Demand for gold is growing, the dollar index is strengthening, and new participants are actively entering the market

TL;DR

The shutdown has put markets into defensive mode: gold updated its ATH, DXY rose to local highs. For BTC, since October, STH have added 81K BTC, 559K over the quarter, signaling fresh demand and absorption of LTH distribution.

#GOLD #DXY #STH

Gold

Gold updated its historical maximum, rising above $4,030 per ounce. Growth accelerated after the start of the US government shutdown, which increased the level of uncertainty in the economy and markets. In conditions where government statistical data is not being published and budget negotiations have reached a deadlock, investors intensified demand for safe-haven assets - primarily gold.

Dollar Index

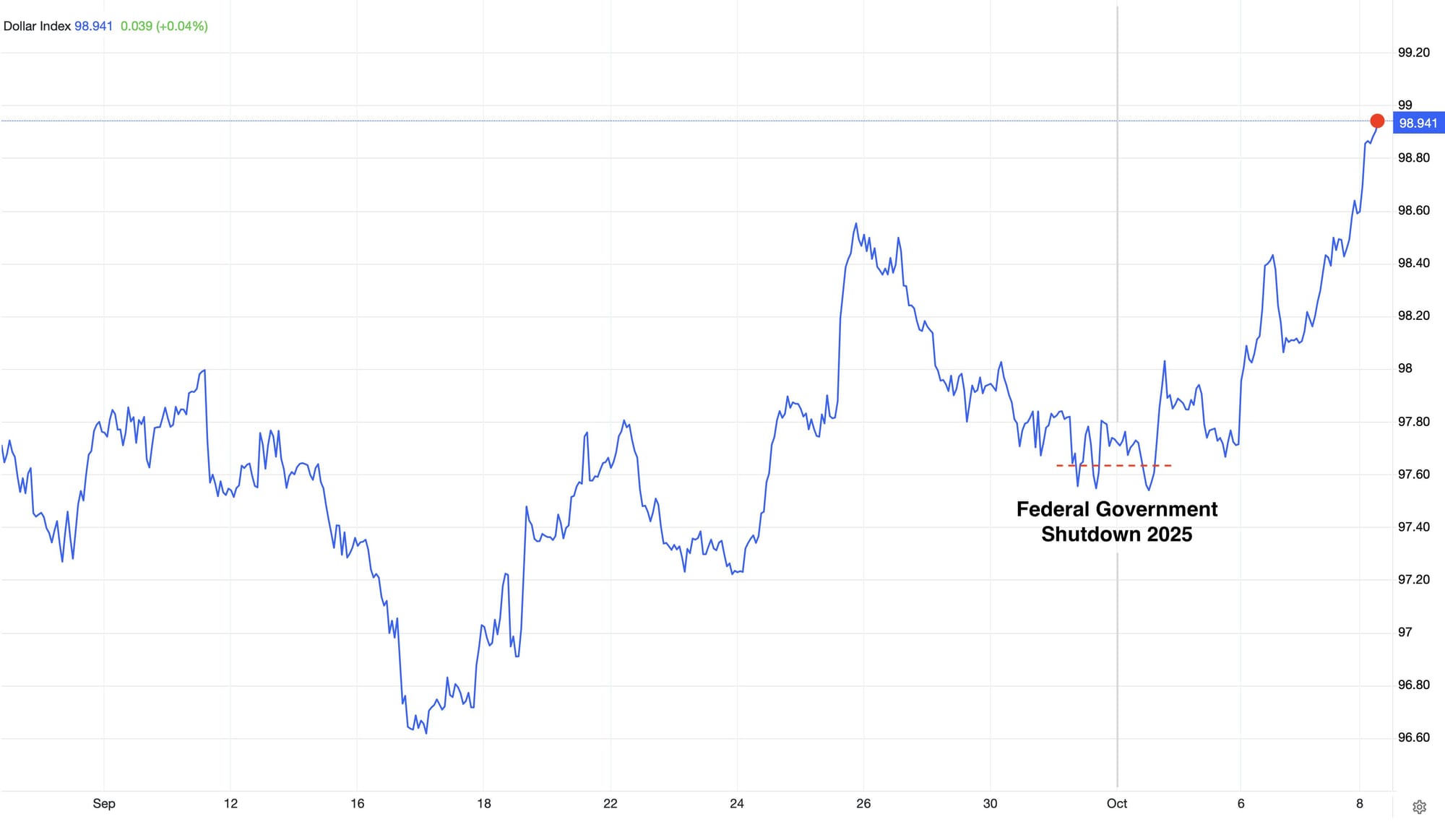

In parallel with gold, the dollar index is also rising. Usually their dynamics are opposite, but in crisis phases they can grow together. The reason: investors are selling assets and moving into liquidity.

In fact, this is not US economic growth, but growing demand for cash and safety. The dollar is perceived as a reliable haven and temporary capital storage place while the government funding situation remains unclear.

