Price has consolidated in the upper half of the range and hit resistance.

TL;DR

The market has shifted in favor of bulls: spot buyers are buying the dips, and the signal structure indicates bull priority. The main focus is testing the upper part of the channel, a breakout on lighter leverage gives a chance for acceleration at the expense of shorts.

#BTC #BULLISH #LIQUIDATIONS

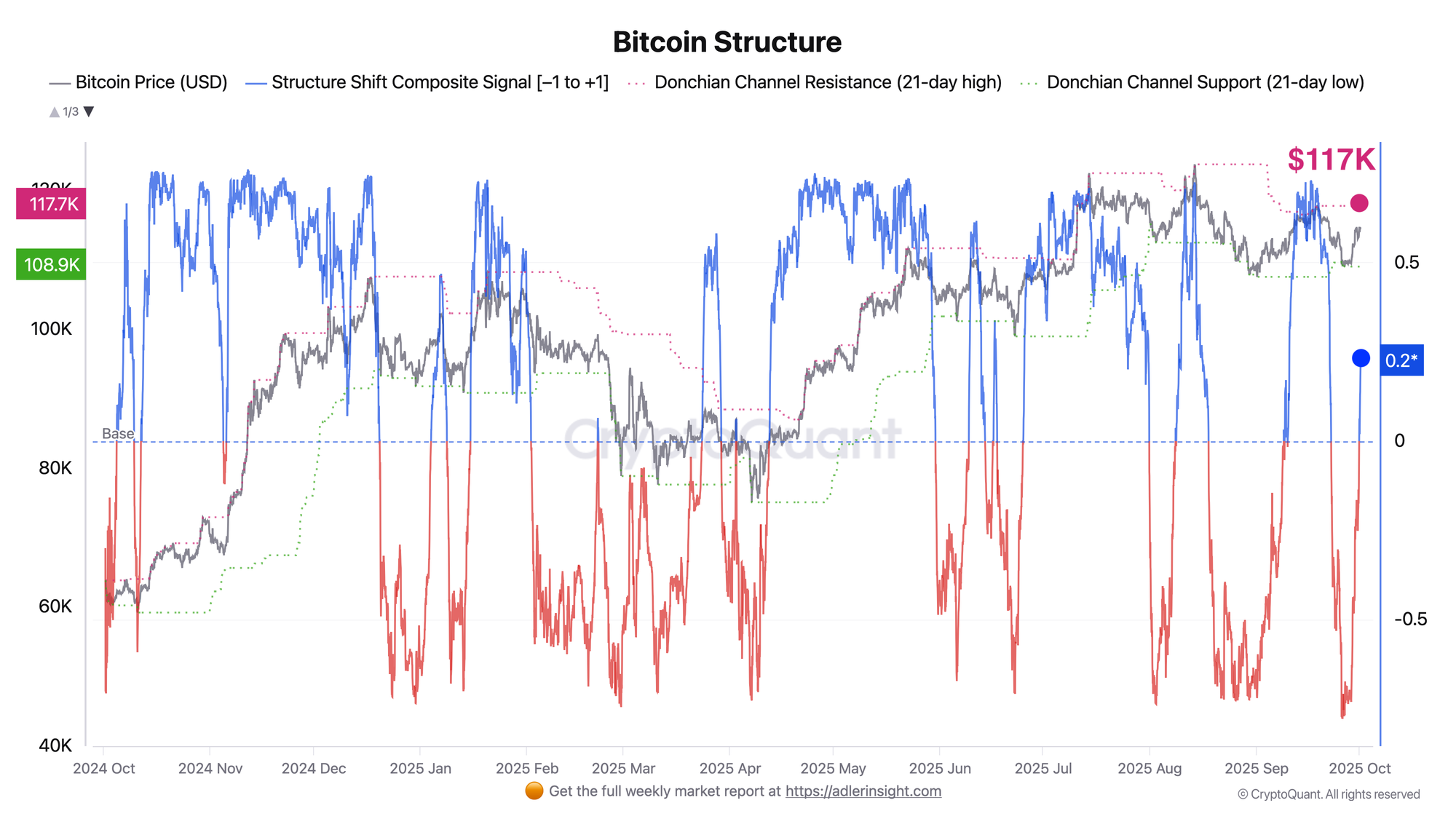

Bitcoin Structure

Sentiment has shifted to the bullish side: price has returned to the upper half of the short-term range, the composite Structure Shift has turned into positive territory, and momentum metrics have recovered - buyers are consistently buying dips. As of Oct 01, spot is trading at $116.2K, which consolidates bulls' control over the mid-level and shifts focus to attack mode within the range.

The key reference point now is the upper boundary of the 21-day channel at $117.7K (local resistance). A breakout and hold above will open the path to the $120K area.

