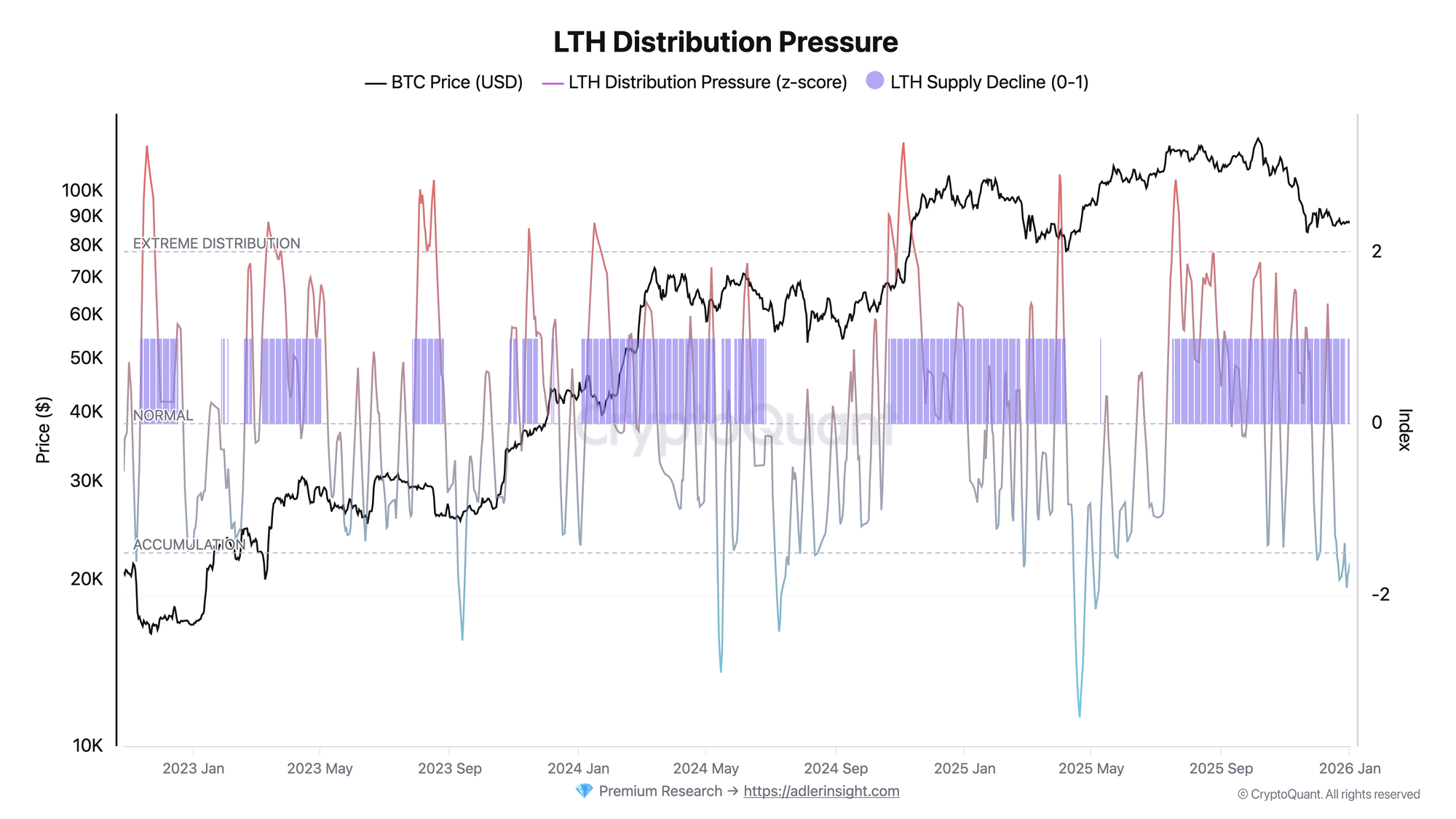

LTH Distribution Pressure Index has dropped into the ACCUMULATION zone, signaling minimal selling pressure from long-term holders. At the current price of around $87K, LTH activity remains subdued, which is historically characteristic of consolidation phases.

TL;DR

This brief analyzes long-term holder distribution pressure. The index is in the accumulation zone - LTH are in no hurry to take profits, which reduces selling pressure. Related reading: If you want to understand how exchange flows complement holder behavior, see Bitcoin Exchange Netflow: What It Is and How to Use It.

