Fed minutes confirm the course toward rate cuts, while Long-Term Holders distribute 295K BTC

TL;DR

The minutes from the latest Fed meeting confirmed moderate monetary policy easing (25 bps reduction to 4.25%) amid labor market cooling, which traditionally supports risk assets, including Bitcoin. Simultaneously, Long-Term Holders distributed 295K BTC over 30 days - this is an elevated but not critical level, provided there is sustained demand from investors.

#FOMC #LTH #BTC

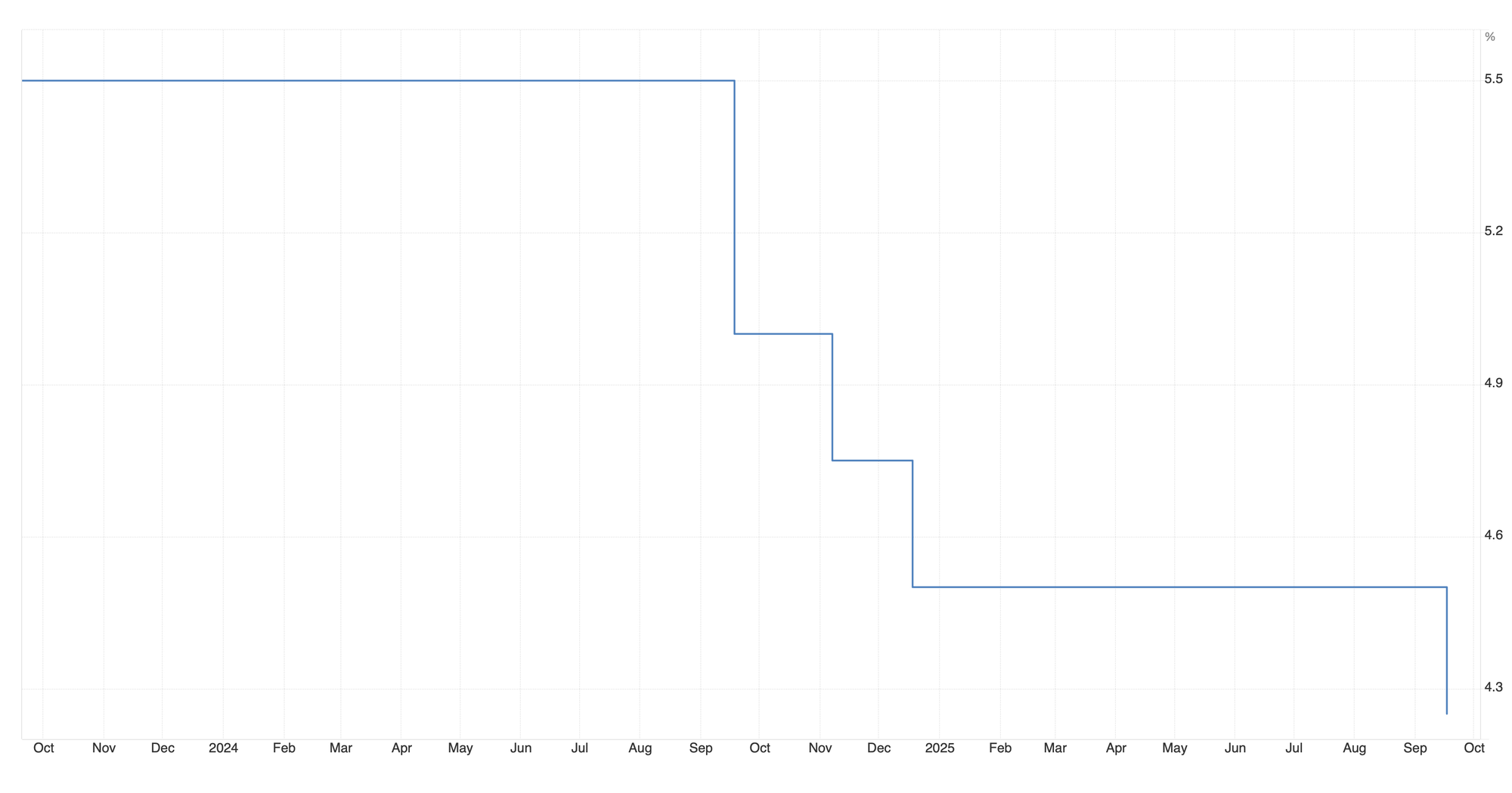

FOMC Minutes

Publication of the minutes from the latest Fed meeting showed that the majority of Committee members agree on the need for moderate policy easing, and the 25 bps rate cut is recognized as a justified step in response to signs of labor market cooling and slowing inflation. One participant advocated for a more aggressive 50 bps cut, while participants noted that inflationary risks remain, but their balance is gradually shifting toward economic downturn.

The minutes indicate that the main concern for Fed leadership is the employment level in the US, which Fed Chair Jerome Powell mentioned in his comments following the September meeting.

For risk assets, this confirms the scenario of a gradual transition from tight policy to a liquidity support phase.

