Short-term holders continue selling at a loss but the volume of unprofitable sales has decreased.

TL;DR

Short-term holders continue to realize losses (−4K BTC/24h), but without signs of panic capitulation. Futures index in bearish zone (29.2%), price $107.6K trading below Fair Value $111.2K. The market is experiencing prolonged consolidation, a breakout and hold above $111.2K with futures index improvement above 45 is critical for phase change.

#Bitcoin #OnChain #Derivatives

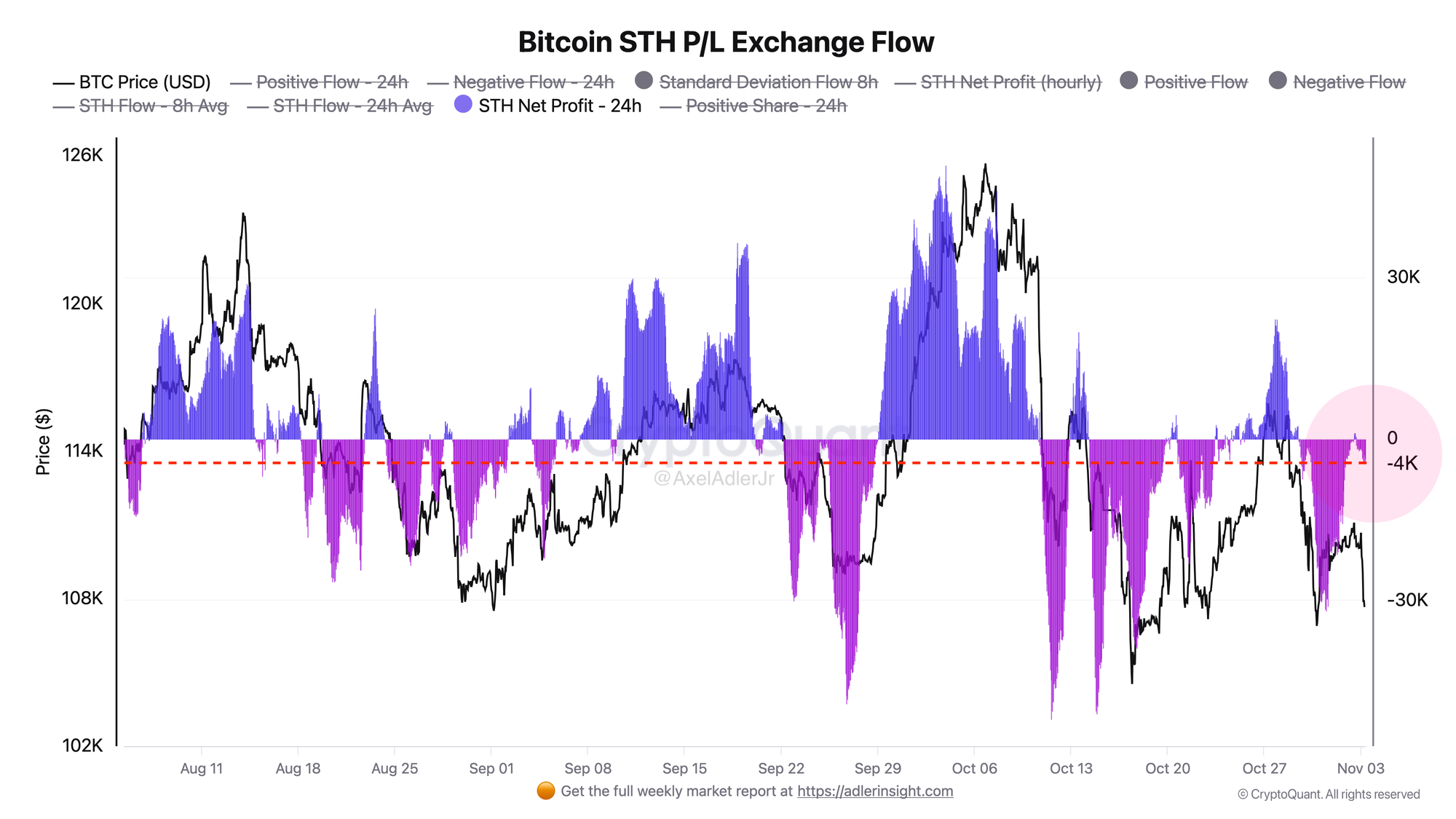

Bitcoin STH P/L Exchange Flow

STH flows over the last 24 hours are predominantly unprofitable (around −4K BTC), indicating price pressure without panic selling. Price is oscillating around $107K. The absence of extreme loss "tails" confirms a scenario of prolonged consolidation rather than final capitulation.

