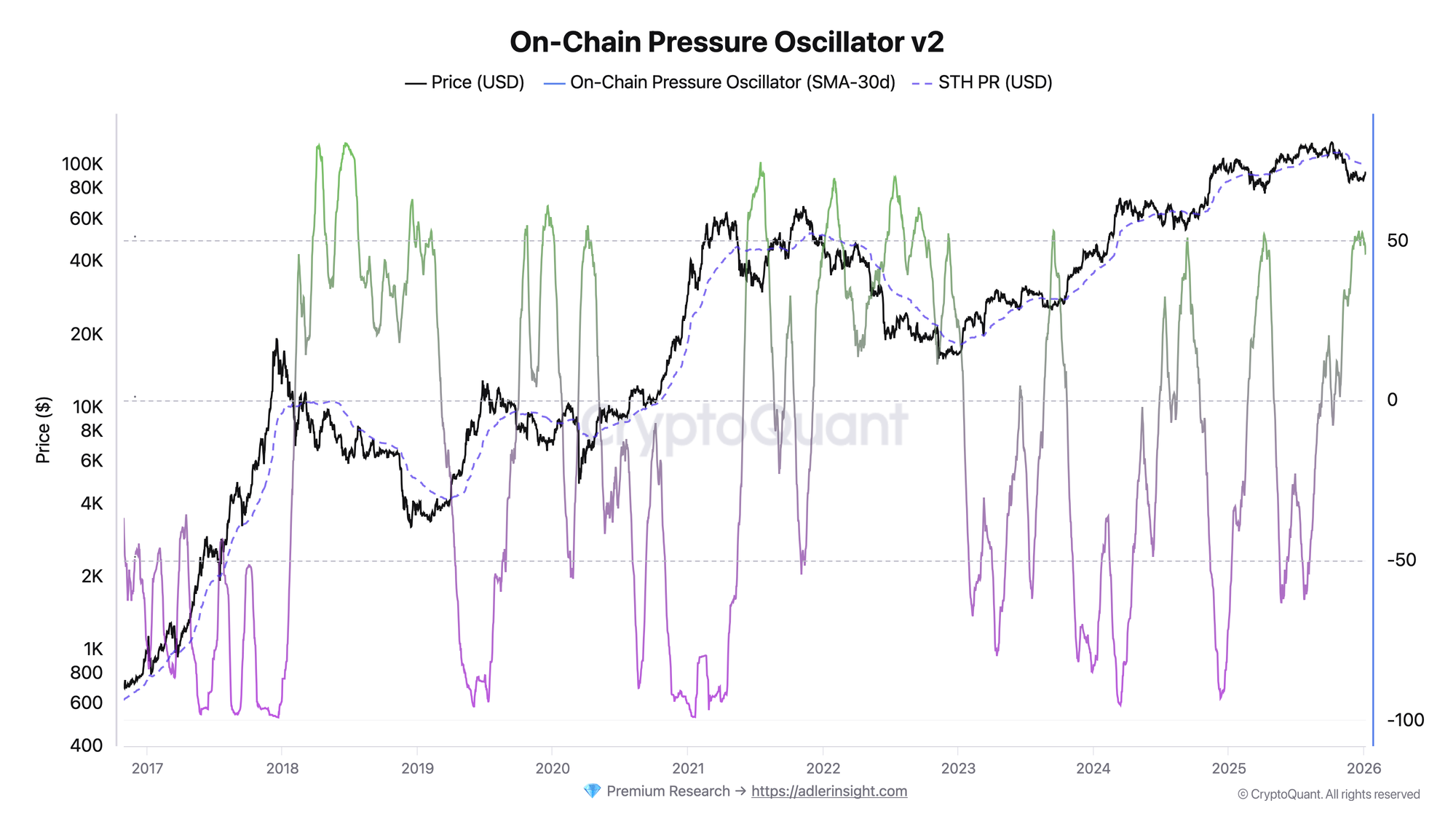

The market is in an accumulation zone. The On-Chain Pressure Oscillator holds near the accumulation boundary, while short-term holders remain at a loss relative to their average entry price.

TL;DR

This brief analyzes the current sell-side pressure balance through the on-chain metrics oscillator and price position relative to STH Realized Price.

On-Chain Pressure Oscillator

The oscillator combines three components: exchange netflows, short-term holder realized P/L, and old coin spending, normalized through percentile ranking. The current SMA-30d value is in the accumulation zone - sellers are scarce, old coins aren't moving, exchange inflows are weak, and the market is deleveraged.

Daily oscillator values have declined in recent days, but the smoothed version remains stable. Similar levels have historically corresponded to consolidation phases before directional moves. The current regime reflects suppressed sell-side pressure from key cohorts with no confirmed demand. The key deterioration trigger is sustained SMA settlement below zero, which would signal a transition to distribution regime.

BTC Price vs STH Realized Price

STH Realized Price is the average acquisition price of coins held by holders with ownership duration up to 155 days.

BTC price trades below STH Realized Price, meaning the average short-term holder is at a loss. STH being underwater limits this cohort's profit-taking potential, with the $100K level acting as local resistance. Currently, this reduces sell-side pressure and explains why the oscillator remains in the accumulation zone with suppressed selling despite price correction. Upon reaching $100K and the cohort returning to breakeven, STH will begin selling, creating price pressure. Key confirmation of market strength is price settlement above STH RP with simultaneous oscillator growth in the accumulation zone >50.

FAQ

Why does the oscillator remain in the accumulation zone despite price correction?

Price correction alone doesn't mean increased sell-side pressure. The oscillator captures actual participant behavior: exchange netflows, short-term holder realized P/L, and old coin activity. When STH are at a loss, their motivation to sell is reduced. This limits exchange inflows and keeps the oscillator in the suppressed sell-side pressure zone, even amid price decline.

What level will signal a regime change?

For the oscillator, the key level is the SMA-30d zero boundary. Sustained settlement below it means transition to distribution regime. For price, the critical level is STH Realized Price. Settlement above it will confirm market strength recovery. Rejection from this level with downside acceleration will intensify pressure from short-term holders.

CONCLUSIONS

The market is in an accumulation phase with suppressed sell-side pressure. The oscillator holds in positive territory not due to new demand inflow, but because of absent selling incentive among short-term holders who are at a loss, as well as low activity from old coins.

Current regime is accumulative but fragile. Key confirmation of market strength is price return above STH Realized Price with simultaneous oscillator growth into sustainable accumulation zone.