Bitcoin recovered above $92,000 amid a return of risk appetite. The composite derivatives pressure index has returned to positive territory, but spot market is currently leading the rally rather than leverage - structurally, this is a healthier dynamic.

TL;DR

The brief captures the market's transition into a moderate expansion regime following December's deleveraging. Key logic: price growth is outpacing the buildup of derivatives positions, indicating a spot-driven nature of the move.

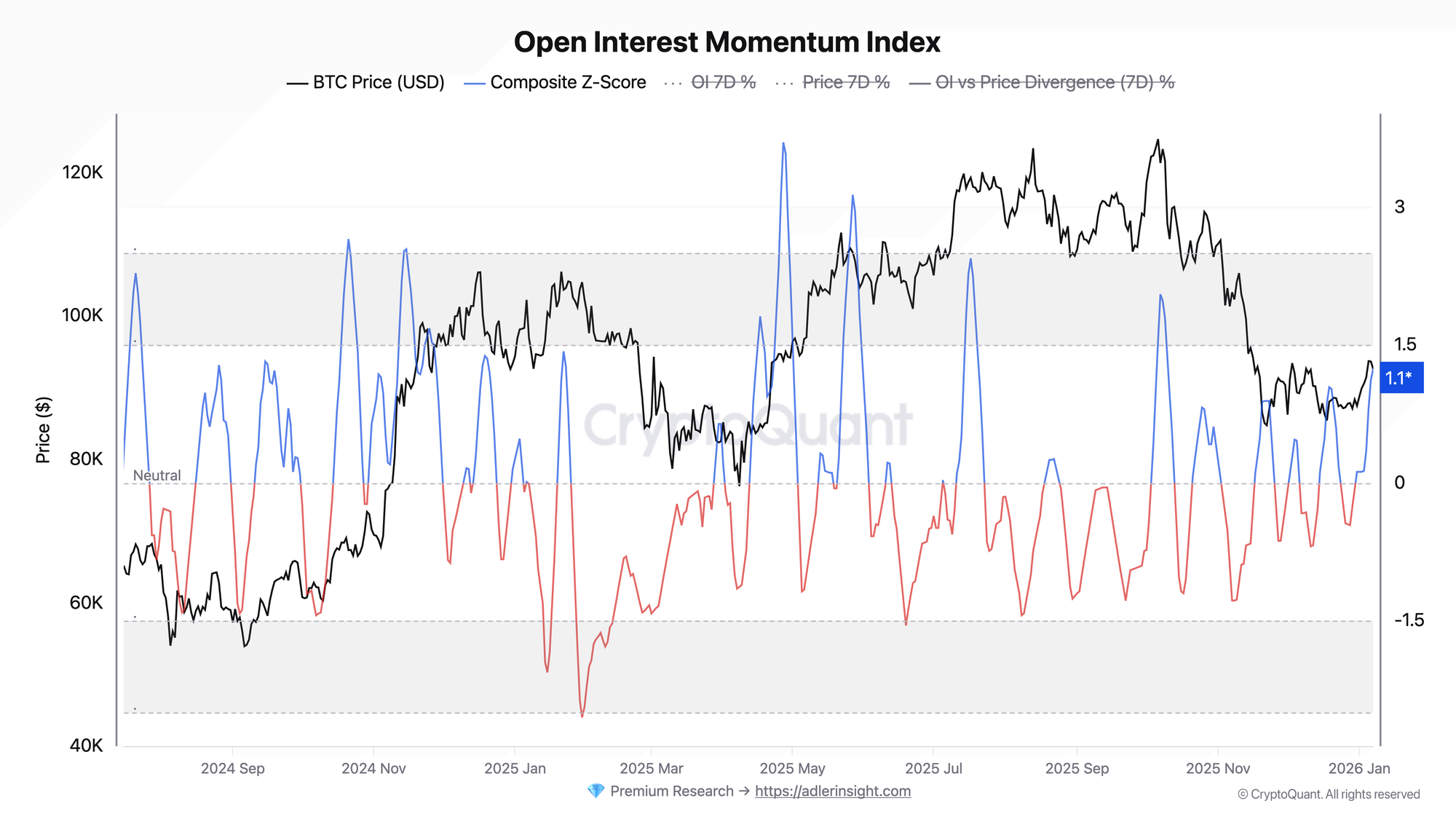

Open Interest Momentum Index - Composite Z-Score

The composite index (0–5) is normalized via a 90-day Z-Score and reflects aggregate derivatives pressure: OI momentum, price momentum, divergence, acceleration, and absolute position levels.

The index is in positive territory after an extended period around zero and below in December. The current reading indicates moderate but not extreme optimism - far from the "overheated" zone above +1.5. The regime is classified as Expansion (Moderate), meaning both price and open interest are rising simultaneously.

A positive Z-Score confirms the return of constructive sentiment in the derivatives market. The trigger for strengthening would be a sustained hold above +1.5; the trigger for deterioration would be a pullback into negative territory accompanied by rising liquidations.

