Bitcoin experienced a shock. The market structure index fell to −12%.

TL;DR

Gold soared to a record $4,140 amid renewed trade war between the US and China and rising expectations of Fed rate cuts. Bitcoin remains under bear pressure; if market stress persists and the structure index does not rise above zero by the end of the week, the Bitcoin market risks getting stuck in a range with downward bias.

#GOLD #BTC #Regime-Shift

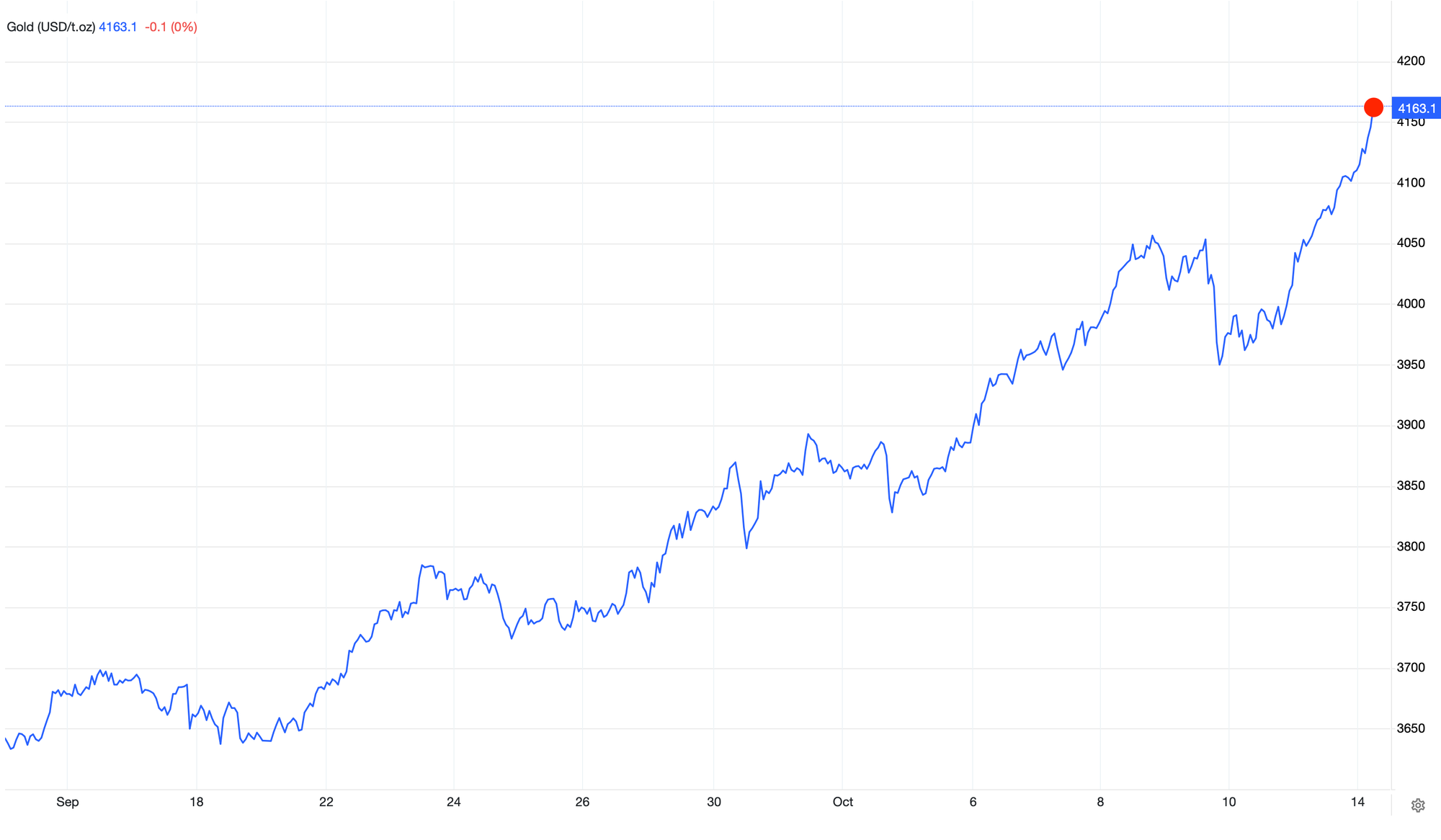

Gold

Gold updated its historical maximum at $4,140 per ounce, reflecting a shift toward safe-haven assets. Growth is occurring amid escalating trade risks between the US and China, as well as near-complete market confidence (97%) in a Fed rate cut at the October meeting. Geopolitical risks with US government shutdown tensions are pushing gold to new records; it has become the main beneficiary of risk-off mode, as investors seek ways to preserve capital amid mounting macro stress.

