Against the backdrop of announced payments worth $300–500 billion from tariff revenues, retail demand could become a new trigger for a BTC rally in 2026

TL;DR

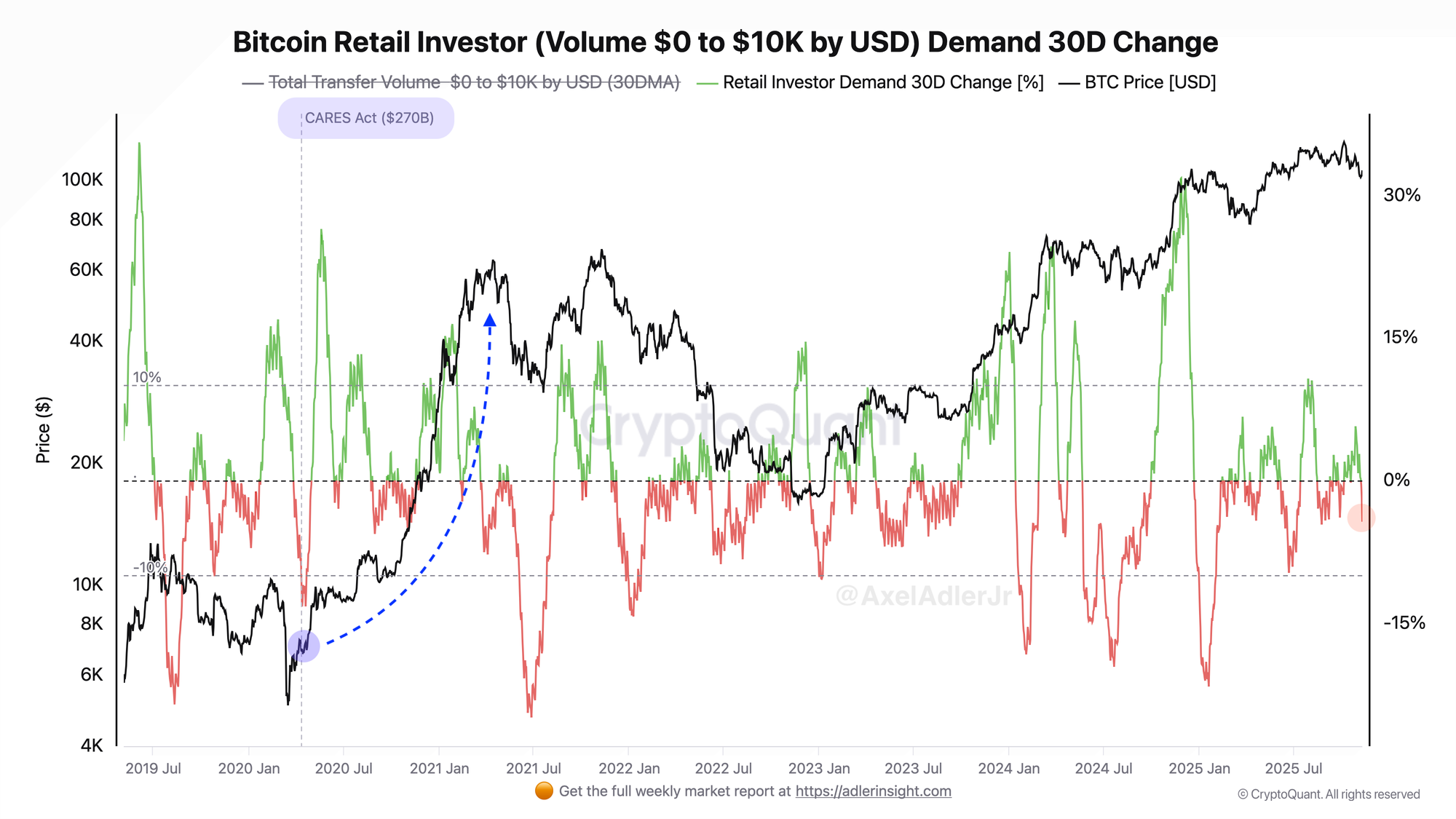

Fiscal payments of $300–500 billion funded by tariff revenues could ignite a new wave of retail Bitcoin demand in 2026, comparable to or stronger than the 2020 CARES Act.

#Bitcoin #Retail #OnChain

Bitcoin Retail Investor Demand 30D Change

The President's announcement on Truth Social regarding payments of $2,000 per person from tariff revenues (total volume could reach $300–500 billion) may stimulate a new rally for the leading cryptocurrency. For comparison: the CARES Act 2020 (first round of COVID stimulus payments) totaled $270 billion, and retail demand for BTC grew to 26% at that time. The current program is comparable in scale, but the 2025 cryptocurrency market is qualitatively different: the institutional base is broader (ETF flows, corporate balance sheets), and retail has already gone through a learning cycle. If recipients direct a portion of funds into BTC, this could stimulate new demand and growth for the leading cryptocurrency.

Additionally, it's worth considering that the effect of potential payments could be amplified by structural changes in capital behavior and liquidity. Unlike the post-COVID period, when retail investors first encountered crypto assets en masse, the current environment is characterized by high integration of Bitcoin into financial infrastructure. This means that any fiscal stimulus, even directed at the traditional economy, now translates into BTC price faster. In this sense, a new wave of retail liquidity could become a catalyst for the next phase of BTC growth, combining fiscal stimulus and institutional infrastructure into a unified demand dynamic.

FAQ

How significant is the potential of the new stimulus compared to the CARES Act?

The volume of potential payments of $300–500 billion is comparable to COVID payments, but the key difference lies in the market structure. In 2020, crypto assets were a niche asset class requiring technical knowledge for access. In 2025, Bitcoin is integrated into the traditional financial system through ETFs, corporate balance sheets, and simplified platforms. This means that the conversion of stimulus into BTC demand could be higher.

CONCLUSIONS

The announcement of fiscal payments worth $300–500 billion creates prerequisites for a new influx of retail liquidity into Bitcoin, potentially more powerful than the CARES Act 2020 effect, thanks to structural market advantages. The current level of retail participation indicates room for growth, key risks are related to program implementation and recipient fund allocation any delays or changes could postpone the materialization of this trigger.