Short-term holders are at a loss (see SOPR guide), price is trading significantly below their average cost basis, and STH Realized Price continues to decline, indicating weakness in incoming demand.

TL;DR

Market in stress mode: short-term holders are underwater and their cost basis is declining. This is pressure from above, but not capitulation - the buffer to critical levels remains sufficient.

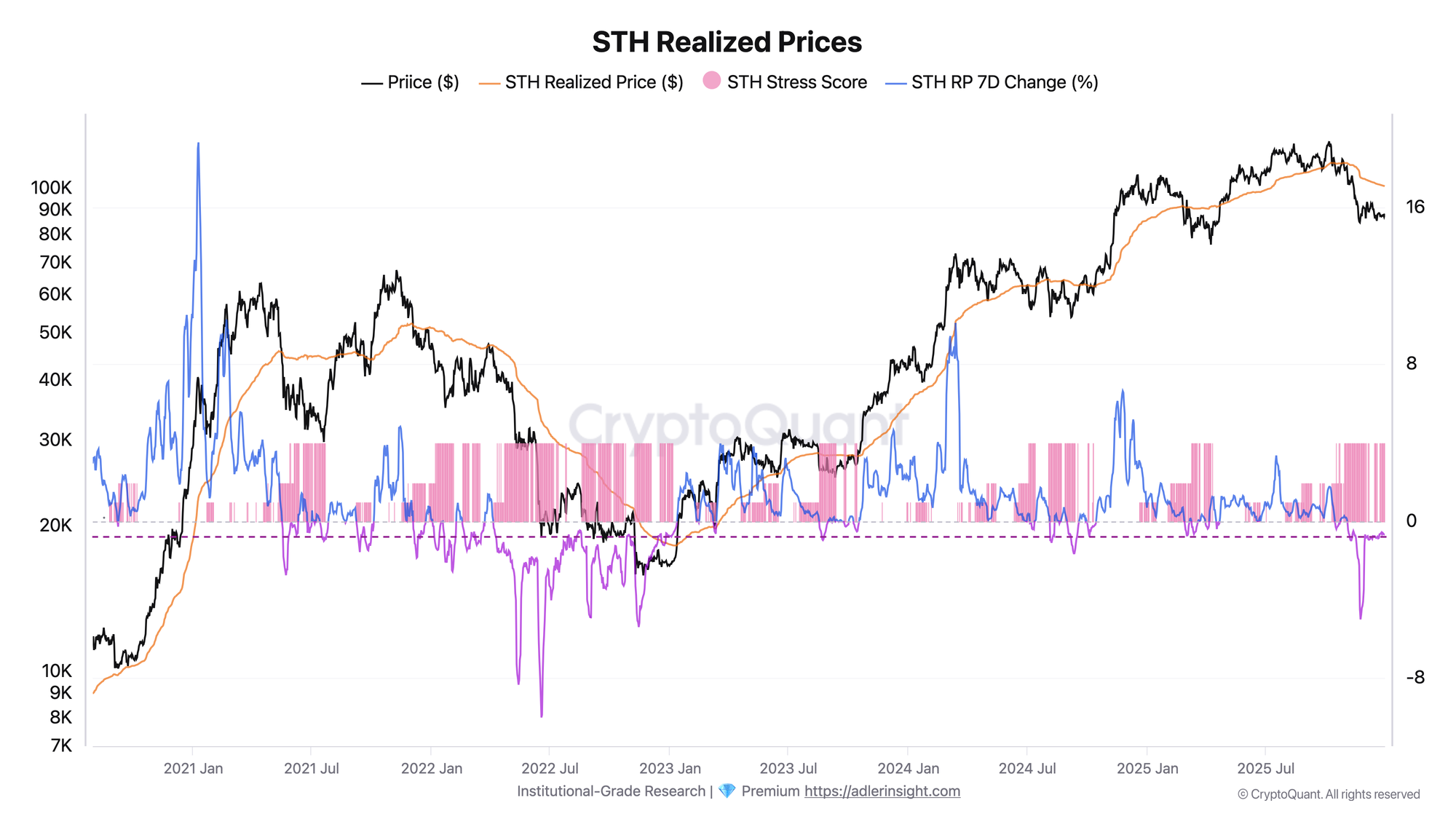

STH Realized Prices

Black line is BTC price, orange is STH Realized Price (average cost basis of short-term holders), pink bars represent STH Stress Score, blue/purple line shows weekly STH RP change in percentage.

Price consistently trades below STH Realized Price - stress mode has been active since October 17. Weekly STH RP change is in negative territory and reaching local lows, reflecting a shift in STH cost basis toward lower levels through redistribution and buying below.

Price demonstrates mixed dynamics across 7-30-90 day timeframes: short-term (+0.9% weekly, +2.3% monthly) shows stabilization, however quarterly result remains deeply negative (−26.7%), with stress as the dominant regime across all horizons. The forecast model indicates continued pressure with an expected decline of approximately 3% over the weekly horizon while maintaining stress mode.

Falling STH RP means the resistance "ceiling" is gradually descending toward price. This lowers the threshold for returning to healthy mode, but simultaneously signals weakness in new demand. The key trigger for improvement is stabilization and reversal of STH RP upward while holding current price levels.

FAQ

Why does it matter that STH RP is falling?

Declining STH Realized Price indicates that new buyers are entering at lower prices, while those who bought higher are exiting at a loss. This is a sign of weak capital inflow and dominance of sell-pressure from underwater positions.

Under what conditions will the regime shift to healthy?

To exit the stress zone, price must return above STH Realized Price. Given current dynamics, this can happen two ways: either price rises to cost basis, or STH RP continues declining and "meets" price. The second scenario is less constructive, as it means regime improvement through cost basis reduction rather than demand momentum.

CONCLUSIONS

The market remains in stress mode with price significantly below short-term holders' cost basis. Falling STH RP confirms the averaging down process and absence of aggressive buying at current levels. Nevertheless, the comfortable buffer to LTH Realized Price reduces the probability of sharp capitulation absent an external shock, as long-term holders remain deeply in profit and provide structural support.