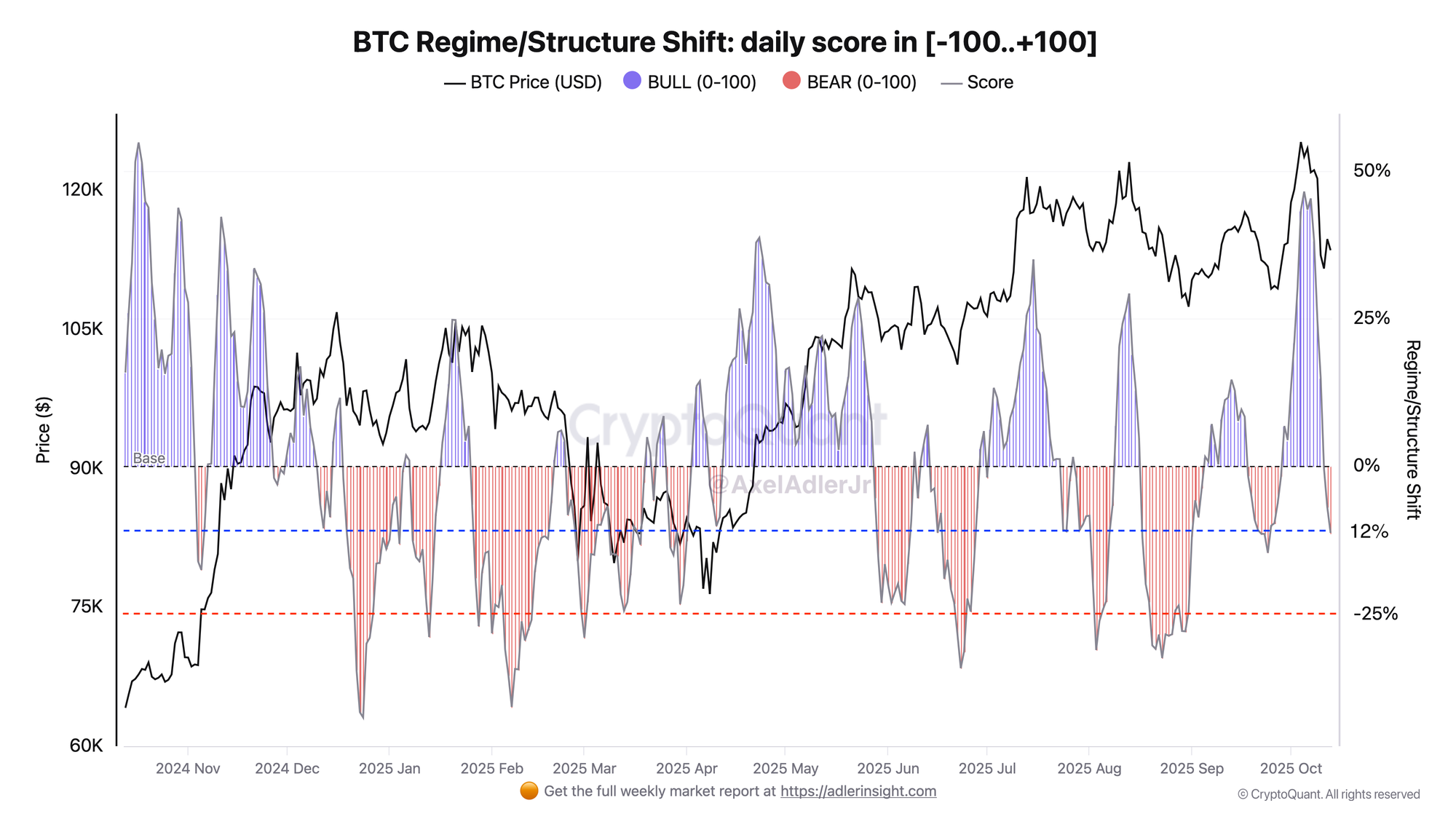

Bitcoin Regime/Structure Shift

Bitcoin's market structure index dropped to −12%, registering a transition to moderately bearish mode. The current value reflects futures market deleveraging after the recent crash - the market cleared excess leverage, however new buyers have not yet formed sustainable demand. Negative Structure Shift values indicate a shift of market energy toward sellers and weakening network momentum. At the same time, the depth of decline is limited, suggesting an absence of panic and a probable consolidation phase. For confirmation of structure recovery, a return > 0 within the next 3–5 days is needed. This will be the first signal of transition to recovery phase.

FAQ

Why is gold growing while bitcoin declining?

The market is reacting to intensifying geopolitical and trade tensions. Gold traditionally benefits from the transition to risk-off mode, whereas bitcoin loses part of capital inflow due to elevated volatility and liquidity reduction expectations.

What will be the trigger for BTC recovery?

Return of the Bitcoin Regime/Structure Shift metric above 0 and macro backdrop stabilization.

Conclusions

Friday's shock changed the regime to moderately bearish; the first cryptocurrency's market structure dropped to −12. Regime/Structure consolidation above 0 will confirm a chance for recovery. A repeated decline toward −20% will indicate continued bear dominance with repeated price decline risk.