🎧 Morning Brief 0090 - audio debate on today’s market setup

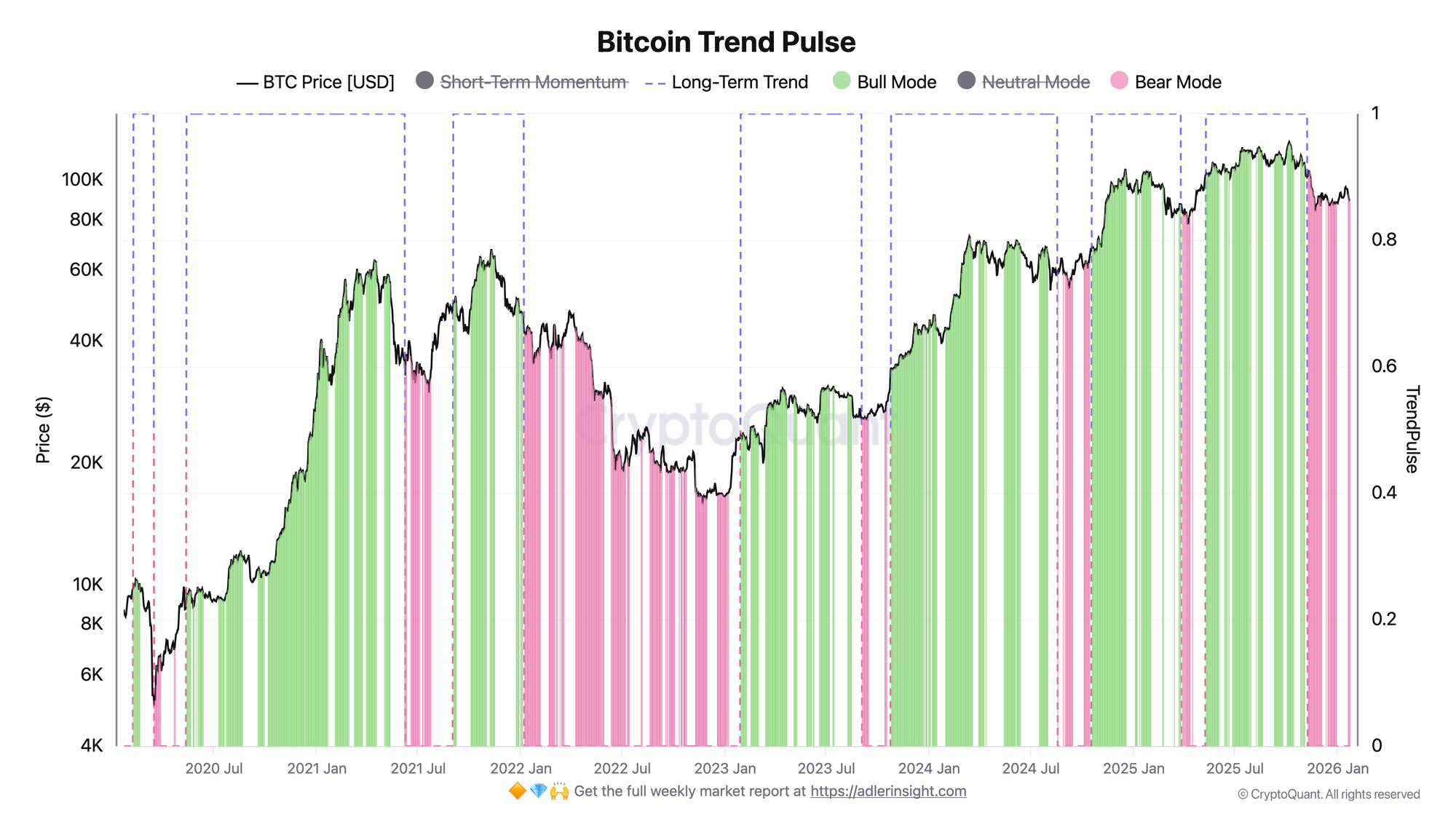

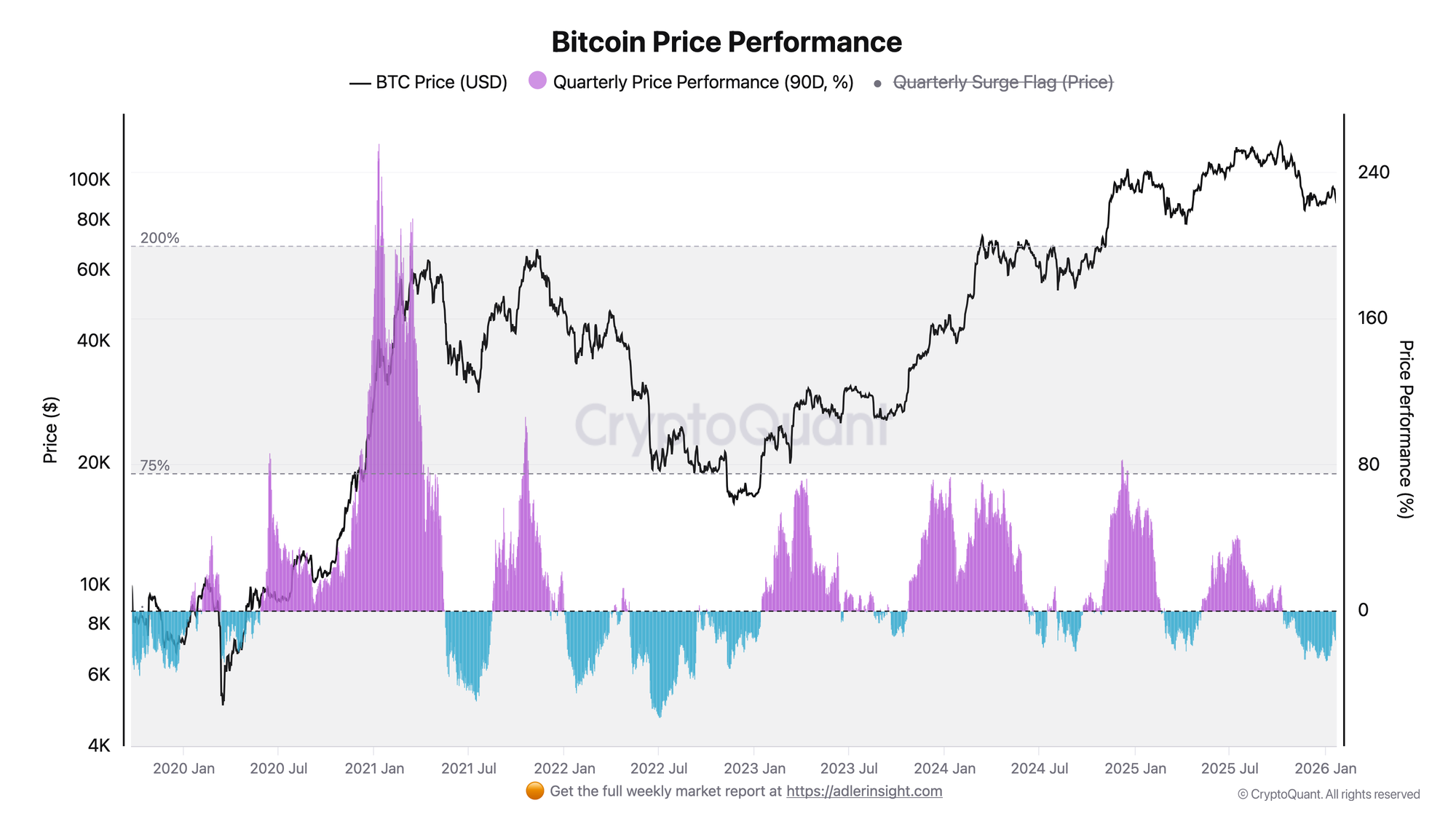

Following yesterday's bearish breakdown below $90K (Brief 0089), the macro indicator Trend Pulse adds context: since January 19, the market has been in Bear Mode, and the Bull phase has been absent for 83 days. Two charts show how short-term momentum and quarterly returns have simultaneously turned negative.

