🎧 Morning Brief 0087 - audio debate on today’s market setup

The Bitcoin market is showing synchronized selling pressure across derivatives and spot. The taker order index has sharply dropped into negative territory after a positive January, while Coinbase Premium confirms weakness in US institutional demand.

TL;DR

Sellers have regained control on derivatives after several weeks of buyer dominance, while US spot is not providing counter-demand - both signals point to a risk-off regime.

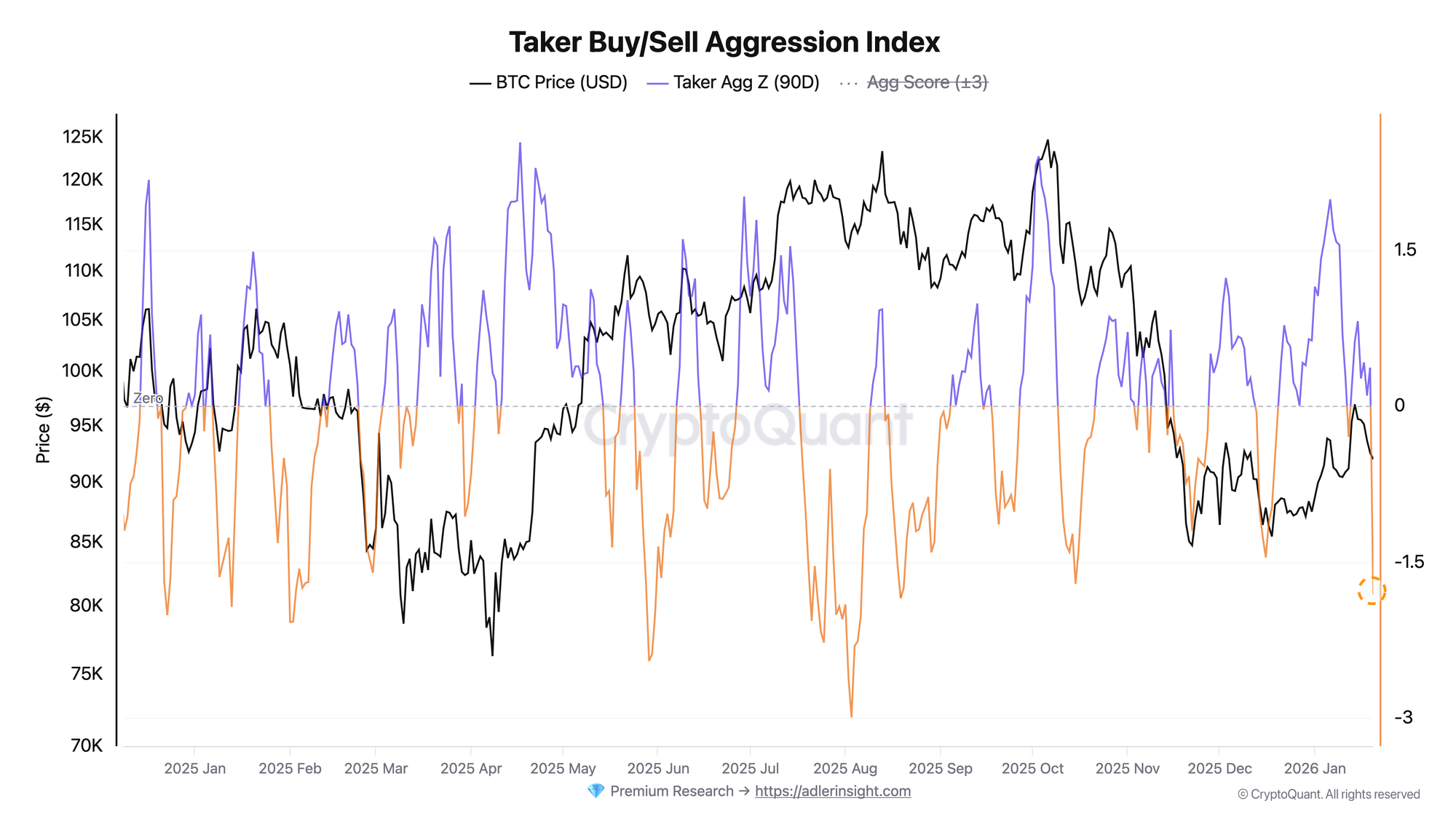

Taker Buy/Sell Aggression Index

The metric measures the balance of aggressive buys and sells on futures exchanges through a normalized Z-Score over a 90-day window.

Taker flow has sharply shifted toward sellers: Taker Imbalance = -0.0917, and Taker Aggression Z 90d = -1.81, corresponding to a sustained sell-dominant market regime. This is a notable deterioration from previous days when the signal was closer to neutral, and it coincided with an expansion of short-side skew: Short Ratio = 0.546 versus Long Ratio = 0.454. This configuration typically means sellers aren't just "holding positions" - they're actively executing market sells, amplifying price pressure.

As long as the Z-score remains in negative territory, bounces remain fragile and more often look like temporary relief rather than reversals. The first sign of improvement would be a return to neutral territory with a sustained reduction in the negative imbalance.

