Analysis of the current state of mining economics through Puell Multiple and Miner Financial Health Index metrics.

TL;DR

Miner conditions remain stable and neutral-bullish. Puell Multiple (1.1) shows moderately high profitability without signs of stress, while the Miner Financial Health Index (59%) confirms sustainable economics with normal margins and absence of forced selling pressure on the market.

#MINER #PUELL-MULTIPLE #BTC

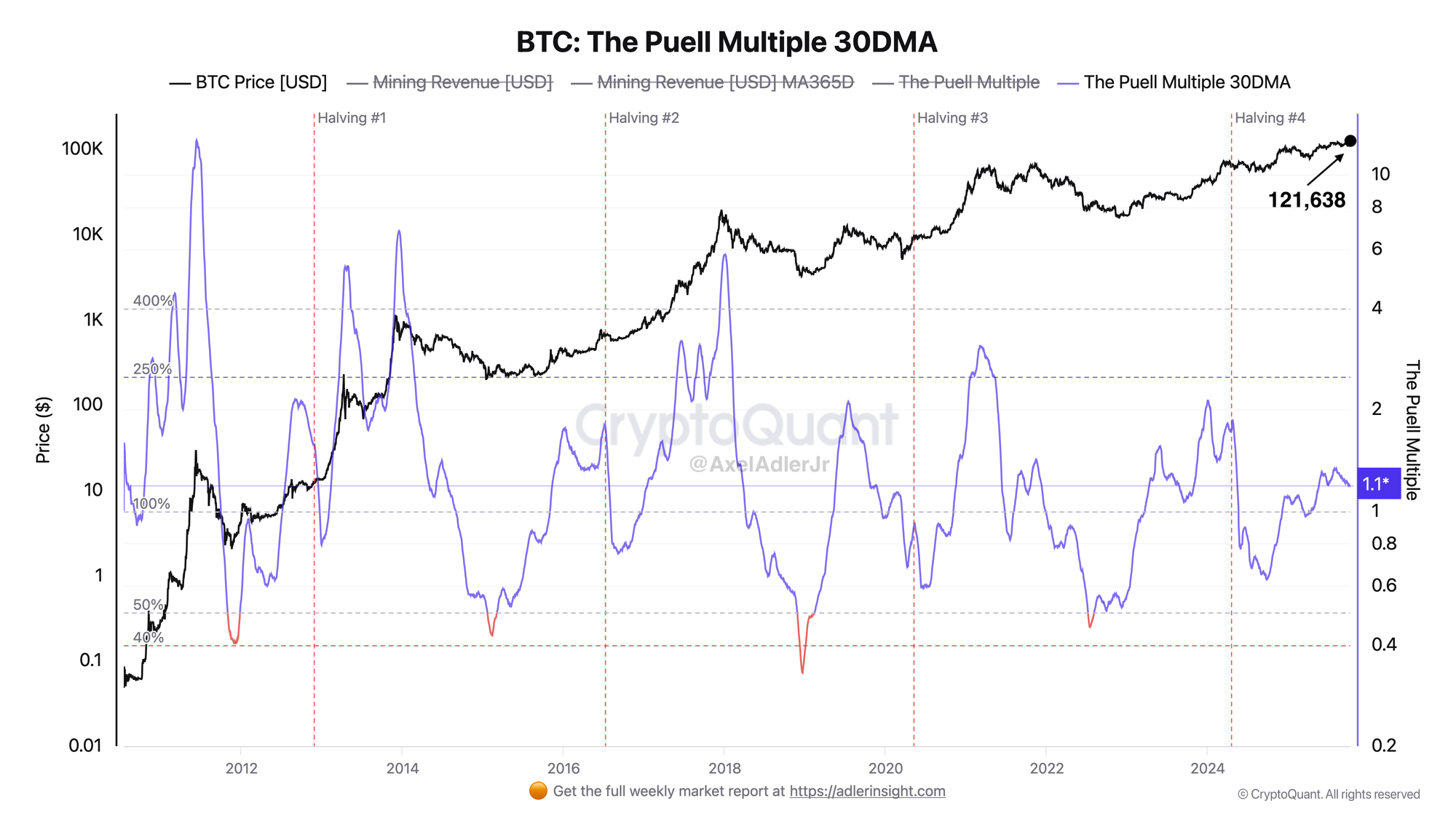

The Puell Multiple 30DMA

Puell Multiple (30DMA) is currently at around 1.1 with BTC price at $121.6K - this is a zone of normalized, slightly above-average miner revenues. The industry economics look balanced: hashrate continues to grow, difficulty is high, and the price supports profitability and compensates for rising costs. There is no capitulation pressure - profitability remains stable, and reserve sales occur only within operational expenses. Such values correspond to "healthy profitability" phases, when the market calmly absorbs supply from miners.