Bitcoin Short-Term Holders Supply

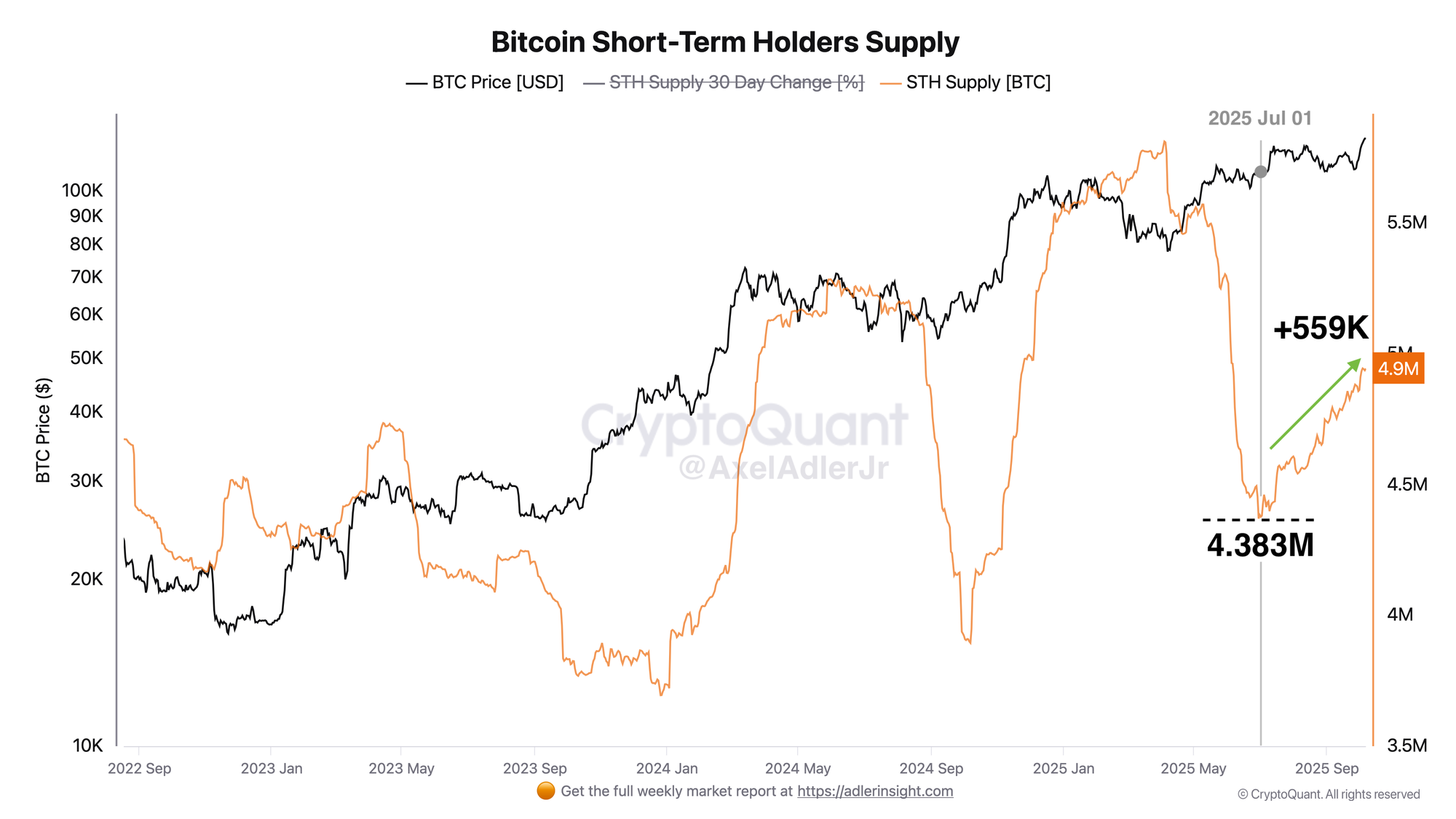

Since the beginning of October (amid the US government shutdown), short-term holder supply has grown by +81 thousand BTC, and over the last quarter by +559 thousand BTC, rising from 4.38 million to 4.9 million BTC (an increase of 13%). This indicates active inflow of new capital and coin rotation from long-term holders to short-term holders: fresh demand is actively absorbing sales from old holders, which supports the price near ATH.

FAQ

Why did gold update its ATH during the US shutdown while the DXY dollar index rose?

The prolonged shutdown increases uncertainty and activates risk-off mode: investors sell risk, seek "safe havens" and liquidity. During such periods, demand grows simultaneously for both gold (insurance assets) and the dollar (cash parking).

What does the DXY surge to 98-99 points amid the shutdown mean?

The DXY rise reflects short-term dollar liquidity deficit: cash is needed for a wait-and-see position.

How should we interpret the growth in Bitcoin short-term holder (STH) supply by +81 thousand since October?

This is a sign of new capital inflow and rotation: LTH sales at highs are absorbed by fresh demand, which supports the price near ATH.

Conclusions

The US government shutdown has put the market into "defense + liquidity" mode - gold updated its ATH, DXY at local highs, reflecting heightened uncertainty. Since October 1st, STH have bought 81 thousand bitcoins, fresh demand is absorbing LTH distribution and keeping the price at the peaks.