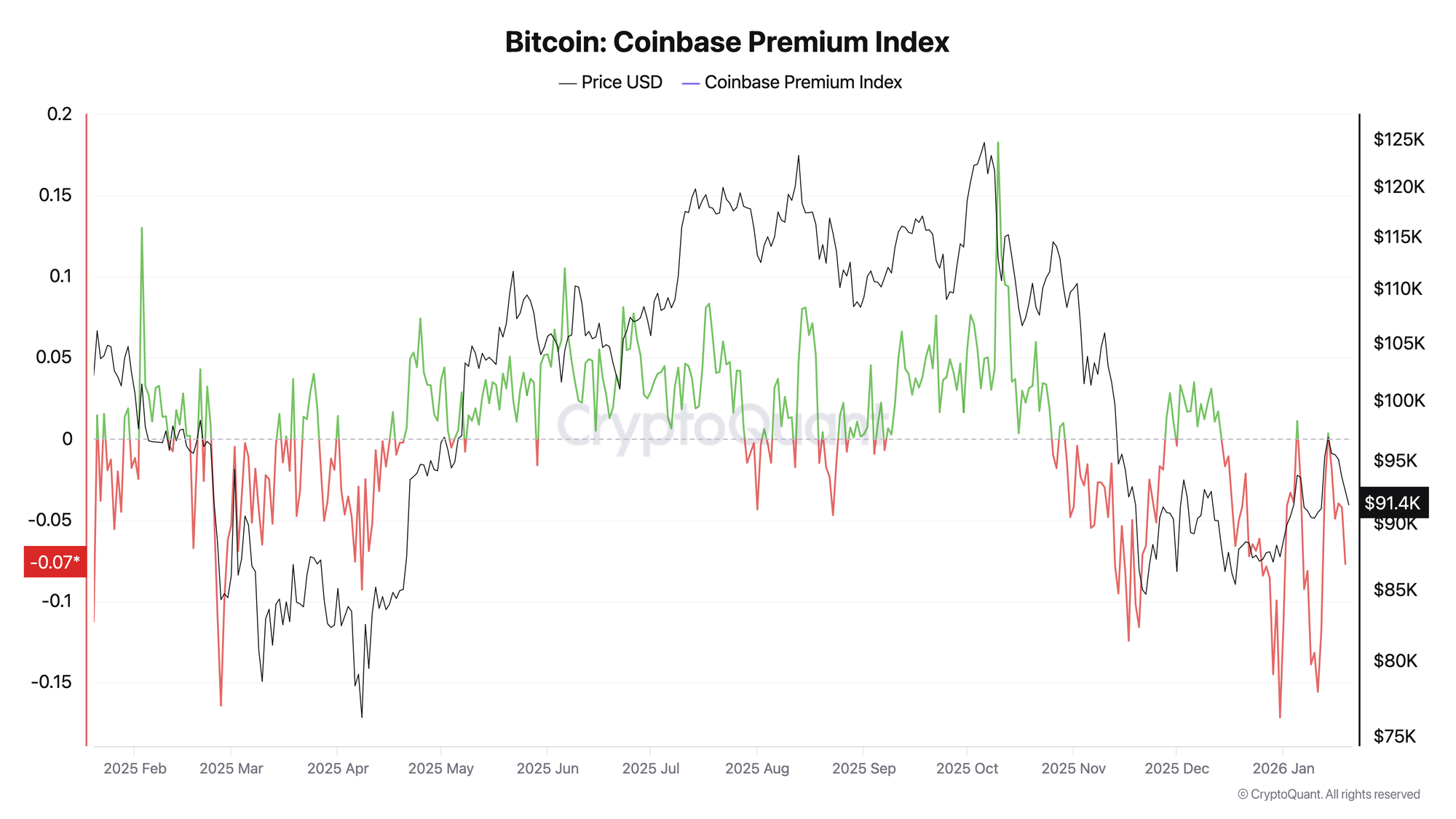

Bitcoin: Coinbase Premium Index

Coinbase Premium reflects the BTC price difference on Coinbase relative to Binance and is used as a proxy for US spot demand.

The premium remains negative, with the current value around -0.077, indicating a lack of willingness from US demand to pay above global market prices for the asset. Under such conditions, derivative impulses can produce sharp moves and short-lived bounces, but without spot support they rarely translate into sustained recovery. This isn't "panic" - it's precisely a deficit of buying pressure in the segment that typically confirms demand quality.

A signal for improvement will only appear when the premium stops being negative and begins to consistently confirm the return of spot demand from the US.

The combination of both charts reinforces the risk-off picture: derivatives are already showing an active seller, while spot via Coinbase provides no counter-confirmation. This reduces the probability of a sustained bounce and increases market sensitivity to any new downward impulse.

This brief is only part of the system.

Full access to the Biticon strategy and Deep Research is available in the 7-day trial.

FAQ

What does a negative Taker Aggression Z-Score mean for short-term dynamics?

A negative Z-Score indicates that sellers are willing to aggressively execute orders at market prices, taking liquidity from the order book. This creates price pressure, especially during periods of low spot support. However, extremely negative values below -2.5 have historically preceded local bottoms, as they indicate excessive pessimism.

How can you tell if the market is actually exiting risk-off mode?

Key reversal triggers: Taker Aggression Z-Score returning above zero with sustained holding for 3-5 days, and Coinbase Premium transitioning into positive territory above +0.02. Ideally - a synchronized reversal of both indicators, which would confirm the return of demand on both derivatives and spot.

CONCLUSIONS

The current regime remains risk-off: derivative flow has shifted into a sell-dominant state with Z-Score -1.81 and negative imbalance, while Coinbase Premium around -0.077 confirms US spot weakness. The main trigger for improvement is a sustained easing of taker-sells and a return of the premium to positive values - otherwise the market will remain vulnerable to continued pressure even without new liquidation cascades.