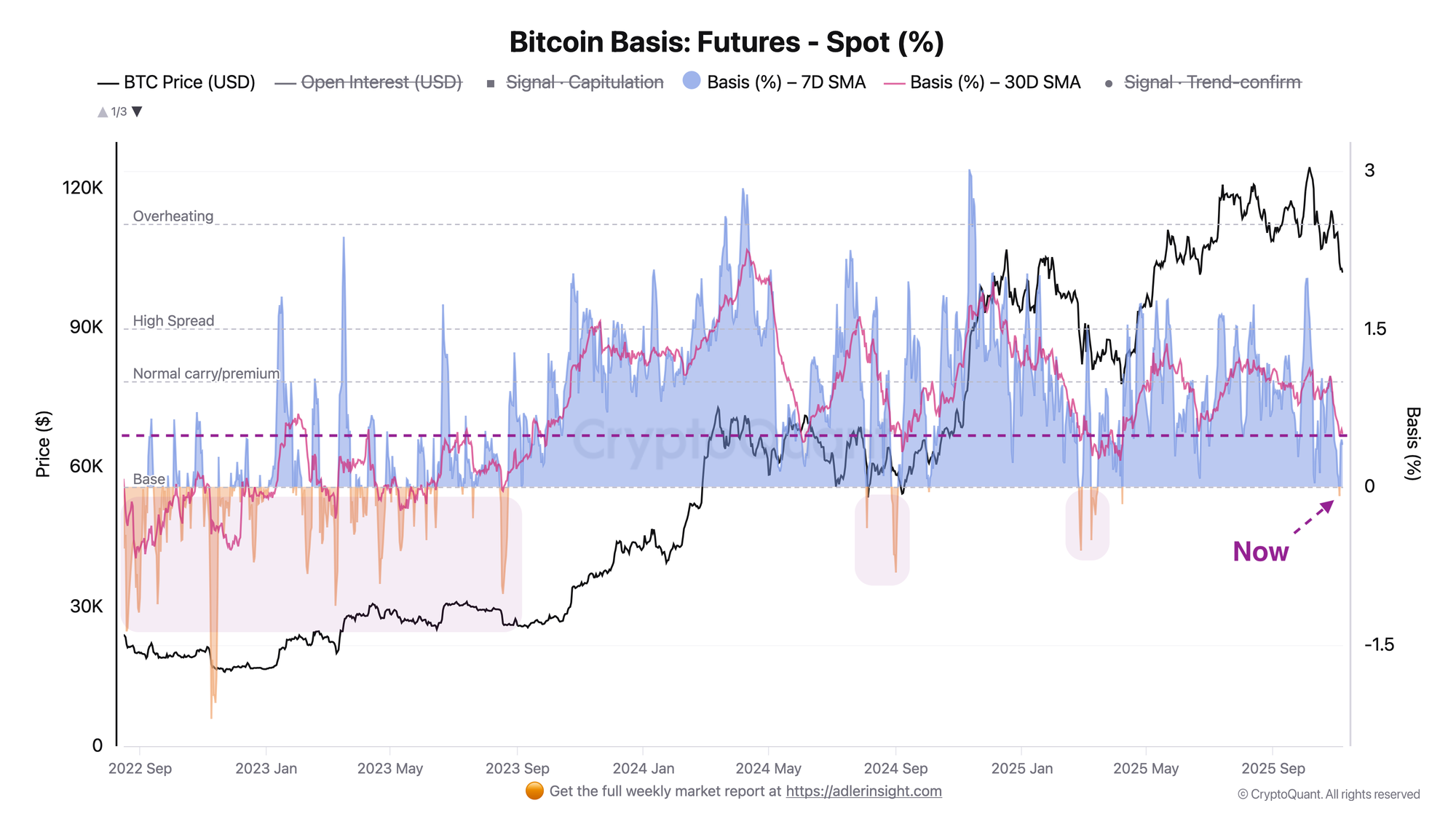

UST10Y shows local growth, Bitcoin basis has dropped to zero.

TL;DR

BTC basis compressed to zero (leverage deleveraging) - movement is happening on spot/ETF. UST10Y rise above 4.12% blocks impulsive rally.

#Bitcoin #Macro #Derivatives #Bonds

US 10 Year Treasury Yield

10-year UST yield reached local maximum 4.16% (November 5-6), after which correction began. Declining yields relieve pressure on risk assets and weaken the dollar, which traditionally favors crypto and growth stocks. In the current situation, a new impulse upward is visible, which weakens risk appetite.

Bitcoin Basis: Futures - Spot

esterday there was spread compression to zero, i.e. long leverage in futures was partially cleaned out, risk premium on perpetual contracts almost disappeared. Now the movement is supported more by spot-ETF than futures. While the basis is around zero - this is deleveraging, a worrying signal will be if 7D consolidates below 0% while maintaining price pressure.

For the market to return to risky investments, not one good piece of news is needed, but a sustained change in a series of signals across multiple directions. US Treasury yields must stabilize or decline, which will give the market confidence. Simultaneously, the VIX index must contract to 14-16, credit spreads must narrow, and gold must lose its upward momentum, meaning safe assets will no longer be the only obvious answer.

For cryptocurrencies, this means stopping BTC selling at support around $100K, return of net inflows to spot ETFs, and restoration of its role as a high-beta asset relative to global risk. When these components are fulfilled simultaneously for at least 1-2 sessions without new shocks, this will signal the emergence of sustained risk-on.

FAQ

What does BTC basis compression to zero mean?

Long leverage in futures has been cleaned out - current movement is happening on spot and through ETFs, not on speculative positions. Deleveraging reduces the risk of sharp liquidations. Concern - if the basis goes below 0% amid price decline (capitulation signal).

Why do high UST10Y yields block BTC growth?

Rising yields improve the attractiveness of cash/bonds and increase pressure on distant risk assets (growth, crypto). BTC has long duration risk - while UST10Y is above 4.10-4.12%, an impulsive rally is unlikely. Stabilization or rate decline is needed.

CONCLUSIONS

Base scenario: BTC consolidation in the $95K-105K range. For a reversal to growth, 3-4 factors are needed simultaneously (1-2 sessions): UST10Y below 4.08%, VIX to 14-16, net inflow to BTC-ETF, credit spread narrowing, gold loses momentum. Until this happens - the market will be inclined toward bear pressure.