Bitcoin Long Short Liquidations

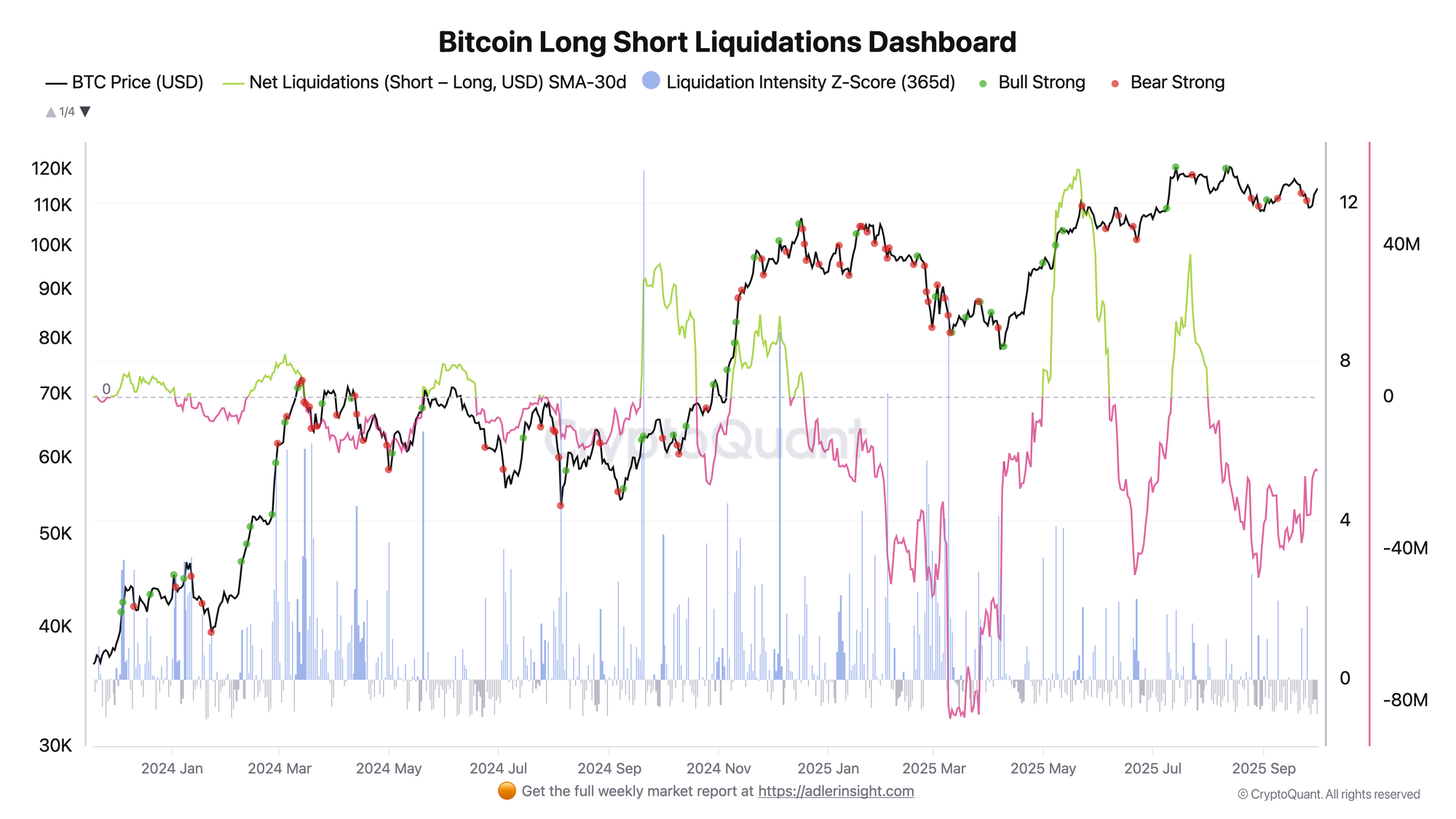

fter the structure shift to the bullish side, the futures market still looks bearish. Over the last 30 days, the liquidation balance remains in favor of long liquidations. Net Liquidations (Short–Long) = −$19.6M, but liquidation intensity has dropped to −0.87. This is a post-correction picture, excess leverage on the bull side has been removed without cascading stress, so the $116K price was able to return to the upper half of the range already on lighter leverage due to bear liquidity.

In such conditions, pain can shift to shorts if spot/ETF demand pushes price to $117–118K and above. With lighter longs, a resistance breakout will be accompanied by a wave of short squeeze, as soon as Net Liquidations turns to positive values and intensity spikes - this will confirm that the market is liquidating shorts, supporting momentum.

FAQ

How to understand that the bullish structure shift is confirmed? Confirmation is when the Structure Shift indicator remains in positive territory, and price consolidates in the upper half of the range and closes above the upper part of the Donchian Channel.

How do futures liquidations affect BTC movement?

A negative Net Long Short Liquidations balance means the market has cleaned out long positions and leverage is unloaded. If against this backdrop price breaks resistance and Net Liquidations reverses into positive territory with rising intensity, a short squeeze is likely, when shorts close at market and amplify upward momentum.

Conclusions

Market structure has shifted to a bullish phase, but the futures circuit hasn't turned bullish yet: the 30-day liquidation balance remains against longs with reduced intensity, indicating leverage discharge without stress.

The key trigger is breaking and holding $117.7K: consolidation above for 1-2 sessions will increase chances of testing $120K+ with Short Squeeze risk.