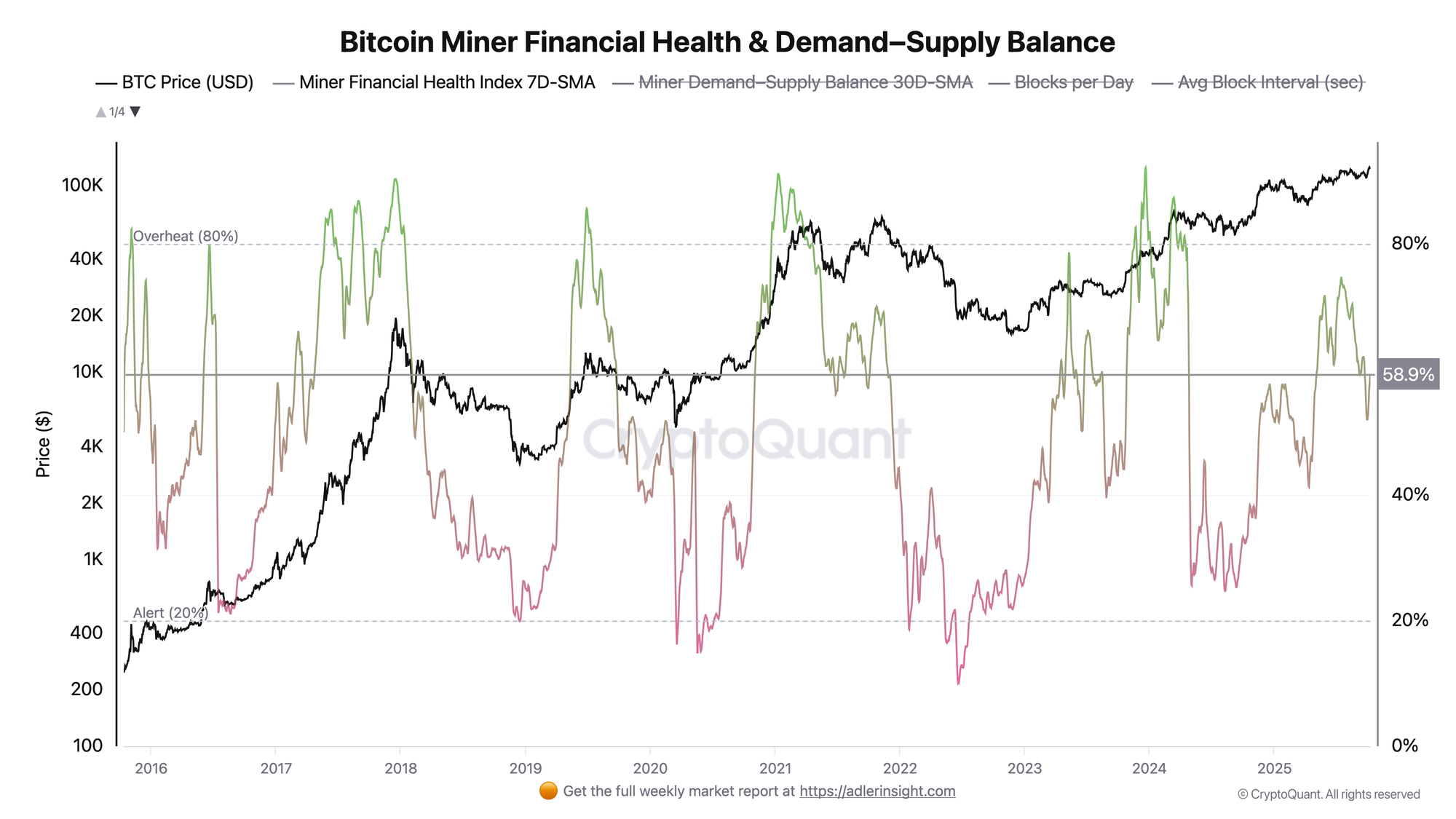

Bitcoin Miner Financial Health & Demand–Supply Balance

The Miner Financial Health Index metric provides a much more accurate picture of miner conditions than the outdated Puell Multiple. The index accounts for the real network economics - profitability (hashprice), block profit, fee share, and total cash flow, translating them into a 0-100 scale. Currently the value is 59%, which reflects healthy, neutral-bullish economics: miners are earning stably, there is no capitulation risk, no forced selling is observed. At the same time, the "overheating" zone (80%+) is still far away - this means the market is not experiencing pressure from miners, and their margins are balanced.

FAQ

Why is the Miner Financial Health Index metric considered more accurate?

The metric evaluates the real economics of miners, combining four key indicators: hashprice, block profitability, fee share, and total miner revenue. Thanks to logistic calculation and the 0-100 scale, the index reflects not just profitability, but the balance between profit, difficulty, and fee activity.

What does the current value of the metrics mean for the Bitcoin market?

The value of the metrics indicates a healthy and stable condition of miners - a neutral-to-bullish regime with no signs of stress or overheating.

Conclusions

Against the backdrop of BTC price at $121.6K, both indicators - Miner Financial Health Index = 59% and Puell Multiple = 1.1 - point to balanced miner economics. Market pressure is absent, margins are stable, forced selling is not observed. This is a neutral-bullish structure in which miners support the trend without signs of overheating.