The Bitcoin market is in a correction phase with a 30% drawdown from the all-time high. Two on-chain indicators STH SOPR and P/L Block point to loss realization by participants and deteriorating market sentiment. Learn more about the STH SOPR indicator here.

TL;DR

Short-term holder capitulation, SOPR below one with negative P/L Score indicates local stress in the market.

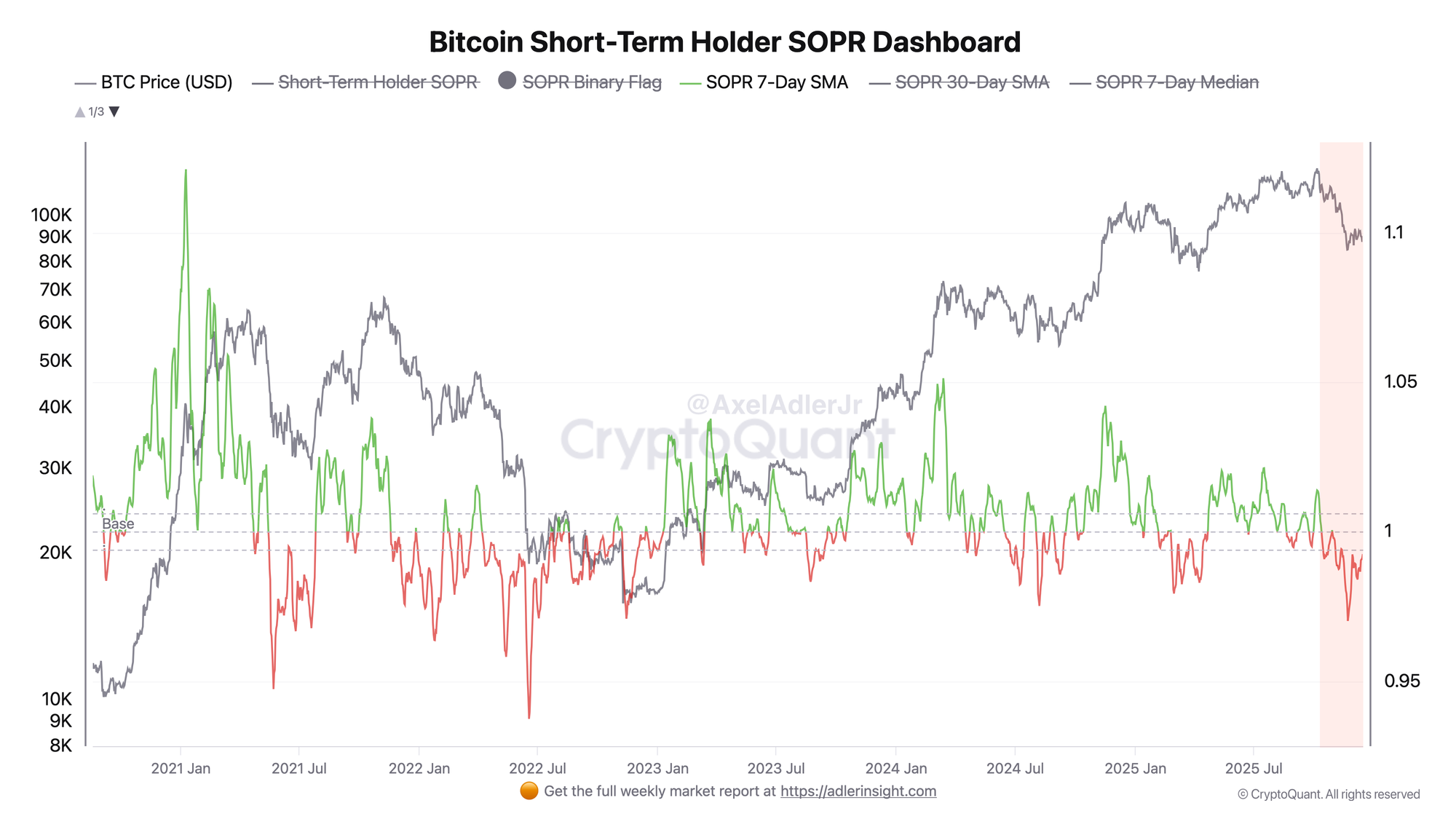

Bitcoin Short-Term Holder SOPR

The STH SOPR metric reflects the ratio of selling price to purchase price for coins held less than 155 days; a value below one indicates loss realization. The chart shows that the 7-day moving average SOPR has dropped below the threshold level of one and is in the red zone. The current value around 0.99 confirms that short-term holders are on average selling below their purchase price. Historically, such episodes corresponded to local capitulations - periods of maximum pressure from market participants.

As long as SOPR 7-Day SMA remains below one, the market is in stress mode for short-term participants. The key trigger for improvement will be the indicator's return above one with confirmation on daily close - this will signal that sellers are exhausted and demand is absorbing supply.