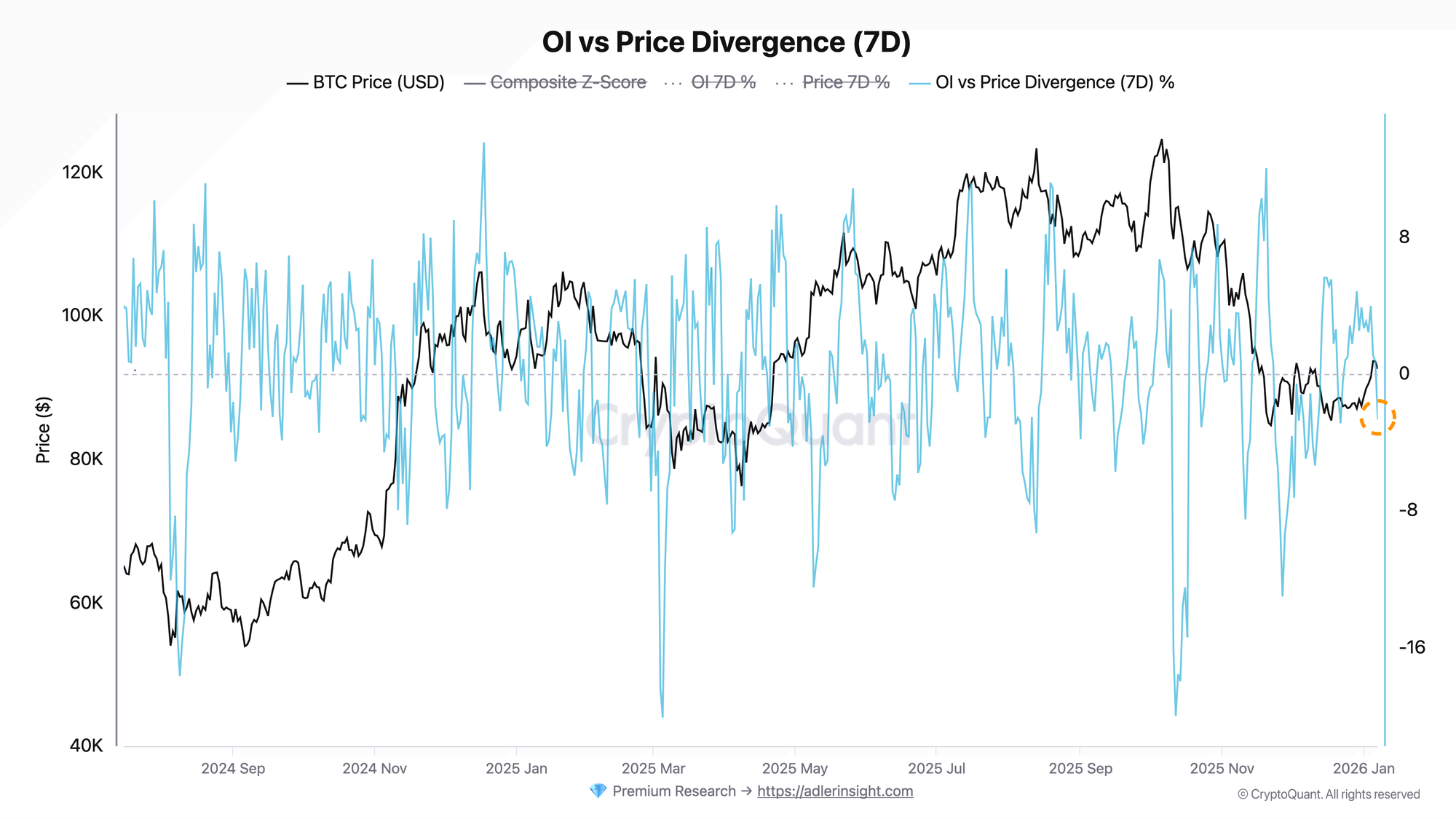

OI vs Price Divergence (7D)

Divergence is calculated as the difference between 7-day OI change and 7-day price change; positive values mean leverage is growing faster than price.

Current divergence is in negative territory - price has risen more than open interest over the past week. This contrasts with mid-December, when divergence was sharply positive against a backdrop of falling prices (short accumulation). Now the picture is mirrored: the market is rising, but derivatives are not rushing to build positions.

Negative divergence is a sign of a spot-driven rally, which is historically more sustainable. Risk will emerge if divergence reverses into positive territory without price support - this would signal excessive leverage.

Both charts are aligned: the composite index is in the moderate expansion zone, and the divergence pattern confirms that spot demand is the driver. The key focus today is monitoring Open Interest acceleration; if derivatives begin aggressively chasing price, this will increase the risk of a local correction.

FAQ

What does the current Expansion (Moderate) regime mean?

This is a market state in which both price and open interest are rising but not reaching extreme thresholds (above the 80th percentile). Moderate expansion is a normal trend phase without signs of euphoria.

When to expect a regime change?

A transition to Strong Expansion will occur upon breaking upper thresholds on both indicators. A transition to Distribution will occur if OI continues to rise while price reverses down. The key deterioration marker is positive divergence above +5% with stagnating price.

CONCLUSIONS

The Bitcoin market has emerged from December's deleveraging and transitioned into a moderate expansion phase. The positive composite Z-Score confirms the return of constructive sentiment, however negative divergence indicates that the current rally is led by the spot market rather than leverage. This is a structurally healthy dynamic that reduces the risk of cascading liquidations. The main trigger for continuation is price holding above current levels with gradual rather than explosive open interest growth. The main risk is a sharp reversal of divergence into positive territory without price support, which would indicate excessive accumulation of speculative positions.