The Fed cut rates and completed its quantitative tightening program, against this backdrop Bitcoin declined to local support levels.

TL;DR

The Fed announced a rate cut and the end of QT, however Powell's tone was less dovish than the market expected. He made it clear that the regulator will act based on circumstances, not according to a predetermined trajectory. Against this backdrop, Bitcoin pulled back to key support zones, reflecting traders' nervousness ahead of the December meeting.

#Bitcoin #FOMC #BTC #Macro

Fed decision in December

The Federal Reserve decided to lower the base interest rate by 25 basis points, to a range of 3.75–4.00%, and to end the quantitative tightening program on December 1st. Speaking after the meeting, Fed Chairman Jerome Powell noted that further rate cuts at the December meeting are not guaranteed and will depend on incoming data on inflation and the labor market.

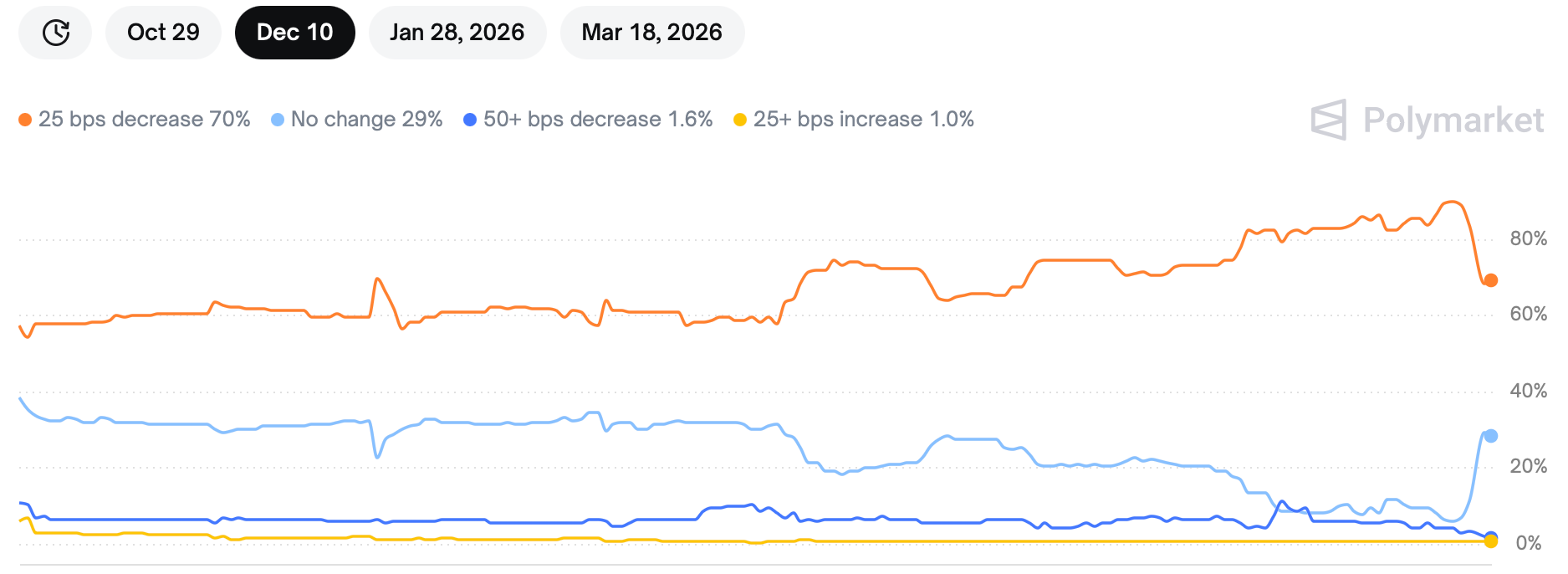

Following his comments, market participants' confidence declined: the probability of another rate cut in December, according to the Polymarket platform, decreased from 90% to 70%. Financial markets reacted moderately - stock indices closed without significant changes, while the price of Bitcoin and Ethereum declined. Overall, the Fed's policy remains accommodative, but without clear signs of further rate cuts. The regulator seeks to act cautiously to balance economic support and inflation control.

