The sentiment index has dropped into the risk-off zone, while price has settled below the realized price of all short-term holder cohorts. This combination indicates a heightened risk regime where any bounces will face selling pressure from participants seeking to exit at breakeven.

TL;DR

Sentiment and on-chain structure are synchronously pointing to market weakness. Short-term holders are underwater, and all key nearby support levels have turned into resistance.

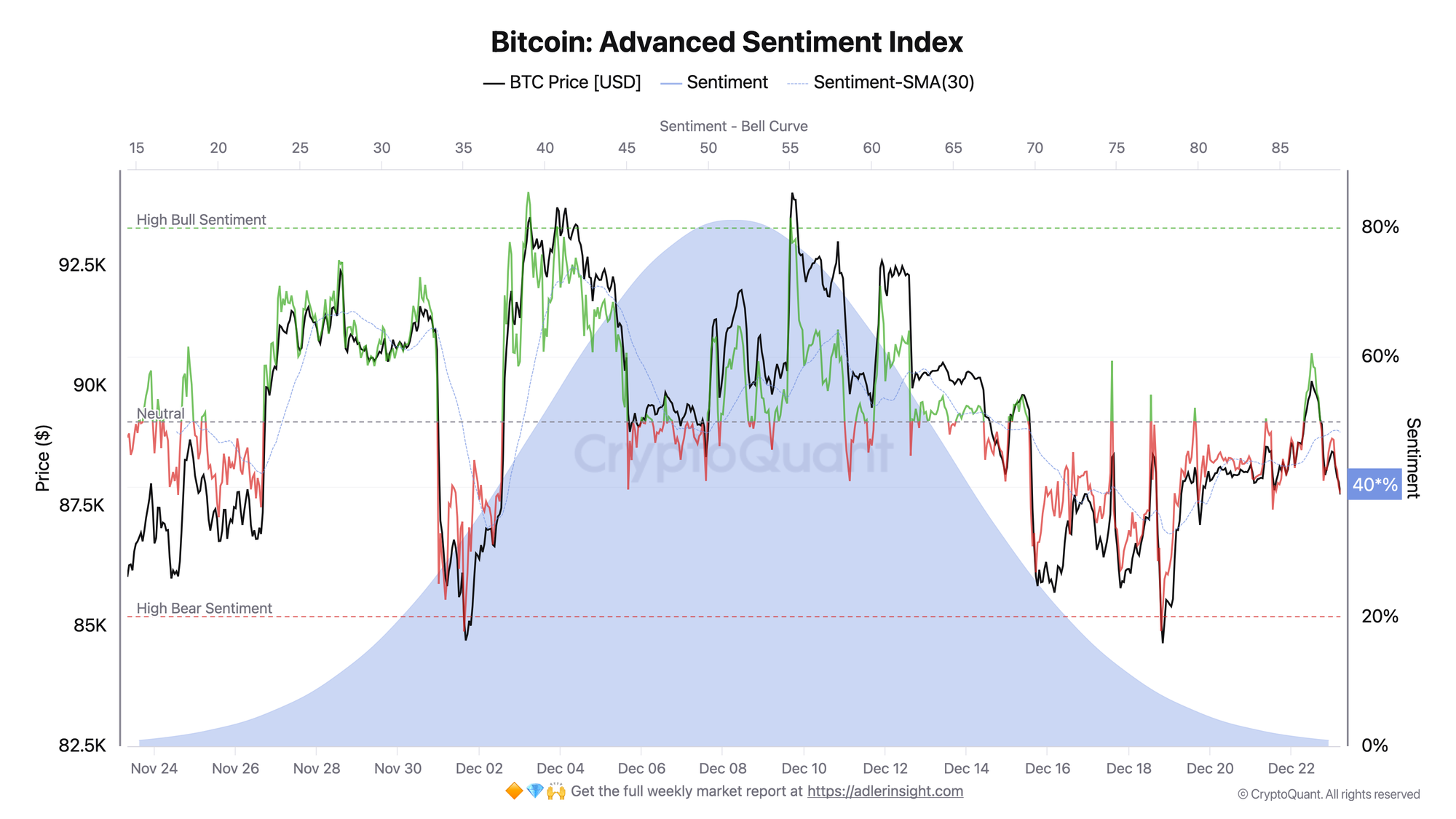

Bitcoin Advanced Sentiment Index

The composite index aggregates normalized metrics of price, taker volume, open interest, and volume delta. Interpretation zones: above 80 - overheated bullish sentiment, around 50 - neutral territory, below 20 - extreme fear. After peaking in the first week of December when sentiment was in bullish extreme territory, a sustained correction in sentiment began. The index's moving average has also turned downward, confirming a shift in the short-term market regime. Against the backdrop of yesterday's failed Santa rally attempt, the index declined to 40%, corresponding to a transition into risk-off mode.

