Following the onset of a bearish cycle, Bitcoin's price has dropped below the average purchase price of short-term holders. Two on-chain indicators point to growing selling pressure from new market participants.

TL;DR

Short-term holders have entered a stress regime, price has fallen below their average purchase price, and STH-SOPR (30D) has dropped to 0.98, indicating loss-taking and increased risk of accelerated selling.

Bitcoin: Short Term Holder SOPR

SOPR 30D measures average coin sales by short-term holders: values above one indicate sales at a profit, below one indicate sales at a loss. The chart shows that the 30-day SOPR moving average has dropped to the 0.98 zone, meaning short-term holders are on average selling their coins at a loss. Further decline of the metric will intensify selling pressure and lead to new local lows. Recovery confirmation trigger: return and hold of the metric above one.

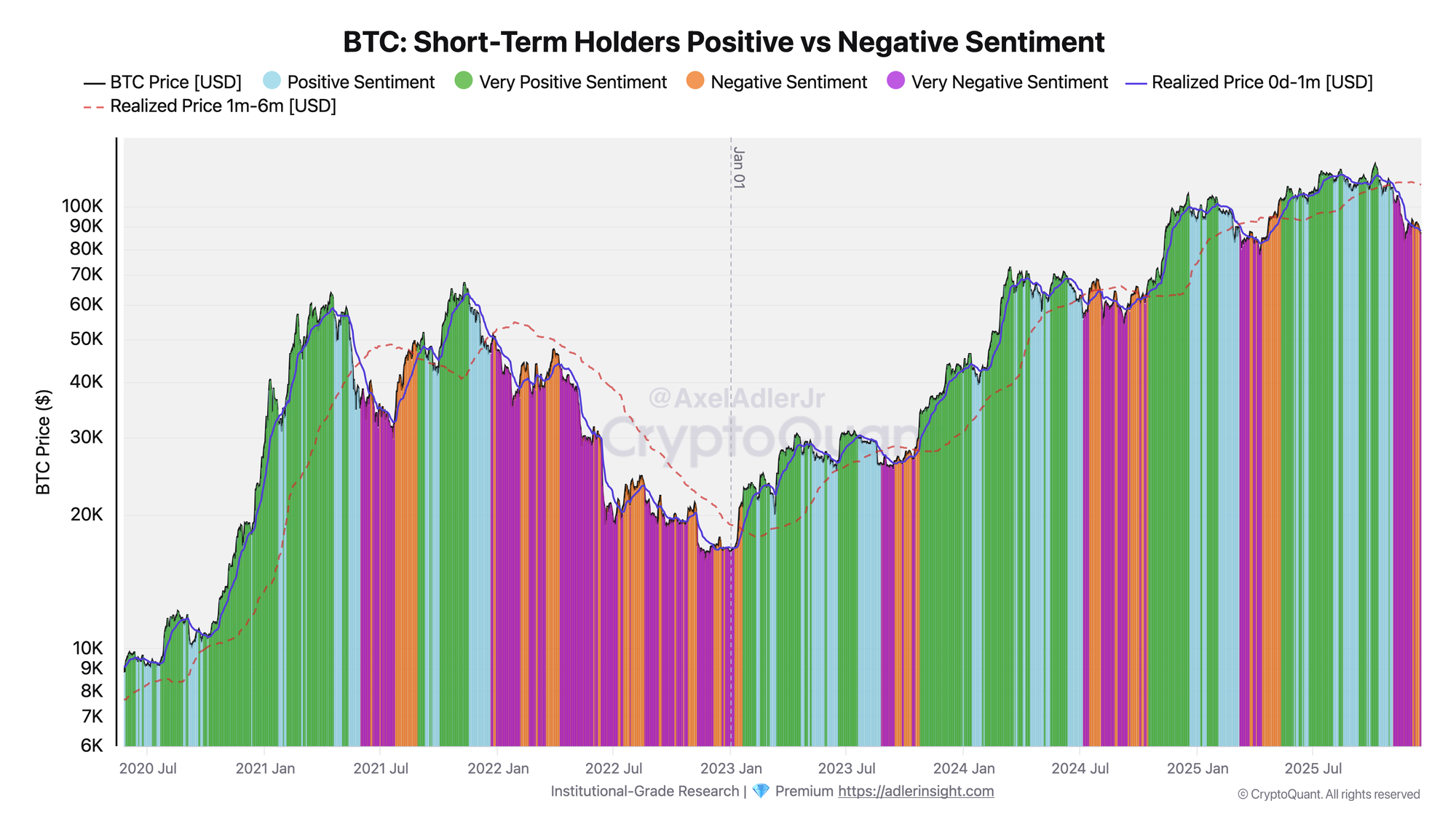

Bitcoin Short-Term Holders Positive vs Negative Sentiment

The indicator classifies STH by their current state relative to entry price: green and blue represent positive sentiment (profit), orange and purple represent negative sentiment (loss). Over the past five weeks, the sentiment structure has shifted toward orange and purple zones, reflecting a growing share of holders at a loss. Dominance of negative sentiment creates conditions for panic selling. The second chart confirms the signal from the first: SOPR declining below one coincides with a growing share of underwater holders, indicating consistency of the stress signal within the STH cohort.

FAQ

What does SOPR below one mean for the market?

SOPR below one means short-term holders are on average selling coins at a loss. During a bearish trend, a breakdown accelerates capitulation.

What trigger will indicate a regime change?

Sustained SOPR closure above one combined with expansion of blue and green zones on the second chart will signal a transition to market recovery mode.

CONCLUSIONS

Both indicators point to short-term holders transitioning into a stress zone: SOPR has approached the critical level of one, while the sentiment structure has shifted toward negative zones. Current regime is risk-off for short-term positioning. Key reversal confirmation trigger: price returning above STH realized price and SOPR recovering above one.