Bitcoin under pressure from short-term holder loss-taking with volatility above 83%.

TL;DR

STH pressure continues with no signs of stabilization.

#Bitcoin #OnChain #Volatility #STH #MarketStructure

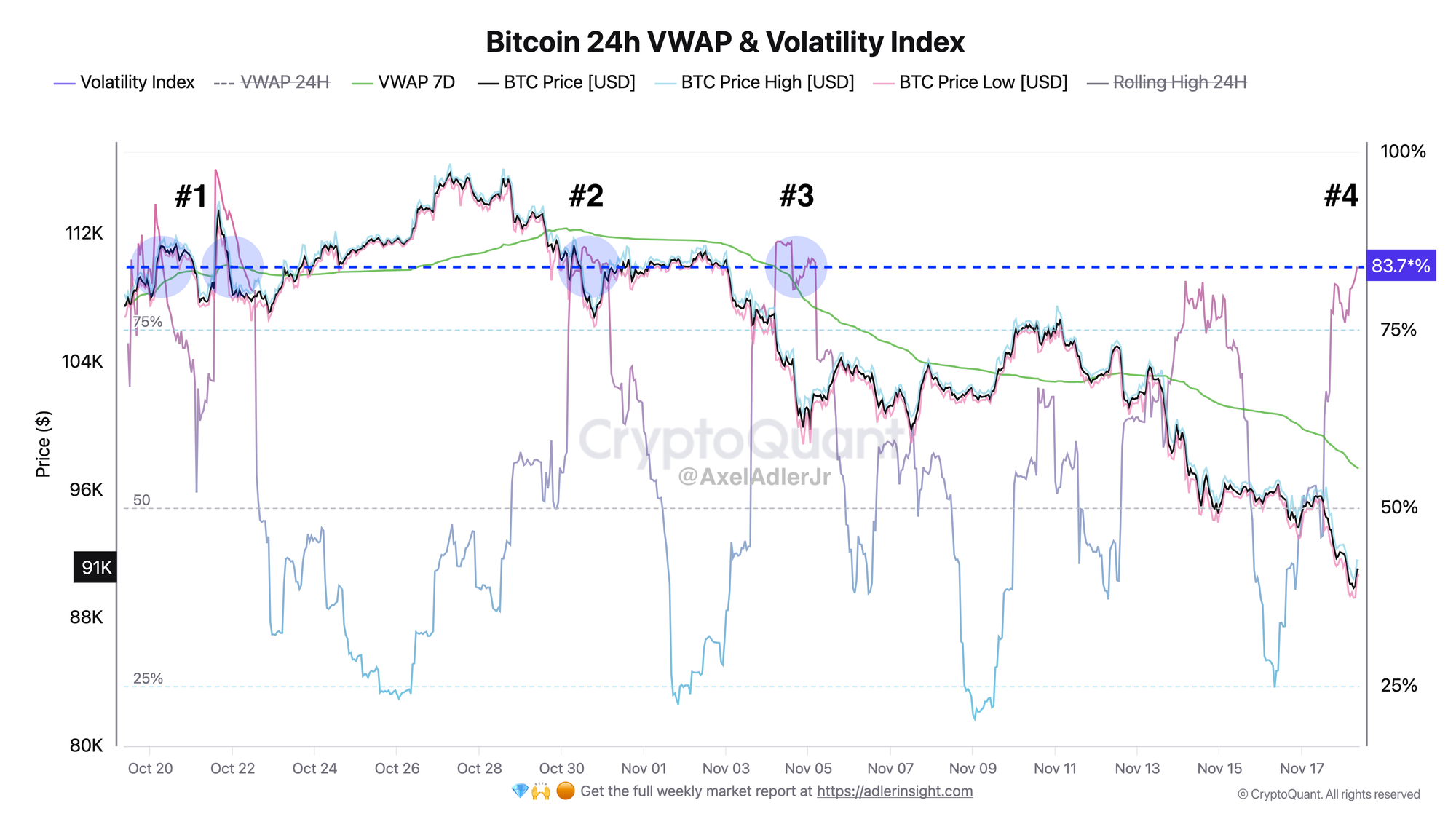

Bitcoin 24h VWAP & Volatility Index

Price is entering the fourth wave of elevated volatility over the past month.

The 7-day VWAP is declining, indicating weakening medium-term momentum.

The volatility index is at the upper boundary of its range, reflecting sharp and unstable price movement.

Bitcoin Short-Term Holder P&L to Exchanges

STH are realizing losses of –60.2K BTC over the past 24 hours. Price has pulled back from the $125K highs earlier this month to the current $89K. Loss-bearing coin flows to exchanges have reached an extreme level of -60.2K BTC/24h. The rise in volatility directly correlates with the scale of these losses. Price remains approximately $20K below the 24-hour VWAP, confirming that the majority of short-term buyers are underwater and actively capitulating.

FAQ

Why has volatility risen again?

Because the market is simultaneously experiencing rising loss flows from STH, pressure from a declining 7D VWAP, and bear pressure on futures - all of which amplify sharp movements.

Why are STH realizing losses so aggressively?

Price is significantly below the 7D VWAP, and most short-term buyers entered the market above current levels. Their positions are underwater, and as the market falls they are capitulating en masse, sending coins to exchanges.

CONCLUSIONS

Bitcoin is under pressure from short-term holder capitulation with loss flows of -60.2K BTC/24h and volatility at 83.7% - the market is in an active distribution phase.