selling because they're in profit. But there's no one to buy either - Net Realized P/L at zero means a balance of forces with no clear advantage. Historically, such points preceded either a new impulse or a transition into capitulation phase.

FAQ

Why is Net Realized P/L at zero not a positive signal?

In June 2022, the metric also passed through zero, after which the market lost another 50%. Zero is not the bottom, but a fork in the road: either stabilization or transition into loss realization mode. In the current bearish context, the second scenario is more likely.

What to monitor for directional confirmation?

The key indicator is Net Realized P/L dynamics over the coming weeks. A move into negative territory will confirm transition into capitulation mode. A return to positive values above $200-300M will signal renewed capital inflows.

CONCLUSIONS

Net Realized P/L has reached near-zero territory - similar to June 2022, when this proved to be merely an intermediate stop before the main capitulation phase. Large holders (100+ BTC) remain in profit with a 25-80% buffer, which explains current stability. Regime is risk-off: structure is fragile, historical analogies are negative. The market stands at a fork - the coming weeks will show whether this becomes a base for stabilization or a prelude to capitulation. The primary indicator to monitor is Net Realized P/L direction.