BTC price is below the average purchase price of short-term investors, putting them at a loss. Both charts show the same picture: when price approaches the STH breakeven point, the market will face a wave of sellers looking to exit at zero.

TL;DR

This brief covers resistance formation at the short-term holders' breakeven level. While STH remains underwater, selling pressure is limited, but approaching $99.5K will activate supply from investors looking to reduce positions without losses.

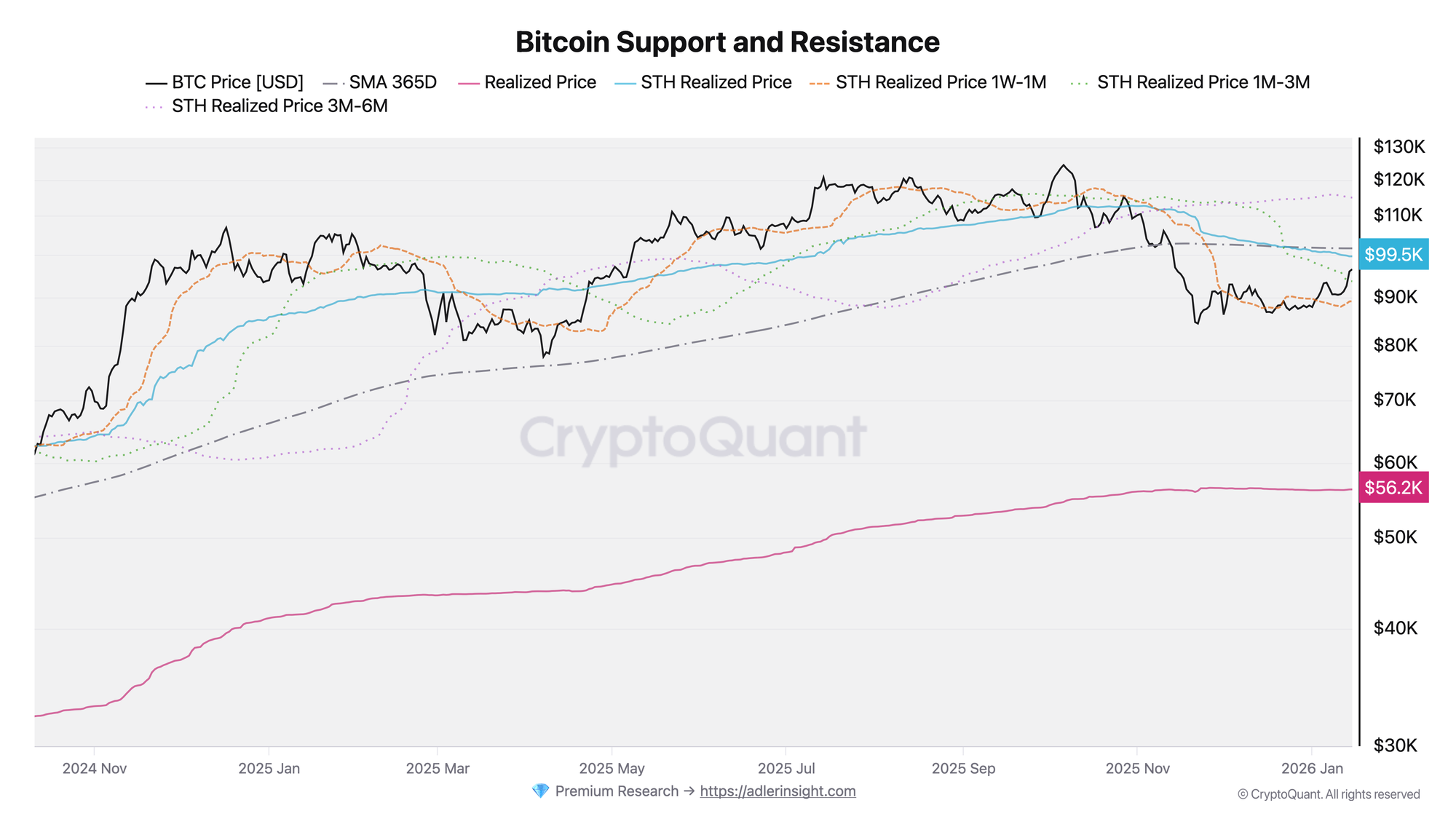

Bitcoin Support and Resistance

The metric displays realized prices of various short-term holder cohorts relative to BTC spot price. More on methodology and historical signals in the article Bitcoin Realized Price Bands Explained.

Current price around $96.4K is below STH Realized Price ($99.5K), indicating average unprofitability of short-term investor positions. At the same time, price remains above STH 1W-1M Realized Price ($89.1K) and STH 1M-3M ($93.6K), pointing to earlier buyer cohorts being in profit. Notably, STH 3M-6M Realized Price sits significantly higher at $114.9K, forming the next tier of resistance.

The $99.5K level represents the nearest resistance: as price approaches this mark, investors who bought in recent months will have the opportunity to exit at breakeven. Historically, such levels generate supply and slow down rallies. A sustained break above $99.5K would open the path to the next resistance around $101.5K (SMA 365D).