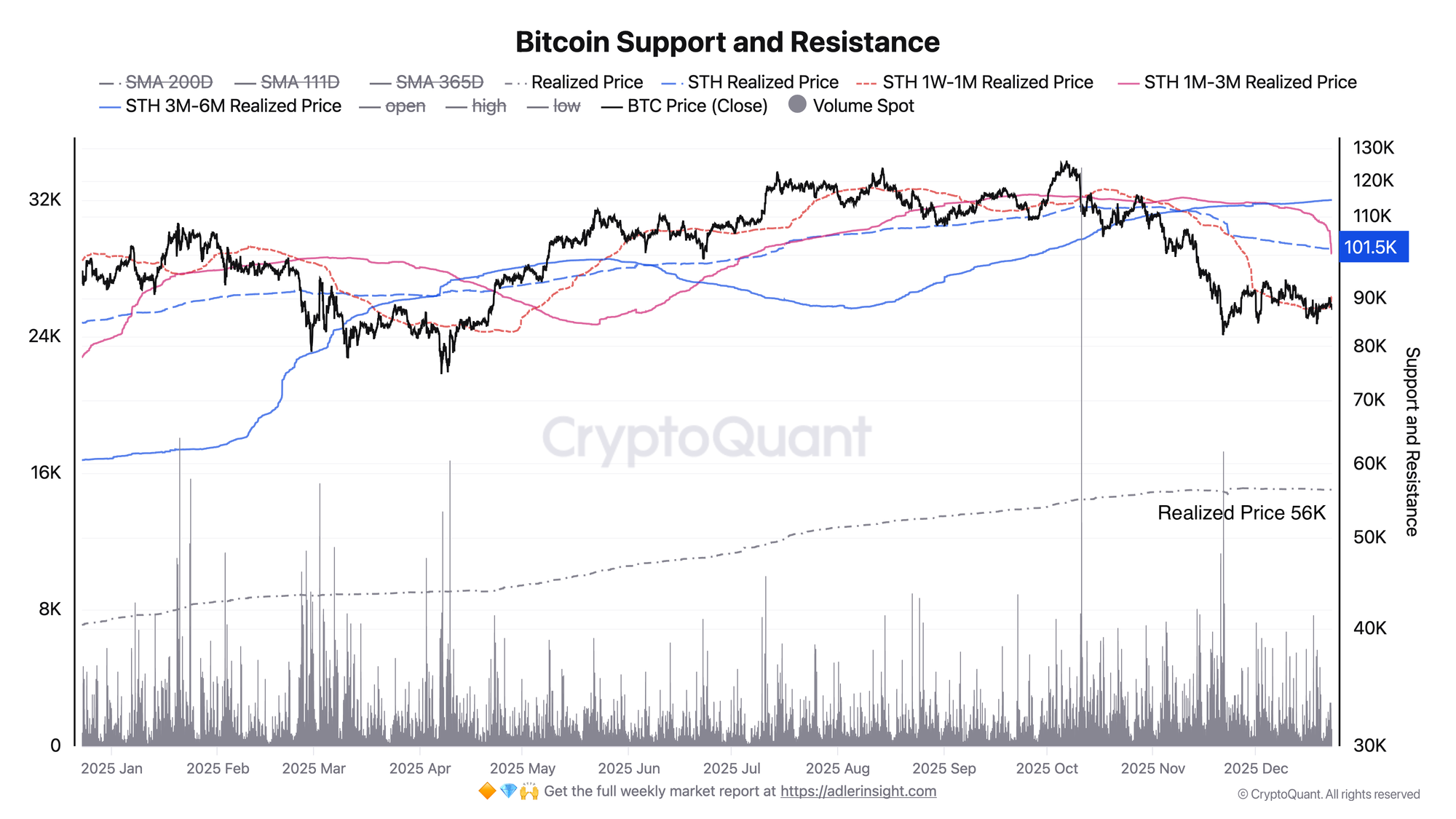

Bitcoin Support and Resistance

Price is trading at the $87,400 level, below all key short-term holder realized price levels. The nearest resistance, STH 1W-1M Realized Price, sits at $90,300. Above that lies a cluster comprising STH 1M-3M ($100,400) and the aggregate STH Realized Price ($101,500), which coincides with the SMA 365D zone ($101,800). The SMA 111D ($104,300) and SMA 200D ($107,900) form additional resistance levels significantly above the current price. Global support, the aggregate Realized Price - currently stands at $56,300.

The current price position below STH Realized Price means the majority of short-term holders are underwater, creating selling pressure on bounces toward breakeven levels. A shift to a constructive regime requires a recovery and consolidation above $90K, which would serve as the first signal of recovery. The risk is continued decline amid absent buyer interest at current levels.

FAQ

What does the current sentiment index value of 40 indicate?

A value below 50 points to prevailing bearish sentiment. This is not extreme fear (which would require a drop below 20), but a clear shift from optimism to risk-off mode.

What level is key for determining further direction?

The $56K realized price serves as critical support. Holding this level preserves a constructive market structure. A breakdown would trigger additional pressure from holders and transition the market into a deep correction phase.

CONCLUSIONS

Both indicators point to the market transitioning into a red regime. Sentiment has dropped below the neutral zone, while price is testing critical support levels formed by short-term holder realized prices. The current regime is risk-off. The main trigger for improvement is sentiment recovery above the neutral zone while holding STH Realized Price support.