LTH Distribution Pressure Index (Z-Score)

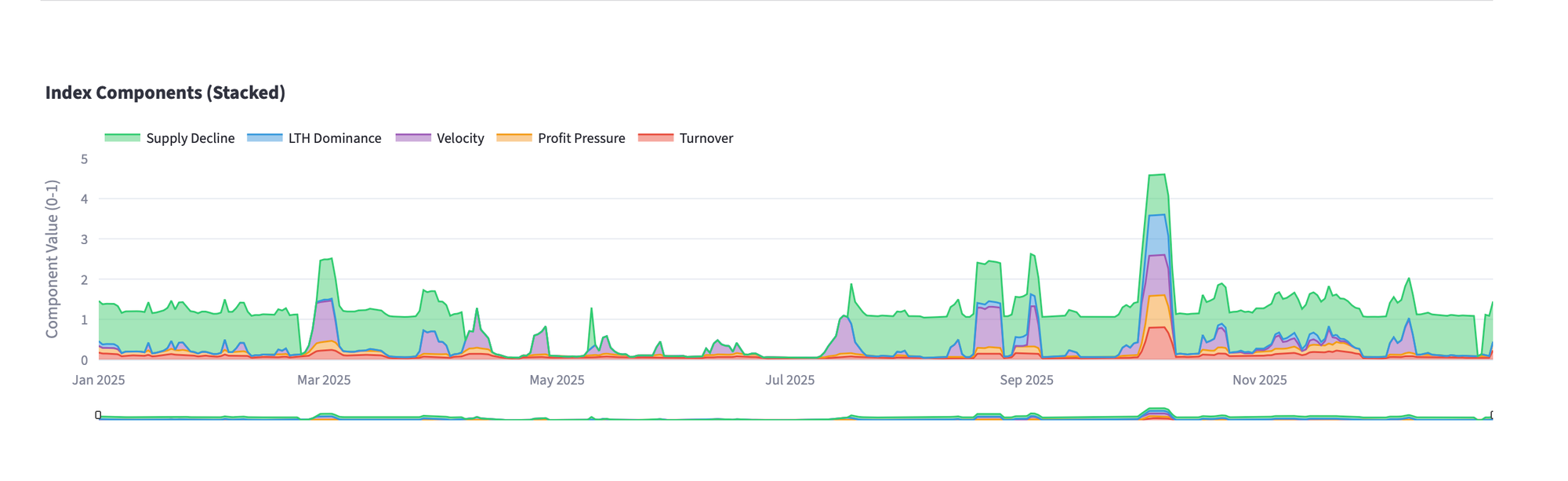

The index aggregates five components: LTH supply turnover, SOPR, spending change velocity, LTH/STH dominance, and supply dynamics. The Z-score normalizes the composite indicator relative to a 90-day window.

The current value of -1.628 is confidently below the -1.5 threshold, corresponding to the ACCUMULATION regime. After a sharp spike to ELEVATED on December 10-11 (z-score ~1.0-1.4), when velocity jumped above 100% WoW and LTH spent reached 408-457 BTC/day, the index quickly retreated - within approximately 9 days (by December 20) it was already in ACCUMULATION. Since then, the indicator has fluctuated in a low range from -1.5 to -1.9, periodically moving into LOW DISTRIBUTION and returning back. The current ACCUMULATION streak is 5 days (since December 28).

The 7-day average LTH spending is 221 BTC - one of the lowest levels in recent months. Meanwhile, SOPR remains above one (1.13), indicating sales at a profit, but their volume is too small to create significant pressure. This is the key characteristic of the current regime: LTH are sitting in profit but are in no rush to realize it. If you want to not just read the signal but reproduce it - with the same windows, smoothing, and regime thresholds - a full methodology breakdown and ready-to-use SQL code can be found at this link: SQL of the Week 002.

FAQ

What does the ACCUMULATION zone mean for short-term price action?

Low distribution pressure removes selling pressure from the most patient market participants. This doesn't guarantee immediate growth but reduces the probability of a deep correction caused by massive LTH selling. The market remains in the hands of short-term speculators and new buyers.

What trigger would move the index into distribution regime?

A transition to ELEVATED would require a sharp increase in velocity (above 20% WoW) combined with an increase in LTH spending volume. In December, such a transition occurred when LTH spent rose to 400+ BTC/day and velocity exceeded 100% WoW. Historically, such spikes occur after impulsive price movements.

CONCLUSIONS

The LTH Distribution Pressure Index is in the accumulation zone, fluctuating in the range of -1.5 to -1.9. Long-term holders are not participating in current price action - their selling volume is minimal (221 BTC/day), although SOPR > 1 confirms they are in profit. This is a positive structural factor: in the absence of pressure from LTH, new demand inflows will encounter limited supply. The main trigger for reassessment is LTH spent growth above 400 BTC/day with a simultaneous velocity spike, as occurred on December 10-11.