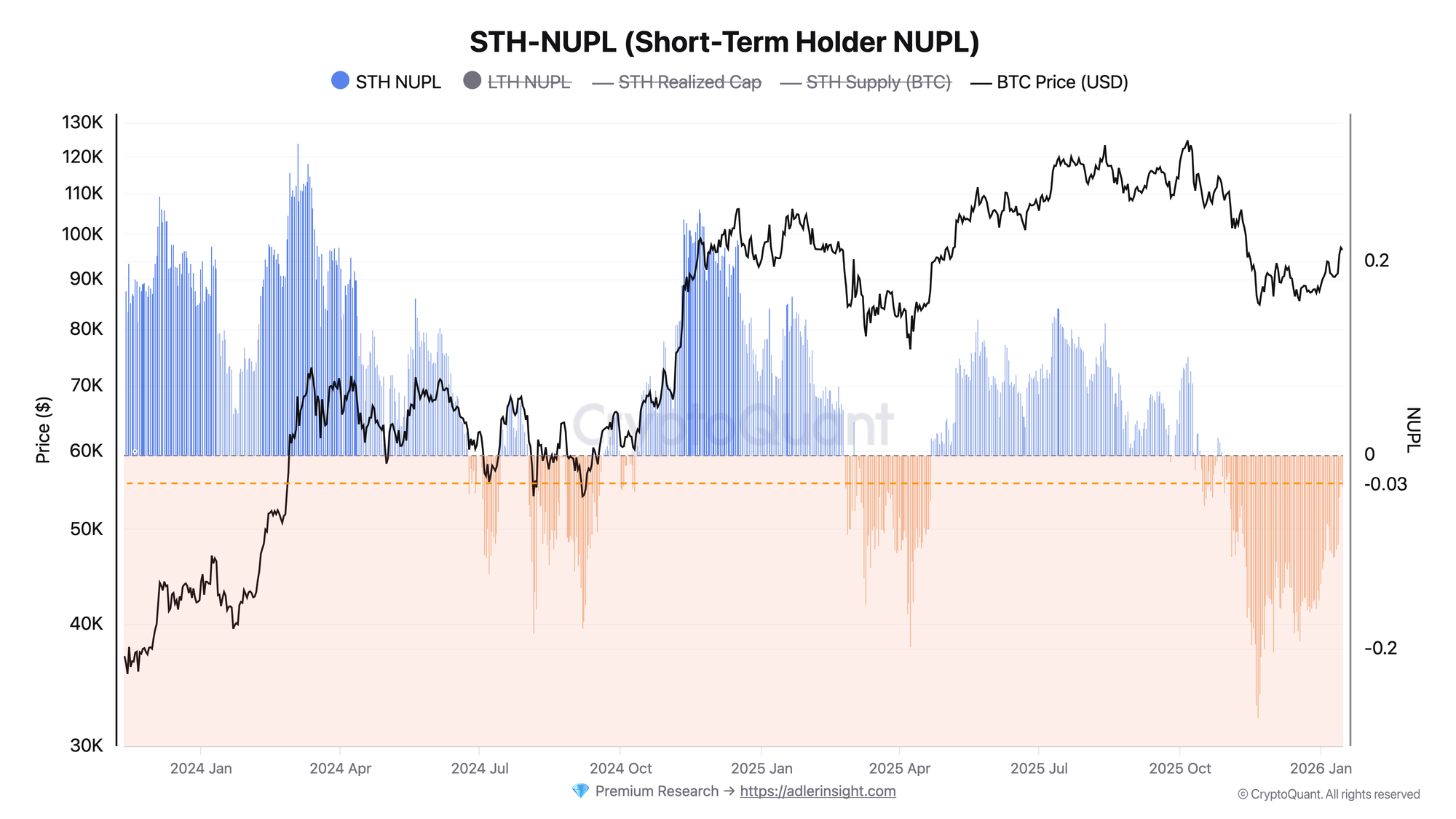

STH-NUPL (Short-Term Holder NUPL)

The metric measures the aggregate unrealized profit or loss of short-term holders as a percentage of their realized capitalization.

STH NUPL currently stands at -3.15%, confirming the cohort is in a slight loss. The value is close to the zero line, indicating a borderline state between loss and profit. The chart shows that similar crossings through zero have historically coincided with local reversal points or consolidation.

Negative NUPL means selling at a loss is psychologically difficult — this limits supply pressure. However, NUPL returning to zero and into positive territory will create conditions for profit-taking. The trigger for increased selling will be NUPL transitioning into the +5-10% zone, where investors will begin more actively reducing positions.

Both indicators synchronously point to one tension point: the $100K level simultaneously represents STH Realized Price (chart 1) and the NUPL zero-crossing point (chart 2). The convergence of these signals amplifies the significance of this resistance.

No time for deep analysis?

Adler Insight Light is a compact weekly Bitcoin dashboard.

Only what actually drives decisions.

Market Regime – current market regime and structural risk

(on-chain + derivatives, consolidated into a single index).

Cycle Phase – the current market cycle phase and its practical context.

One screen. Once a week.

For traders and investors who value clarity.

→ Adler Insight Light | User Guide

FAQ

Why does the STH breakeven level become resistance?

When investors move from loss to breakeven, the "exit at breakeven" behavioral pattern kicks in. After a period of paper losses, many prefer to close positions without a loss rather than risk another decline. This creates a concentration of sell orders in the zone of the cohort's average purchase price.

Under what conditions will the resistance be broken?

For a sustained break of $99.5K, either a strong inflow of new capital or gradual "flushing out" of weak hands through the time factor is needed. If price holds near this level for several consecutive days, some sellers will reconsider and resistance will weaken. A sharp breakout on above-average volume would confirm a local regime change.

CONCLUSIONS

Short-term Bitcoin holders are at an aggregate loss of approximately 3%, and their average purchase price ($99.5K) forms the nearest resistance level. Current regime is neutral with a cautious bias: selling pressure is currently limited by position unprofitability, but price approaching the breakeven point will activate supply. The main trigger for continued upside is a sustained break above $99.5K with STH NUPL transitioning into a stable positive zone. The main risk is rejection from this level with a deeper correction toward the next support around $93.6K (STH 1M-3M Realized Price).