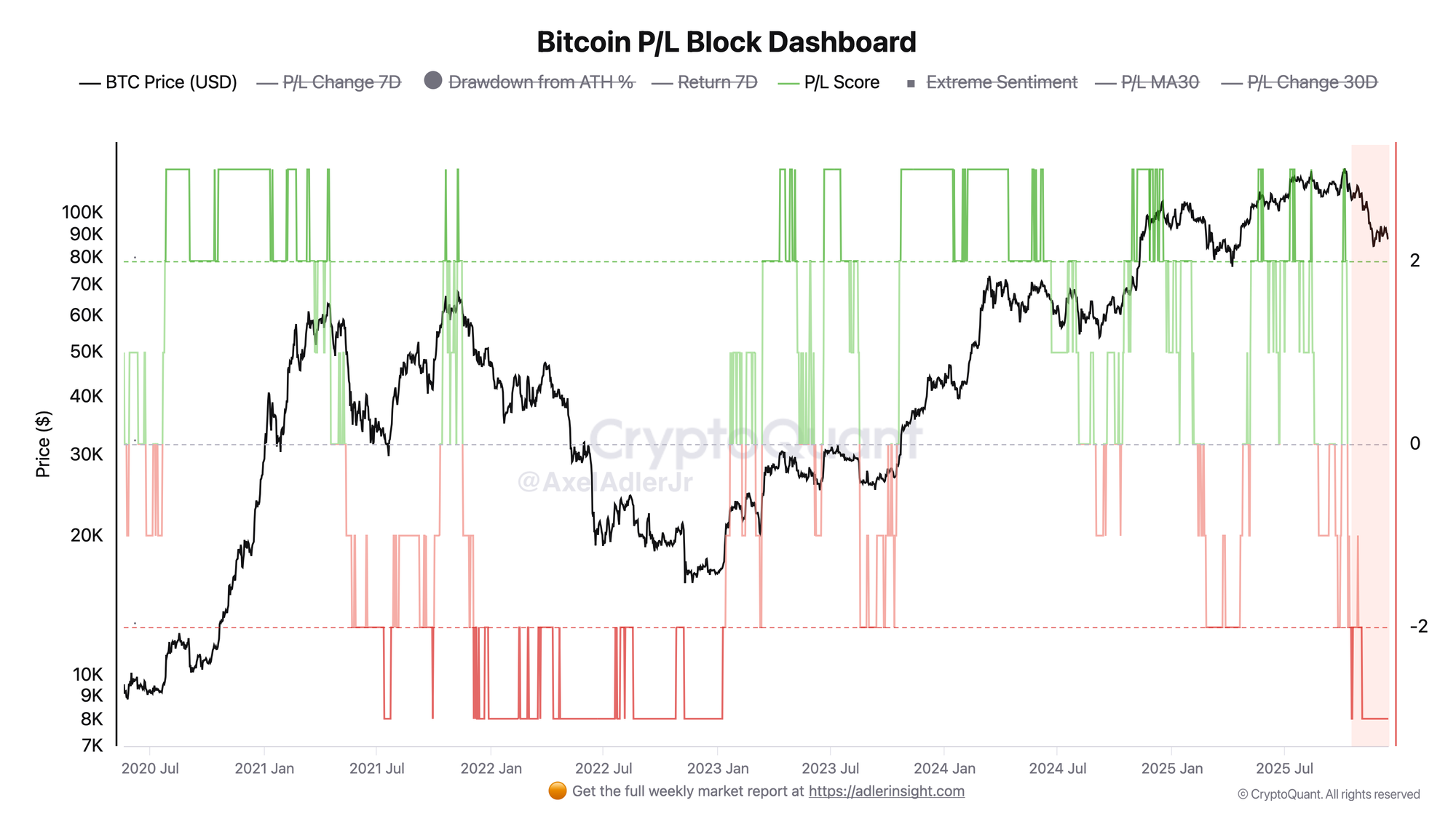

Bitcoin P/L Block

P/L Block visualizes the aggregated state of market participants' profits and losses through colored blocks: green - profit predominance, red - loss predominance. The current period is marked with a red block, corresponding to negative sentiment. The P/L Score value is at minus three, which is classified as pronounced stress. The drawdown from the all-time high is 30%, and 30-day returns are negative.

The negative P/L regime confirms pressure on the market from short-term players. The second chart reinforces the signal from the first - both SOPR and P/L Block synchronously point to capitulation.

FAQ

What is SOPR capitulation and why does it matter?

Capitulation is recorded when short-term holders massively sell coins below their purchase price, reflected in SOPR below one.

What trigger will indicate the end of the current stress phase?

The main trigger will be a sustained return of SOPR 7-Day SMA above one with simultaneous transition of P/L Block to the green zone. Until then, the market remains vulnerable to continued seller pressure.

CONCLUSIONS

Both on-chain indicators synchronously signal short-term holder capitulation: SOPR 7-Day SMA below one records sales at a loss, while P/L Block confirms negative sentiment at minus three. The current regime is risk-off with local stress characteristic of correction phases.

The main trigger for improvement SOPR returning above one with confirmation of a positive P/L block. The main risk - continued capitulation in the absence of demand capable of absorbing supply from short-term participants.