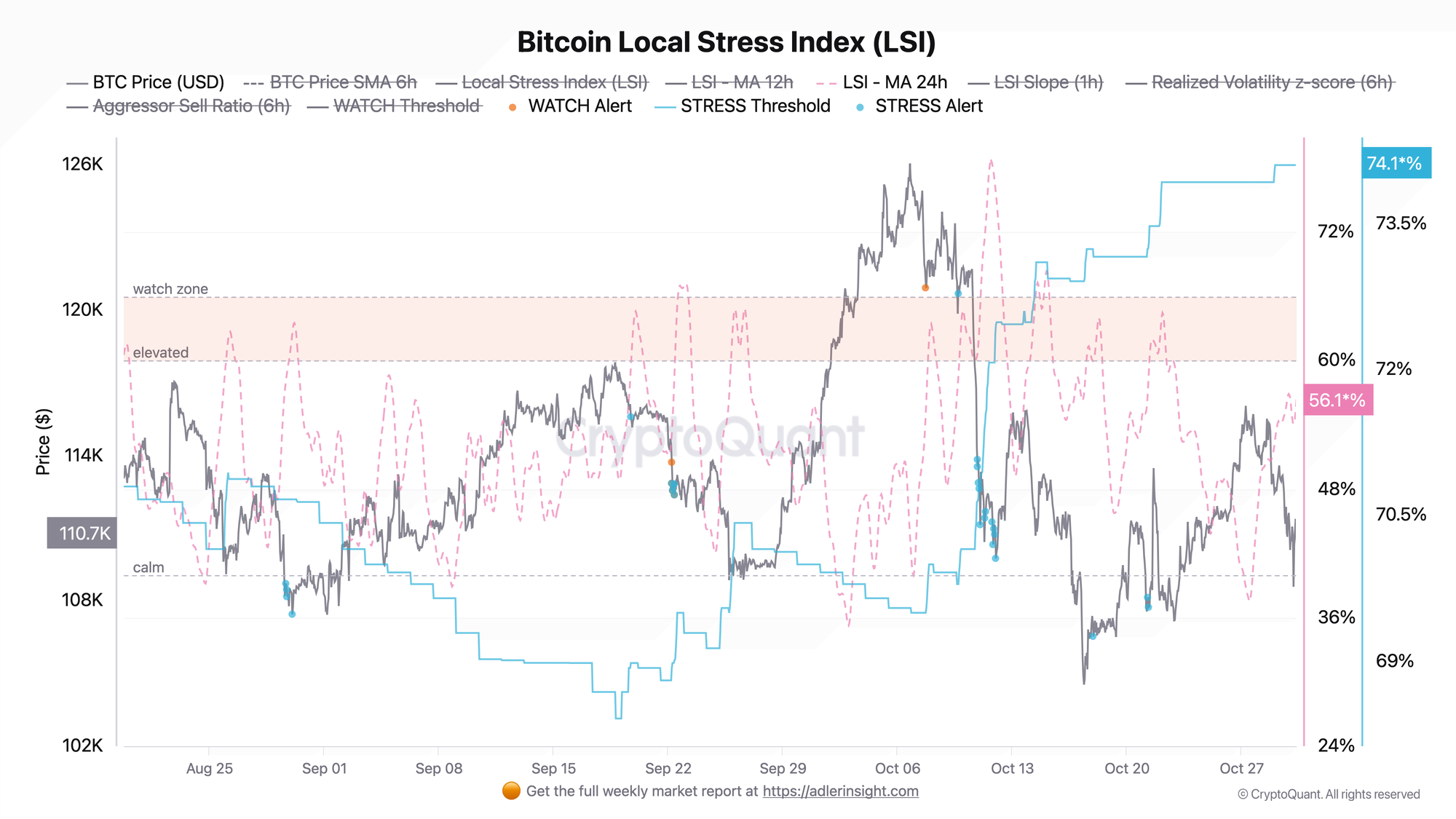

Bitcoin Local Stress Index

The dynamic stress signal threshold has risen to 74%, while the Local Stress Index itself remains at 56% - this is an elevated but not critical level. After the October spikes, the model automatically raised the levels at which alarm signals are generated, so now an increase in the index alone is not sufficient. For a new stress signal to appear, the model must simultaneously see price movement below the local trend, increased realized volatility, a predominance of aggressive selling, and acceleration of the index itself. These conditions are not yet present: the market looks tense, but a more pronounced deterioration in structure is required to move into the red zone.

FAQ

Why didn't the market react with growth to the Fed rate cut?

Although the rate cut can be considered an accommodative measure, Jerome Powell's comments shifted the emphasis to caution. He stressed that further decisions will depend on inflation and employment data, rather than on a predetermined course.

What does the current level of the Local Stress Index mean?

The LSI value of 56% shows moderate instability, but without signs of panic behavior among market participants.

CONCLUSIONS

The Fed continues to ease monetary policy, cutting rates by 25 bp and ending QT from December, but Powell's cautious rhetoric regarding the regulator's further steps had a restraining effect on markets. The probability of a December cut fell from 90% to 70%, which triggered a Bitcoin pullback to local support levels.