TL;DR

Trend Pulse shifted from Neutral to Bear - both signals (14D return and SMA30 vs SMA200) are negative. Quarterly return of -19% confirms macro weakness without signs of extreme capitulation.

Bitcoin Trend Pulse

Since January 19, the market has been in Bear Mode - the 14-day return turned negative, while SMA30 has remained below SMA200 since mid-November. The last Bull Mode occurred on November 2, 2025 at ~$110K - 83 days ago. The Neutral period (December 30 - January 18) proved insufficient to restore the long-term trend.

The trigger for initial improvement is 14D return crossing back above 0, which would shift the regime from Bear to Neutral. Transition to Bull Mode additionally requires SMA30 to break above SMA200, which at the current divergence would take at least 3-4 weeks of sustained growth.

Bitcoin Price Performance

The metric measures the percentage price change over 90 days. Values above +75% historically corresponded to euphoria, below 0% to pessimism, below -30% to capitulation.

Current quarterly return is approximately -19% - firmly in negative territory, but far from bear market extremes (-50% and below). The 7-day dynamic (-6.8%) shows accelerating decline after the $90K breakdown. For comparison: in May 2021 and June 2022, the -20% zone preceded further deepening of the correction, while in July 2024 a similar level marked a local bottom before recovery.

The two charts together form a unified picture: Trend Pulse confirms the structural transition to Bear Mode, while quarterly return shows the market is in a zone of moderate pessimism - deep enough for caution, but without signs of final capitulation. The key question is whether -19% holds as the bottom or the correction continues toward the -30% zone.

This Sunday, the full in-depth Bitcoin market report comes out. It includes:

1) Bitcoin Strategy

Key components: Regime (main filter) → Bitcoin Index Market Phase → Bitcoin Halving Cycles Timing → Point triggers: Bitcoin Advanced Net UTXO Supply → BTC Buy/Sell Index & Risk → Weekly strategy status

2) Market Analysis

Deep market analysis using key on-chain metrics and final market state with forecast for the following week.

3) Adler Insight Light

Adler Insight Light - a one-page weekly brief based on our proprietary models. It aggregates over 50 on-chain and market parameters and uses machine learning-based forecasting.

7-day trial subscribers receive both reports in full. → Subscribe before Sunday

FAQ

Why is 83 days without Bull Mode a significant signal?

Bull Mode requires simultaneous fulfillment of two conditions: positive 14-day return and SMA30 above SMA200. Historically, periods without Bull Mode lasting 80+ days (2018-2019, 2022) corresponded to bear phases rather than consolidations. The current structure resembles prolonged distribution rather than a pause before continued growth.

What is needed for a regime change to Neutral or Bull?

For Neutral, it is sufficient for 14D return to turn positive - this can occur with a reclaim of the $89-90K level (former STH support zone) and holding above it for two weeks. For Bull, SMA30 must additionally break above SMA200, which at the current divergence would take at least 3-4 weeks of sustained growth.

CONCLUSIONS

Macro indicators confirm the structural picture from Brief 0088 and 0089: Trend Pulse shifted to Bear Mode on January 19 (both signals negative), Bull phase has been absent for 83 days - a period historically associated with bear phases rather than consolidations. Quarterly return of -19% is in a zone where outcome is ambiguous: in 2021-2022 this was an intermediate stop before deepening, in 2024 it was a local bottom. The current structure (lack of confirmation from SMA, sustained SOPR below 1.0) corresponds more to a distribution scenario than a V-shaped reversal. Improvement trigger is a reclaim of $89-90K with sustained hold, which would return 14D return to positive and shift Trend Pulse to Neutral. Main risk is continued pressure toward the -25/-30% zone in quarterly return, which would confirm transition to a full bear phase.