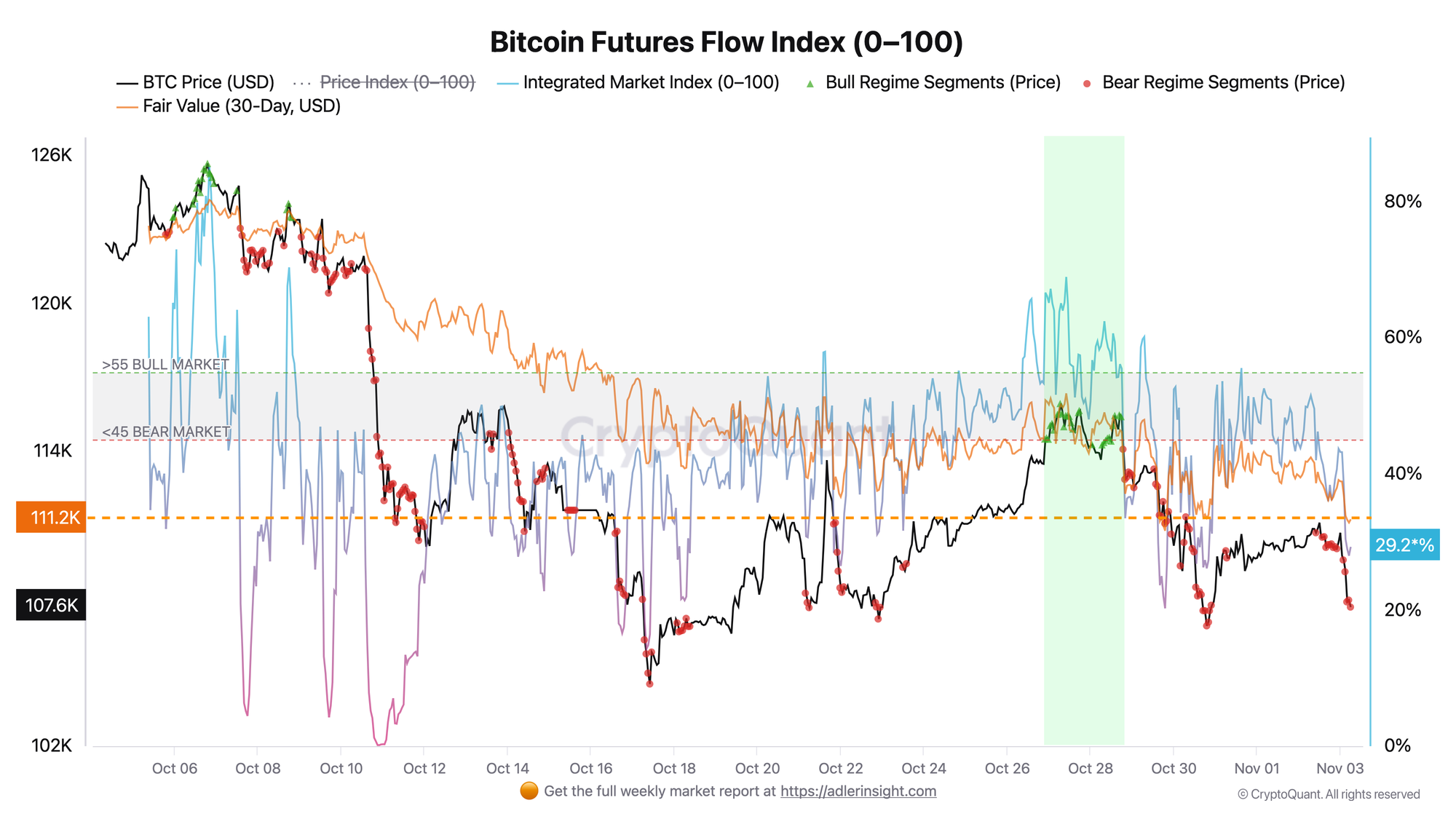

Bitcoin Futures Flow Index

Futures flow index dropped to 29.2% - bearish zone below 45. Price $107.6K trading below 30-day fair value $111.2K. For regime change, index needs to return to neutral-bullish range and break through fair value. Moderate loss flow from STH without clear signs of capitulation combines with weak futures momentum. While index remains below 45 and price below $111.2K, priority is consolidation, decisive move will be breakout above $111.2K.

FAQ

What does the current picture on the Bitcoin STH P/L Exchange Flow chart mean?

STH are on average selling coins at a loss, 24-hour sales volume equals −4K BTC, but without extremes - this is more about "momentum exhaustion" of local selling at this level rather than capitulation.

How to interpret the signals from the Bitcoin Futures Flow Index chart in today's context?

While the index is below 45 and price below $111.2K, the market remains in consolidation mode with bearish bias, a return above $111.2K together with index >45 signals a market phase change.

CONCLUSIONS

Base case scenario - flat/consolidation with bearish bias with key level at $111.2K. A breakout and hold of this level with index improvement will provide a window for growth.