Dollar consolidates near six-month peak, STH loss-taking pressure at extremes.

TL;DR

Strong dollar has intensified loss realization among Bitcoin short-term holders. While DXY holds above 100, pressure persists. However, rising probability of December Fed rate cut to 69% could become a catalyst for reversal if the market starts pricing it more aggressively.

#DXY #Macro #OnChain #STH

Dollar Index (DXY)

Dollar holds above psychological 100.0 level after rally from November 13. Consolidation occurs amid rising probability of December Fed rate cut to 69% (from 44% a week ago), though Fed officials remain divided: Williams allows for cuts, Collins hasn't decided yet.

While DXY stays above 100, risk appetite remains suppressed. Local pullback in the index could improve positioning for risk assets, but this hasn't happened yet - macro remains the dominant factor.

Bitcoin Short-Term Holder SOPR

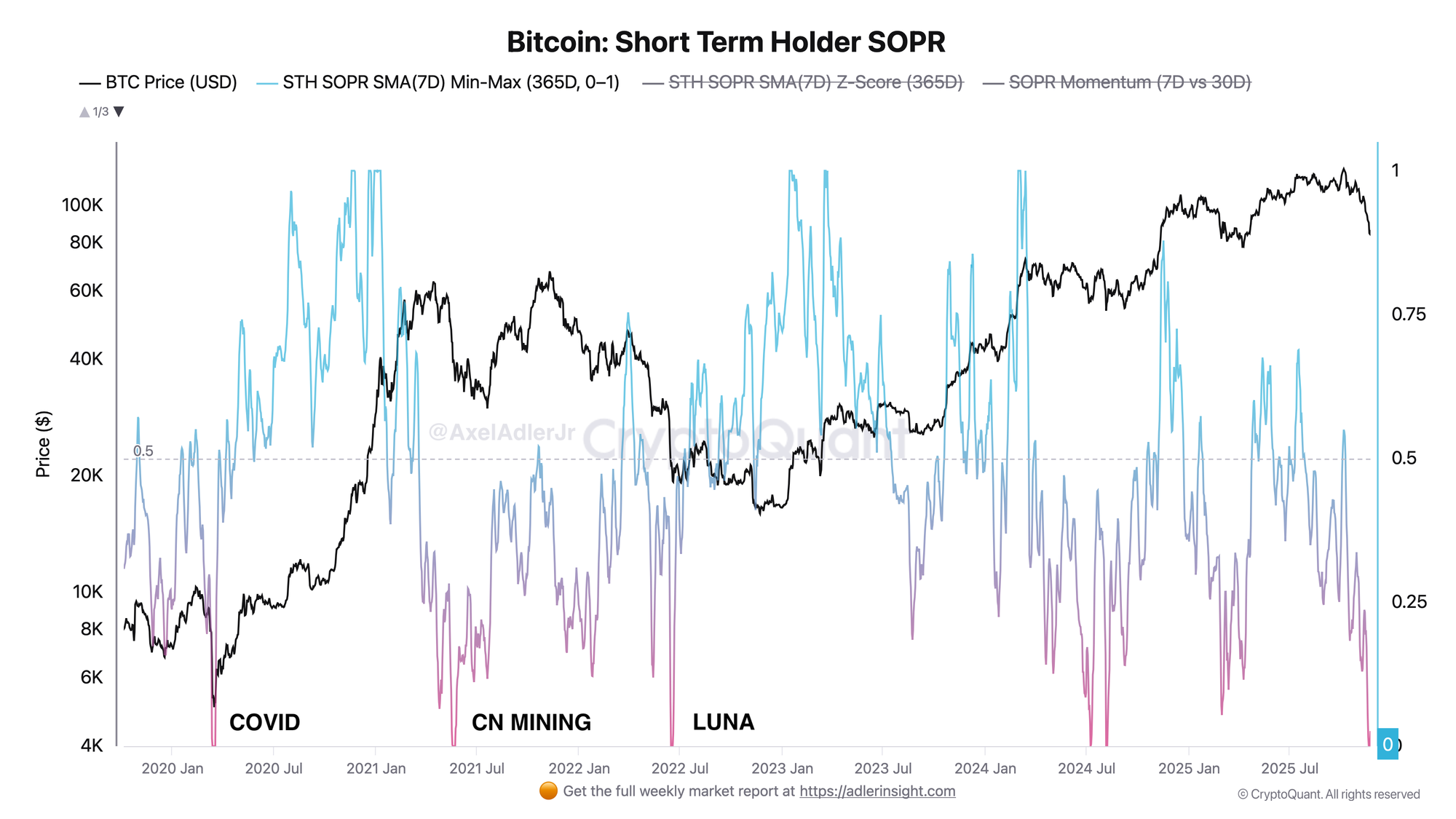

Short-term holders are realizing losses with intensity observed during COVID shock, China mining ban, and Luna collapse. SOPR Momentum dropped nearly to 0, which historically indicated capitulation zones and near-term reversal points.

Important: such extremes produced both V-shaped reversals and technical bounces within downtrends - further dynamics depend on macro backdrop. If market starts pricing December cut more actively, this could reverse DXY, removing some pressure from BTC. Until this happens - macro factor outweighs behavioral capitulation signals.

FAQ

What does the current DXY picture mean?

DXY strength pressures risk assets. Key reversal catalysts - weak US macro data or new Fed signals. While dollar remains strong, pressure will persist.

How to interpret STH SOPR signals?

SOPR Momentum near 0 reflects peak loss-taking - levels historically coinciding with local reversal zones, but in current phase macro vector will maintain pressure.

CONCLUSIONS

Current situation is a conflict between macro pressure and behavioral extreme. Strong dollar pushes short-term holders to capitulation at levels of major crises, forming potential accumulation zone around $80-85K, where liquidity clusters and ETF Cost Basis converge.