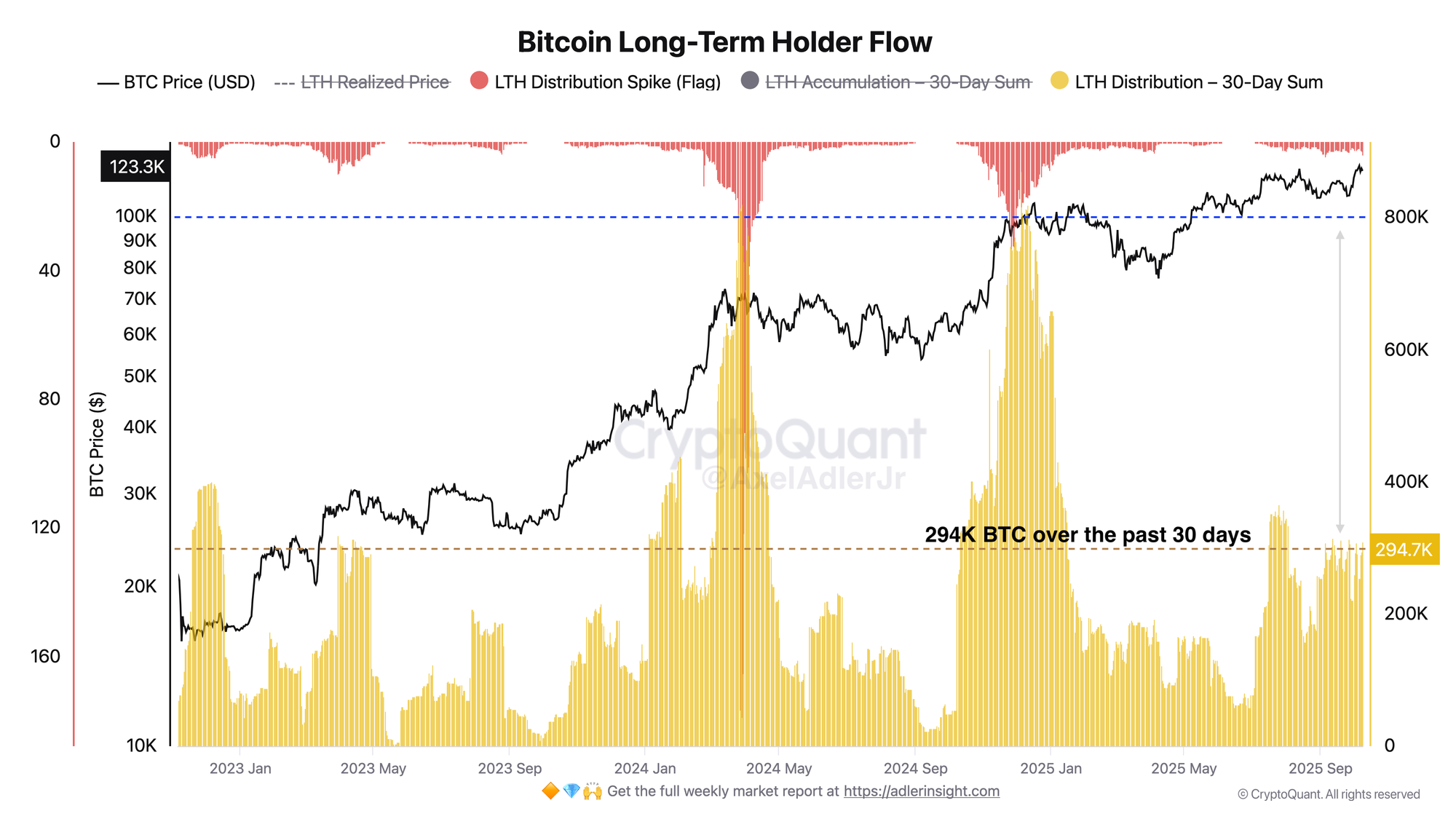

Bitcoin Long-Term Holder Flow

Over the last 30 days, LTH spent 295K BTC (9.8K BTC/day). This is an elevated but not extreme level relative to spring-fall 2024 peaks (800K). Such flow is compatible with bullish structure if absorbed by structural demand from new players. Correction risk increases noticeably when the 30-day sum accelerates >400-500K and holds for 2-3 weeks.

The LTH Distribution – 30-Day Sum indicator calculates the volume of coins spent by long-term holders (UTXO age >155 days) over 30 days. Currently this is 295K BTC, about 1.5% of circulation and approximately 22 times daily miner emission. By cycle standards, the level is elevated but far from extremes: LTH are taking profits without signs of aggressive pressure - this is rather healthy rotation.

FAQ

How does the Fed minutes publication affect Bitcoin?

The Fed's soft tone lowers the expected rate trajectory and real yields, improving liquidity conditions. This supports demand for risk assets (stocks, crypto, gold). In coming weeks, the effect strengthens if macro data confirms labor market cooling without an inflation spike.

What does the LTH Distribution 30-Day Sum metric measure?

The indicator sums the volume of coins spent by long-term holders over 30 days - essentially providing an estimate of LTH sales. Currently this is 295K BTC per month - this is elevated but not extreme, such a level is compatible with bullish structure if absorbed by demand from new players.

Conclusions

The Fed's soft policy pivot creates a favorable backdrop for Bitcoin, as rate cuts and expectations of further easing increase the attractiveness of risk assets. Meanwhile, the distribution of 295K BTC by long-term holders reflects natural profit-taking after the rally, not a mass market exit. As long as this volume is successfully absorbed by new demand, the market structure remains stable, allowing us to view the current phase as redistribution rather than the beginning of a new downward cycle.